Franklin Street Properties (NYSE:FSP) is a REIT focused on office properties in the U.S. that is currently trading much lower than its book value. In the last couple of months, the company’s stock price experienced a slow decline, making it more attractive for investors.

The last time we have covered the company, we analysed the Q3 report and reiterated our buy rating based on those results. Since our last article, the company’s stock price has declined by around 13%. The decline in stock price, combined with the company continually following their plans diligently, creates a compelling investment opportunity.

Since Our Last Report

Since our last report, the company has shared their Q4 2023 financials, which show a continued focus on dispositions and debt repayments.

Simultaneously, the company has also announced a sweeping debt amendment, affecting all of the company’s debt. With the debt amendment, the company has repaid a substantial amount of the total debt and also changed maturities across the board.

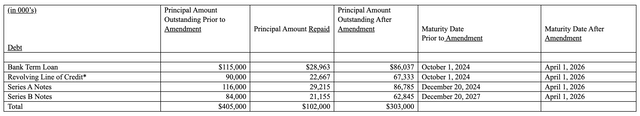

Debt Amendment Table (Q4 2023 SEC Filing)

In light of the debt amendment, the company repaid a total of $102m in debt using cash on hand. All the debt series’ maturity dates have also been moved to April 1, 2026, making the company have zero maturities for the next 2 years.

With a healthy balance sheet, debt hasn’t been a problem even before this amendment. However, the amendments put the company in an even better spot, giving them 2 worry-free years without maturities to execute on their current strategy and only $303m of debt maturities on April 1, 2026.

With positive cash flow and at least $40m in cash on hand, the main concern now is, whether the company can continue to dispose of their real estate at favourable prices and, if the company will be in a position to eventually be able to return capital to their shareholders.

On the disposal front, the company makes steady progress. Since our last article, the company has made public 2 more disposals, bringing them closer to the CEO’s communicated goal

to increase shareholder value by continuing to (…) pursue the sale of select properties where we believe that short to intermediate term valuation potential has been reached.

Property Sales

On December 6, 2023, the company has completed the sale of “Blue Lagoon” in Miami, Florida for ~$68m in gross proceeds. Cash proceeds from this disposal have evidently been used as part of the ongoing debt reduction, executing on the company’s long term stated strategy of using disposal proceeds for debt reduction.

On January 26, 2024, the company has completed the sale of “Collins Crossing”, an office property in Richardson, Texas for ~$35m in gross proceeds. Since the before mentioned debt reduction was completed in February and could have been covered with cash on hand on FY2023, the cash proceeds from this disposal are available to pay for operations and/or further debt reductions.

Updated Valuation

Following our valuation in our last article, we can update our assumptions based on the most recent sales and further information shared by the company in the FY23 release. First, we can update our previous estimation of price per square feet of all of FSP’s real estate holdings.

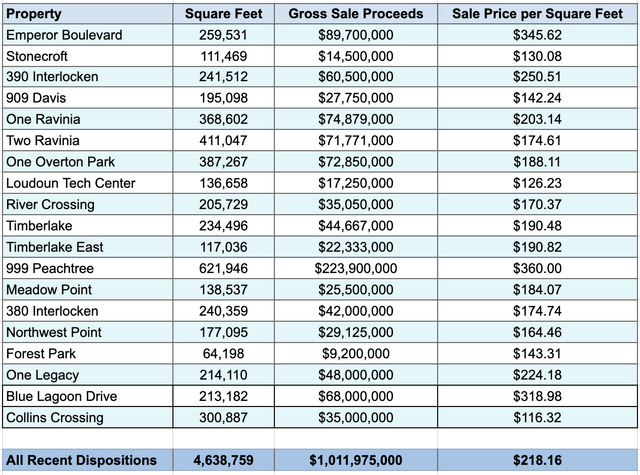

Price per square feet of recent dispositions (Asset Alchemist)

By updating our spreadsheet calculating the average price of previous property sales, we can include the latest closed sales in our calculation. Up until now, FSP has sold 19 properties across the U.S. since December 2020, at an average sale price per square feet of $218.16. The two latest dispositions have been priced close to our previous average of $220.37.

After the recent dispositions, the company’s real estate holdings now total a square footage of 5,478,281. Applying the average price per square feet calculated, we can come up with an updated, but still very rough value of ~$1.21b for FSP’s remaining real estate holdings.

Adding our pessimistic estimate of at least $40m cash on hand and drastically reduced debt, the rough net value of the company’s assets is just under $1b. Due to the ongoing disposals and completed debt reduction, even though our updated estimate is slightly lower than from our last report, the company looks much healthier with a more favourable maturity structure.

Risks

We want to reiterate the risks mentioned in our last Article on FSP. Namely, the two main risks are:

- A strong decline in commercial real estate prices going forward, significantly impacting the company’s net asset value.

- The inability of management to “close the gap” between the company’s net asset value and the price of the common stock.

The relatively low price the company received for their Collins Crossing property further confirms that risk number 1 is not to be underestimated. We are closely following further developments in the commercial real estate industry and what prices FSP will be able to sell their other properties at.

The absence of any cost-cutting measures might also confirm that risk number 2 is not to be underestimated. In theory, the company should be able to reduce their workforce now, since they have sold a lot of properties in the last couple of years and thus should need less manpower to manage them. However, so far, the company has not conducted thorough cost-cutting measures.

With the continued execution of the company’s stated goals for disposing real estate and reducing debt, the question of the long-term future for the company becomes more important. At some point, shareholders have to ask themselves if they will ever receive capital returns from their investment into a company managing a dwindling real estate portfolio.

Conclusion & What To Look Out For

Based on the ongoing efforts of the company to sell properties and unlock shareholder value, we believe the points brought up in our last analysis are still valid. We welcome the positive updates regarding successful property sales.

Based on our estimations, the stock is still trading at undervalued levels. Factoring in a ~13% decline in stock price since our last article, we believe this to be an attractive investment opportunity and an even better entry point compared to 6 months ago.

We are still looking out, mainly for updates on the planned property sales and potential updates on the company successfully renting out more of their owned space. We are continuing to look out for any comments on possible share repurchases or clarification for long-term plans of the company.

Read the full article here