Thesis

Enphase Energy, Inc. (NASDAQ:ENPH) is a renowned pioneer in the commercialization of microinverters. These devices convert DC current into AC current, enabling them to power households or be connected to the grid for earning credits. Despite reaching a peak of $336 in December 2022, the stock has since experienced a significant decline, currently trading at $128.73. However, based on my Discounted Cash Flow [DCF] model analysis, the stock appears undervalued, with a fair price estimate of $148.80. This suggests a potential upside of 15.5% from the current stock price of $128.73.

Looking ahead, the future price projection indicates a substantial upside of 54%. This projection takes into account a market-performing revenue growth rate of 17.9%. Furthermore, Enphase is expected to experience a robust 21% growth rate from 2023 to 2024.

Considering these factors, along with the potential for hype and momentum to support the stock, I would categorize Enphase as a “strong buy.”

Overview

Business

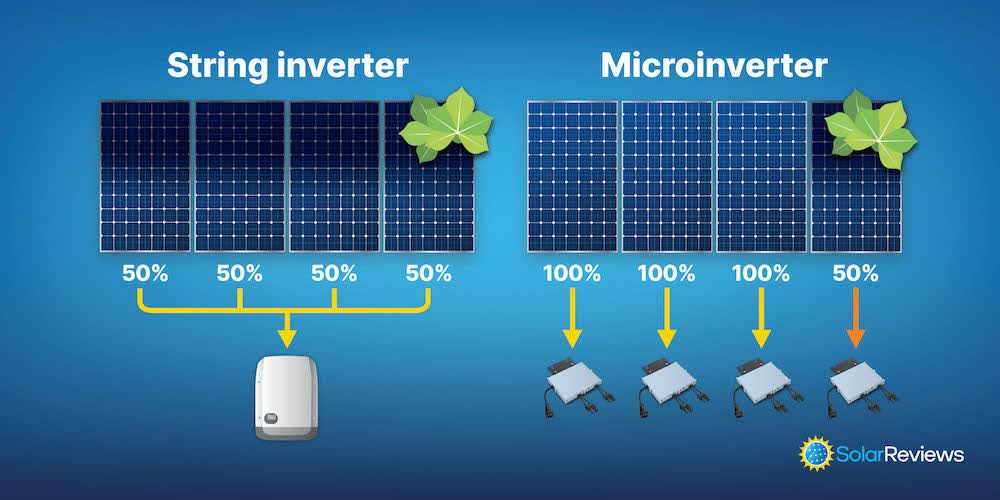

Enphase’s core business centers around microinverters, whose primary function is to convert DC current generated by solar panels into AC current. It’s important to note that microinverters aren’t the sole technology capable of this task; there’s also the string inverter, which operates in conjunction with a series of 6 to 12 panels. However, the key advantage of microinverters lies in their ability to independently convert the current from each connected solar panel. In contrast, with a string inverter, if one panel operates at reduced capacity due to factors like shading or snow, the entire system’s performance is affected proportionally.

String Inverter vs Microinverter (SolarReviews)

Another crucial consideration is the warranty period: string inverters typically come with warranties lasting up to 12 years, whereas microinverters boast warranties extending up to 25 years. This distinction highlights that Enphase’s business model cannot rely solely on the sale of microinverters, as it would entail fluctuating demand, experiencing both high and low periods.

In addition to microinverters, Enphase offers a range of products, including batteries such as the IQ Battery and IQ Battery 5P, the IQ Portable Energy System, and EV Chargers. Enphase’s overarching goal seems to be to establish a network effect, where all the components in a household are unified under the Enphase brand. This integrated approach aims to create a comprehensive energy ecosystem for consumers.

