Dear Partners and Friends:

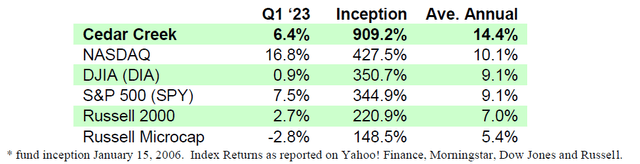

Markets, or at least the NASDAQ, recovered a bit in the first quarter of 2023. The NASDAQ, which had performed the worst in 2022, declining by 33%, bounced back the strongest, rising by nearly 17% in the quarter. Cedar Creek increased by 6.4% in the first quarter, net of fees and expenses.1

While Cedar Creek Partners focuses primarily on microcap stocks, and over-the-counter stocks in particular, we compare our returns against larger indices as well since we believe we need to outperform the most prominent passive benchmarks over time in order to justify our existence.

Cedar Creek’s average annual return over our 17 1/4 year history is 14.4%, net of fees and expenses, which compares favorably to all the indices we compare against. Cumulative returns since inception for Cedar Creek were 909.6%, net of fees and expenses.

$100,000 invested in the fund at inception in January 2006 would have grown to $1,009,166 as of March 31, 2023, net of fees and expenses, whereas $100,000 invested in the indexes we compare against would have only grown to between $248,488 in the Russell Micro Cap and $527,479 in the NASDAQ.

Fund Holdings are at Incredibly Attractive Prices

On the whole, as of the end of March 2023, the fund’s holdings were trading at 5.1 times our estimate of earnings for the coming year, and 4 times expected earnings net of cash at the respective businesses.2 Trailing earnings multiple was 7.7 times assuming no earnings for Pacific Coast Oil Trust (OTC:ROYTL), or 6.0 times assuming the ARO assessment is improper and ROYTL should have earned $0.27 per unit in 2022. Weighted price to book was 1.3. Dividend yield was 2.4%. Weighted expected return on equity as of March 31, 2023 was 26%.

Cash Levels and Fund Repositioning

We started the year with cash levels at 6% and ended the quarter at 16%, due primarily to capital inflows into the fund. We continued to add to PD-Rx Pharmaceuticals (OTC:PDRX) and Pacific Coast Oil Trust (ROYTL). We initiated a new position in a community bank that was not a recipient of funds through the Emergency Capital Investment Program (ECIP). It trades on the expert market and was selling for about three times trailing earnings and half of book value.

During the quarter we finished exiting our position in BM Technologies (BMTX). The poorly named company was a poor investment. Maybe the first part of the name should have told us it was going to be a turd. Anyways. It is always important to look at what mistake was made in a poor-performing investment. In this case, and it is embarrassing, we failed to truly understand the industry and the company’s position. We know there are industries we don’t understand as well as business models. When we encounter them, we have to either invest the time to understand the industry and the specific business or move on.

BMTX presented itself as a fintech company on the cusp of a new wave in banking focused on college students and white-label banking products for companies, such as T-Mobile (TMUS) (and possible Google (GOOG, GOOGL) until that was canceled). The reality is that they are a middleman trying to earn a spread on funds disbursed to college students and white-label banking products. Our zero-interest rate environment hid this. College students have small balances and T-Mobile banking customers are interest rate sensitive so as rates rose, the spread BMTX could earn shrunk. T-Mobile money currently pays 2.5% on balances. BMTX was getting 3% from Customers Bancorp (CUBI), but it was not a market rate. They now get a floating rate closer to 4%. But what once was a 3% interest spread when interest rates were zero, collapsed as rates increased, and is now roughly half of that. Their profitability vanished quickly. Thankfully, it was a modest size position at roughly 3% of the fund and our overall loss was probably less than 1% of assets.

Expert Market Exposure

Our exposure to stocks trading in the expert market decreased slightly in the quarter, primarily due to capital inflows. Expert market stocks are companies impacted by SEC Rule 15c2-11. For those unfamiliar, the rule prevents brokers from not only displaying quotes for non-reporting companies but also restricts transactions to selling only. Institutional accounts, depending on the broker, are not subject to the buying restriction. We started the quarter with 29% exposure and ended at 27% of the fund.

