Investors Title Company (NASDAQ:ITIC) (“ITC”) was the first company I covered this year. At the time, I rated it a Buy. My previous thesis mainly considered:

- Consistent profits, even in tough years

- Small insurance liabilities against a large portfolio

- Steady buybacks and dividends

- Being a simple business done well

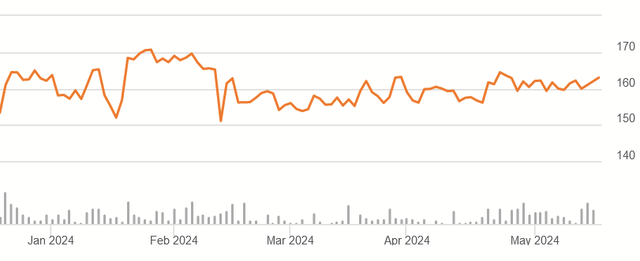

The stock price has been rather flat since then.

ITIC 5M Price History (Seeking Alpha)

Both FY 2023 and Q1 2024 results have come out as well. Additionally, since I live in Chapel Hill, I was able to attend the annual shareholder meeting this week and meet the heads of the company. I figured it was time to update my thesis and elaborate more on why ITC is a Buy. This time I will focus more on better understanding their growth, their moat, and the subtleties of how their pieces fit together.

Brief Recap

ITC primarily deals in title insurance. This is insurance for real estate, given to both the buyer and the lender that provides the mortgage. Title insurance protects them from any defects in a title that may cause a legal claim against property against it by a third party. Title insurance helps cover the cost of indemnification or legally defending against the claim.

I observed that the company has consistently reported positive earnings since 2009 (only narrowly going red in 2008). Additionally, it has a large portfolio well in excess of its insurance liabilities that it has been growing, with special dividends that offer potential yields of 4% to 10% on the current price.

Growth Prospects

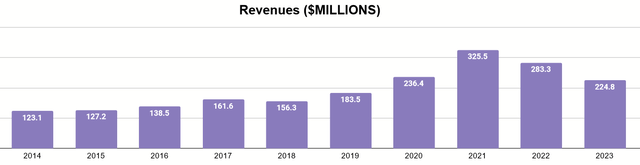

Some might look at the FY 2023 results and note that revenues have declined quite a bit.

Author’s display of 10-K data

Yet, this is mainly in comparison to the surge in real estate activity that happened due to COVID stimulus. Compared to pre-COVID revenues, the company has still shown long-term growth, and I believe that trend is continuing.

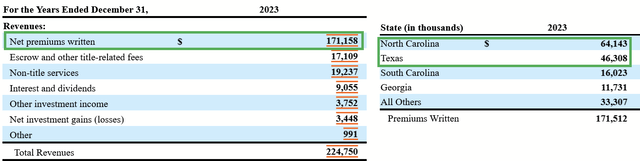

2023 Form 10-K

As seen above, the vast majority of revenue comes from net premiums written. Unsurprisingly, North Carolina accounts for the bulk of that. Texas, however, has reached a key second place, and it’s a much larger state than NC. Similarly, management conveyed at the shareholder meeting their plans to expand into Florida, a similarly larger state, so there are two key opportunities for growth in these markets.

Southern Moat

I had an interesting conversation with James Allen Fine, Jr., current President of the Company. He explained to me that one of ITC’s strengths is that it knows how to operate in the South in regard to local attorneys. In short, titles are legal documents, and their business necessarily involves attorneys. I already mentioned how their coverage can pertain to legal defense against a claim by a third party. In NC, titles also involve legal work with the local Register of Deeds. My own background as a legal assistant showed to me, even as a state like NC urbanizes, much of the legal system here (and in the South broadly) is built on a culture of going with the local guy.

By being a title insurance pure play, ITC has developed strong, recurring relationships with several localities, and over time, I believe this has given them a strong moat.

The Tar Heel Spawner

Beyond the underwriting itself, ITC has been able to leverage its position to launch adjacent operations that fit well into the current business. Their Investors Trust Company does asset management, leveraging their relationships with attorneys who establish trusts for their clients.

Similarly, they provide agency services for commercial title insurance and have an exchange business that assists in achieving tax-deferred sales of real estate, leveraging many of the same networks for additional services.

I view ITC’s model as being a good example of Mohnish Pabrai’s model of spawners. These are businesses that attain the right “DNA” by focusing on a single, simple operation that provides a steady engine of cash, thereby allowing them to continue to grow and support natural additions of new lines of business. For ITC, it was NC title insurance, which opened the doors to these additional income sources.

Portfolio

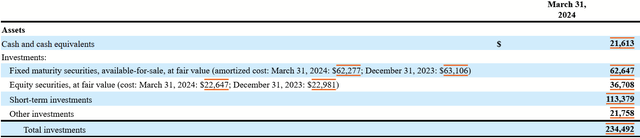

While there isn’t much that has changed about the portfolio, being mostly in interest-bearing securities backed by the federal government, I wanted to share the current composition and relay some thoughts that Mr. Fine shared during the shareholder meeting.

Q1 2024 Form 10-Q

One thing he noted is that the largest concentration is in short-term investments, taking advantage of the high rates of interest and inverted yield curve. Some might notice that there is a sizable number of equities, and at one point equities even made up about a third of the portfolio.

