One of my most successful calls over the past few years has been Clean Harbors, Inc. (NYSE:CLH). For those not familiar with the company, it focuses on dealing with hazardous waste disposal throughout parts of North America. It engages in activities like the collection, recycling, and re-refining of used oil as well.

The last article that I published about the company discussed how management missed out on an opportunity to acquire Heritage-Crystal Clean at really attractive terms. Despite this mishap, I still believed the company made for a good “buy” candidate. Since then, shares are up 29.1%. That’s comfortably above the 20.8% increase seen by the S&P 500 (SP500) over the same window of time.

Obviously, this was not the only time that I wrote about the firm. The first time I rated it a “buy” was back in November 2021. Because of how cheap shares were, I believed that attractive upside existed for investors. This led me to think that the company made for a better opportunity than just investing in the broader market. From that time through today, the S&P 500 is up 17.3%. However, Clean Harbors is up a whopping 89%.

After all this upside, however, I think it’s time for investors to be more cautious. While I wouldn’t exactly call the stock overvalued, I do think it is fully valued. I struggle to imagine more market beating returns moving forward. Because of this, I’ve decided to downgrade the firm to a “hold.”

Growth continues

Sometimes when a company is downgraded, investors perceive the downgrade as a reflection of a negative change in the fundamentals of the business in question. But for me, that is rarely the case. Instead, a firm can continue to achieve attractive growth, but still warrant a downgrade based on valuation. That is the case here.

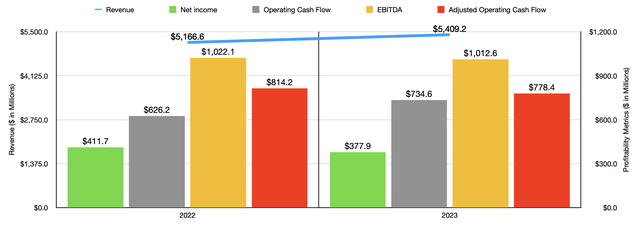

It would be helpful, in analyzing Clean Harbors, to talk about the most recent performance of the business. In 2023, for instance, revenue came in at $5.41 billion. That marks an increase of 4.7% compared to the $5.17 billion the company generated in 2022. This was driven by an 8.1% surge in sales associated with the company’s Environmental Services segment from $4.17 billion to $4.51 billion.

Author – SEC EDGAR Data

Management did not provide a great deal of detail here. But they did say that the firm benefited from growth across its service offerings under this segment. This was offset to some extent by a 9.8% drop in sales involving the company’s Safety-Kleen Sustainability Solutions segment, from $994.4 million to $897.3 million. That drop, according to management, was mostly because of lower market-based pricing on the firm’s base oil product sales that more than offset higher volumes that were sold.

With revenue rising, you would expect net profits for the business to also improve. However, that was not the case. Net income fell from $411.7 million to $377.9 million. Some of this was because of an increase in selling, general, and administrative costs. These managed to grow from 12.1% of sales to 12.4%. However, the company is also hit by an increase in the cost of revenue from 68.6% of sales to 69.3%. Other profitability metrics were mixed. Operating cash flow, for instance, expanded from $626.2 million to $734.6 million. On an adjusted basis, however, it fell from $814.2 million to $778.4 million. Meanwhile, EBITDA for the company ticked down only modestly from $1.02 billion to $1.01 billion.