Markets

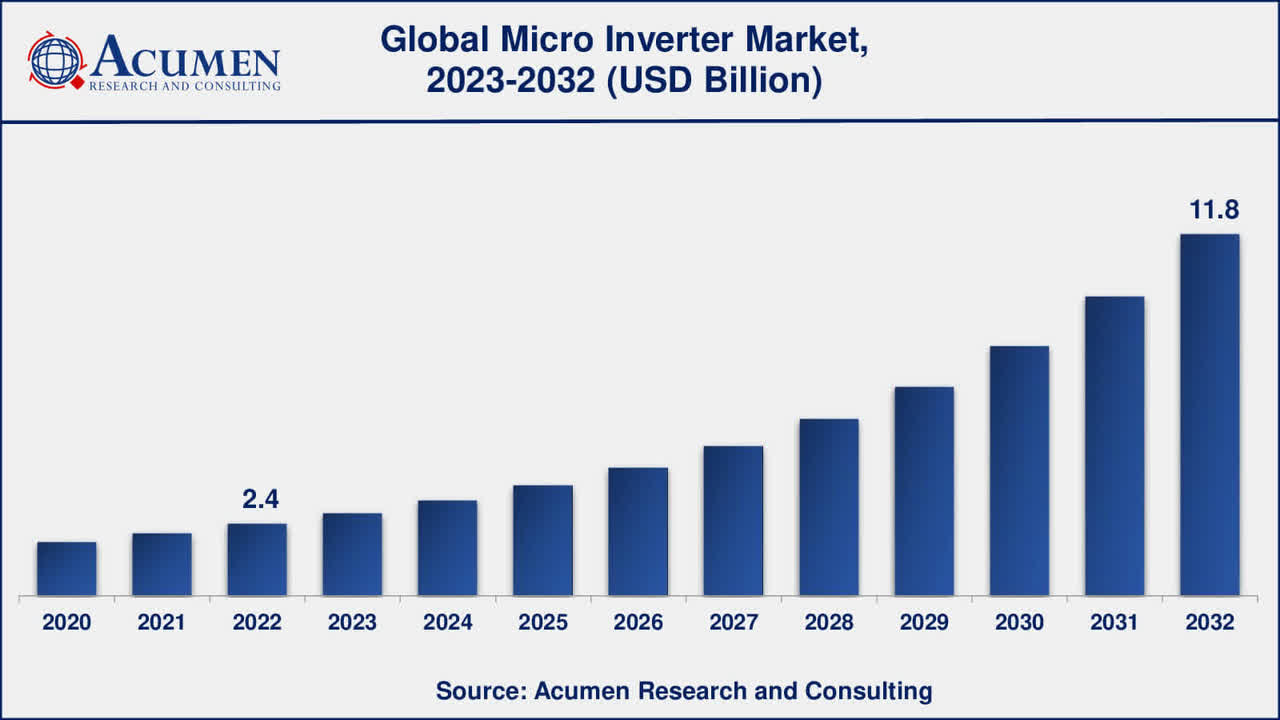

The microinverter market presently holds a valuation of approximately $2.8 billion, with a projected growth rate of 17.8% expected from 2023 to 2032. This robust growth trajectory suggests that Enphase is well-positioned to expand organically, primarily driven by market forces. By 2032, the market is forecasted to attain a valuation of approximately $11.8 billion.

It’s worth noting that in comparison to larger markets, the microinverter market may seem relatively modest in size. However, this observation underscores the potential for sustained growth well beyond 2032. This growth aligns with a global shift towards reduced reliance on finite fossil fuel resources.

Global Micro Inverter Market (Acumen Research and Consulting)

Guidance Lowered

In Q2, Enphase revised its Q3 guidance, anticipating sales ranging from $555 million to $600 million, falling below the earlier estimated $749 million. The stated reason for this adjustment was the impact of higher interest rates, which were affecting the execution of solar projects in the United States. This suggests that as interest rates decrease, there is a strong likelihood of a resurgence in the solar project sector. However, it’s essential to recognize that this also implies vulnerability for Enphase in the event of an economic downturn, given its dependence on consumer budgets for growth.

