Self-storage REITs have been gaining popularity due to the industry’s rapid growth over the last three years. Although 75% of the industry comprises small players, only a few large REITs are taking on this booming space. One stand out has been CubeSmart (NYSE:CUBE), a REIT that has been increasing its top and bottom line fundamentals and paying investors a strong and annually growing dividend for the last decade. Furthermore, it has rewarded investors with returns of 40.42% in the previous five years.

Five-year stock trend (SeekingAlpha.com)

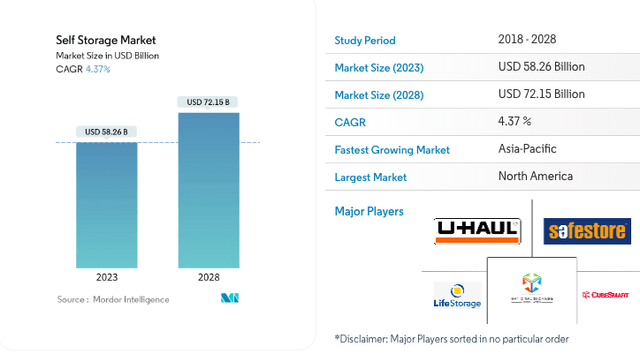

While it’s worth noting that the company is currently trading close to its average price target of $50.91 and demand is returning to levels seen before 2019, CUBE is still a compelling long-term investment option. This is due to its solid fundamentals, attractive dividend, and significant potential for consolidation in an industry that is highly fragmented. Furthermore, the industry is projected to grow at a CAGR of 4.37% and reach a value of $72.15 billion by 2028.

Company overview

CubeSmart went public in 2004 under the name U-Store-It and has since expanded by acquiring other businesses, forming partnerships, and managing third-party facilities. As a result, it is now one of the top five self-storage real estate investment trusts (REITs) in a market that is highly fragmented.

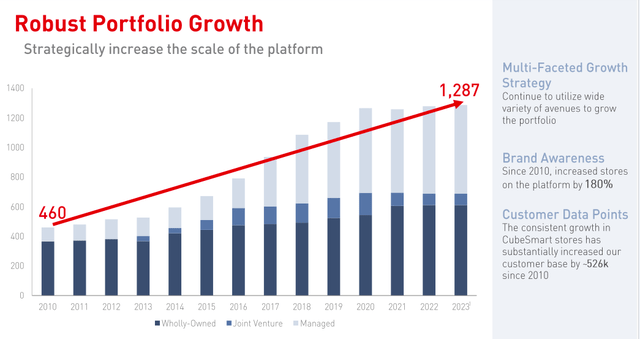

Company growth (Investor presentation 2023)

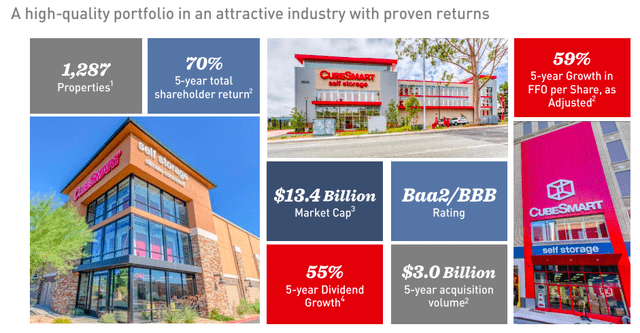

The company offers a variety of storage options, such as self, business, moving, climate-controlled, and vehicle storage, totalling 1,287 properties. Over the past decade, the company has improved its fundamentals and provided investors with generous returns and dividend growth. FFO per share has increased by 47% in the last five years, with shareholder return of 159%. Additionally, CubeSmart has acquired $3 billion in assets over the previous five years, which could aid in their expansion efforts.

Company overview (Investor Presentation 2023)

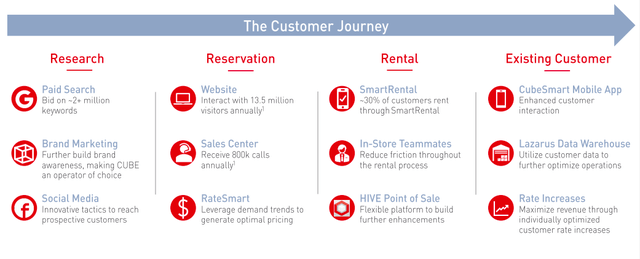

Once established and rented out, the self-storage facility business model requires very little maintenance. CubeSmart, as a large operator, benefits from economies of scale in marketing and pricing, as well as access to extensive data analytics to make informed business decisions. One of the key efforts is to increase the longevity of the customer through various strategies.

Customer journey (Investor presentation 2023)

The self-storage industry comprises many small and unprofessional businesses, which opens up a huge consolidation possibility for larger REITs such as CubeSmart. There are about 44 000 self-storage operators, with an estimated 30 000 operators. The self-storage industry is expected to grow at a CAGR of 4.37% to reach $72.15 billion by 2028. The US accounts for 90% of the market.

Self storage industry (Mordorintelligence.com)

Financials and valuation

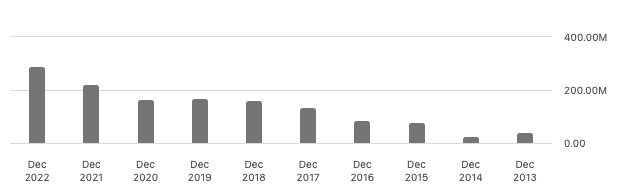

CubeSmart experienced a significant increase in both top and bottom line fundamentals over the past two years as a result of COVID-19 and inflation. However, it is unlikely that the company will be able to repeat this level of success in the upcoming financial year. Looking at the past decade, we can see that annual revenue and net income growth has been increasing, although there was a more gradual growth in the top and bottom line before 2019.

