Investment Thesis

Today is a bit of a trip down memory lane, as HelloFresh (OTCPK:HLFFF) was the first company that I wrote about on Seeking Alpha – and 120 articles later, I’ve decided that it’s time to revisit my investment thesis and see what has changed with this company in the past 15 months.

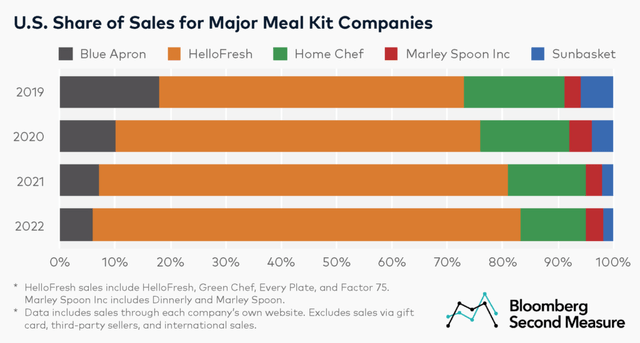

My view of the business remains pretty similar to the detailed investment thesis I laid out in the previous article, and the short version goes like this: HelloFresh is the largest meal kit delivery company in the world, and has continued to dominate its most important market of the United States, accounting for 78% of meal kit sales in 2022. The company has been investing heavily in its fulfilment network and operations over the past few years to cope with rising demand, which will only widen the gap between HelloFresh and its smaller competitors.

Bloomberg Second Measure

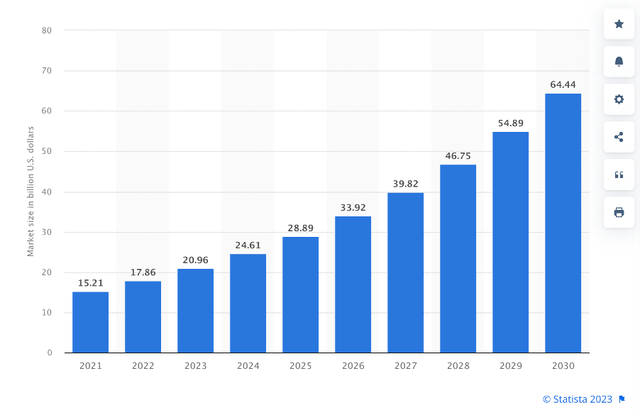

Finally, according to Statista, the Global Meal Kit Service Market is expected to grow at a 17.4% CAGR from 2023 through to 2030, hitting a total value of $64.44 billion. Whilst HelloFresh certainly saw growth pulled forward during the pandemic, and more recently has seen growth come to a halt as the world opened up again, it remains a leader in an industry where long-term growth is expected to return.

Global Meal Kit Service Market Size (Statista)

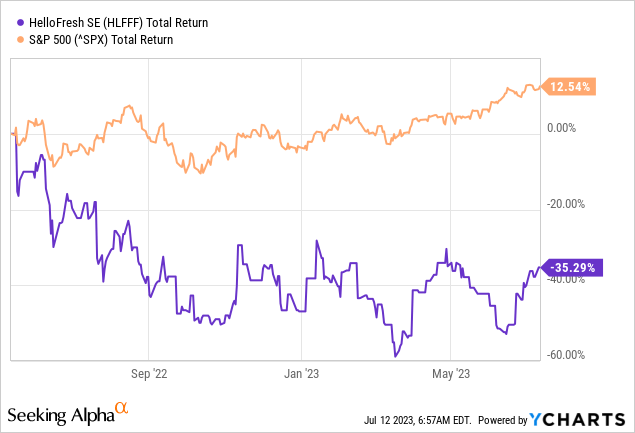

Unfortunately, this slowdown in growth combined with a heavy capex investment cycle has resulted in my first ever Seeking Alpha article being a bit of a loser so far, as HelloFresh shares have fallen by around 35% since May 2022 compared to a 12.5% total gain for the S&P 500 (my personal benchmark).

