Introduction

One of my favorite Tom Petty songs is The Waiting, and I encourage you to follow this link and give it a listen if you’ve never heard it. In this article, we will catch up with Cenovus Energy Inc. (NYSE:CVE) and see if the waiting is about over for it to deliver on its potential. I have previously covered the company, and investors are encouraged to read up on our original “deep-dive” articles. In past coverage, we have given the company a buy rating in the $15ish range.

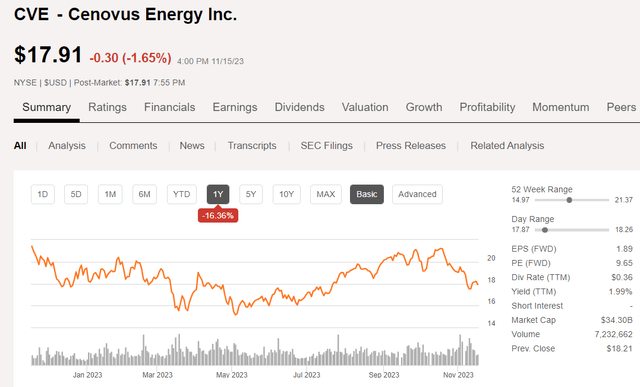

CVE Price chart (Seeking Alpha)

That’s turned into a pretty good recommendation as the stock has peaked above $21 recently, following a ~30% ramp since June. (Timing is everything in the stock business.) The stock has trended down in the current “wall of worry” over oil demand in 2024, and may present itself as a buy at current levels.

We have been focusing the last month on Canadian heavy oil operators over the last month, with articles so far on MEG Energy (OTCPK:MEGEF), Imperial Oil (IMO), having come to the public side, and also on Suncor Energy (SU) and Canadian Natural Resources (CNQ), though these remain exclusive in our membership community.

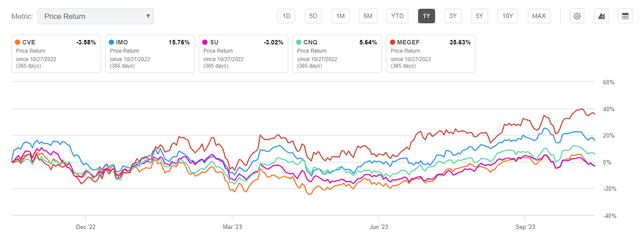

In a comparison chart (below), we see that CVE and SU share a common metric, being nearly tied for the worst price return over the past year.

Heavy oil cohort price returns (Seeking Alpha)

Does that mean CVE is now a spectacular buy? Obviously, the point here is to have a look.

The seagulls seem to think so, with 16 of 17 analysts rating the company a BUY. Price targets range from $19.13 to $27.02, with a median of $24.15. That median is a ~30% bump from today’s pricing of just under $18.00, justifying some optimism about where we will end up at the conclusion of this article. Let’s not get ahead of the story, though, and see what an update reveals for the company.

The thesis for CVE

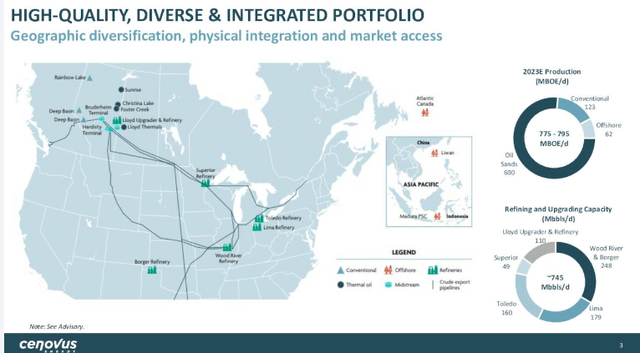

The company is primarily an oil sands producer, but pulls income from conventional and offshore assets as well. 2023 average production is targeted to be approximately 800K BOEPD, with 600K BOEPD coming from the oil sands. The company has 2P reserves of 8.9 BBOE, with a reserve life of ~31 years at present extraction rates.

