When it comes to investing in the energy sector, there is no shortage of options. One that investors look at is the iShares U.S. Energy ETF (NYSEARCA:IYE), a fund that provides exposure to U.S. companies that produce and distribute oil and gas. IYE seeks to track the investment results of an index composed of U.S. equities in the energy sector. Launched on June 12, 2000, the fund has a net asset value of approximately $1.3 billion. The fund’s objective is to offer exposure to domestic energy stocks, making it a suitable choice for investors looking to express a sector view.

ETF Holdings: A Closer Look

The fund has 40 holdings, with the top five positions accounting for 53% of its total assets. The largest holding is Exxon Mobil Corp (XOM), constituting 22.41% of the fund’s assets. This is followed by Chevron Corp (CVX) at 14.45%, ConocoPhillips (COP) at 7.93%, Schlumberger NV (SLB) at 4.55%, and EOG Resources, Inc. (EOG) at 4.31%. These are all prominent large to mid-cap energy companies, thus providing investors with a broad exposure to the U.S. energy sector.

ConocoPhillips: With a global operational footprint, ConocoPhillips is immersed in the exploration, extraction, transportation, and marketing of crude oil, bitumen, natural gas, LNG, and natural gas liquids. The company’s endeavors span the entire globe, marking its presence as a comprehensive energy provider.

- Exxon Mobil Corp: Ranking among the top-tier international oil and gas corporations, Exxon Mobil is publicly traded and distinguished by its pioneering technologies. These advancements facilitate the provision of vital energy and petrochemical products on a global scale.

- Chevron Corp: Chevron stands out as a significant force within the worldwide energy landscape, with operations that span integrated energy production and chemical processing. The company’s business is structured into two primary divisions: Upstream, focused on exploration and extraction; and Downstream, which encompasses refining and marketing.

- ConocoPhillips (COP): With a global operational footprint, ConocoPhillips is immersed in the exploration, extraction, transportation, and marketing of crude oil, bitumen, natural gas, LNG, and natural gas liquids. The company’s endeavors span the entire globe, marking its presence as a comprehensive energy provider.

- Schlumberger NV: As a preeminent entity in the oilfield services domain, Schlumberger NV stands at the vanguard, offering a suite of technology solutions, insightful information analytics, and cohesive project management strategies. These services are meticulously designed to enhance the performance of reservoirs for clients entrenched in the oil and gas sectors.

- EOG Resources Inc: EOG Resources claims its status as a principal entity in the exploration and production of crude oil and natural gas within the United States. Moreover, the company boasts a substantial portfolio of reserves that extends beyond the U.S. borders, incorporating regions such as Canada, Trinidad, the United Kingdom, and China, underscoring its expansive operational reach.

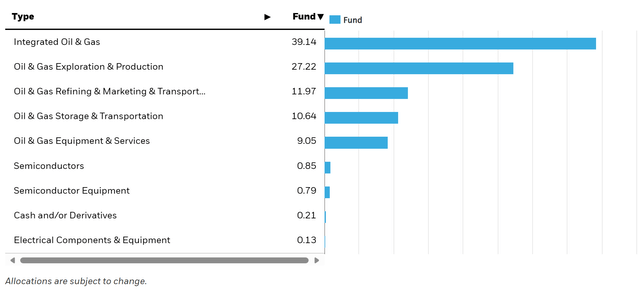

Sector Composition

IYE’s sector composition reflects the diverse nature of the energy industry. The bulk are categorized under Integrated Oil & Gas, making up nearly 40% of the fund. The overall makeup is representative of the Energy sector broadly.

ishares.com

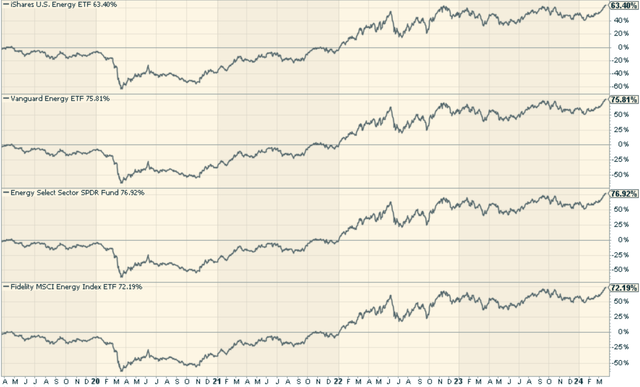

Peer Comparison: IYE Versus Other Similar ETFs

Some of IYE’s peers include the Energy Select Sector SPDR® Fund ETF (XLE), Vanguard Energy Index Fund ETF (VDE), and Fidelity MSCI Energy Index ETF (FENY). IYE has an expense ratio of 0.40%. While this might seem reasonable, it’s significantly higher than many of its peers. For instance, both XLE and VDE have an expense ratio of just 0.09% and 0.10% respectively, while FENY charges a mere 0.08%. This difference in expense ratios could impact the net returns for investors, particularly over the long term. IYE has underperformed all three funds.

stockcharts.com

Advantages and Disadvantages of Investing in IYE

Pros

- Diversification: IYE offers diversified exposure to the U.S. energy sector, with holdings across different sub-sectors and company sizes.

- Potential for High Returns: If oil prices rise, companies in the energy sector (and therefore IYE) can benefit significantly.

Cons

- Sector Concentration Risk: Investing in a single-sector ETF like IYE can be riskier than investing in a more diversified fund. If the energy sector performs poorly, IYE is likely to follow suit.

- Expense Ratio: IYE’s expense ratio is higher than many of its peers, which could eat into your returns over time.

- Volatility: The energy sector can be highly volatile, impacted by factors such as changes in oil prices, geopolitical tensions, and regulatory changes. This could lead to significant price swings in IYE.

Conclusion: Is IYE a Good Investment?

While IYE offers an avenue for investing in the U.S. energy sector, it may not be the best choice for all investors. Its high expense ratio and underperformance compared to peers might be a turn-off for some. Furthermore, the sector-specific nature of the fund could make it a risky proposition for those not comfortable with the volatility of the energy sector. Bottom line? There are better options out there.

Markets aren’t as efficient as conventional wisdom would have you believe. Gaps often appear between market signals and investor reactions that help give an indication of whether we are in a “risk-on” or “risk-off” environment.

The Lead-Lag Report can give you an edge in reading the market so you can make asset allocation decisions based on award winning research. I’ll give you the signals–it’s up to you to decide whether to go on offense (i.e., add exposure to risky assets such as stocks when risk is “on”) or play defense (i.e., lean toward more conservative assets such as bonds/cash when risk is “off”).

Read the full article here