Nevertheless, it’s worth noting that individuals who invest in home solar panel installations tend to be in a more affluent economic condition.

Financials (In millions of USD unless stated otherwise)

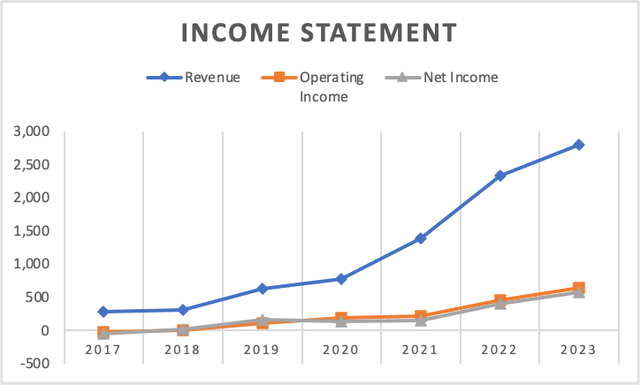

Enphase has demonstrated remarkable revenue growth, surging by a staggering 877% since 2017, when it was at $286 million, to its current level of $2.7 billion. This translates to an impressive average annual revenue growth rate of 125% over the past seven years.

| Revenue | Operating Income | Net Income | |

| 2017 | 286 | -23 | -45 |

| 2018 | 316 | 7 | 12 |

| 2019 | 624 | 105 | 161 |

| 2020 | 774 | 186 | 134 |

| 2021 | 1,382 | 221 | 145 |

| 2022 | 2,331 | 453 | 397 |

| 2023 | 2,797 | 636 | 573 |

Income Statement (Author’s Calculations)

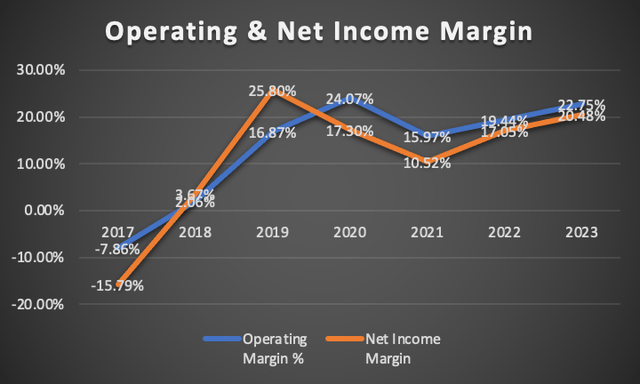

Moreover, the company’s profit margins appear robust, with an operating margin presently standing at 22% and a net income margin at 20.48%. These figures are nearly at their all-time highs, achieved in 2020 and 2019, respectively.

Operating & Net Income Margin (Author’s Calculations)

