I have noticed that Genco Shipping (NYSE:GNK) is a tempting prize among investors. As a successful turnaround and with its recently high dividend yield, many perceive another investment to boost their income and perhaps even enjoy capital appreciation along the way.

Yet, a bet on GNK is not a bet on shipping in general. We’ll talk about the specifics of this business, its fleet, pricing, and its drybulk focus, all of which add up to its bottom line. With those reviewed I will make the case that this stock is a HOLD that can provide some dividends while we get a better idea of how the dust is settling in drybulk shipping from the events of the last three years.

Brief History

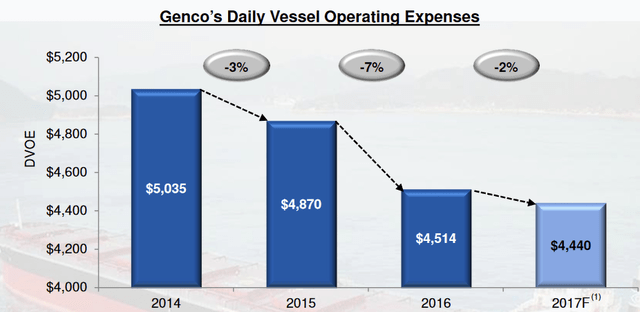

The company took on its current shape after its acquisition of Baltic Trading which completed in 2015. At the time, in addition to chartering its own 70-ship fleet, Genco provided services to other drybulk shippers in exchange for fees. The business generated negative cash flows, had a lot of long-term debt, and was in need of a change. It began the process of renovating its fleet and reducing OpEx.

Q4 2016 Company Presentation

It also began scaling down its fleet, selling off the older models. Alongside a $400m loan, it raised $125 million in capital through preferred shares in 2016, which were converted to common in 2017. This diluted the common from around 7m shares to over 34m, but this was a private placement, oriented toward owners of the common, and the conversion was done with shareholder approval. Since then, dilution has been more incremental.

Genco simplified its model, stepping away from service-related fees to other shippers and focusing squarely on profitably chartering its shrinking and less expensive fleet. To this end, it shifted toward pursuing spot pricing for shorter-term contracts, working directly with cargo owners, and relocated much of their fleet to the Atlantic to capture the higher freight premiums.

Recently

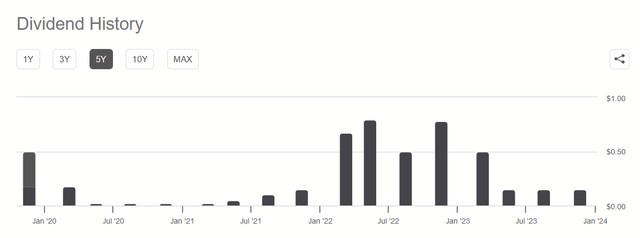

In 2019, the company had improved sufficiently that it finally started paying dividends to shareholders.

Dividends since 2019 (Seeking Alpha)

The improvements further materialized as a confluence of events caused revenues to increase, leading to higher dividends. As management wrote in their 2021 10K (Page 8):

The increase in voyage revenues was primarily due to higher rates achieved by both our major and minor bulk vessels…drybulk freight reached decade highs led by a rise in iron shipments from Brazil and Australia, strong global economic activity, higher port congestion, increased demand for coal due to tightness in the energy complex and manageable net fleet growth due to historically low orderbook.

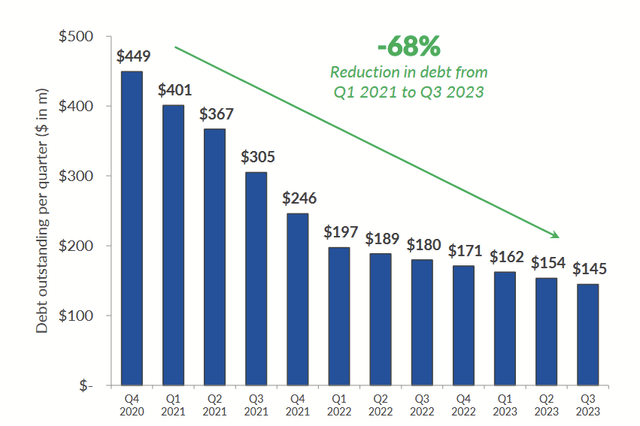

Folks might notice that 2021’s dividends were rather low, however, despite this cash flow. This is because the company also moved to pay down its long-term debt.

