The Yen has surprisingly extended its recent strength relative to the dollar (and other G10 currencies) for yet another week. In effect, Japanese rates have not only priced in an end to the BoJ’s ultra-loose monetary policy by April next year, but also a growing probability of a rate hike by end-2024.

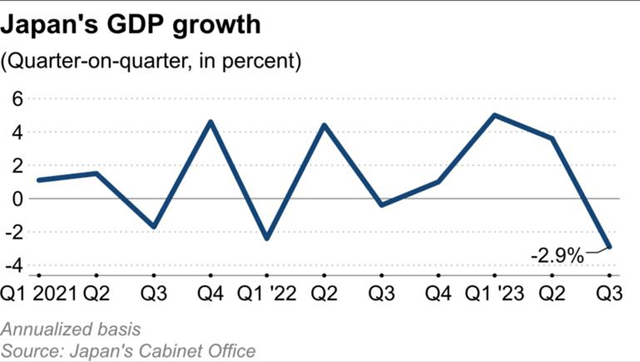

Thus far, there hasn’t been much in the data to suggest such a big move is warranted – Japan is seeing deteriorating GDP numbers, while its balance of payments (i.e., the net flow of economic transactions in and out of the country) is no longer in surplus. And given the BoJ’s conservative track record with regard to policy normalization, there’s a good chance we see a more gradual exit than market pricing currently implies. On the dollar leg, market pricing looks similarly overdone, with around 120bps of Fed cuts presently priced into the Treasury curve – despite Fed chair Powell pushing back on aggressive rate cuts. Bottom line, I would be cautious about playing a sustained yen reversal via the Invesco CurrencyShares Japanese Yen Trust (NYSEARCA:FXY).

Invesco CurrencyShares Japanese Yen Trust Overview – An Investment Vehicle for JPY Exposure

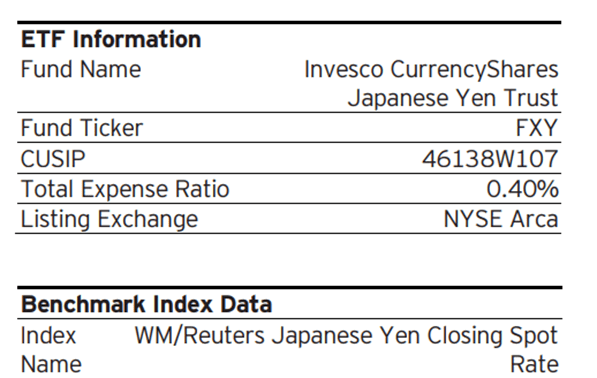

The US-listed Invesco CurrencyShares Japanese Yen Trust provides investors exposure to changes in the value of the Japanese Yen, the national currency of Japan, and all accounts held by its central bank, the Bank of Japan. Unlike most other currency ETFs, FXY incurs yearly interest expenses on top of its headline 0.4% expense ratio (in line with other Invesco CurrencyShares funds). Per last year’s annual report, total expenditure accounted for as much as 0.6% of fund assets. Since then, the fund has seen its net assets under management grow to ~$279m, though its expense ratio remains unchanged at 0.4% (0.6% including the -0.2% interest rate).

Invesco

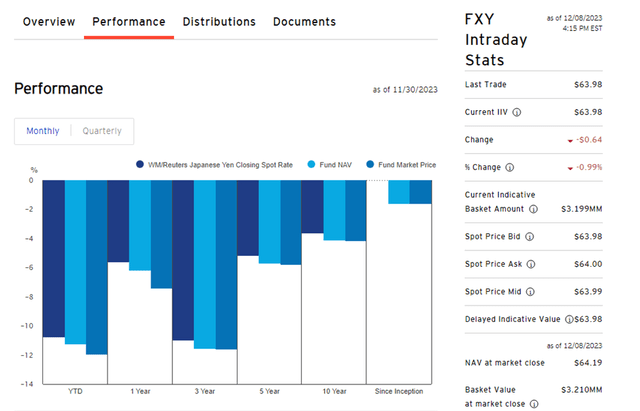

On a YTD basis, the fund has declined by -11.2% in NAV terms (-11.9% in market price terms), far underperforming its benchmark WM/Reuters Japanese Yen Closing Spot Rate. Since its inception in 2007, FXY has declined at an annualized -1.6% pace in market price and NAV terms. Over more recent timelines, however, FXY has drawn down at steeper rates – its annualized three- and five-year performance stand at -11.5% and -5.7%, respectively.

