Investment Thesis

eBay (NASDAQ:EBAY) has all the trademarks of a value stock. Low growth, cheaply priced at around 10x this year’s non-GAAP EPS, and buying back its stock, plus more than a 2% dividend yield. And yet, despite looking superficially cheap, I’m unsure that there is in actuality much value in this name.

The biggest blemish to the bull case, in my opinion, is that its growth rates are anemic. And I question whether eBay can be relied on as much as 5% CAGR next year, as it has just recently reported in Q2 2023.

Why eBay? Why Now?

EBAY Q2 2023

eBay has a big plan for the future of online shopping. They want to make shopping and selling online more personalized and special, especially for people who are really passionate about certain products or hobbies. To do this, they have three main goals: making sure your shopping experience feels just right, finding new ways to make things easier and better for everyone, and using smart technology to make shopping and selling more fun and efficient.

eBay is also using artificial intelligence to help with this. They want to understand what you like and show you things that match your interests. They’re redesigning their website to make it simpler and more personalized.

Plus, they’re working on cool new features that use smart technology to make shopping and selling even more enjoyable. eBay is confident that by focusing on these goals and using technology in clever ways, they’ll make online shopping and selling feel magical, especially for people who are really into their hobbies and interests.

The problem I have is that beyond an attractive turnaround narrative, its customer adoption curve doesn’t tally with eBay’s narrative, see below.

EBAY Q2 2023

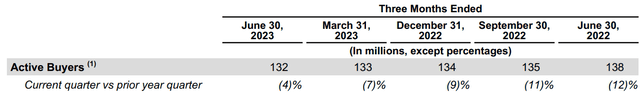

Followers of my work will know how much I value customer adoption curves. The customer or user adoption curve reflects the value of the service or product. And what you see above is not one-quarter of a loss in active buyers. It’s not even 2 quarters. But a steady decline in active buyers.

If one were to put a positive tilt on this curve, one would rapidly remark that the pace at which eBay’s active buyers are churning out is slowing down. And I’ll admit, that this indeed peaks my curiosity to keep eBay on my watch list.

eBay’s Easy Comparables and What About 2024?

EBAY revenue growth rates

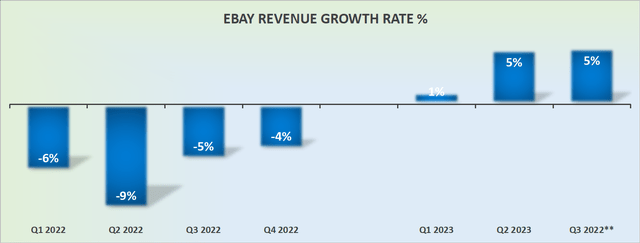

eBay’s revenue growth rates have stabilized. That’s undoubtedly the best news for bulls. Nevertheless, we have to consider the fact that eBay’s comparables with last year were easy.

As we look out to 2024, the comparables against this year will not be as easy. Consequently, I’m forced to ponder. Will eBay be able to deliver a 5% CAGR in 2024? Personally, I’m not convinced. Unless eBay finds a way to stem its active buyer churn, it will be increasingly challenging for eBay to grow at a 5% CAGR in 2024.

EBAY Stock Valuation — Becoming Cheaper

On the surface, eBay is priced at 10x this year’s EPS. Nobody can make the case that this is an expensive valuation. The problem with eBay is that it struggles to deliver growth which means that unless there’s more stable growth to be coming, there’s the potential for it to become a value trap.

Meanwhile, eBay reaffirms its intention to return cash to shareholders, here’s a quote from the earnings call,

[…] We remain committed to the return of 125% of free cash flow as we talked about to shareholders through stock buybacks and dividends between ’22 and ’24

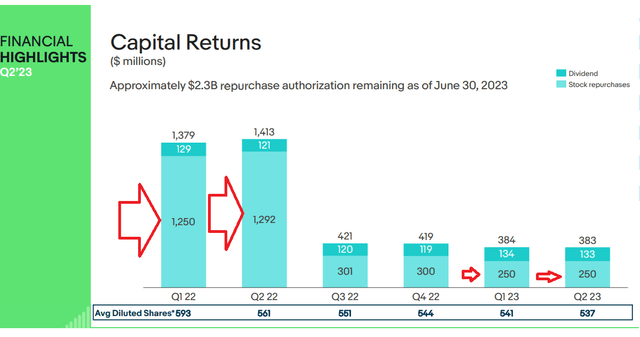

And I agree that eBay continues returning substantial cash back to shareholders. Case in point, both in Q1 2023 and in Q2 2023, eBay repurchased $250 million worth of stock.

EBAY Q2 2023

However, the share repurchases last year reached slightly over $2.5 billion in H1 2022, while this time around the repurchases were less than $500 million in H1 2023. For the most part, the dividends are up slightly, but largely unchanged.

So not only are the capital returns led by repurchases slowing down but also, the capital returns don’t appear to be running at close to the 125% free cash flow commitment that eBay notes it’s determined to match.

It’s easy to comment in hindsight, of course, but the fact of the matter is that eBay was dramatically more aggressive in repurchasing its shares in 2022 when its share price was higher.

And then, to further compound matters, while eBay is a solid cash flow yielding company, the fact remains that its balance sheet holds about $2 billion of net debt. This means that eBay’s debt isn’t hampering its prospects, but it is a further consideration in its ability to be aggressive with its repurchases.

The Bottom Line

While eBay appears to fit the profile of a value stock with its low growth, relatively low valuation, share buybacks, and a 2% dividend yield, I find myself uncertain about the true value it offers.

The main concern is its sluggish growth rates, and I’m skeptical about its ability to achieve the 5% CAGR it recently reported for Q2 2023. The stability in revenue growth rates is a positive sign, but as we look ahead to 2024, comparables won’t be as favorable.

Further, its customer adoption curve seems to be declining steadily, which raises questions about the narrative matching the reality.

While eBay does commit to returning cash to shareholders, recent repurchases have slowed compared to 2022, indicating a shift in its capital return strategy. Moreover, eBay’s net debt of approximately $2 billion could limit its ability to be more aggressive with share repurchases. All this uncertainty leaves me cautious about eBay’s future prospects. But I’ll admit that I’m interested in its developing prospects to keep eBay on my watch list.

Read the full article here