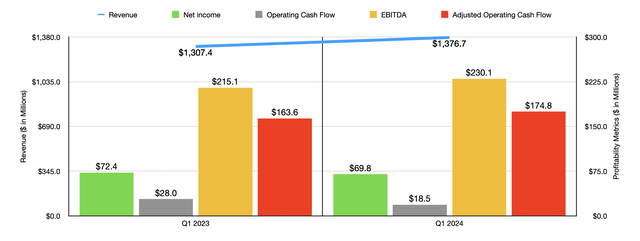

Author – SEC EDGAR Data

Moving into the current fiscal year, revenue growth for the business continued. Sales of $1.38 billion came in 5.3% higher than the $1.31 billion generated just one year earlier for the first quarter of each respective year. Even as lower base oil product revenue fell because of changes in market pricing, the company benefited from a 9.5% surge in sales involving the Environmental Services segment. This, according to management, was driven not only by the strength in demand for its core service offerings, but also because of some acquisitions that the company had made. The most recent of these acquisitions was closed near the very end of March of this year. The company in question was HEPACO, which is an environmental provider of field and emergency response services. The purchase price for this enterprise alone was $400 million. But with $36 million worth of EBITDA from $270 million of revenue, and projected synergies of $20 million on an annualized basis, the picture looks quite positive. This translates to an EV to EBITDA multiple of 7.1.

With revenue rising, profitability has been a bit mixed. Net income did manage to fall from $72.4 million for the first quarter of 2023 to $69.8 million at the same time this year. Operating cash flow also took a hit, dropping from $28 million to $18.5 million. But the company really delivered where it most needed to. If we adjust for changes in working capital, we would get an increase in operating cash flow from $163.6 million to $174.8 million. Over the same window of time, EBITDA expanded from $215.1 million to $230.1 million.

Between the acquisitions the company has made and organic growth, management seems to have high hopes for 2024. They did not provide any estimates when it came to revenue. But they expect net income to be between $376 million and $418 million. At the midpoint, this would be $397.5 million. That’s up 5.2% from the $377.9 million the company generated in 2023. Operating cash flow should be around $785 million, which should translate to adjusted operating cash flow of about $832 million. Meanwhile, EBITDA is expected to be somewhere between $1.10 billion and $1.15 billion.

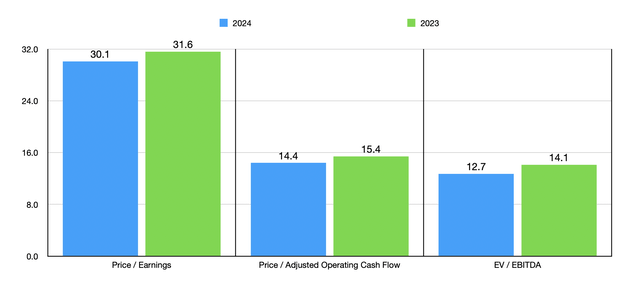

Author – SEC EDGAR Data

Taking these estimates, as able to value the firm as shown in the chart above. On a forward basis, even, it’s difficult to argue that the stock is undervalued. And when we use the 2023 figures, shares look fully valued on an absolute basis. As part of my analysis, I then compared the firm to five similar enterprises. In this case, the company does look more appealing. On both a price to earnings basis and a price to operating cash flow basis, Clean Harbors ended up being the cheapest of the group. And when it came to the EV to EBITDA approach, only one of the five firms was cheaper than it. While I do assign weight to relative valuation, I do prioritize absolute valuation above that. So, even though the stock appears cheap compared to similar firms, I can’t quite get past how shares are priced on an absolute basis.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Clean Harbors | 31.6 | 15.4 | 14.1 |

| GFL Environmental (GFL) | 1,161.7 | 18.4 | 12.6 |

| Tetra Tech (TTEK) | 42.9 | 31.0 | 23.6 |

| Casella Waste Systems (CWST) | 312.4 | 24.5 | 23.6 |

| Republic Services (RSG) | 32.9 | 15.9 | 16.2 |

| Stericycle (SRCL) | 194.4 | 38.6 | 23.4 |

Takeaway

While things aren’t perfect when it comes to Clean Harbors, Inc., they aren’t bad either. The company is a solid operator that likely will do well eventually. Having said that, I think that shares have more or less run their course. I struggle to imagine additional upside that would beat with a broader market would experience. Because of this, I have finally decided to downgrade the firm from a “buy” to a “hold.”

Read the full article here