Holcim (OTCPK:HCMLF) (OTCPK:HCMLY) is one of the top 3 largest cement producers in the world. It is a Swiss company active in more than 60 countries. The primary company listing is in Zurich, Switzerland, under the ticker HOLN, so if you want to buy the stock, I suggest that you do it there because the trading volume is usually above 1 million shares daily.

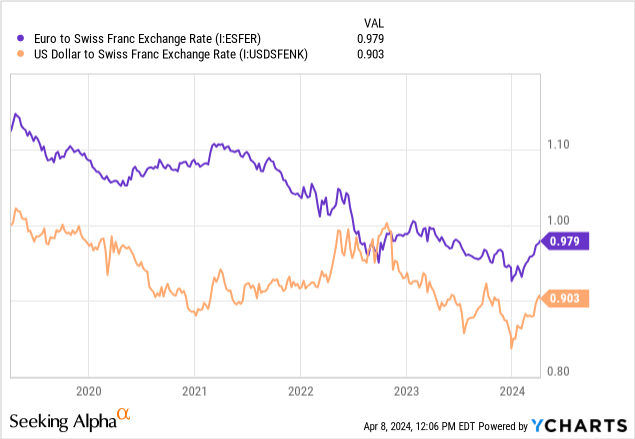

The company is reporting its results in Swiss francs, and I will also use this currency for this report. The results of the company are therefore influenced by currency movements, which are volatile, but as you can see from the chart below, in the last five years, the Swiss franc has strengthened against the US dollar and the Euro, which makes company results look weaker than they are.

Business overview

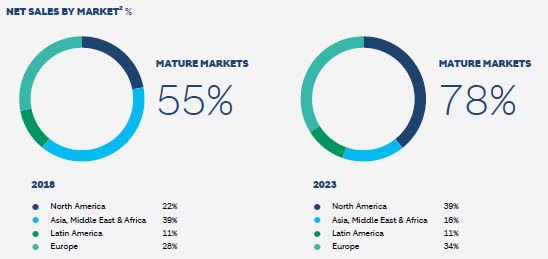

The strategy of the company is to focus on mature markets, and in the last 5 years, the share of revenue from these markets has increased to 78%. This strategy is realized through divestments of operations in Africa, Asia, and the Pacific and selected acquisitions in mature markets like North America and Europe. Last year, the company signed agreements to sell its businesses in Uganda, South Africa, and Tanzania.

Holcim 2023 annual report

In its “Strategy 2025,” the company aims to achieve 30% of net sales from the Solutions & Products segment, which focuses on high profitability and attractive advanced roofing and insulation systems.

Holcim 2023 annual report

In 2023, the company made 11 acquisitions in the Solutions & Products segment and 17 bolt-on acquisitions in the aggregates and ready-mix concrete segments. The average price paid for bolt-on acquisitions in the last 6 years was 5.1x EV/EBITDA and for acquisitions in the Solutions & Products segment, 8.1x EV/EBITDA, so they are willing to pay more for such companies as they want to reach their goal of 30% of net sales from the Solutions & Products segment in 2025.

Holcim 2023 annual report

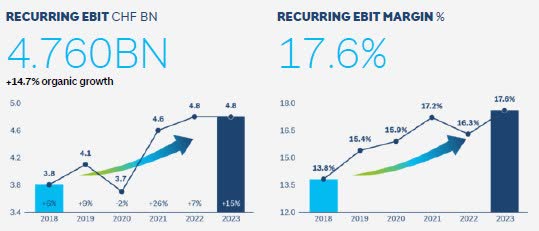

As you can see from the picture above, they are really delivering on their strategy. By the start of 2024, the company had closed three bolt-on acquisitions in Europe and two acquisitions in the Solutions & Products segment.

Holcim 2023 annual report

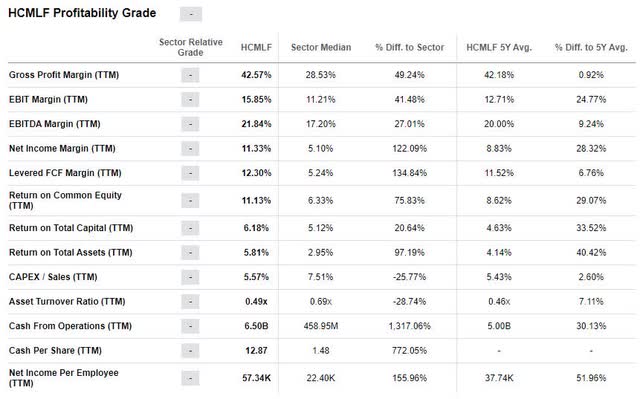

The management is really delivering good results. When we compare the company with sector median results, Holcim clearly stands out.

