Investment Thesis

Honeywell has started a transition to consolidate and restructure its segments and growth with a focus on Automation which will account for 50% of its overall net sales, while continuing to emphasize on selling in the Aviation and Energy Transition market. We deep dived straight into this diversification across different industries creating opportunities and strong growth but also met with different sets of international and domestic risks. We looked at the recent inventory build and backlog, its operational strengths and challenges that are critical in managing this conglomerate, and what they mean for its near-term growth. Its current price has embedded bullish expectations of future growth and is at its top range leading me to a Hold rating.

Company Overview

Honeywell International Inc. (NASDAQ:HON), with its brand dated to 1906, incorporated in Delaware in 1985 and headquartered in Charlotte, North Carolina, is an integrated industrial conglomerate operating in the aerospace, energy-efficient products, and solutions for business, specialty chemicals, electronic and advanced material, process technology for refining and petrochemicals, and productivity, sensing, safety, and security technologies for buildings and industries. The company has reportable segments such as Aerospace, Honeywell Building Technologies [HBT], Performance Materials and Technologies [PMT], and Safety and Productivity Solutions [SPS].

Strengths and Weaknesses

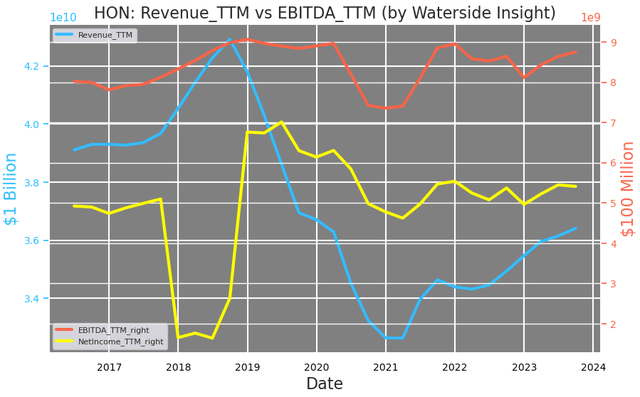

Honeywell’s more stable EBITDA and net income, in contrast with its decline in revenue from ’18 to ’21, shows the resilience of this conglomerate industrial.

Honeywell: Revenue, EBITDA and Net Income (Calculated and charted by Waterside Insight with data from company)

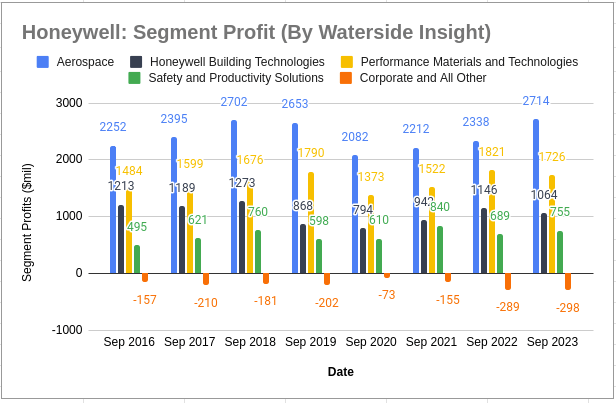

As a conglomerate, diversification is one of the biggest strengths of Honeywell to hold growth stability. We compare its segment profit since it changed to the current segment classification in 2016. The only segment that hasn’t had a clear increase in profit since then is The Honeywell Building Technologies, all other segments have had double-digit growth in the eight years’ time. In particular, the Safety and Productivity Solutions segment grew by 52% in its profit since September 2016.

Honeywell: Segment Profit (Calculated and charted by Waterside Insight with data from company)

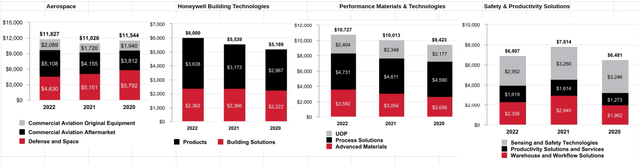

Up until the end of last year, at the sub-segment level, it was the Commercial Aviation Aftermarket in Aerospace, Products in HBT, and Process Solutions in PMT that mostly drove the growth in the past three years. On the other hand, Defense and Space in Aerospace and Warehouse and Workflow Solutions in SPS led a decline during the same period.

