EPD Q2 Update:

Enterprise Products Partners (NYSE:EPD) reported a solid if unspectacular quarter that was impacted by low prices across the board for oil, natural gas, NGL’s and petrochemicals. Read my previous coverage on EPD here. While much of EPD’s business is just volume based, the company uses its scale and varying capabilities to ring out margins from pricing differentials across its value chains and geographies. Lower prices generally mean lower differentials, although as we saw in Q2, even when prices for natural gas drop from between $3 and $4 to as low as $2 and NGL’s like propane and ethane drop from $90/gallon and $30/gallon to below $60 and $20 respectively, the impact to EBITDA is only a few percentage points.

That leads me to the real story here: EPD generates cash and can reinvest some of it at high rates of return for long periods of time while it returns increasing amounts to unit holders. As the company mentioned during the conference call, it bought back 2.9 million units during the quarter making that 3.6 million repurchased on the year. The company also has increased the “cadence” of its distribution growth recently, going to increases every two quarters. These distributions are still covered 1.6x even after growth capital expenditures that will be $2.4-2.8 billion this year.

On the investment front, while the company is finishing some major projects this year, on the call management said to expect growth capital to be at $2-2.5 billion annual range over the next few years. They’re simply seeing a lot of growth opportunities throughout the system. This continued spending should not come at the expense of distribution growth or unit repurchases. With leverage at 3x and plenty of excess free cash, the company should be able to do it all, particularly as growth projects invested at 5-6x EBITDA comes online.

Valuation:

| Market Cap (Using $26.22/unit) | $57 billion |

| Cash | $76 million |

| Preferred | $49 million |

| Minority Interest | $1.07 billion |

| Debt | $29 billion |

| Enterprise Value | $87 billion |

| EV/2023 EBITDA (Using $9.3 billion) | 9.3x |

| Distribution yield | 7.6% |

| Free cash flow yield | 12% |

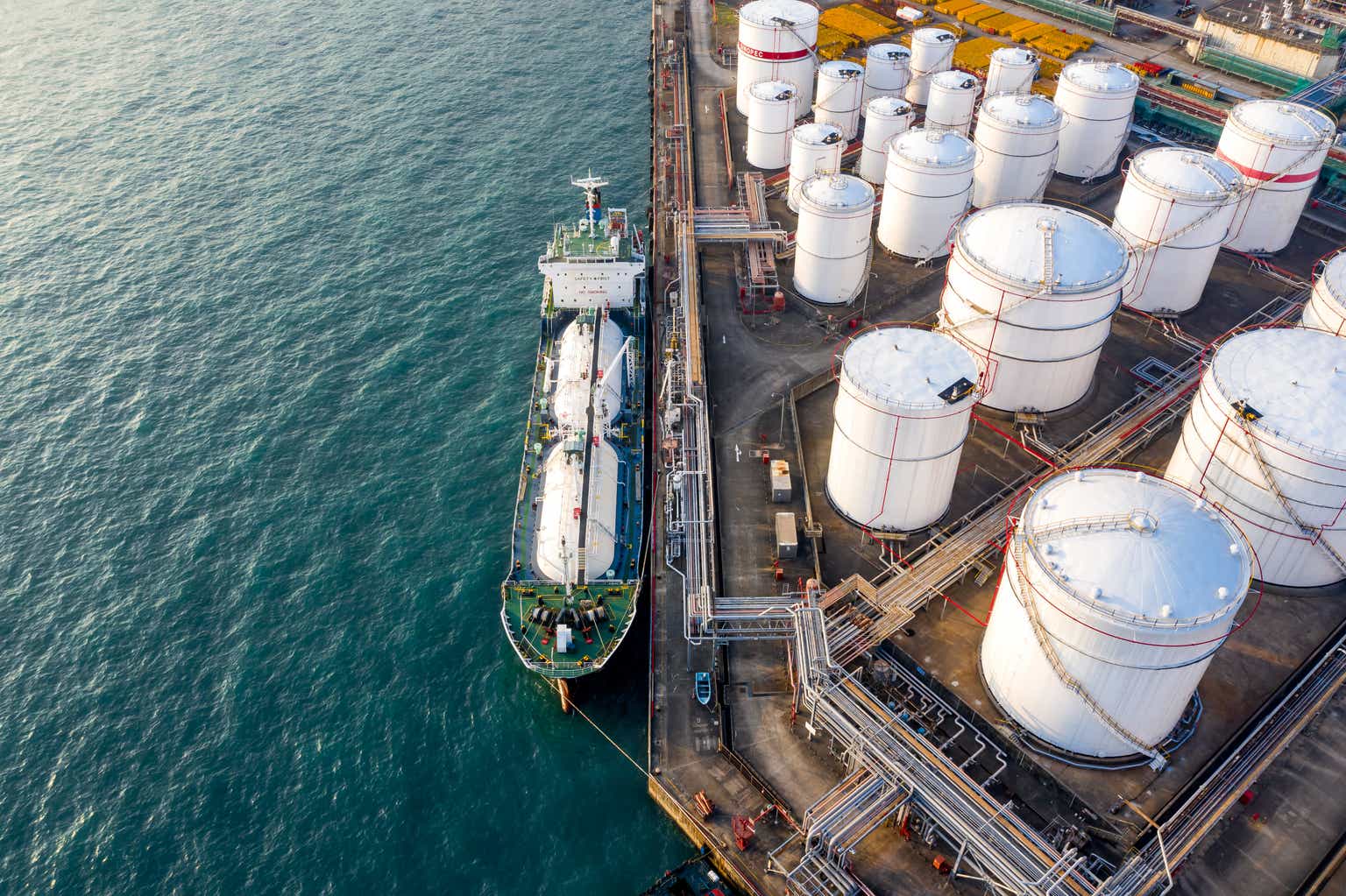

For such a predictable business with irreplaceable assets, I still marvel that EPD trades below its pre-COVID peak. While it trades in line with its C-Corp peers ONEOK (OKE) and Targa (TRGP) and at a premium to large MLP’s like Energy Transfer (ET), I argue that the whole space is cheap and EPD should command premium versus those other businesses. It has a dominant position on the Houston ship channel and its scale and connections to major refineries and crackers on the Gulf Coast give it unmatched ability to grow as export markets grow. It also has one of the best balance sheets in the industry and incredible stability within management and the shareholder base led by the Duncan family.

I wrote over two years ago that I thought EPD was of the scale, quality and moat-like nature that it was something that Berkshire (BRK.A) (BRK.B) ought to buy out the public unitholders and just partner with the Duncans. I still believe that although as someone who wants to keep owning this thing it’s not something I’m rooting for.

Risks:

As I say with every energy company, even though their cash flows are often not impacted much these stocks/units trade sensitive to commodity prices, especially oil. As midstream company that is primarily fee-based, EPD’s unit prices whip around much more than its cash flows. Fortunately, the company is finally buying back units at a faster rate where it can take advantage of those dips. Long term holders shouldn’t really care about the unit fluctuation since the distributions are so good and tax efficient. That said, it’s a risk worth noting.

Conclusion:

I like EPD as a core holding for any conservative or income-oriented investor. A greater than 7.5% distribution yield that is well-covered and growing plus more capital returns via unit buybacks makes for an attractive risk profile in my mind. I think the stock should at least recover its pre-COVID high of over $30 if not exceed it.

Read the full article here