Introduction

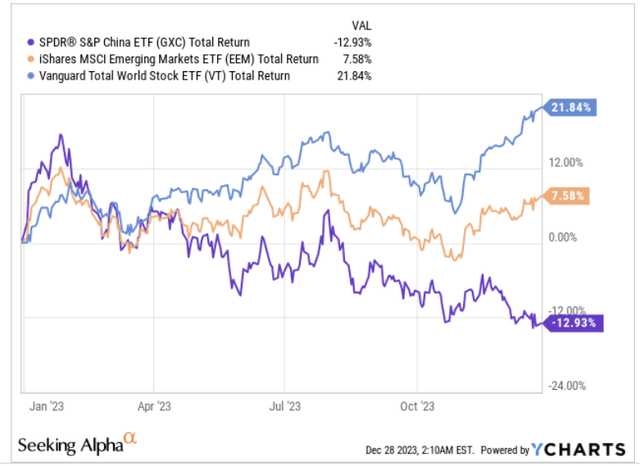

The SPDR S&P China ETF (NYSEARCA:GXC), a $675m-sized product that covers close to 1,200 Chinese domiciled stocks, has been a disappointment of sorts in 2023. In a year where global equities were rather resilient, delivering +20% returns, and emerging markets too were rather steady, witnessing +8% upside, GXC’s portfolio fared poorly, witnessing total returns of -13%.

YCharts

Could we see a change in the script in 2024? Well, here are some notable talking points that could weigh on GXC’s prospects.

Macro Considerations

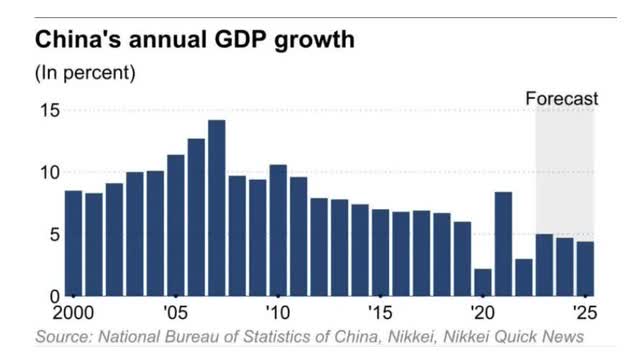

The Chinese economy has been making a stuttering recovery for a while now, and it does not look like the tide will turn significantly in 2024; in fact, the most recent reports coming out of China suggest that growth next year could be worse off than what will be seen this year.

2023 GDP growth will likely come in close to the 5-5.2% range, but next year’s growth rate looks set to drop to 4.6%, with some institutions such as S&P Global, even flagging the risk of a drop to 2.9%.

Nikkei

Much has been said about China’s property woes, and data from the NBS shows that property investments for the first 11 months of the year dropped by 9.4%. There are little signs of a positive shift here in early 2024 at least as the government is unlikely to come out with any aggressive reforms (source: Economics Intelligence Unit)

However, beyond the property headwinds, investors should pay particular attention to the consumer dynamics, as the consumer cyclical stocks dominate GXC’s portfolio, accounting for over a quarter of the total holdings.

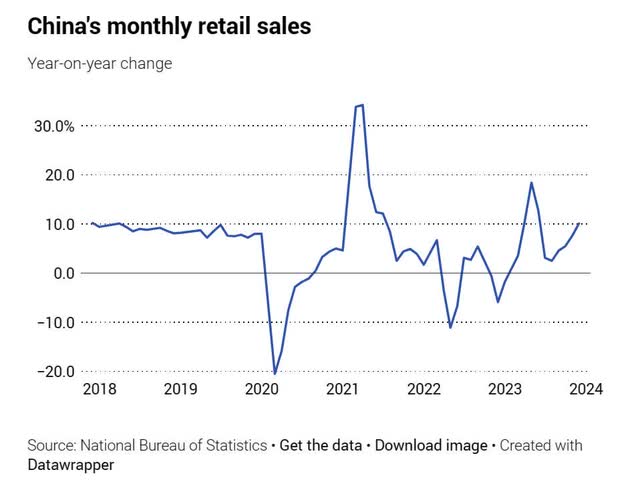

SCMP

Prima facie, impressive double-digit retail sales growth in November (in October growth was only 7.6%) may suggest that all is well here, but don’t disregard the impact of a weak base effect where pandemic restrictions last year resulted in retail sales slumping by 5.9% in November 2022.