Honeywell: Sub-segment Profit (Company 2022 10K)

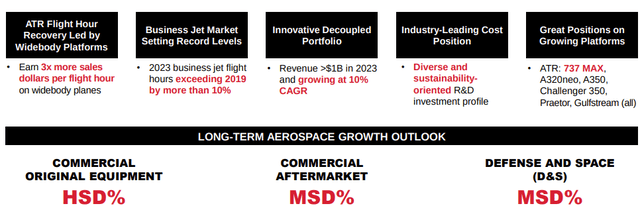

In October this year, the company announced it had secured a contract to supply South Korea with 41 T55 Engines to build their new CH-47F aircraft, and there are only 1000 such engines worldwide serving heavy-lifting helicopters. This order is managed through the office of US Army Foreign Military Sales, which will go into the Defense and Space sub-segment in Aerospace. This sub-segment has been impacted on its export by the trade action on China by the US and the Russia-Ukraine war, but the declining trend predated the recent war in Ukraine. Added with more flare-ups in the Middle East, this sub-segment could see growth driven by domestic spending to replenish and strengthen the US army. Also, NASA’s Artemis space program, which starts to have astronauts landing on the moon again soon, will continue to drive the need for propulsion engines, satellites, and other space components well into 2027. The D&S sub-segment is expected to halt the decline and grow moderately in mid-single digits over the long haul. For the Aerospace segment, which is its largest segment, the Commercial Aviation Aftermarket grew 34% in the past three years, far outpacing the other two sub-segments (Commercial Aviation Original Equipment and Defense and Space). In the Aftermarket, the company provides spare parts, repair, overhaul and maintenance. This subsegment is expected to slow down to mid-single digit in the long-term outlook. However, due to the record spending in the business jet market this year recovering to a higher than pre-pandemic level, the Aftermarket subsegment could still see strong growth in ’24. The Commercial Original Equipment subsegment, which has seen higher sales volume from business aviation and other air transport in the past three years, is the only one that will continue its high single-digit growth trend from the past three years into the future. Overall, the mixed picture points to a strong near-term growth for the Aerospace segment next year.

Honeywell: Long-Term Aerospace Growth Outlook (Company Q3 presentation)

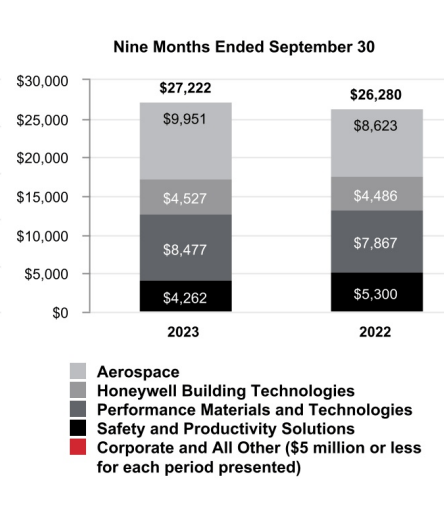

When reviewing its Q3 data, the largest two segments, Aerospace and PMT, were again the ones that had obvious growth. Aerospace grew 15%, PMT grew 7.8% YoY, HBT held almost flat, and SPS declined by 20%.

Honeywell: First Nine Months of Segment Net Sales (Company 10Q Q3 2023)

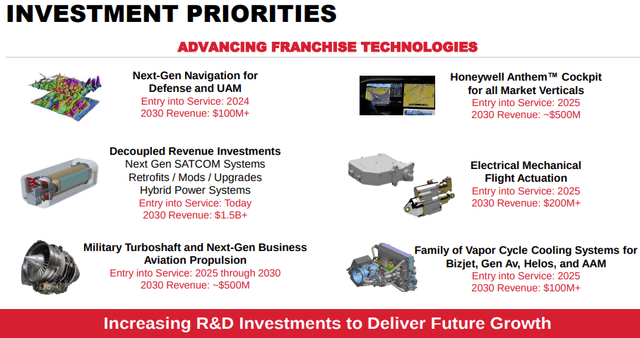

The next seven years’ growth is still strongest in the Aerospace segment as the six franchise technologies in Aerospace are deemed as top investment priorities driven by its R&D efforts. With most of them entering into service in ’24 and ’25, their potential growth combined is north of $3 billion.