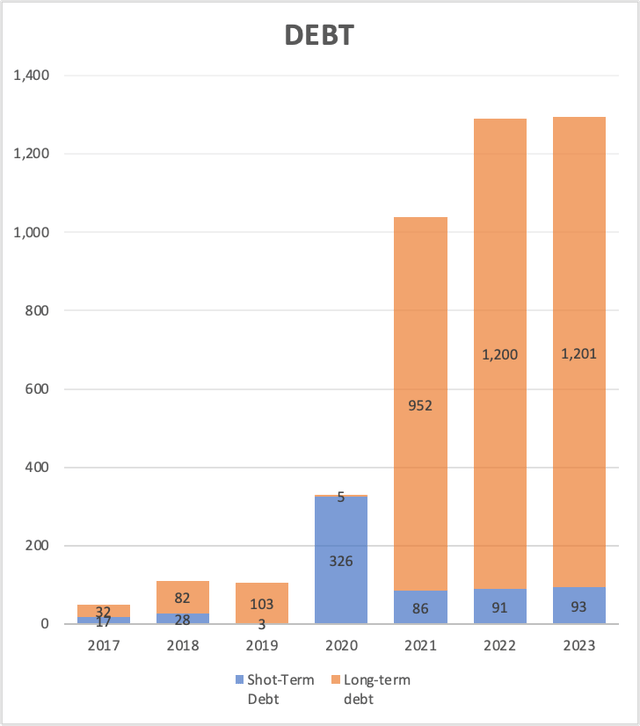

Taking a quick look at its balance sheet, Enphase’s financial health appears strong. While its long-term debt has risen from $32 million in 2017 to $1.2 billion in 2023, the company maintains a healthy cash position of $1.8 billion. This favorable cash-to-debt ratio underscores Enphase’s solid financial standing.

Debt (Author’s Calculations)

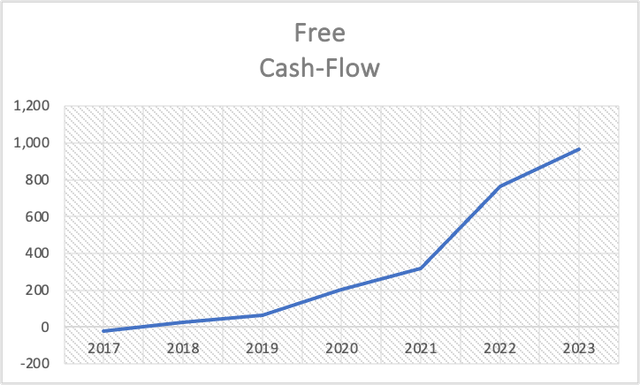

Furthermore, Enphase boasts a substantial free cash flow of $968 million, with a robust free cash flow margin of 32.6%, which is currently at an all-time high.

| Free Cash-Flow | Margin % | |

| 2017 | -24 | -8.5% |

| 2018 | 24 | 7.6% |

| 2019 | 63 | 10.1% |

| 2020 | 202 | 26.1% |

| 2021 | 320 | 23.2% |

| 2022 | 763 | 32.7% |

| 2023 | 968 | 34.6% |

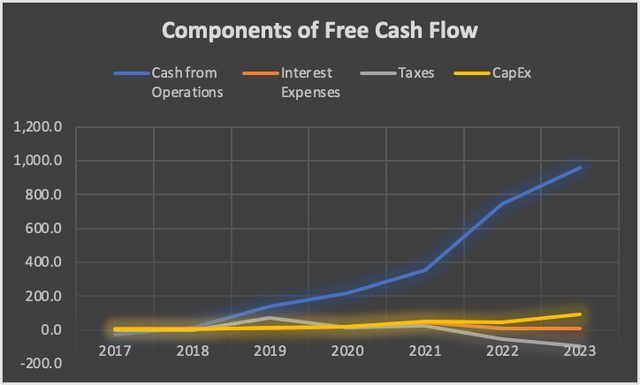

Components of Free Cash Flow (Author’s Calculations)

Free Cash Flow (Author’s Calculations)

In summary, Enphase is positioned exceptionally well from a financial perspective. It enjoys a strong balance sheet, impressive free cash flow, and healthy operating margins. These factors, coupled with its strong performance in the market, make it an enticing investment opportunity.

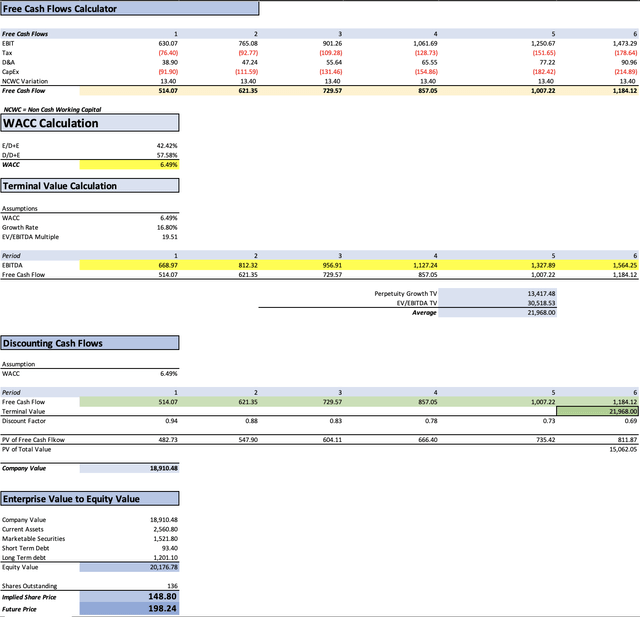

Valuation (In millions of USD)