Annual revenue growth (SeekingAlpha.com) Annual net income growth (SeekingAlpha.com)

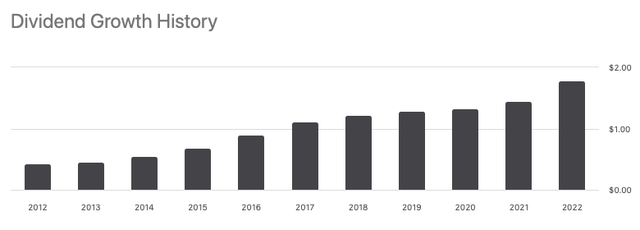

CubeSmart is currently providing a dividend yield of 4.32%, which is considered to be safe. The cash dividend payout ratio of the company is 73.41%. CubeSmart has maintained a consistent growth rate of 10.18% CAGR over the last five years, and this upward trend is expected to continue in the future.

Annual dividend history (SeekingAlpha.com)

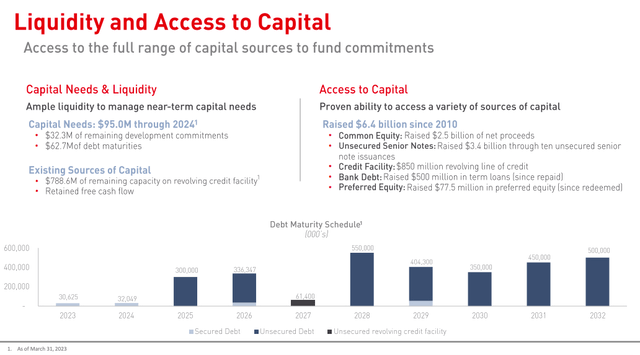

REITs typically carry a lot of debt and little cash. We can see that CubeSmart has a total debt of $3.06 billion. If we look at the balance sheet, the company has an average debt maturity of six years, and 98% of our debt is fixed rate. There are no major maturities until November 2025. We can see that the leverage is 4.4 X debt-to-EBITDA.

Balance sheet overview (Investor presentation 2023)

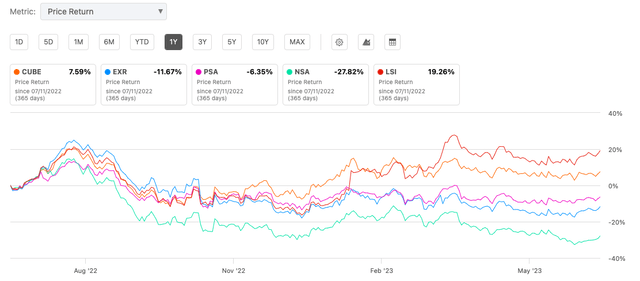

Analysts are fairly bullish on CubeSmart if we look at Wallstreet’s Buy rating of 3.84 on the stock, and it is currently trading below its average price target of $50.91. There is a low short interest of 4.20%. There are a few larger REITs in the space, such as Extra Space Storage (EXR), Public Storage (PSA), National Storage Affiliates (NSA) and Life Storage (LSI). CubeSmart has had better price returns over the last year, with 7.59%, compared to all its peers except for Life Storage, with an attractive price return of 19.26%.

One year price return versus peers (SeekingAlpha.com)

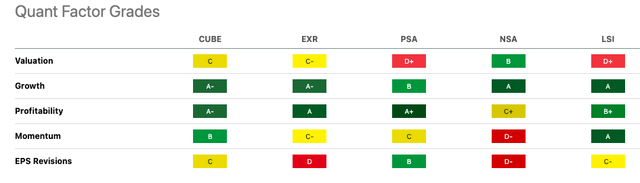

When examining the Quant’s factors grades, it is evident that CubeSmart performs favorably when compared to its peers. It appears to be one of the more appealing stocks within the REITs, considering its valuation, growth, profitability, and momentum.

Relative peer valuation (SeekingAlpha.com)

Risks

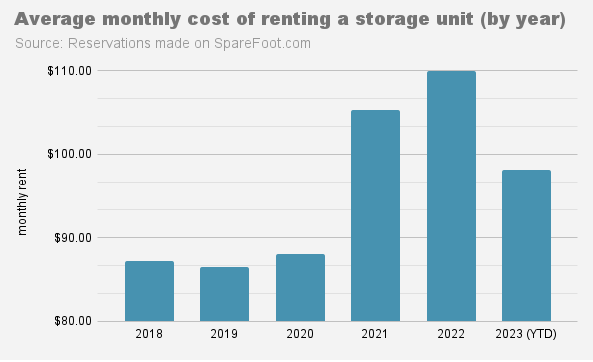

Although the self-storage industry has experienced impressive growth over the past ten years, it’s important to be aware of the risks involved. One major concern is the decline in demand and the abundance of supply due to the low entry barrier. This has the potential to result in an oversupply, which could negatively impact performance. In fact, we’ve already seen a decrease in the average price of storage in 2023, returning to pre-2019 levels. Additionally, a struggling economy could lead to a decrease in demand for short-term storage leases, which could easily be cancelled or postponed.

Average storage cost (Sparefoot.com)

It’s important for investors to note that investing in REITs may come with increased interest rate and financing risks, as these investments often have low liquidity rates and high debt intake.

Final thoughts

The performance of self-storage REITs has been impressive in the past, and in the last two years, it has seen significant growth. However, this doesn’t guarantee future success. Although growth may decline in the short term due to growing supply and less demand, the industry’s consolidation opportunities offer great potential for long-term upside. As a result, investors may consider taking a bullish stance on this stock.

Read the full article here