Honeywell: Investment Priorities in Aerospace (Company Presentation at Baird Global Industrial Conference)

On the other hand, the consecutive decline in SPS could be boosted by a recent win. The company’s Advanced Solvent Carbon Capture [ASCC] system, which enables greater than 95% carbon dioxide capture for post-combustion flue gas applications, was recently adopted by SK E&S in South Korea and other parts of Southeast Asia. This success could bring more projects in other parts of Southeast Asia.

For the HBT segment that has seen growth stalled and even a small decline, the company has made efforts to boost its growth. It’s recent announcement of an acquisition of Carrier’s Global Access Solutions to enhance HBT’s digital value-added product offerings such as LenelS2, Onity, and Supra, which are all physical security product brands in locks, lockboxes, etc, with digital network control systems. Adding these brands to its building portfolio will lead to more Building Automation transitions for this segment.

Due to its diverse yet unique business segments, Honeywell is subject to various industry and economic conditions that may adversely affect its operations and growth. Besides the political environment with foreign entities impacting its defense exports, the domestic commercial real estate market is not in a stellar shape as of late. For Honeywell’s HBT segment’s future growth, the company identified hospitals, airports, education, and data centers as the end markets where it wants to position itself. Office buildings are noticeably missing.

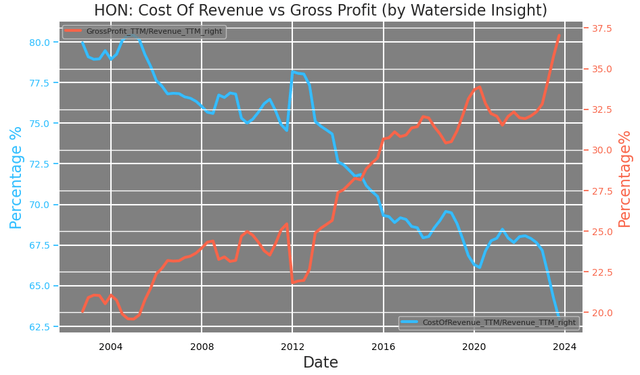

Communicated with investors in May this year, Honeywell’s goal is to transform into a “leaner and more innovative organization” that uses its operational prowess to navigate different economic scenarios. Its effective control of costs has directly contributed to the improvement of its gross margin. The 22% decrease in costs with respect to its revenue resulted in a 17.5% increase in gross margin since 2004. Honeywell needs a whole range of supplies, including copper, fluorspar, tungsten salts, ethylene, aluminum, and molybdenum for its PMT segment, and nickel, steel, titanium, and others in its Aerospace segment. The company’s ability to sort out the supply chain challenges was put on display, especially in recent years. It crushed down another 5% since 2021.

Honeywell: Cost of Revenue vs Gross Profit (Calculated and charted by Waterside Insight with data from company)

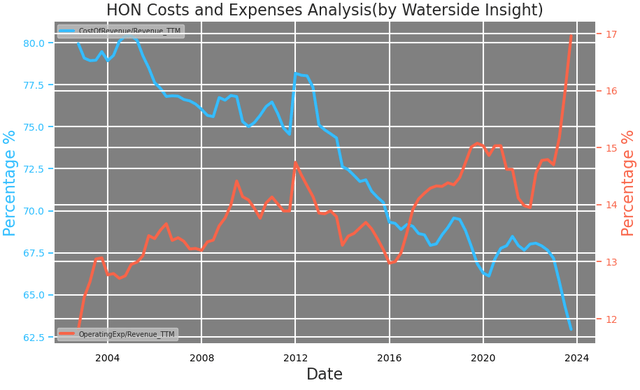

But it still has some way to go in this transformation. While its cost of revenue has had a streak of continued decline for twenty years, its operating expenses took a jump this year. Although it is only by 2 percentage points higher relative to its revenue, its revenue has been on average unchanged on a YoY basis. So it shows that when the topline slows down, the op. expenses still have to be paid, and there is a certain inelasticity that makes it hard to cut down.