To assess the valuation of Enphase, I will employ a Discounted Cash Flow [DCF] model. The initial step involves projecting revenues for the next five years. For 2023 and 2024, I’m utilizing the estimates found in the Seeking Alpha “summary section.” Incorporating a growth rate of 17.8% from 2025 to 2028, along with a net income margin of 20%, a depreciation and amortization [D&A] margin of 1.46% of revenues, and an interest expense margin of 0.33% of revenues, I have compiled the following data:

| Revenue | Net Income | Plus Taxes | Plus D&A | Plus Interest | |

| 2023 | $2,660.00 | $544.77 | $621.17 | $660.07 | $668.97 |

| 2024 | $3,230.00 | $661.50 | $754.27 | $801.51 | $812.32 |

| 2025 | $3,804.94 | $779.25 | $888.53 | $944.18 | $956.91 |

| 2026 | $4,482.22 | $917.96 | $1,046.69 | $1,112.24 | $1,127.24 |

| 2027 | $5,280.05 | $1,081.36 | $1,233.00 | $1,310.22 | $1,327.89 |

| 2028 | $6,219.90 | $1,273.84 | $1,452.48 | $1,543.44 | $1,564.25 |

| ^Final EBITA^ |

| D&A Projection | Interest Projection | |

| 2023 | 38.900 | 8.90 |

| 2024 | 47.236 | 10.81 |

| 2025 | 55.644 | 12.73 |

| 2026 | 65.548 | 15.00 |

| 2027 | 77.216 | 17.67 |

| 2028 | 90.960 | 20.81 |

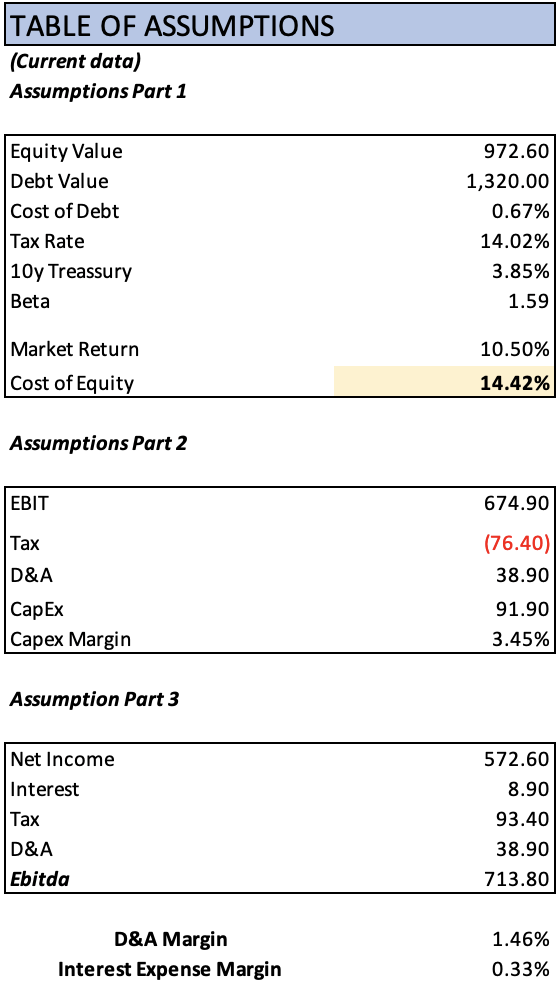

Subsequently, I fill the assumption table with Enphase’s current available data and proceed to complete the DCF model:

Table of Assumptions (Author’s Calculations)

DCF Model (Author’s Calculations)

As evident from the calculations, the current fair value of Enphase stands at $148.80, representing a 15.5% upside from the current stock price of $128.73. Additionally, there’s the future price projection, indicating a 54% upside potential.