I asked Mr. Fine what exactly their approach was to the equity side. He told me that much of their equity position started in the aftermath of the Great Recession, when many stocks were undervalued, and they’ve steadily added to it since. Overall, they don’t characterize their approach in any specific terms and choose equities opportunistically. One thing he did mention is that, similar to the benefit of higher interest in money markets, they would likely look toward reliable dividend stocks for the cash flow they provide, which they see as being better for their insurance business.

Valuation

Because I don’t think I appreciated the growth aspect of this business as much last time, I want to revisit my valuation. This time I will use a method similar to a Discounted Cash Flow model, but I’ll substitute their adjusted earnings for free cash flow. In my previous analysis, I valued it for their tangible book value plus growth of the book over the decade, but this business is too much of an earner for that to remain valid, in my view.

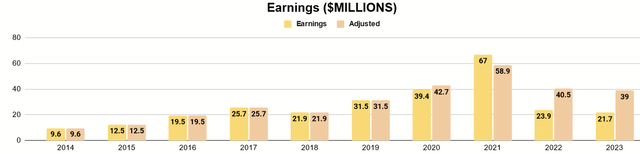

Author’s display of 10-K data

The data above is based on their 10-K data, but also input provided at the shareholder meeting about, namely how their adjusted earnings are the differences that resolve unrealized gains and losses in the portfolio, which I feel provides a better indication of value. I’ll make the following assumptions in my calculation:

- $42.52M as baseline earnings

- 3% average growth in the first 5 years

- 6% average growth in the second 5

- Terminal multiple of 10

$42.52M is the average-adjusted earnings from across the last five years. I’m assuming a slower growth rate of 3% for the first five years as high-interest rates limit real estate deals and opportunities for new policies. As I expect rates to be lower in the latter half of the decade, I have doubled the growth assumptions. Considering the CAGR of adjusted earnings for the past decade was 16%, I don’t think these growth assumptions are too ambitious. Terminal multiple of 10 is priced, as that encompasses the middle range of where the shares have tended to trade.

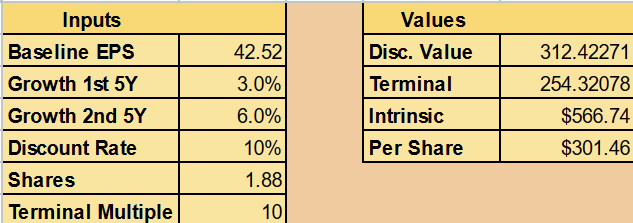

Author’s calculation

Altogether, this suggests a fair value for the company of about $566M, resolving to about $301 per share. (Under my previous thesis, I valued the shares at $262.) Its tangible book value per share is $125.51 as of Q1, which I think establishes a good floor of the value and suggests the shares currently trade on the lower end of their potential.

Risks

The two long-term risks that I see are a potential spike in foreclosures and the future of the Fine family.

Given what title insurance is, a wave of foreclosures (perhaps in the course of a real estate crash) would provide ample opportunities for their customers to make increased claims. While claims are typically just a small percentage of premiums written, the main challenge here is what it could mean for growth.

2023 Form 10-K

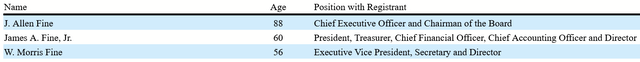

Above, I indicate the current positions and roles of the Fine family. I already mentioned speaking to James, and I got to speak to Morris as well. I think both are sensible men with a keen eye for the industry in which they operate. Yet, as the family ages and eventually steps down, this can raise questions about whether future management will operate the same way.

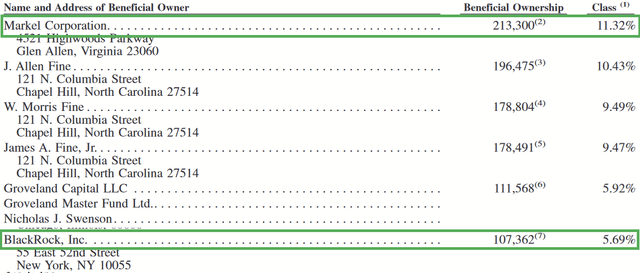

April 2024 Proxy Statement

As seen above, Markel Group (MKL) now holds a larger position than the founder himself. Similarly, BlackRock (BLK) has taken a position as well. The Fines explained to me that Markel has always supported them, so that’s good. Given the growing signs of outside interest, a day may come when new entrants gain enough influence to change the direction of the company. So much of the bright future that I spelled out depends on the lasting influence of the Fine family.

Conclusion

My experience at the annual shareholder meeting gave me a taste of something we don’t often get to see in the corporate world: a homegrown business led by an insightful founder, supported by his sons, who have avoided complicating something that just works. Their prudence has more time still to provide ample returns to shareholders as they saturate their current states and expand into others, all while tacking on new services that provide easy revenue.

While the risks aren’t non-existent, the capitalization of this business is too healthy for them to be major, and when the worst-case scenarios mean the growth will just disappoint, that right there gives me the confidence that this a textbook Buy.

Read the full article here