Honeywell: Cost vs Expenses (Calculated and charted by Waterside Insight with data from company)

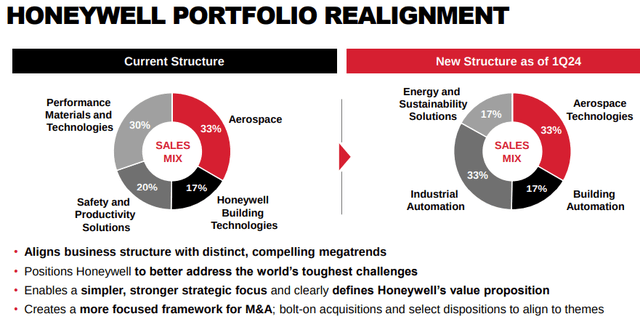

More importantly for future growth, Honeywell identified three megatrends, since its new CEO Vimal Kapur came on the post six months ago, that it would realign its portfolio with: Automation, the future of Aviation, and Energy Transition. These three megatrends essentially outlined one streamlined production to application: automate the production and sell in the Aviation and Energy transition markets. As we can see, the structure of the segments will change. PMT and SPS into Energy and Sustainability Solutions [ESS] and Industrial Automation. While their combined share in sales is still 50%, Industrial Automation increased from 20% to 33%, while PMT once converted into ESS, almost became half of its current size. But from Automation’s point of view, HBT will converted into Building Automation, so combined with Industrial Automation, together they have 50% of the sales. Aerospace maintains the same share. Therefore, the biggest change is the expansion of automation in its sales mix.

Honeywell: Portfolio Realignment (Company Q3 presentation)

Automation naturally needs digital platforms for control and iteration, and Honeywell already has one of the existing advantages in this, the Honeywell Forge Solutions. This digital platform is effectively offered to customers across all segments as a tool to turn the data into predictive analytics, connect different assets and processes, and with cybersecurity capabilities to help identify risks and act on them. Honeywell Forge Solution recently won a contract at One Bangkok, the largest integrated district of the city. This is one of the largest wins for buildings in APAC, and is expected to have additional expansion potential. Helping its customers to automate needs first to automate its own products. From this perspective, the operation efficiency could see continued improvement for the company.

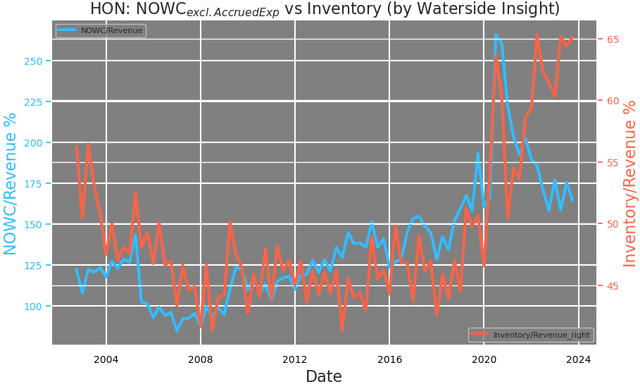

There is a certain urgency for Honeywell to make the transformation if the management believes it’s the path to go. Honeywell’s net operating working capital (excluding recurring expenses) is declining while its inventory is rising. The contrast can be seen as a trend since 2021. This divergence is more pronounced than usual in the past twenty years. Something will need to be reconciled here for the company, most likely to be the inventory reduction since the NOWC is reverting to the average.