Another scenario to consider involves a revenue growth rate of 21% from 2025 to 2028, matching the expected revenue growth from 2023 to 2024. In this case, the intrinsic price would be $162.83, with a future price of $218.59, reflecting a 69% upside—equivalent to an average return of 11%.

It’s worth noting that Enphase reached its peak price of $336 on December 2, 2022, which is an upside of 161% from the current stock price. While it’s not a prediction that Enphase will return to that exact price level, it serves as an illustration of how the stock price could exceed $218.59 in the future, especially considering that this stock operates within a growing market, making it susceptible to hype and momentum.

In conclusion, I rate Enphase as a “Strong Buy” due to its current trading position, which, according to my DCF analysis, falls below fair value. Furthermore, the potential influence of momentum and hype could drive the stock price beyond the $218.59 future value. My target price for Enphase would be $162.83.

Risks to Thesis

It’s crucial to bear in mind that while momentum serves as a beneficial force for Enphase, it also renders the stock more susceptible during market downturns. This susceptibility arises because, over time, this stock can easily become overvalued.

Another noteworthy aspect is the extended lifespan of microinverters, which typically spans around 25 years. In fact, Enphase warranties its microinverters for 25 years in North America and 10 years outside of North America. Consequently, there will be periods when Enphase reaps the benefits of customers replacing their microinverters, followed by phases of declining sales. This cyclic nature underscores the importance of Enphase diversifying its revenue sources to mitigate volatility. A similar situation arises with Enphase batteries, which come with a 15-year warranty. Furthermore, the substantial investment required for energy equipment often compels customers to endure issues rather than switch to alternative solutions.

Nevertheless, it’s worth noting that solar power currently accounts for just 4.5% of global energy generation. This statistic suggests that Enphase has significant room for expansion as the adoption of solar energy continues to grow. However, it remains prudent for Enphase to explore alternative revenue streams beyond the sale of batteries, microinverters, portable energy systems, and chargers. This diversification strategy will enhance the company’s resilience and growth prospects in the evolving renewable energy landscape.

Conclusion

In conclusion, Enphase Energy, Inc. stands at a pivotal juncture in the renewable energy sector, and its future outlook is as promising as it is complex. The company’s core focus on microinverters, a technology renowned for its efficiency and durability, has propelled Enphase’s revenue growth at an astounding rate of 877% since 2017. It has robust profit margins, strong balance sheet, and impressive free cash flow.

Yet, Enphase is not immune to market forces. Recent guidance adjustments due to higher interest rates highlight the importance of external factors. While these factors can influence stock performance, the long-term potential for solar energy adoption suggests continued growth opportunities.

However, Enphase’s reliance on product replacement cycles for microinverters and batteries poses inherent sales fluctuations. To mitigate this volatility, diversification into less cyclical revenue streams becomes essential.

Furthermore, while the company has enjoyed the benefits of momentum and hype, it’s important to recognize that these same forces can lead to overvaluation, making the stock more vulnerable during market downturns.

In a world where renewable energy adoption remains on the rise, Enphase is well-positioned to capitalize on this trend. Still, prudence dictates exploring additional revenue sources beyond their core offerings to ensure sustained growth and resilience.

In light of these dynamics, Enphase presents a compelling investment opportunity, trading below its calculated fair value, with future potential driven by both market fundamentals and momentum. Thus, Enphase’s journey in the renewable energy landscape holds promise, and it remains a stock to watch closely, especially for those considering a “Strong Buy” in the present market conditions.

Read the full article here