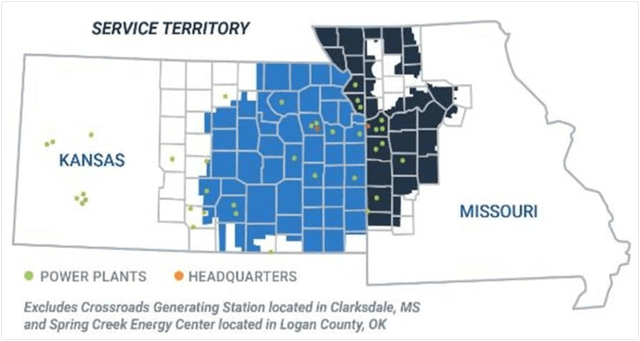

Evergy, Inc. (NASDAQ:EVRG) is a holding company for three electric subsidiaries: Kansas Central, Evergy Metro and Missouri West. The company generates and transmits electricity to 1.7 million customers in Kansas and Missouri, and covers the urban and suburban markets of Kansas City, Topeka, Lawrence and St. Joseph. Evergy is the largest utility in Kansas and has a market capitalization of $11.04 billion, having existed in various forms since 1882. The current version was incorporated in 2017. Evergy has 15,400 megawatts of generating capacity, with a nuclear generating plant in Burlington Kansas, and it sells energy it does not need on the wholesale market. Standard & Poor’s currently rates Evergy’s credit as A-, or medium investment grade, and it is a component of the S&P 500. The beta of the stock is 0.55, so it is significantly less volatile than the market as a whole. Below is a map of Evergy’s service area.

Evergy Market (2022 Annual Report)

Shares are currently priced at $50.27, and I believe they are about 10.0% undervalued here and I have rated them a buy. They were a better buy until this past Tuesday, when the new data was released showing inflation had slowed to an annual rate of 3.2% and the Dow Jones Industrial Average jumped 496 points.

Unusual Weather Created Unusual Earnings

According to Evergy, its revenues are seasonal and the third quarter, which includes the summer months of July and August, typically accounts for one-third of the company’s revenue. In its 2022 Annual Report the company specifically states that “unusually mild winters or summers can adversely affect sales.”

Earnings per share in 2021 were $3.83 and in 2022 they dropped to $3.26. This was primarily because Kansas and Missouri had one of their warmest winters on record in both of the last two years. Average temperatures were 4.0 to 5.0 degrees above normal. Now for 2023, the non-GAAP earnings per share expectation is $3.65, at the upper end of the current guidance of $3.55-$3.65. The corresponding GAAP earnings estimate is $3.22-$3.32 per share. In the third quarter this year, the numbers were impacted by a cooler than usual start to August. GAAP earnings per share for Q3 were $1.53; non GAAP was $1.88. By comparison, non-GAAP earnings were $2.00 in the third quarter of 2022. For the second quarter of 2023, non-GAAP earnings were $0.88, while in 2022 they were slightly lower at $0.81 per share.

Despite the variance in earnings created by weather, management has a long-term growth plan for 4.0%-6% annual increases for earnings per share; this is reduced from a prior long-term growth target of 6.0-8.0% as of last year.

Evergy’s Growing Dividend

On November 7th, Evergy increased its dividend by 4.8%, from $0.613 to $0.6425. This will come to shareholders in the December payout. At the current share price of $50.27, the yield is 5.11%. Evergy has now raised its dividend for 20 consecutive years. Five more years and it will be a member of the Standard & Poor’s Dividend Aristocrats Index.

It hasn’t always been smooth sailing though. The dividend was cut in 2000 from $0.535 per quarter to $0.30, then to $0.19 in 2003. In 2004 it began increasing again at an annual compound growth rate of 6.28%. The company states that its current dividend payout target is 60.0 to 70.0%, still with a growth rate of 6.0 to 8.0% per year, so this means there will have to more contained expenses in the future. Evergy’s actual payout ratio based on earnings has ranged from 56.9% to 75.4% as illustrated below. These are still very acceptable payout ratios over time.

Evergy Payout Ratio (Author Calculated)

There are a few dividend limitations noted in Evergy’s annual report. For example, the Kansas utility subdivisions can only pay dividends out of retained earnings. The Missouri Divisions cannot pay dividends if their credit rating falls below Standard & Poor’s BBB-, the lowest investment grade level, or if long-term debt exceeds 60.0% of total capitalization. I don’t expect either of these to be an issue for the company going forward, but it’s smart to know the limitations are there.