Seeking Alpha

I also like their approach to divestments and acquisitions. As you can see in the table below, the amount of acquisitions in the last 6 years is just CHF 563 million higher than the amount of divestments, so the acquisitions were paid for by divestments.

Table: author; Data: Seeking Alpha

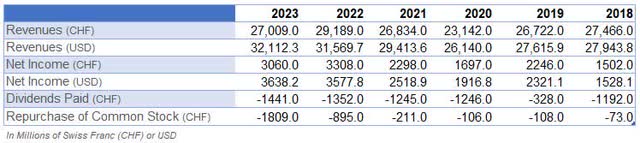

The business has delivered really good results in the last few years and is constantly growing revenue and net income in US dollars. The data in Swiss francs was influenced by the exchange rate and is therefore lower.

Table: author; Data: Seeking Alpha

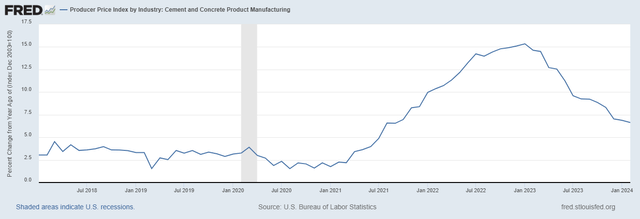

I was curious how much the results were influenced by inflation in the last few years. US data show that the price increase for cement and concrete was approximately 10% in 2021 and 15% in 2022. These price increases helped boost revenues by 12.5% in 2021 and 7.3% in 2022, so the business was able to increase prices for customers and is offering a certain level of protection against inflation.

Cement and concrete price increase (U.S. Bureau of Labor Statistics)

However, as the inflation in 2023 decreased, the revenue growth was smaller too, and this should be taken into account when we make our valuation and assessment of future performance.

The company’s plans for 2024

Holcim has announced that it is planning a spin-off of its North American business. The US listing should be completed in 1H2025, and the business may be valued at $30 billion. If the North American business is valued at $30 billion, the remaining business should have a valuation at least another $30 billion, as the North American business represents about 40% of sales. The current market cap of Holcim is CHF 45.6 billion, which represents $50.1 billion, so the shareholders may gain another 20% value from the company after the spin-off if the value of North American business is in line with the estimates.

Another positive piece of information for the shareholders may be the announcement of a CHF 1 billion share buyback program until the end of 2024. The share buyback should be financed from the cash on the balance sheet, which at the end of 2023 reached a value of CHF 6 billion. So there is enough cash for it. The current stock price is CHF 78.98, and the number of shares is 579.124 million. So if they spend CHF 1 billion and the average share price is CHF 80, they will potentially reduce the number of shares by 2.2% to 566.62 million.

Then you should also receive a dividend of CHF 2.80 for 2023 performance, sometime during May 2024, which makes it a 3.54% dividend yield. So during this year, you will get back approximately 5.7% of the current stock price in the form of a share buyback or dividend, and there is still possible upside for the following years.

The company has also provided the following outlook for 2024:

- organic net sale growth above 4% and additional growth from M&A of above 2%

- increase in recurring EBIT margin to 18%

- free cash flow above CHF 3 billion

What I expect from Holcim in 2024

When I look at the outlook provided by the company, I notice two things. First, the targeted recurring EBIT margin for 2024 is just 0.4% higher than in 2023. So I ask myself, are they being conservative or are we reaching the limits of the EBIT margin? Looking at the EBIT margins by region, I see that in North America and Asia, the margins are above 21%, so there is still some room for improvement in the future.

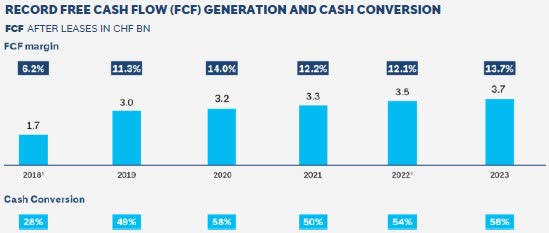

The company is targeting free cash flow above CHF 3 billion, and I think, in this case, they are conservative, as they reached the CHF 3 billion level already in 2019.

Holcim 2023 annual report

The reason for this conservatism may be not very positive outlook for cement prices and demand in 2024. The outlook for cement prices is stable, with no price increase expected, and the demand picture is mixed.

