There are plenty of concerns around the banking sector, which is why I’m not as concerned on my end. I think a ton of bad news has already been priced in, and while yes it can get worse, I do think as a contrarian play the banking sector is getting more and more interesting. If you agree, then the Invesco KBW Bank ETF (NASDAQ:KBWB) is worth a look. This is a passive exchange-traded fund, or ETF, designed to track the modified-market capitalization-weighted KBW Nasdaq Bank Index.

KBWB invests in a group of publicly traded companies that are predominantly engaged in the business of banking within the US. The focus is on companies which generate most their revenue from the banking industry. It’s meant to provide more of a pure play to the space overall, ranging from large national money centers, regional banks and thrift institutions. Holdings in KBWB are rebalanced and reconstituted quarterly to track the changing banking industry.

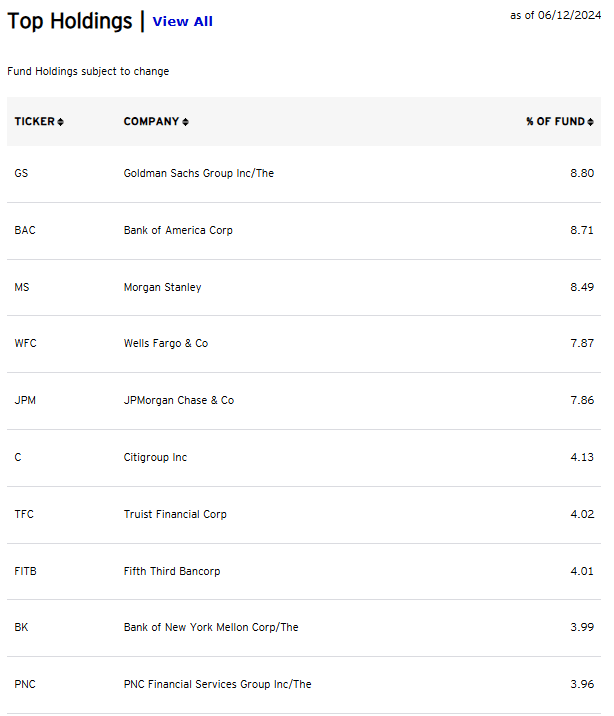

A Look At The Holdings

The fund currently has 25 positions, with holding making up more than 8.8% of the fund. This is fairly top-heavy. The top 10 positions alone make up nearly 62% of the fund.

invesco.com

The top names are all the ones you’d expect. Bank of America (BAC), for example, is a multinational investment bank and financial services holding company with operations consisting of numerous banking and non-banking financial services. Morgan Stanley (MS) offers investment banking, securities trading, wealth management and investment management services. JPMorgan Chase (JPM) is a major global financial services company with operations in almost all areas: investment banking, consumer banking, commercial banking, and asset management. And of course, at the top is Goldman Sachs (GS), which is a global investment banking, securities and investment management firm.

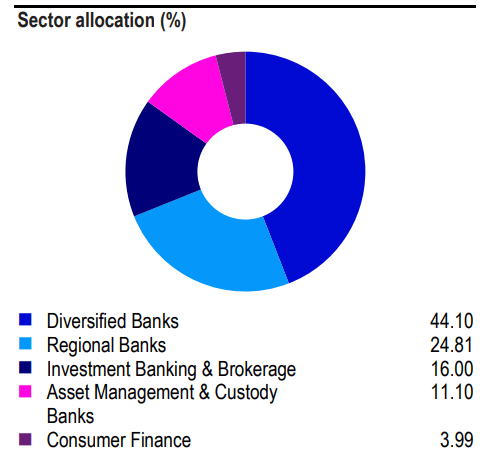

Sector Composition and Weightings

From an industry allocation standpoint, the largest weight goes to diversified banks (clear by looking at the top 5 largest positions). Regional banks (the problem child for the past year) make up nearly 25%.

invesco.com

I actually don’t mind the regional bank exposure here. It’s not particularly large, and that part of the marketplace has been such a poor performer that I suspect there’s some good value there anyway.

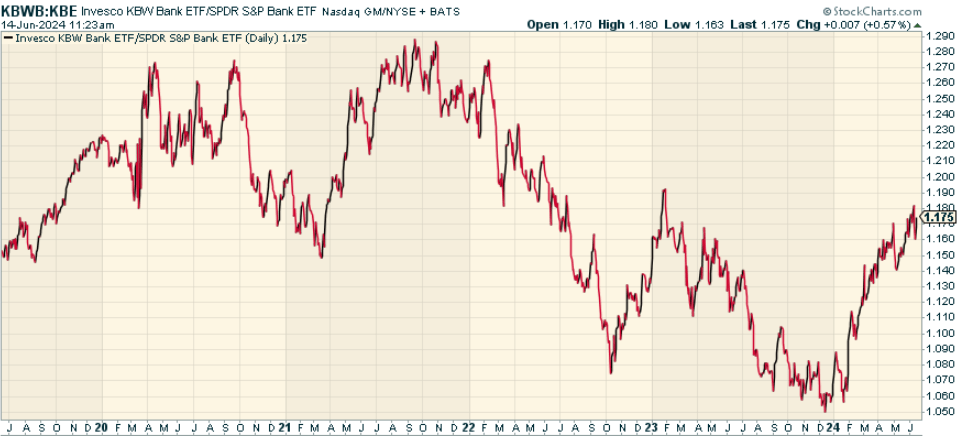

Peer Comparison

A good comp is the SPDR® S&P Bank ETF (KBE), which is designed to track the performance of the S&P Banks Select Industry Index. This is a better comp than The Financial Select Sector SPDR® Fund ETF (XLF), which provides exposure to the broader financial sector, including banks, insurance companies, and others with exposure to the financial services market as a whole. When we compare KBWP to KBE, the two have performed largely in line with each other. KBWB has recently been outperforming, but not sure whether we can glean anything from that.

stockcharts.com

Pros and Cons

The advantage for investors is that KBWB provides exposure to the sector broadly and with only a single transaction. The fund captures large institutions such as Bank of America, Citigroup (C), Wells Fargo (WFC), and JPMorgan Chase, but also smaller regional companies and thrift institutions. When economies are growing, rates on new loans are higher, and many banks make more profits and experience revenue growth. This performance can translate into benefits for investors holding the fund.

But the potential negatives are worth noting, too: banks are exposed to a range of risks, including regulatory changes, credit risk and overexposure to an economic downturn. During a credit crunch or economic downturn, banks could experience higher loan defaults, more onerous regulation and reduced profitability, which could negatively impact KBWB.

Conclusion

For those looking for targeted exposure to the banking sector within the US, there’s a compelling argument for buying the Invesco KBW Bank ETF. It’s a good pure-play overall. And while the banking industry is fraught with natural risks and volatility, KBWB gives you a simple, cheap way to get exposure to this critical corner of the economy. I think it’s worth considering over more crowded sectors like Tech now.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report today.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Read the full article here