Honeywell: NOWC vs Inventory (Calculated and charted by Waterside Insight with data from company)

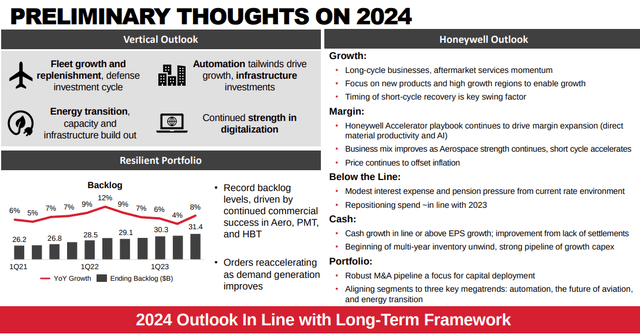

Overall, for 2024, Honeywell offers a strong outlook with resilience, which is a conclusion we echo through our discussion above. The main swing factor the company is concerned with is the uncertainty of the short-term cycles. There could still be volatility coming that mostly from its current weaker sub-segments as we alluded to earlier. But the record backlog in Aerospace, PMT, and HBT can create a buffer for any downside hits, including a possible slow reduction of its inventory. The coexistence of record backlog and record inventory indicates there is a mismatch between the product offerings and the market demand accumulated in the past three years mostly. It expects a multi-year unwind of inventory, which is realistic in our opinion.

Honeywell: Preliminary Outlook for 2024 (Company Q3 Presentation)

Due to Honeywell’s diversified business and current transition, we have conducted a bottom-up analysis of each business segment to its overall operational strength which led to margin improvement over the year. Its current strong digital platform serves as a privital foundation to transition into largely relying on automation in its net sales. Its portfolio will contain more distinct growth categories and more opportunities for M&As. We won’t be surprised to see more than one acquisition coming in 2024.

Financial Overview and Valuation

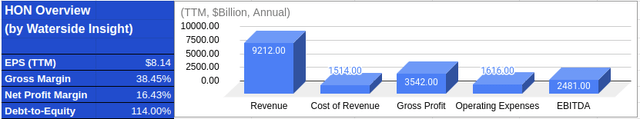

Honeywell: Financial Overview (Calculated and charted by Waterside Insight with data from company)

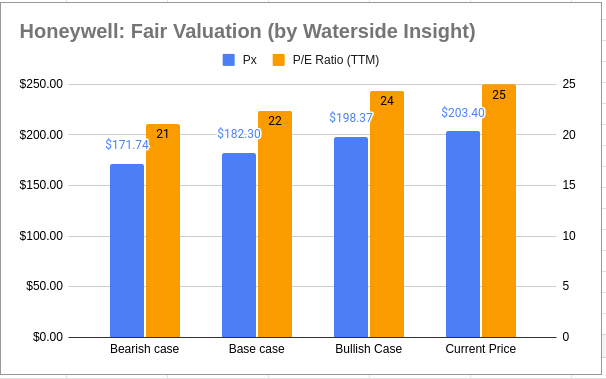

Based on our analysis above, we use our proprietary models to assess Honeywell’s fair value by projecting its growth ten years forward. We assume a cost of equity at 6.66% and a WACC of 8.86%. In the base case, the company’s transition will start taking place in ’24 and be complete in ’25 with a stronger growth pattern to form afterward; it was priced at $182.30. In the bullish case, it takes more aggressive acquisition and divestiture to form the new targeted portfolio and it will be largely complete by the end of next year, stronger growth kicks in sooner than in the base case; it was priced at $198.37. In the bearish case, short cycles in energy transition and commercial buildings created swings while international politics became more of a headwind in the near term; it was priced at $171.74. The current market price has included a bullish outlook on the company’s execution and the transition plan, both in the short-term and the long-term. However, it is slightly above our top range of estimates.

Honeywell: Fair Valuation (Calculated and charted by Waterside Insight with data from company)

Conclusion

With a deep technological know-how and portfolio of franchises, both in equipment and digital platforms, Honeywell is poised to leap into further automation while maintaining its leading position in Aerospace. Its pockets of slowdown in the past few years came from a mismatch of short-term cycles and product offerings, while its long-term growth stayed strong. While we are optimistic about its growth outlook, the market has mostly priced in the rosy picture. We think it is a hold at the current level.

Read the full article here