There is an article in World Cement discussing the outlook for cement prices in the near future. A short, excerpt is below:

Price increases are likely to become more difficult, particularly as inflation eases and price increases for other building products slow in developed countries and capacity utilization remains low in many emerging markets. Pricing has been particularly strong in Europe, but may become more difficult in the future if volumes remain low and companies need to keep production up in order to retain their allocation of free carbon permits.

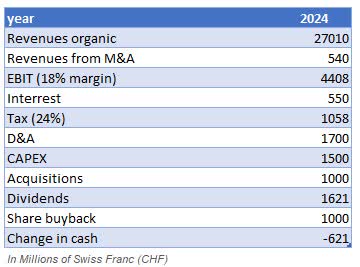

Now, it is time to estimate how the company may be doing in 2024. I am a bit conservative, so based on the cement price and demand prediction for 2024, I expect zero growth in organic revenue. I think that they will probably achieve their goal of increasing revenue from M&A by 2%. To achieve this goal, Holcim has to spend approximately CHF 1 billion on acquisitions. This estimate is based on the fact that in 2023, the company spent CHF 1.975 billion on 28 acquisitions, which increased net sales by 4%. The expenses for dividends and share buybacks are known, and for the remaining expenses, I used the numbers from 2023 to simplify it.

Table: author; Data: Holcim 2023 Annual Report

If they achieve a 16% EBIT margin, I expect that the cash generated by the company will be CHF 621 million lower than expenses in 2024. They also have CHF 1,127 million in debt maturing in 2024, but they have enough cash and can refinance old debt and still maintain their target for net debt.

Holcim really looks like a good business. The question is whether it is undervalued and we should buy it or overvalued and we should wait for the stock to reach our price target. So, let us check my valuation below.

Valuation

For the valuation, I am using a 12% discount rate. In my opinion, targeting a lower rate makes no sense, as the S&P 500’s annualized average return has been around 10% from 1957 to 2023.

The valuation below represents my expectations for what may happen, and does not indicate that exactly such a development will actually occur in the future.

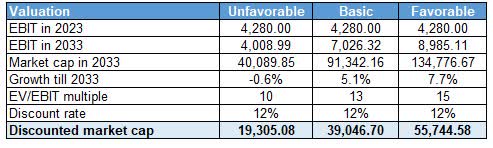

For the unfavorable scenario, I expect yearly revenue to grow by 2%, EV/EBIT multiples to decline to 10 (the near-term lows for the company), and also EBIT margins to decline from the current 15.85% to 12% in 2029, with stabilization at this level as the sector median EBIT margin is currently at 11.15%. I assign a low probability for this scenario, but as an example of what can happen, investors should also take this outcome into consideration.

The basic scenario assumes that the company may increase its EBIT margin to 16% and keep it until 2028, when I project a margin decline to 15% for the long term. I expect EBIT to grow by 3% in 2024 and then by 6% annually, as it is near the long-term EBIT growth rate for the company.

Estimated valuation for Holcim; numbers in CHF million (Author)

The favorable scenario assumes a 16% EBIT margin for the long term and 7.7% EBIT growth, which exceeds what Holcim has delivered over the past 10 years.

The current market cap is CHF 45.7 million, I consider the company slightly overvalued, but I will add it to my watchlist. A year ago, Holcim’s stock price was CHF 60, and it may reach this level again. I do not know whether this will happen, but I know that stocks are volatile and there is always something undervalued.

If I just slightly decrease the discount rate to 10% and use a 5-year EV/EBIT ratio of 13x for Holcim, the stock valuation jumps to CHF 45.6 billion, indicating that the company is now fairly priced. Ultimately, it all depends on the expectations of investors.

Risks to my thesis

The biggest risk to my thesis is a change in cement and concrete prices. Another inflationary wave may increase the company’s revenues and net income, as seen in 2021 and 2022. A recession and low demand for cement and concrete could negatively impact net income. It is impossible to predict both factors in the long term. Therefore, I have used the market outlook for cement prices and demand in 2024, as well as the company’s long-term growth rates, for my valuation. The valuation is based on estimates, and each investor should conduct their own assessment before making an investment decision.

Conclusion

Holcim is really good business. The company is one of the top 3 cement producers in the world, enjoys higher than sector median EBIT and net income margins, and is producing a lot of cash flow.

A possible spin-off of North American businesses may create another 20% gain for investors from the current stock price if the expected valuation for both companies after the spin-off is correct. Meanwhile, the shareholders may enjoy a 3.54% dividend yield and a 2.2% yield from share buybacks.

For me personally, Holcim is still a bit overvalued, but the company will certainly be on my watchlist, and I may buy it later this year if Mr. Market offers me an attractive price.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here