Electric vehicle start-up Fisker (NYSE:FSR) has made a couple of important announcements lately that affect its delivery ramp in Europe. The company is aggressively entering new markets and is seeking to establish a wide-ranging service network in Europe. Recent announcements about the company’s expansion in Europe, however, were overshadowed by Fisker lowering its production outlook for FY 2023 again as a key supplier requires more time to prepare for Fisker’s expected production ramp in the second half of FY 2023. However, I believe the risk profile has improved and shares look appealing as a speculative buy, in my opinion!

Previous Rating

Fisker reduced its production outlook earlier this year from 42,400 electric vehicles to a range of 32,000 to 36,000 EVs: Change In Production Target Is A Game-Changer. Now, for the second time, Fisker lowered its FY 2023 production forecast due to supplier issues. On the other hand, Fisker is getting to seriously expand into Europe which should bode well for the company’s brand recognition as well as top line growth.

Fisker’s European expansion

Fisker is moving into Europe with determination and speed. The electric vehicle start-up has started deliveries in Europe (Denmark and Germany) and the U.S. in the second-quarter and the company is set to launch its Fisker Ocean electric vehicle in Belgium, the Netherlands, and Switzerland. The company is investing heavily to build Fisker Lounges and centers throughout Europe and the company has said that regional deliveries in Belgium, the Netherlands, and Switzerland are expected to start at the end of September.

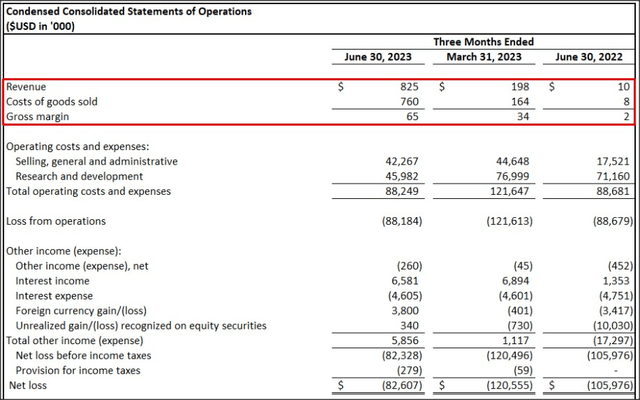

Fisker is in the early stages of growing its revenues and the company managed to quadruple its revenue base from the first to the second fiscal quarter of FY 2023. Granted, the revenue volume is still relatively low (less than $1M in Q2’23), at least compared to other EV manufacturers that already achieve much greater delivery volumes, but the company is on the right track and making progress: Fisker’s Q2’23 revenues were $825 thousand compared to $10 thousand in the year-earlier period. With deliveries now expected to ramp up in the third-quarter, especially in Europe, Fisker is set to achieve significantly higher revenues in the second half of FY 2023.

Source: Fisker

Fisker lowered production target a second time

Fisker’s production is going slower than expected, but I believe the EV company is nonetheless on a good path. In July, 1,009 Fisker Oceans were produced, compared to just 741 in June, reflecting 36% month over month growth. In the entire second-quarter, Fisker produced 1,022 EVs.

Earlier this year, Fisker lowered its production target from 42,000 EVs to 32,000 to 36,000 EVs due to supplier problems. Now, the EV company expects 20,000-23,000 thousand EVs in FY 2023, which calculates to a 37% decline compared to the prior outlook. While I would normally see this as a reason to down-grade the shares, I believe the company’s expansion in Europe and successful $340M senior unsecured convertible notes offering in Q2 (ensuring that Fisker can continue to ramp up its production) are reasons for me to upgrade the EV company.

Fisker’s valuation

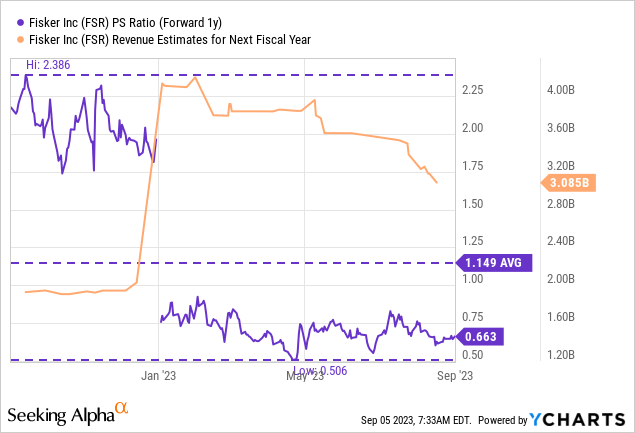

Fisker is valued based off of its projected revenue potential since the EV maker is still widely unprofitable… which is normal for start-ups that are in the early stages of their production and delivery ramps. Given the reduced production outlook for FY 2023, analysts have lowered their revenue estimates lately: for the current fiscal year, the consensus estimate calls for $1.2B in revenues. But the real growth is expected to happen in the next 4 years which is when analysts project Fisker will be able to grow its annual revenue volume above $10B, or by 73% annually.

Shares of Fisker are currently valued at 0.6X forward revenues while other EV manufacturers (those that are already rolling a high number of electric vehicles off of their production lines) are selling at significantly higher price-to-revenue ratios. Shares of Fisker are currently trading 42% below the 1-year average P/S ratio. Lucid Group (LCID) has a FY 2024 P/S ratio of 7.1X while Rivian Automotive (RIVN) trades at 3.2X forward revenues.

Risks with Fisker

Fisker successfully raised $300M in (gross) proceeds from a $340M senior unsecured convertible notes offering which is bolstering the company’s cash position and ensuring a smooth production ramp in the third and fourth quarter. Fisker had $522M in cash on its balance sheet at the end of Q2’23, so the EV company should have enough cash to finance its production ramp until mid-FY 2024. While the company has no immediate need for additional short-term financing, Fisker is not as well capitalized as other EV companies, such as Lucid Group or Rivian Automotive… both of which have extremely healthy balance sheets. Another risk that I see relates to the production timeline. If Fisker continues to lower expectations with regard to its production ramp, investors may lose patience and ditch the shares for other, more promising EV companies. Given the company’s early stage in its production ramp, investors must expect more convertible debt offerings or equity raises that dilute shareholders going forward.

Final thoughts

Fisker lowered its production outlook a second time recently and now expects an annual delivery volume of between 20,000 to 23,000 electric vehicles. While this would normally be a reason for me to down-grade shares, the company is making progress in scaling its footprint in Denmark, France, Germany, U.K. and Scandinavia and, despite a lowered production outlook, production is ramping up nicely. As Fisker starts to make its first deliveries in new countries, such as Belgium, the Netherlands, and Switzerland, investor sentiment may change for the better. With revenues now starting to ramp up and Fisker Ocean deliveries beginning at scale in Europe, I believe Fisker faces an important catalyst for growth!

Read the full article here