Plans are in place to ramp production higher to the tune of ~80K BOEPD over the next couple of years with about half of that coming from the White Rose asset, and rest coming from facilities improvements-de-bottlenecking, at heavy oil assets in Sunrise, Foster Creek, and Christina Lake. The company is also a major U.S. refiner with plants mostly in the upper Midwest, that serves as an internal outlet for some of its heavy crude.

CVE footprint (CVE)

CEO Jonathon McKenzie discusses the impact the refineries have on CVE results-

These assets are incredibly important and meaningful contributors to our integrated heavy oil strategy, our focus in the third quarter and beyond will be to operate them reliably, efficiently and profitably.

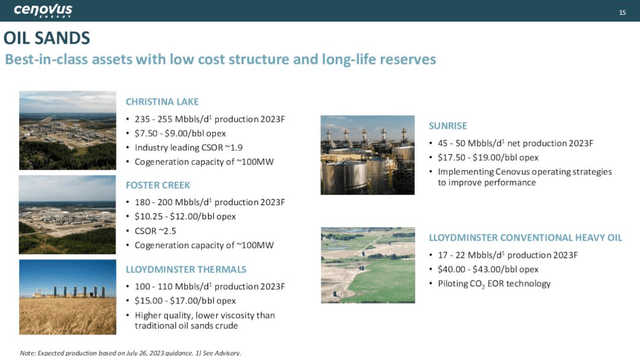

Much of the oil sands production comes from thermally generated reservoirs with very low Cumulative Steam to Oil Ratios-CSOR, and single-digit-CAD, opex costs, at Christina Lake and Foster Creek. The lower the CSOR number, the lower the opex costs to produce each BOE.

Business segments for CVE (CVE)

Addressing the wild fires and other maintenance issues the company had in the first half, CEO McKenzie commented-

And as I mentioned, with the vast majority of our major maintenance behind us and the forecast continual ramp-up of wells across the upstream portfolio, we expect to see elevated and steady production numbers over the remainder of the year.

Why is heavy oil, heavy oil?

We talk a lot about grades of crude and other petroleum variants in the normal course of discussing companies searching for oil and gas. You may find this very high level discussion of how petroleum matures informative. In a nutshell, petroleum is produced from bits of organic debris that are carried along with grains of flotsam and jetsam in wind-aeolian, and water-fluvial, high to low processes. As these begin to form sediments in riverine and tidal basins, that are buried in successive layers, a thermal maturation process begins that geologists term, “Diagenesis,” essentially cooking the organic material into a petroleum precursor called Keragen. With heavy crudes the burial depth is not great enough to take this maturation much farther, and the final product produced is a thick, viscous-sometimes semi-solid material (bitumen). In general, the deeper the sediments, along with some other factors like manner of sedimentation and the original nature of the organic debris, determines the quality of the oil in-situ, and whether it is oil or gas.

Without wanting to get too wonky, the geology of Western Canada Sedimentary basin is such that older sediments more on the western side in northern Alberta and to an extent in British Columbia provinces, the Montney and Kaybob-Duvernay sediments are buried deeply enough that we have competent shale reservoirs that generally require fracking to yield oil-sometimes light, sometimes heavy, and gas. Farther south and on the eastern edge in the Fort McMurray, Peace River, and Athabasca regions we begin to see the younger oil sands where shallow wells for steam flooding, or in some cases, strip mining are used to extract the hydrocarbons. Ok, back to Cenovus.

A couple of potential catalysts for CVE

Near term, refining could bring an uplift to shares. From capital costs-acquisition of BP’s (BP) interest in the Toledo, Ohio refinery to de-bottlenecking across the assets to improve throughput. The refineries could go from generating a cash drain to throwing off cash in similar fashion to large refining competitors that trade at much higher prices.

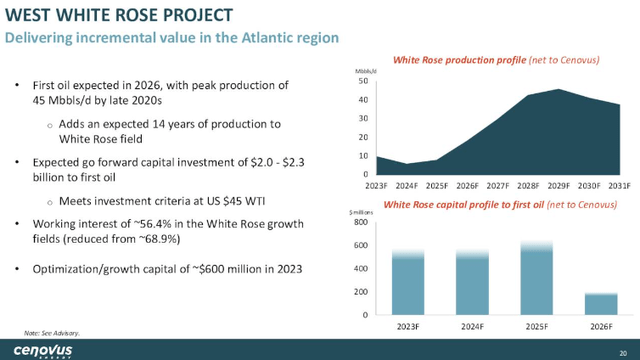

A little farther down the road, White Rose could also be a catalyst. White Rose will bring up to 45K BOEPD by 2028. The slide below notes the capex to bring this asset to higher levels is front-loaded, and declines in 2025, just as production ramps up as the same time. By 2026 only maintenance capex is forecast. At current Brent pricing (CL1:COM), this could be an EBITDA uplift of ~$1.0 bn/year at peak flow rates.