Q3 2023 Company Presentation

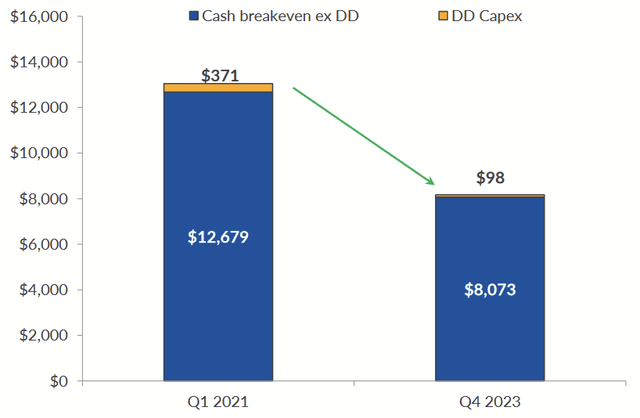

Paying down the debt was a key area of interest for management. Not only did it reduce the usual risks of default, but it helped to reduce interest expense. As management put it, this helped to reduce their “cash flow breakeven rate” going forward:

Q3 2023 Company Presentation

With the breakeven rate down by over a third, this makes it easier for the extant fleet to produce positive earnings that can be passed onto shareholders. Let’s take a look at the full impacts from 2015 to 2023 (YTD).

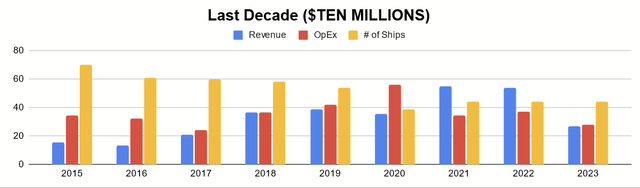

Author’s display of 10K/10Q data (Forms 10K/10Q 2015 – 2023)

Here we can see that the company managed to reduce the size of its fleet from 70 vessels in 2015 to 44 today (and thus the cost of maintaining it), while increasing revenue production, due partly to their more proactive focus. Operating expenses sometimes exceed revenues, even after the turnaround, but these often include non-cash items. Let’s take a look at the cash flow generation over that time as well. I created a graph based on what I think is a meaningful way to view Genco’s cash flow, given the type of business it is.

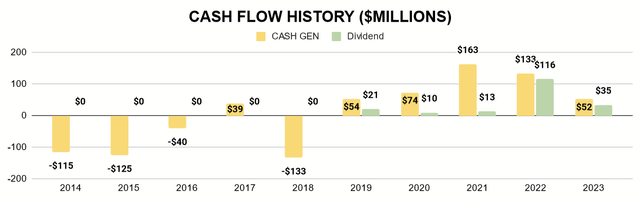

Author’s display of 10K/10Q data (Forms 10K/10Q from 2015 – 2023)

Utilizing its 10K/10Q data since 2015, I took operating cash flows and factored in the impacts of the purchase of new vessels, the sale of old ones, and the purchase of fixed assets. Based on this, we can see that cash flow is positive now. We can also see that, after significantly reducing their debt, they return a large portion of that cash flow to shareholders as a dividend now.

From what I see, this new dividend is what’s drawing buyers of GNK. With so much that has changed in the last decade, let’s take a look at the current business to better understand its dividend going forward.

Business Model

Drybulk

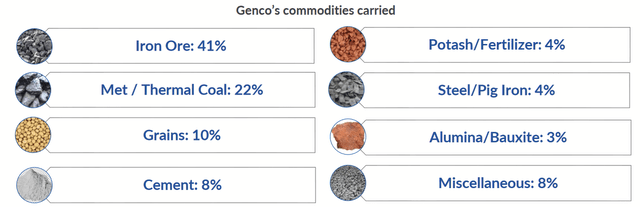

Like I said before, Genco is about not about shipping in general but drybulk shipping. This can further be broken down into Major Bulk and Minor Bulk.