Consumer confidence continues to make tenuous sequential progress for the third straight month, but for context note that the current run rate at around 87 is still a long way off the 32-year consumer confidence average of 110. Besides, recent local reports from China suggest that the middle class there has little inclination to loosen their purse strings. Spending appetite is so weak that Chinese public sector banks have been forced to curtail deposit rates to dampen the incentive to lock up money and rather spend.

Trading Economics

In addition to all this, some of the consumer companies that dominate GXC’s portfolio aren’t helped by the fact that the government there appears to be curtailing momentum in the gaming sector. After a difficult couple of years, the Chinese gaming market managed to grow this year and cross the RMB300bn mark, but last week we saw the gaming regulator come out with a slew of proposed rules aimed at curtailing incentives to dabble in online games.

Closing Thoughts – Valuation and Technical Considerations

The Chinese macro backdrop may be quite iffy, but if one considers only the technical and valuation quotients, it’s fair to say that GXC does offer some promise.

Investing

The chart above captures GXC’s price movements on a weekly basis. What’s evident is that the ETF has trended lower all through this year, but the weakness has also come about in the shape of a falling wedge pattern although we haven’t quite seen a massive drop off in volumes compared to what was seen at the start of the decline.

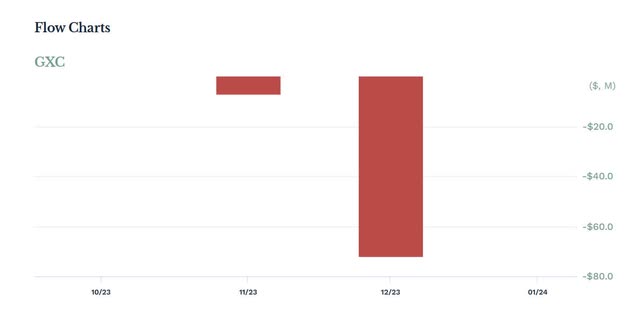

ETF.com

In fact if you look at the net flow trajectory in Q4 alone, we can see that after a dormant month in October, net negative flows have ramped up quite significantly, particularly in December. This suggests that the bulls are yet to turn more constructive, and thus one may not necessarily see a breakout from the upper boundary of the wedge.

However, if you want to keep your horizon short, and only want to play the two boundaries of the wedge, it looks like the reward-to-risk equation looks quite encouraging at these levels.

Supplementing this, you have another sub-plot that showcases how oversold Chinese equities look, relative to global stocks.

StockCharts

Since the turn of the GFC, note that GXC’s relative strength versus the Vanguard Total World Stock ETF (VT) had tended to chop around and lose clout within a descending channel. However, since the second half of 2021, we’ve seen this totally upended with the ratio dropping below the lower boundary of the channel, and slumping to record lows. Separately, also note that the current relative strength ratio is only half as much as the mid-point of the long-term range, offering up some potential for mean-reversion.

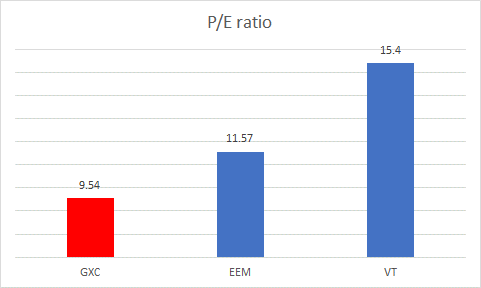

Meanwhile, even from a valuation angle, it’s worth highlighting that GXC offers tremendous value. The ETF is currently priced at only 9.5x P/E; this translates to a 17% discount to emerging markets and an even larger discount of 38% to global stocks.

Morningstar

Read the full article here