White Rose Project CVE (CVE)

No discussion of a Canadian oil company is complete without mentioning the impending line fill and 890K BOPD daily shipping capacity of the Transmountain Pipeline. This is nearly finished, and will do a couple of things. It will provide a nearly 900K BOPD of new demand to new markets in the west coast. It will also help to permanently narrow the WCS discount that is constant source of diminished returns when it expands-as it has been doing recently.

Q3 2023 and guidance

In Q3, the company missed on the top line by $1.29 bn, but beat on the bottom line by $0.11 per share. On revenues of $14.6 bn, CVE generated $2.7 billion in cash from operating activities, $3.4 billion in adjusted funds flow and $2.4 billion in free funds flow in the quarter. All metrics up significantly QoQ thanks to higher realizations from higher prices and narrower WCS margins. Total upstream production was 797,000 BOPD and downstream throughput averaged over 664,000 barrels per day (bbls/d). Net debt is ~$6.0 bn. CEO McKenzie comments:

I’d like to highlight our corporate and financial performance. In the third quarter, Cenovus delivered approximately $3.4 billion of adjusted funds flow with both upstream and downstream, businesses demonstrating strong performance and contributions to operating margin.

CVE has no significant maturities until 2027/8 and has USD $1,635 bn of cash on the balance sheet.

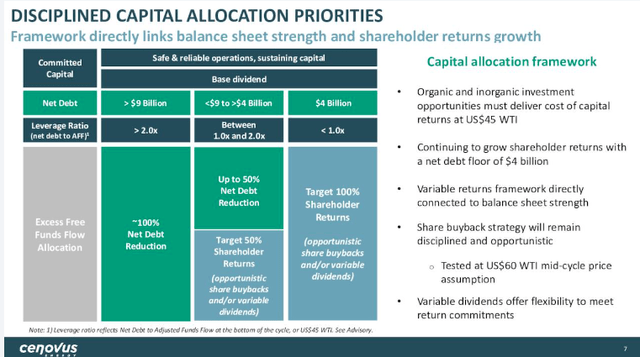

One of the things that investors can look forward to with CVE is increasing distributions and share count reduction. With debt in the $6.0 bn range and declining, CVE’s leverage ratio will drop below 1.0, triggering the variable commitments noted below.

CVE Capital allocation priorities (CVE)

In Q3, they delivered $1.2 billion to shareholders, including $600 million for the partial payment of the common share warrants obligation, $361 million in share buybacks and $264 million through common share dividends.

Risks

The big risk for Canadian heavy oil comes from oil prices fluctuating and some political risk. The political risk comes from the increasing imports Venezuelan crude that might displace some Canadian oil. This is attenuated by the fact as a refiner CVE can control their input mix.

As noted, the WCS risk is ever-present and has been on the increase in Q4, possibly impacting results.

Your takeaway

Cenovus Energy Inc. is on track to generate ~$7 bn in EBITDA in the next 12 months. That would put their current trading multiple at 5.85X, a bit higher than some competitors we’ve discussed. At current production rates, their price per flowing barrel is $54K per barrel, barely beating SU on that metric.

Alternatively, if you’re a really long-term investor, that 8.9 bn bbls of 2P reserves is pretty reassuring. At current production rates the company can pump for ~31 years, without worrying where its next barrel is coming from.

I think Cenovus Energy Inc. rates a buy at current levels for growth in 2024 and increasing income as debt is paid down and float declines. The waiting for CVE to catch up to peers could be over, and that, as Tom Petty said in the song riff, is “the hardest part,” for investors. At current pricing, I think the risk is largely to the upside, rewarding long-suffering investors in the new year.

Read the full article here