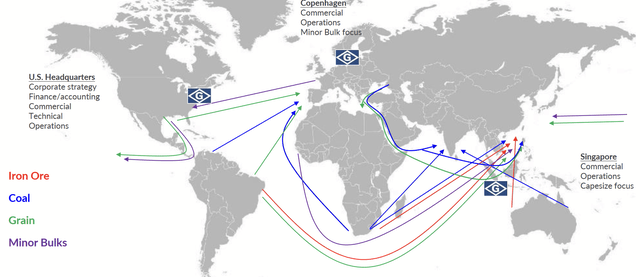

Capital Link New York Maritime Forum Presentation

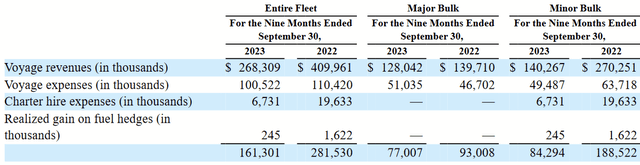

Major Bulk designates Iron Ore and Coal. Minor Bulk refers to the rest. This quarter’s 10Q shows that Major and Minor have a somewhat even impact in the financial picture.

Q3 2023 Form 10Q

At the same time, the comparison with 2022’s results show that it can be much more lopsided toward one component over the other. Shifts in supply and demand of these different types of cargo, even if we focus on drybulk, can therefore affect the rates that shippers charge (and thus what Genco earns for certain cargo).

China is the largest importer of drybulk globally, having the most demand for iron ore and coal. As such, China’s own cycles and behavior will impact this commodity pricing. Similarly, events like the Russian invasion of Ukraine and the impact on grain prices and thus the rates for hauling that cargo along other routes. Let’s take a look at the routes Genco covers.

Capital Link New York Maritime Forum Presentation

Iron ore shipments primarily come from Brazil, Africa, and Australia into China. Coal shipments go from places like Venezuela, Africa, Russia, and Australia into Europe, India, and China. Grain and other minor bulks are shipped from America, Brazil, and the Black Sea into Europe and China.

Charters and Rates

The company’s revenues ultimately derive from rates it charges to charter its fleet to their charterers. These rates are impacted by both the value of the cargo itself, the availability of vessels, and other factors like congestion at ports. Interestingly, a study found that port congestion at American and European ports causes rates to increase more than congestion at Asian ports.

There are time charters and voyage charters, both of which Genco utilizes to realize best possible prices.

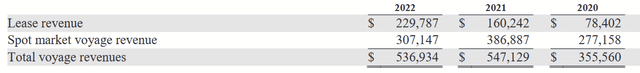

2022 Annual Report

Time Charters

Normal time charters set a fixed daily rate for use of a vessel over a period of time. Spot-market related ones have a variable daily rate the adjusts with changes to the Baltic Dry Index (BDI). Genco typically likes the potential upside that can arise from these charters.

Voyage Charters

Genco’s voyage charters are all spot market in nature. Here, the contract isn’t based on daily rates but on the metric weight of the cargo during the voyage from when the vessel leaves to when it reaches its destination, based on spot market rates.

Costs

Typical costs include things like crew, maintenance, port/canal charges, and fuel. Fluctuations in these (fuel being a big one) can therefore have a major impact. Crew-related costs can generally be expected to increase over time with wages, while short-term matters (like COVID safety procedures) can increase these temporarily. As of Q3 2023, average daily operating expenses are about $6,100 per vessel per day.

Fine To Hold For Now

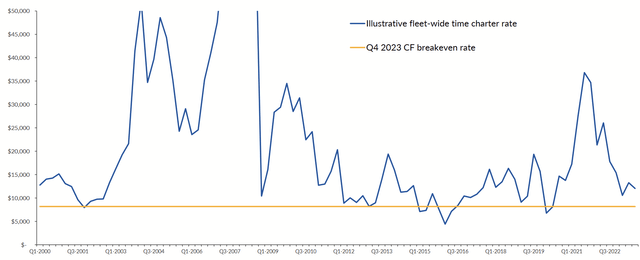

Q3 2023 Company Presentation

The company was kind enough to compare their current breakeven rate with charter rates based on historical data. If we assume this chart indicates what the floor of shipping rates must be, drybulk shipping should be a profitable operation for Genco in most circumstances.

I’m not too worried about that, but since investors in GNK typically like the dividend, the tricky part here is the middle range that shipping rates seem to occupy, as that will impact the dividend’s upside and thus the kind of income they can collect.