The Regulatory Environment Could Be Better

Kansas operations are regulated by the State Corporation Commission of Kansas and Missouri operations are regulated by the Public Service Commission of Missouri. Evergy is the only utility in its market; there is no competition. The Wolf Creek generating station is subject to the Nuclear Regulatory Commission’s oversight. Of the two states, Kansas is considered more “utility friendly,” but even so, Evergy states in its third quarter report that “rate base growth rate (in Kansas) is at the low end of peer utilities.”

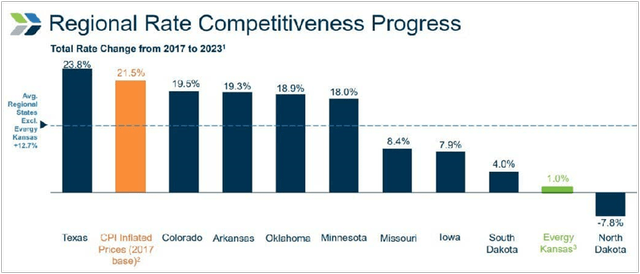

One of the company’s goals is to maintain affordable electric rates for its customers. Evergy’s current average rate was $0.1097 in 2022, compared to Hawaiian Electric (HE) at $0.4030, Sempra (SRE) at $0.3225, or American Electric Power (AEP) at $0.1101. Only nine major US utilities have less expensive rates than Evergy. Since 2017, Evergy’s rates have only increased 2.7% while inflation in the area has increased by 18.0%. So there is definitely room for higher rates in Evergy’s markets if it gets more favorable regulatory boards.

Utility Rate Change Comparison (Evergy Q3 Investor Presentation)

Kansas currently allows a 9.4% return on equity for the Kansas Central and Metro markets. However another rate increase request will be decided by December 21. The Missouri regulated segments are not structured with a return on equity. Missouri functions on a “plant in service” basis, which limits increases to 3.0% per year after a general rate increase every few years. A new Missouri rate base settlement was made in late 2022 and it was considered low. However Missouri did allow for a recovery of $308.0 million in “extraordinary” costs due to 2021’s Winter Storm Uri. This was done through securitization, where the existing debt is turned into customer backed bonds, which are sold in the open market. In Missouri, another rate increase request is expected to be filed in February 2024.

Five Year Plan, Capex and Debt

Last year, the US Congress passed the Inflation Reduction Act. A portion of this created new emissions targets for utilities, based on the levels recorded in 2005. These included a reduction of 40.0% by 2030 and a zero emissions goal to be achieved by 2050. A set of financial incentives totaling $369 billion was created to help utilities get to these numbers. There is a 30.0% tax credit for “qualifying wind, solar, and energy storage.” There is also a nuclear production tax credit that will enable Evergy to benefit from its Wolf Creek nuclear plant. Another $2.0 billion is allocated to upgrade transmission lines for utilities. This would be of use to Evergy, which states that “45.0% of its transmission system is more than 50 years old.”

To get to the new emissions standards, Evergy plans to invest $11.6 billion in infrastructure though 2027. Some $2.1 billion of this amount will be invested directly into renewables. Evergy’s specific company-set goals are different; a 70.0% carbon reduction from 2005 by 2030, and net zero carbon emissions by 2045. As of year-end 2022, its carbon dioxide emissions were half of the levels in 2005.

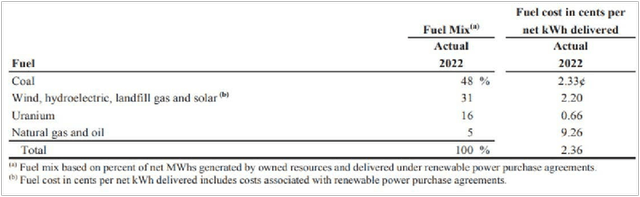

Evergy currently has a wind portfolio that generates 4,400 megawatts and plans to add another 300 megawatts by 2024. In August of 2022, Evergy acquired the Persimmon Creek Wind Farm in Western Oklahoma for $250 million. The company also has a 50.0% interest in a wind farm joint venture with American Electric Power (AEP) and Berkshire Hathaway (BRK.A). Coal is currently 38% of Evergy’s generating capacity, while wind is another 28.0% and natural gas is 26.0%. Uranium makes up 7.0% and solar about 1.0%. Over the next decade, the company expects to retire 1,900 megawatts of coal. Since 2005, it has already retired 2,400 megawatts of fossil generation. The costs of all these fuel types per kilowatt hour is presented in the table below.

Fuel Costs by Type (2022 Annual Report)

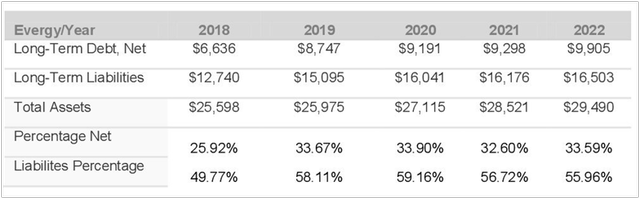

Below is a table illustrating Evergy’s long-term debt as a percentage of total assets. All figures are in millions except, of course, the percentages. I believe the ratios appear reasonable, when compared to other utilities.

