The markets are expecting a tough macro climate across all industries heading into the second half of this year, but when investing in tech stocks, one rule remains paramount: don’t trust a company that isn’t able to grow.

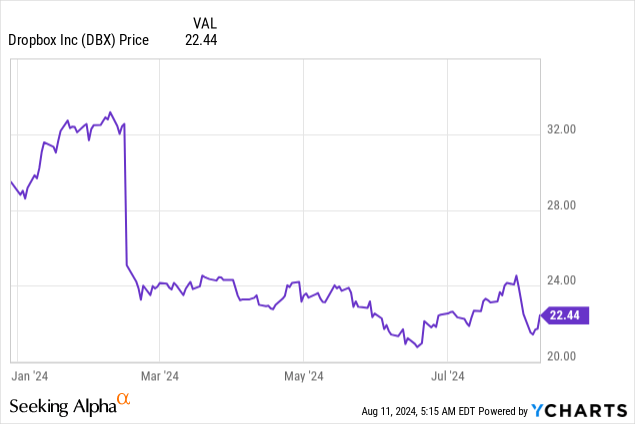

For Dropbox (NASDAQ:DBX), this unfortunately appears to be the case, as the file storage company continues to post lackluster growth rates and customer additions. Year to date, shares have lost more than 20% of their value. It rebounded ever so slightly after posting Q2 results, but that’s largely a function of muted expectations. Despite a cheap valuation, Dropbox remains a snare as a value trap.

I last wrote a bearish note on Dropbox in June, when the stock was trading at similar $22 levels. Since then, growth has continued to decelerate further, and the company hasn’t been able to turn performance around and lift its guidance. Furthermore, it’s becoming more evident with each passing quarter that Dropbox is losing market share to its rival Box, which has more insulation against the current macro due to its greater concentration to enterprise clientele (which tend to have lower churn rates). As such, I’m renewing my sell call on Dropbox.

To me, continued deterioration in Dropbox’s fundamentals serves to highlight all the red flags underpinning the bear case for this stock, which include:

- Growth rates are tepid and customer acquisition counts are faltering. In its most recent quarter, Dropbox added only 63k new users (a small fraction of a total ~18 million user base). Revenue growth has slid to the low single digits, and constant-currency growth is even lower than what the company is reporting.

- AI isn’t a major tailwind for Dropbox, especially with its customer base tending toward simpler, smaller users. Though the company has released a smart-organization tool called Dropbox Dash, AI features haven’t lifted the company’s top-line growth rates, nor is AI spend likely to be a major tailwind for Dropbox going forward – especially as the majority of Dropbox’s base tends to be consumers or smaller businesses that don’t need complex AI tools.

- Dropbox is proving to be less sticky than originally thought. As churn rates have increased over the past year, many investors are re-evaluating the stickiness and value of Dropbox’s subscription revenue base.

- Net debt. Despite its large free cash flows, Dropbox is still maintaining a net debt position, which is atypical of an enterprise software company of its scale.

- Deep competition. Dropbox has always been in a tug-of-war with competitors Google Drive (which has an advantage in pricing and integration with consumer email accounts) and Box, Inc. (BOX), which is better known for its enterprise-grade features and security.

Steer clear here and invest elsewhere.

Q2 download

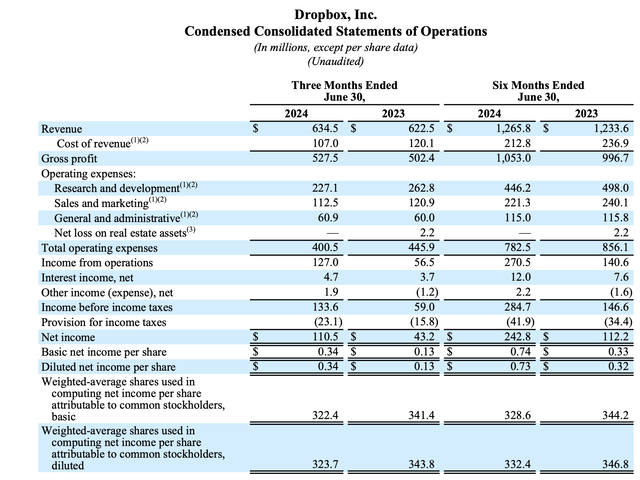

Let’s now go through Dropbox’s latest quarterly results in greater detail. The Q2 earnings summary is shown below:

Dropbox Q2 results (Dropbox Q2 earnings release)

The core highlight here is revenue, which grew only 1.9% y/y to $634.5 million in the quarter; though this came in marginally ahead of Street expectations of $630.5 million, or 1.3% growth. Not only is this the lowest quarter for growth in Dropbox’s history, the already-slow growth rate got sliced further in half from Q1 (dropping 140bps relative to 3.3% growth in Q1).