But the stock market doesn’t care too much about the past, so let’s take a quick look at what’s been going on with HelloFresh since May 2022, and whether it looks like an attractive investment from this point onwards.

How Severe Is This Growth Slowdown?

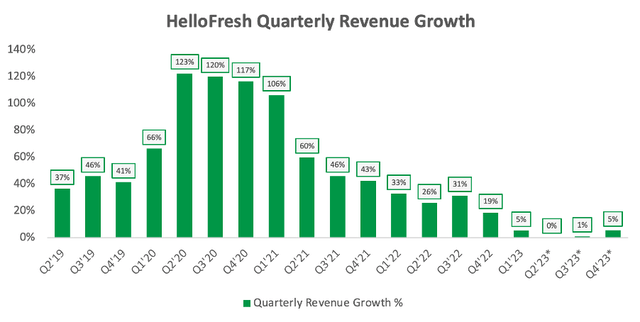

Let’s be clear about the number one reason I believe my previous ‘Buy’ rating on HelloFresh hasn’t panned out – the slowdown in revenue growth has been sharper than expected. There are several reasons for this, including the easing of lockdown restrictions and broad economic uncertainty for the past 6-12 months due to soaring inflation and interest rate hikes.

The below graph shows just how much of a slowdown HelloFresh experienced in Q1’23, with revenue growing at just 5% YoY.

Author’s Work / TIKR

This slowdown is expected to continue throughout the year, with analysts forecasting zero- to low-single digit revenue growth each quarter in 2023, according to TIKR. However, revenue growth is expected to recover slightly to 10.8% in 2024 and 8.2% in 2025 – so even if the days of consistent 30%+ growth are gone, analysts are still expecting HelloFresh to keep growing.

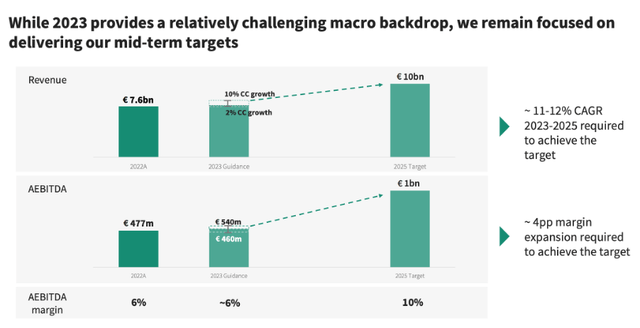

Management is slightly more optimistic, as they believe HelloFresh can achieve revenues of €10 billion by 2025 (for reference, analysts currently expect €9.5 billion). As per their latest Capital Markets Day presentation, this would represent around 11-12% a year revenue growth from 2023 through to 2025.

HelloFresh 2023 Capital Markets Day Presentation

The company also expects to deliver €1 billion in adjusted EBITDA by 2025, which would require a semi-substantial margin expansion from this point onwards – but, I think that can be achieved, as its latest investment cycle comes to an end and it can start to reap the rewards of these investments.

Capex Cycle Draws To A Close

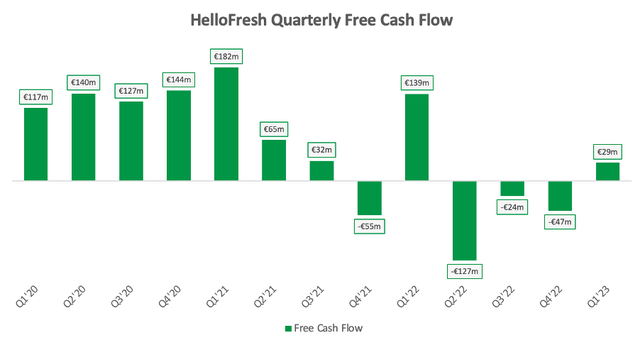

Another factor that has been weighing on HelloFresh over the past couple of years has been its declining free cash flow. This company is something of an outlier in the meal kit delivery space thanks to its profitability, and I was initially attracted to HelloFresh thanks to its impressive ability to generate cash.