Debt Ratios Over Time (Annual Reports)

Current Valuation of Shares

I have used a discounted cash flow model and current market P/E ratios to value Evergy shares. In general, 2023 has been a challenging year for utilities and Investor’s Business Daily called it the “worst performing sector” of the year. In October, Morningstar said that utilities were generally trading at a 15.0% discount, and at a current 16.0 P/E ratio for the sector, shares are the cheapest they have been since 2009. Just a few years ago, in 2020, the overall utility sector was trading at a P/E Ratio of 23.0.

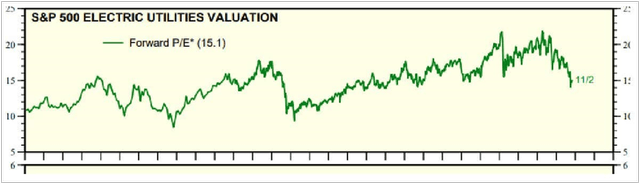

I have relied on two investor surveys to determine an appropriate P/E ratio to value Evergy. The most current is from Yardeni Research, which was updated on November 13th with data up through November 2nd. This survey indicated that P/E multiple compression is still on-going in the sector, and that the current ratio was 15.1 for all electric utilities. This is the low valuation the market is handing utilities right now. Yardeni’s chart is shown below.

Electric Utility P/E Ratios (Yardeni Research)

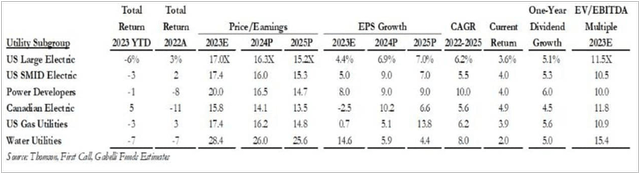

Another survey, the Gabelli Utilities Mid-Year Update reported that “defensive sectors (utilities, healthcare and consumer staples) were among the worst performing in the first six-months of 2023.” It continued to report that “Electric utility valuation multiples have declined from 23x forward earnings in early 2020 to 17x 2023 and 16x 2024 earnings estimates. Over the past twenty-five years, utility forward multiples have ranged between 10x and 23x earnings with a median of 17.1x.” The results of this mid-year survey are presented below.

Utility Mid-Year Review (Gabelli Funds)

Using the 2023 projected EPS of $3.65 with the recent Yardeni multiple of 15.1, the value of Evergy is $3.65 x 15.1 = $55.12 per share. I believe this is a more current multiple to use for valuation than the Morningstar or Gabelli multiples of 16.0 or 16.3x, which lag from the middle of the year.

As a secondary method, I have used a discounted cash flow. The estimated value per share here is $56.19, a difference of less than 2.0%. In this calculation, the growth rate I used was 5.0% per year (the Evergy long-term number is now 4.0-6.0%), and the high end consensus earnings of $3.65. I used 10.0% for the discount rate, based on the S&P 500 average return over time, estimated at 9.8%, with a reversion rate of 7.75%, to allow for future growth.

Discounted Cash Flow (Author Calculated)

The two valuation methods indicated a range of $55.12 to $56.19 per share, so let’s conclude at about $56.00 per share as a fair value. That makes Evergy shares 10.0% undervalued at their current price of $50.27.

Risks to Outlook

There are two risks that immediately come to mind. The first is the weather – the milder the winter, the lower Evergy’s revenues. The case is the same in the summer and happened this year with a cool start to August. The second risk is regulatory, with Missouri and Kansas not being the most favorable environments for rate increases. That said, Missouri did allow a recovery for the Winter Storm Uri one-off costs. And Evergy has had fewer rate increases than its peers which makes the case for new rate requests more compelling.

Conclusion

Share Price History (Seeking Alpha Charting)

EVRG are currently trading at $50.27, down 31.0% from their February 2020 peak of $72.91, as shown in the chart above. At that time, the dividend yield was 2.77%. Currently the yield is 5.11%. This makes it higher than the 30-year yield of 4.66%, but slightly below the three month treasury yield of 5.40%. I believe Evergy’s payout is sustainable and that it will also grow, but perhaps not as much as management’s target of 6.0-8.0% per year. I think in the long-term this is a strong dividend paying utility to hold with a diversified portfolio and that at the current price, there will likely be some upside in terms of share price appreciation in addition to the current yield. The markdown across the utility sector has created some bargains to buy and this is definitely one of them.

Read the full article here