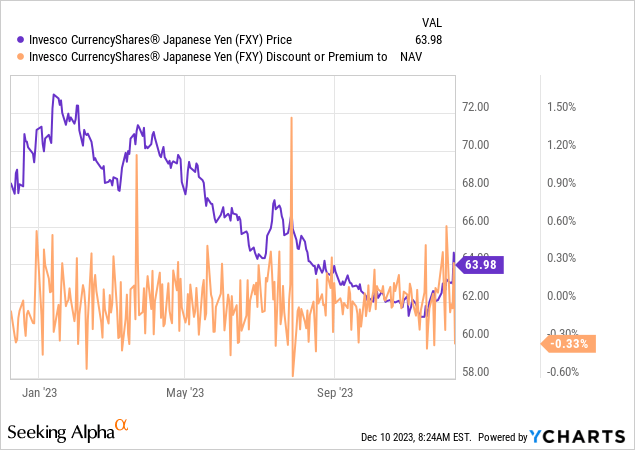

For the most part, the fund has tracked its benchmark well after adjusting for expenses. The BoJ’s negative interest rate policy has, however, widened the relative underperformance in recent years. In general, currencies aren’t very good ‘buy and hold’ investments, as FXY’s historical performance shows. Thus, FXY makes more sense, instead, as a vehicle to express tactical views or as a hedging instrument.

Invesco

Normalization May Not be a Given at the December Monetary Policy Meeting

The USD/JPY carry trade has long been an FX investor favorite, but the backdrop today is much different. For one, Japan’s balance of payment surplus has been unwound – largely on account of net outflows from the capital account outweighing a positive current account balance. Meanwhile, economic sentiment is poor – per BoJ surveys, Japanese households continue to struggle with inflation expectations, a key reason for Prime Minister Kishida’s poor approval ratings. In tandem, household spending is down YoY, and so is real wage growth, as recent nominal wage hikes fail to keep up with inflation. Japan may also be in danger of a recession, with Q3 GDP growth recently revised deeper into contractionary territory.

Nikkei

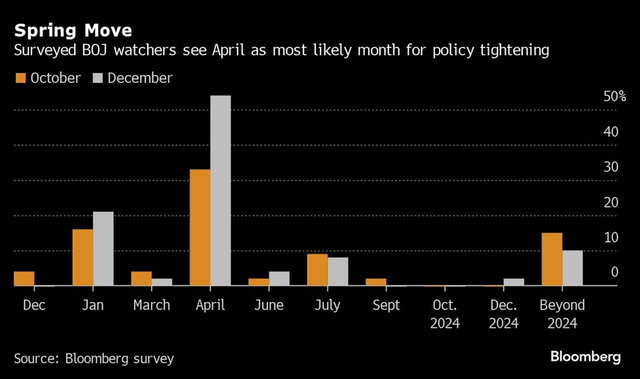

Given the uncertain backdrop, it has perhaps been no surprise that the BoJ has elected for incremental tweaks to its ‘yield curve control’ policy (i.e., capping Japanese sovereign bond interest rates across longer maturities) in recent months rather than push ahead with full-blown policy normalization. In line with its prior tendency to err on the side of caution, BoJ Governor Ueda has more recently focused his commentary on a more gradual normalization approach, for instance, by phasing in through the tiered-rate system rather than a broad-based adjustment. In any case, market expectations already call for a complete exit at the April 2024 policy meeting, so in the event the BoJ hints at a ‘wait and see’ approach at this month’s meeting, the Yen might reverse lower.

Bloomberg

Too Fast Too Furious for the Japanese Yen

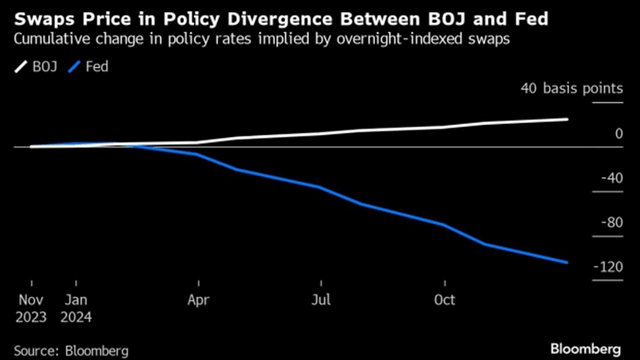

Having surged on the back of widening rate differentials throughout this year, the USD/JPY setup into next year couldn’t be more different. The Fed is now on course for rate cuts in 2024, while the BoJ is going in the other direction, lending strength to the Yen.

The issue is the extent to which USD/JPY has already sold off in recent weeks. At current levels, the market seems to have priced in extremes across both legs for 2024 – rate hikes and a full exit from yield curve control by the BoJ, as well as 120bps of rate cuts by the US Fed. In contrast, economic data from both countries and their history of cautious central bank policy have shown little to support underwriting such an aggressive path. At these levels, I would be cautious about expressing a long yen/short dollar trade, particularly via a negative-yielding vehicle like FXY.

Bloomberg

Read the full article here