Despite its relatively cheap valuation, Citigroup Inc. or Citi (NYSE:C) stock has continued to underperform its financial sector (XLF) peers. Therefore, it seems like the focus of investors remains on the execution risks of its business transformation, even as CEO Jane Fraser & her team stressed their confidence that the bank could “bend the curve on an absolute basis by the end of 2024 and continue to bring down expenses over the medium term.”

As such, investors are asked to continue their journey more patiently, as elevated expenses growth in its recent second quarter or FQ2 earnings release could have disappointed holders. Accordingly, Citi notched a 9% YoY increase in operating expenses to $13.6B, despite posting a revenue decline of 1% YoY.

Unsurprisingly, analysts on the call were concerned whether Citi has what it takes to really “bend the cost curve” over time. However, management assured investors its near-term expense outlook remains unchanged at $54B. Notwithstanding, management highlighted that “expenses are anticipated to increase sequentially due to continued investments in transformation and risk and controls.”

I assessed that Citi attempted to frame the scale of its business transformation appropriately to help investors consider the risk/reward of buying more C shares at the current levels. Fraser has not avoided the hard questions in the call, as she also cautioned that the bank could be impacted by regulatory changes on capital requirements. As such, investors need to continue assessing the near-term impact on its earnings as C remains a turnaround play.

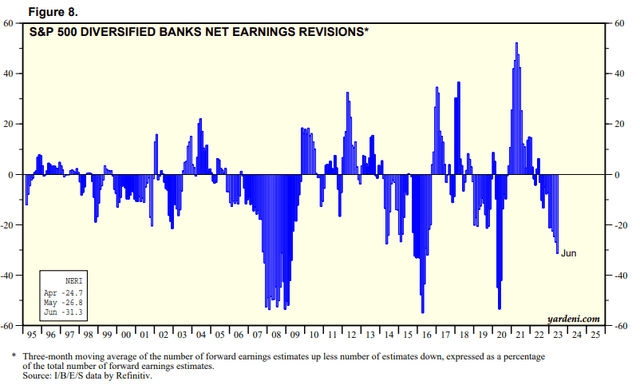

Diversified Banks net earnings revisions % (Yardeni Research)

The revised analysts’ estimates likely discounted the industry’s risks in FY23, as analysts turned more pessimistic about banking stocks in June. However, I believe the pessimistic positioning has likely reached a bottom, as the economy is increasingly skewed toward a soft landing than a hard one.

Management’s commentary in the call assured investors that the bank doesn’t expect a hard landing as the base case. While Citi sees “credit normalization is happening faster in retail services, with a more cautious consumer,” Fraser doesn’t expect consumer spending to be “necessarily recessionary.” Notably, Citi delivered encouraging results in its US Personal Banking Revenues, which rose by 11% to $4.6B. It helped mitigate the impact on Markets and Investment Banking, as their recovery has not panned out and normalized.

Given the scale of the Institutional Clients Group’s or ICG’s sum-of-the-parts or SOTP framework (82%) on C’s valuation, the market is likely concerned about whether Citi’s ICG revenue growth could bottom out in Q2 after posting a 9% decline.

I assessed that more favorable macroeconomic conditions should bolster the recovery of Markets and Investment Banking in the second half. As such, it should continue the more robust momentum in Citi’s consumer banking business. However, a growth inflection in ICG should be considered more important in the grand scheme of things. Still, the market will likely remain lukewarm over the expense trajectory of Citi until we get more clarity toward the end of 2024.

Therefore, investors who decide to invest in C at the current levels must have a high conviction of Citi’s ability to execute its transformation, particularly in “bending the cost curve.”

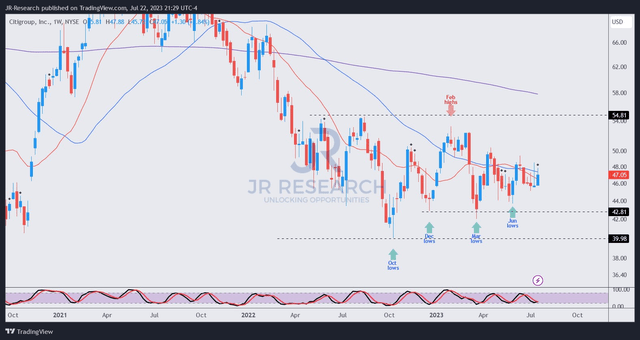

C price chart (weekly) (TradingView)

As seen above, C bottomed out in October 2022 and survived the initial selling onslaught in March 2023.

Also, C managed to eke out a higher low price structure in early June 2023, suggesting dip buyers had sufficient momentum to defend May’s selloff, not allowing C to fall back toward its March levels.

I assessed that C holders still waiting on the sidelines could capitalize on its improved buying sentiments and attractive relative valuation (Seeking Alpha Quant valuation grade of “A-“), adding more exposure.

I don’t expect Citi’s operational performance to worsen from here. Coupled with more constructive price action and valuation, I’m ready to upgrade my thesis on C.

Rating: Strong Buy (Revised from Buy).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here