We continue to be hold-rated on DoorDash (NASDAQ:DASH) in spite of management’s better-than-expected guidance. We think the market has priced in the expectation of recovery after the stock jumped more than 15% on earning results. We think the stock’s higher valuation is not justified for our expectations of DoorDash’s slower growth trajectory through 1H24. Consistent with our expectations back in early August when we downgraded the stock, the company’s total order growth decelerated both QoQ and Y/Y this quarter. We think macro headwinds will continue to weigh on consumer spending in the back end of the year and see macro headwinds spilling into 1H24. Hence, we think it’ll be more difficult for DoorDash to reaccelerate order growth or marketplace GOV under the current high-interest rate and tight budget environment.

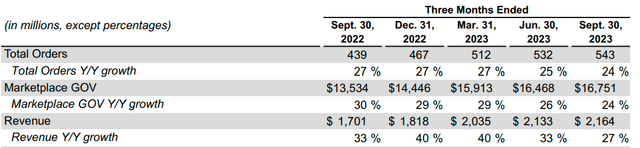

Total order growth Y/Y has been slowing; this quarter, total orders increased 24% Y/Y versus 25% a quarter ago and 27% Y/Y in 3Q22. Marketplace GOV also slowed to 24% compared to a higher 26% in 2Q23 and 30% in 3Q22. We’re constructive on the uptick in consumer spending, especially on food delivery, but we don’t think it will be an overnight kind of recovery. We now see a more gradual growth pace for DoorDash in 1H24 due to still-easing macro headwinds. We believe the growth for total order, marketplace GOV, and revenue will remain in the double-digit range but see a slower growth runway as macro weakness spills into next year.

The following table outlines the 3Q23 results for DoorDash.

3Q23 earnings press release

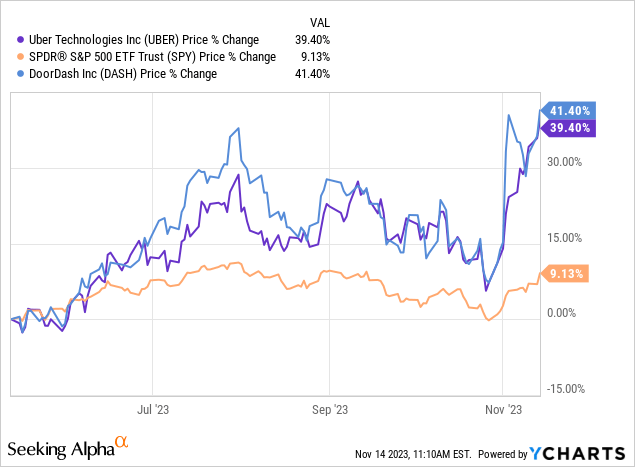

For the company to financially outperform, it would have to materially exceed the guidance of 17-17.4B for marketplace GOV, and we don’t see this happening in the near-term. While we see signs of consumer spending remaining resilient, we think investors should be careful about getting too excited too early. The CNBC/NRF Retail Monitor report for the month of October found retail sales fell 0.08% during the period. We expect softer consumer spending to weigh on Marketplace GOV growth next quarter. We’re closer to the recovery now, but we don’t think we’ve hit the infliction point yet. The stock is up 41% over the past 6M versus the S&P 500 up 9% during the same period, and Uber (UBER) up 39%. The following outlines the stock’s six month performance against Uber and S&P 500.

YCharts

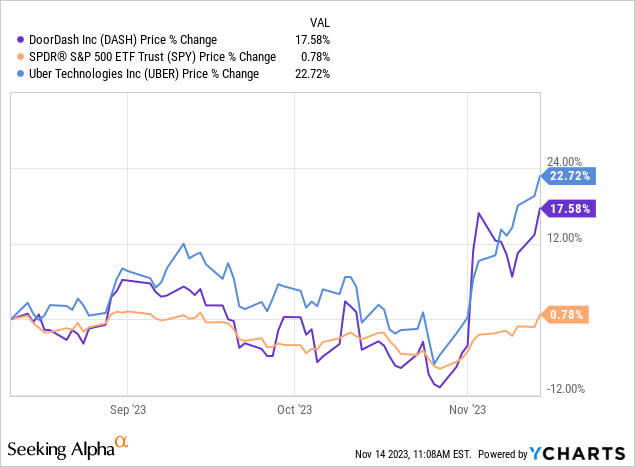

However, we think outperformance is moderating even with management’s top-line beat and better-than-expected guidance. Over the past three months, Uber has outperformed both the S&P 500 and DoorDash by 22% and 5%, respectively. The following graph outlines Dash’s performance against Uber and the S&P 500 over the past three months.