Unfortunately, the company’s free cash flows have gone in one direction – down.

Author’s Work

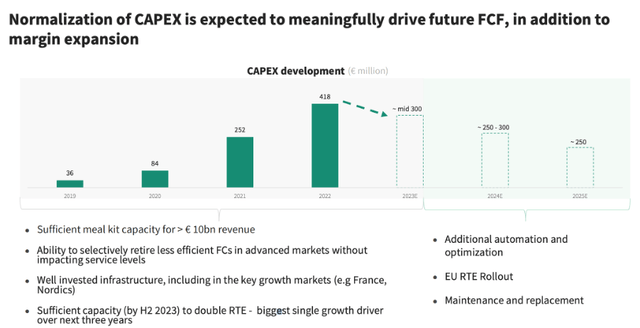

But if you’ve been paying attention, you’ll know that there’s a good reason for this. HelloFresh has been investing heavily in its business, enabling the company to add plenty of value for shareholders over the upcoming decade for all the reasons listed in the below slide.

HelloFresh 2023 Capital Markets Day Presentation

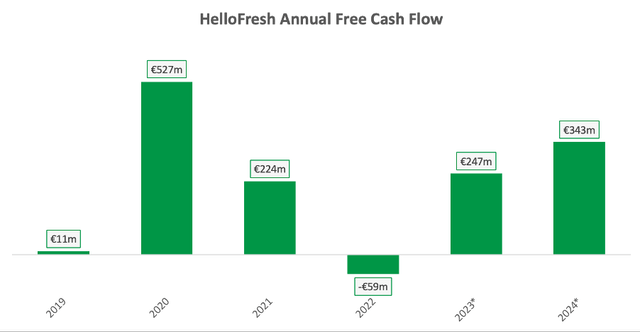

So not only should these investments deliver a boost for HelloFresh over the coming years, but we can also see that the company’s capex spend peaked in 2022, and is expected to start normalising. This should lead to a nice boost for HelloFresh’s free cash flow in 2023 and beyond, and that’s what analysts are expecting too.

Author’s Work / TIKR

As per the above graph, analysts are expecting to see a strong recovery in free cash flow from HelloFresh as these investments pay off and the latest capex cycle comes to a close, which could result in a bit more love for these shares.

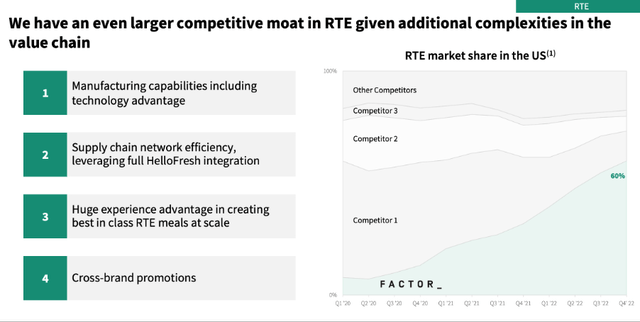

Factor Acquisition Looks Like A Success

In late 2020, HelloFresh acquired ready-to-eat (or RTE) meal company Factor75 (now Factor) for a total price of up to $277m, and that feels like money well spent! The RTE segment of HelloFresh accounted for ~12% of revenue in 2022, but saw astounding triple digit growth alongside a breakeven AEBITDA margin. The company now expects the revenue generated from RTE to double by 2025, whilst seeing a clear path towards adjusted EBITDA margins exceeding 10% for the segment.

One of the most impressive stats that HelloFresh boasts in its 2023 Capital Market Day presentation relates to Factor’s astounding market share growth in the US, as HelloFresh has been able to use its existing scale to supercharge Factor’s brand and operations.

HelloFresh 2023 Capital Markets Day Presentation

Factor still has plenty of growth potential for HelloFresh, as it was only launched in Canada early this year and will also be launching in Europe by the end of 2023. So whilst there are several areas for growth that HelloFresh can continue exploring (such as under-penetrated markets, new brands, new geographies, and new verticals), Factor and its RTE segment appear to be the real growth engine for now.