A word here on Box’s results — Box has a January year-end (versus a regular December fiscal year for Dropbox), and so Box hasn’t yet reported its Q2 (May results). But in Q1, Dropbox grew 3% to Box’s 5%. And even if Box decelerates this quarter, it likely won’t be as low as Dropbox’s 2% (especially when Box has been successful at attaching its Box Skills AI solutions and selling multi-product packages to its enterprise clientele). In other words, Dropbox’s competitive luster against Box continues to falter. And though we can’t see results broken out for Google Drive, Drive continues to be a compelling option for freemium users, with up to 15GB free storage on any Google account that seamlessly integrates with email and other Google services. Dropbox, which isn’t natively integrated with anything, offers only 2GB of free storage with its free basic plan. So on the enterprise side, Dropbox is getting squeezed by Box, and on the consumer/SMB side, it has to contend with Google Drive. To top it off, in the SMB (small business) space where Dropbox may have a shot, macro headwinds are darkening and threatening elevated churn.

One bright spot of good news that we’ll acknowledge: the company did add 63k net-new paid users in Q2, which was higher than 35k in net adds in Q1. Still, it’s likely that the bulk of these adds are on the consumer side, as it’s not moving the needle on revenue growth (though these users have the potential to expand their usage and upgrade their plans over time).

The company noted that it continues to face macro headwinds and a more elastic reaction to recent price increases, but to its credit, it is optimizing certain sales motions to improve results. Per CEO Drew Houston’s remarks on the Q2 earnings call:

However, we continue to face headwinds from factors, including the challenging macro environment for SMBs, price sensitivity following our recent Teams price increase, and changes we made to the storage limits for our advanced Teams plan. These headwinds have thus far largely offset the progress we’ve made across our top of funnel initiatives. To combat these headwinds and to ensure a tight alignment of our product development and go-to-market efforts, we recently concluded an in-depth refinement of our customer segmentation model. The segmentation work informs our product roadmaps and guides both our self-serve motion and outbound sales teams as we build integrated sales campaigns targeted at key user profiles across our priority industries and geos.

Specifically as well, the company notes that a lot of its new user sign-ups come from when an existing Dropbox user shares a file, so it has improved the sharing experience to make for more seamless lead additions here.

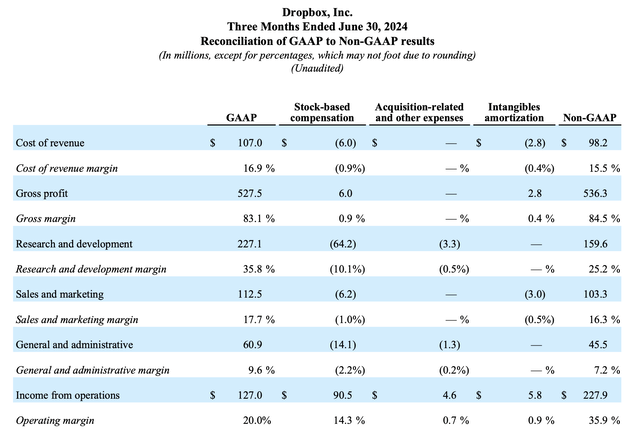

Optically, it does look like Dropbox increased its profitability this quarter – but there are some one-time drivers underneath that are partially responsible. Pro forma gross margins increased 180bps y/y to 84.5% this quarter, but note that this was primarily due to the company extending the accounting on the useful life of its server hardware, reducing the depreciation cost captured in cost of sales.

Dropbox margins (Dropbox Q2 earnings release)

Pro forma operating margins, meanwhile, rose 160bps y/y to 35.9%, as some of the optical gross margin benefit was offset by higher sales and marketing, as well as general and administrative spending. We note operating margins are sequentially lower than 36.5% in Q1, where the company had improved eight points on a year/year basis: which is a disappointing result when growth rates tumbled so sharply since Q1.

Valuation and key takeaways

At current share prices near $22, Dropbox trades at a market cap of $7.30 billion. After we net off the $1.18 billion of cash and $1.38 billion of debt on the company’s latest balance sheet, its resulting enterprise value is $7.50 billion. Again, we’ll emphasize that Dropbox is one of very few enterprise software companies sitting on a net debt position instead of having ample net cash.

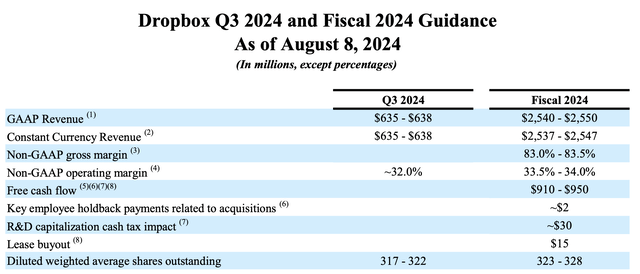

Dropbox outlook (Dropbox Q2 earnings release)

Against the $930 million midpoint of Dropbox’s $910-$950 million FCF target for this year, the stock trades at 8.1x EV/FY24 FCF, which is the only main appeal to this stock. Still, I’d caution that with a slowdown in margin expansion, as well as near-zero revenue growth that makes future margin or FCF growth very difficult, Dropbox has all the signals of a value trap.

Steer clear here and continue to invest elsewhere.

Read the full article here