YCharts

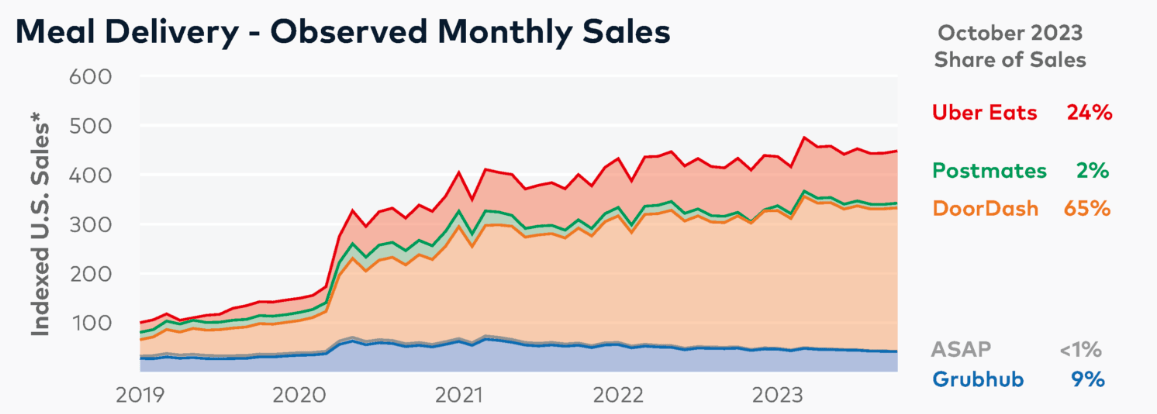

DoorDash still holds the majority of the meal delivery market with a 65% share versus Uber at 24%. While DoorDash has the upper hand in this market, we think Uber’s diversified revenue across delivery, mobility, and freight gives it a competitive advantage over DoorDash on the delivery front and Lyft (LYFT) on the mobility front during times of macro uncertainty. We expect Uber’s delivery business to fare better in the near-term than DoorDash’s business.

The following graph outlines the meal delivery market share for October 2023.

Bloomberg Second Measure October 2023

Valuation

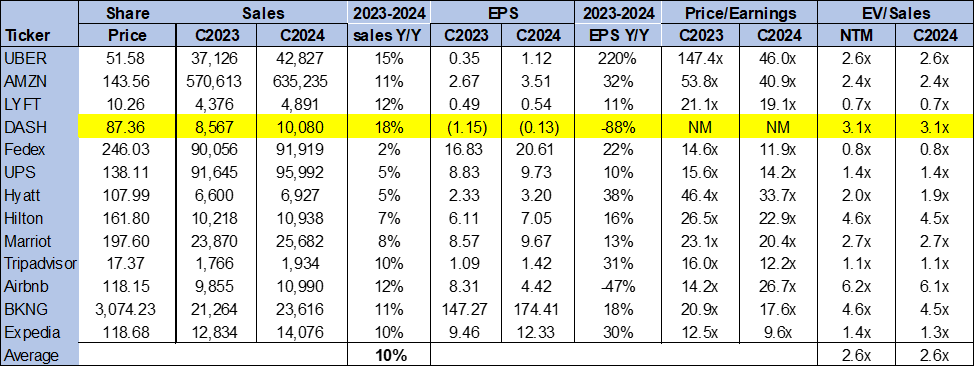

We think the stock is overvalued for the near-term risks present. The stock is trading at 3.1x EV/C2024 Sales versus the peer group average of 2.6x. We don’t think the higher valuation is justified as we expect Dash’s growth rate to slow into the first half of next year. We recommend investors stay on the sidelines for the near-term as we don’t see the stock working.

The following chart outlines DASH’s valuation against the peer group.

TSP

Word on Wall Street

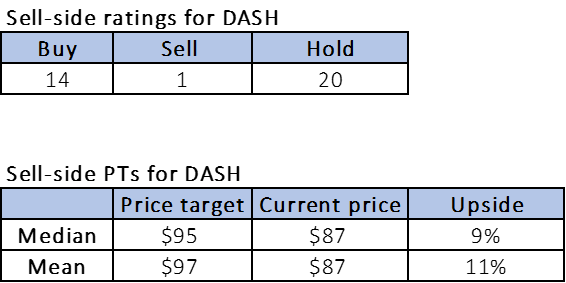

Wall Street is also neutral on the stock. Of the 35 analysts covering the stock, 14 are buy-rated, 20 are hold-rated, and the remaining is sell-rated. The stock is currently priced at $87 per share. The median sell-side price target is $95, while the mean is $97, with a potential 9-11% upside. We see minimal upside potential for the stock in the near-term due to the current macro backdrop; we think there is an upside risk if consumer spending rebounds materially next year or sees a seasonal uptick from the holidays.

The following charts outline DASH’s sell-side ratings and price-targets.

TSP

What to do with the stock

We continue to be hold-rated on DoorDash. We don’t see the stock materially outperforming in the near-term as macro headwinds spill into 1H24. We’re less optimistic about a meaningful reacceleration of growth in total orders and marketplace GOV in the near-term. We think DoorDash will be more of an in-line performer in the near-term and hence recommend investors stay on the sidelines.

Read the full article here