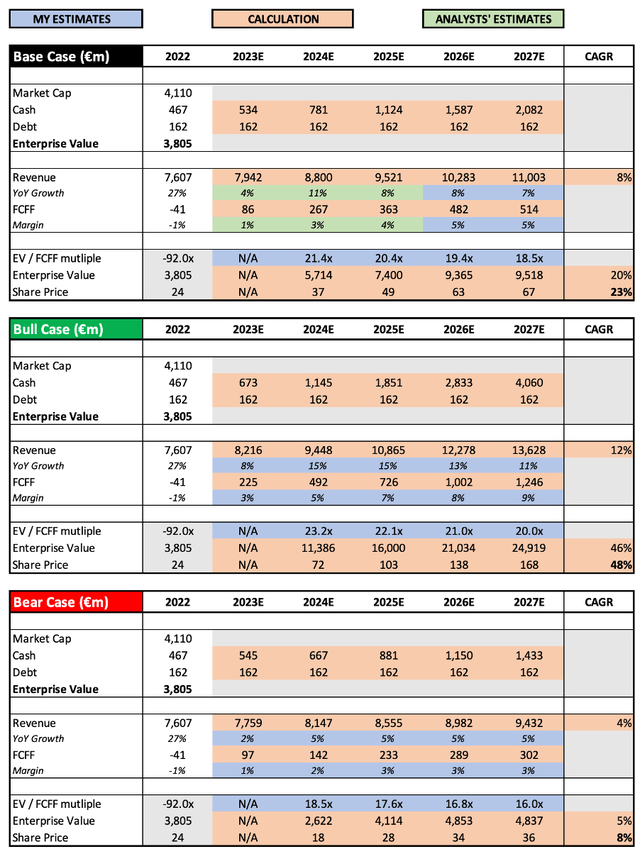

HelloFresh Stock Valuation

As with all companies, valuation can be pretty tough. I believe that my approach will give me an idea about whether HelloFresh is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

Author’s Work / TIKR

I have gone through several iterations of valuation models over my 120 Seeking Alpha articles, and I feel fairly comfortable with this model that I have settled on. I use analysts’ estimates in my base case to avoid making any overly optimistic (or pessimistic) assumptions due to any personal biases, and then I have more flexibility with my own bull and bear case.

I think that, following this latest investment cycle and a normalisation of growth rates in a post-pandemic, post-reopening world, HelloFresh certainly has the ability to achieve the 12% revenue CAGR through to 2027 that I’ve assumed in my bull case scenario, particularly if the RTE segment continues its impressive growth trajectory. I’ve also assumed that free-cash-flow-to-firm margins will expand to the high single digits, which could be achieved through a reduction in capital expenditure and greater economies of scale, especially within RTE as it improves its margins with size.

The bear case scenario effectively assumes the opposite; that HelloFresh’s growth days are over, and that the company will just plod along at ~4% growth for the next few years, with meal kit companies proving to be just another fad.

Put that all together, and I can see shares of HelloFresh achieving a CAGR of 8%, 23%, and 48% in my respective bear, base, and bull case scenarios. The key takeaway from this is that I do believe HelloFresh shares to be very attractively priced right now, and I wouldn’t be surprised to see attractive returns for shareholders from a very achievable base case scenario.

Bottom Line

It has been somewhat nostalgic writing this article, but I tell you one thing – I think that, if I revisit this article in a year or two, the results will be much better.

I believe that HelloFresh is currently being priced as a company that had a great run during the pandemic and now has no future prospects, but I don’t think that could be further from the truth.

In the next few years, I could see low double-digit growth returning and substantial margin expansion driving value for shareholders, as this €4 billion marketing-leading business starts to benefit from all the investments it has been making, hopefully alongside a more positive macro environment.

Given that I think the future remains bright for HelloFresh, and I believe the shares to be very attractively priced, I will upgrade my prior rating from a ‘Buy’ to a ‘Strong Buy’.

See you in 15 months!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here