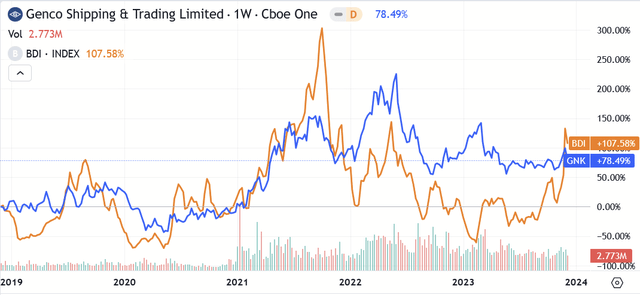

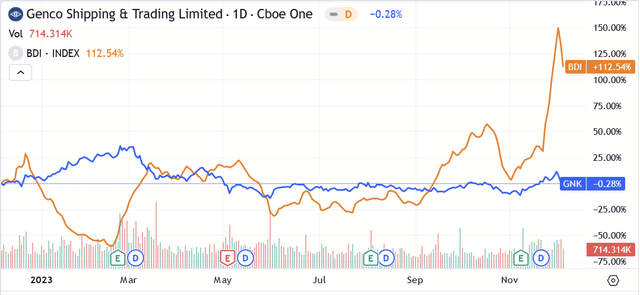

As mentioned before, spot market charters ride the rise and fall of the BDI. As it goes up, so do revenues for the company and thus potential dividends. Take a look at the movement of the index over the last decade, relative to shares prices of GNK. Keep in mind these charts are showing rates of change, not actual prices.

Seeking Alpha

Over a long period of time, we see above that movement of GNK will roughly follow the ebbs and flows of the BDI. If we look at more recent activity, we get a different impression.

Seeking Alpha

Short-term movements can diverge quite a bit. GNK had briefly begun paying heftier dividends, and the price increased, even while the BDI declined. Let’s look at GNK’s actual price chart over the past year.

Seeking Alpha

We’ve seen that it got close to $20 per share. With total dividend payments in 2022 of $2.74, the market seemed to think it was getting a killer yield above 10%. With the quarterly dividend at $0.15 since May, we see how much the price dropped.

At that rate, the annual yield is barely above 4%. We saw that it can go much lower in 2020 and 2021. A money market gives better income right now for the same capital, while other stocks have higher yields. I can understand if someone did buy at a lower price and doesn’t want to have a taxable event, but dividend reinvestment at this price seems like a poor way to compound one’s wealth.

Moreover, many dividend investors see quotes that give a yield based on TTM. If the next quarter is lower than Q1’s distribution of $0.50, then the yield will “change” from 6.5% to as low as 4.2% and probably scare the people who bought it in haste this year into a selloff. That’s why I think patience is warranted for folks looking for an entry price. In the long-run, it might not be terrible, but if actual dividends are important, then it’s okay to wait.

Risks

Even if the bottom line is to hold for now, we need talk about the risks of sticking with Genco that could play out even in a short span of time.

China

A Republican victory in the next election, potentially Trump again, could reignite trade wars between China and the United States, which could hurt the Minor Bulk shipments between the two countries. Additionally, anything that sets back China’s demand for iron and coal, like its re-adoption of COVID lockdowns in 2022, will have an impact on revenues.

Black Sea

Similarly, uncertainty about the war between Ukraine and Russia is in play. The sanctions limited Russian exports to the U.S. and Europe, but they did open the door for exports of coal to India. How international trade will continue to adapt to the ongoing war is not totally clear, and a sudden end to the war would complicate things further. Investors should watch to see how a change either way can affect Genco.

Improved Supply Chain

Anything that improves the international supply chain, such as reducing port congestion or increasing availability of ships by competitors can have a negative impact on charter rates and hurt revenues.

Conclusion

Genco successfully turned itself around, became profitable, and eliminated debt to the point that I think it’s unlikely to go zero. There’s more to say about this company from a longer-term outlook, and perhaps that’s worth doing once we get farther into 2024.

Let other investors realize that TTM is not reflective of current distributions, so that GNK can be more reasonably priced. For what the company, its cash flows, and its dividend are right now, I think GNK is more of a HOLD than a buy. Charter rates are in an uncertain middle range, and with this high payout ratio, a lower (re)entry price for a higher yield makes a big difference. Until then, watch the BDI.

Read the full article here