Two positions make up about 60% of the expert market exposure – PD-Rx Pharmaceuticals (PDRX), which is about 10% of the fund, and Pacific Coast Oil Trust (ROYTL), which is roughly 6.5% of the fund. We discussed PD-Rx Pharmaceuticals briefly in our Q1 2021 letter and Pacific Coast Oil Trust in our Q2 2022 letter. We also provided more detail on both in our 2022 yearend letter (link).

Update on a Few of Our Top Holdings

Citizens Bancshares (OTCPK:CZBS) – is an Atlanta, Georgia-based bank. Citizens has roughly 2 million shares outstanding. Shares ended the first quarter at $38.53 per share. The fund started buying in June of last year at $12 per share, which was less than half of common book value, and six times 2021 earnings. We kept buying as it rose in price. Our basis is under $19. Citizens received $95.7 million of additional capital via the US Treasury’s Emergency Capital Investment Program (ECIP) at the end of June 2022. Citizens does not report quarterly earnings, but the bank does file quarterly Call Reports which are available on otcmarkets.com. Earnings for the fourth quarter of 2022 had no unusual items and were about $1.75 per share, giving an annualized rate of $7 per share. The sharp increase in earnings was due to yields on their loan portfolio rising and having the ECIP funds invested in US Treasuries yielding 4-5% during the quarter.

Assuming a $7 per share annual run rate in earnings, Citizens is trading at a multiple to earnings of around 6 times. Over time, the ECIP capital should move from being in 4% short-term treasuries to being leveraged via growing deposits and loans or securities, which will boost earnings further, or Citizens could use the funds to buy another bank and increase earnings that way. Without an acquisition, we think the bank can earn roughly $7 per share this year despite rising deposit costs. The bank has also started expanding into Texas and Tennessee so organic growth may kick in over the coming quarters. An acquisition would likely speed that timetable up.

During the fourth quarter Citizens announced receipt of a $5 million preferred investment by TD Bank (TD, TD:CA). The rate was only 1%, which was more favorable than the 2% we expected. In February, they increased their annual dividend from $0.50 to $0.75 per share. Citizens released their annual report this past week which did contain a subsequent event that they experienced the loss of their largest depositor, accounting for more than 5% of deposits. Due to their significant cash holdings, the loss is not a concern to the stability of the bank, but it does dampen earnings growth in the near term. One bright spot was in their proxy statement, which shareholders received, which showed a share count of 1,890,302 versus a year-end count of 1,981,259 (otcmarkets.com also shows 1,890,302 shares outstanding). This implies a repurchase of approximately 5% of their outstanding shares in early April.

M&F Bancorp (OTCPK:MFBP) – is a North Carolina-based bank with two million shares outstanding. Last summer, it received $80 million of low-cost capital through the US Treasury’s ECIP. The stock ended the first quarter at $22 per share. It had reached $30 prior to the bank selloff. Our cost basis is under $12. M&F earned $0.82 per share in the fourth quarter of 2022 versus $0.51 per share in the third quarter. Most of the earnings increase was from ECIP funds being moved into shorter-term treasuries earning 4-5%. Annualizing fourth-quarter earnings gives a $3.25 per share earnings run rate. We expect earnings to have grown modestly in the first quarter of 2023 due to some of their loan portfolio re-pricing (i.e., existing loan rates increasing due to the prime rate being higher) faster than their cost of deposits likely increased.

A buyer today is paying 7 times earnings for a bank with the potential to see earnings double from an acquisition using the ECIP funds or steadily grow by attracting deposits and making loans. (See our 2022 third quarter letter for a more detailed discussion of ECIP recipient banks.)

Solitron Devices (OTCPK:SODI) – the bid price for shares increased by 16% in the first quarter of 2023 from $8.70 per share to $10.10 per share. As a reminder, I am CEO and CFO of Solitron due to a proxy fight in 2015 and management change in 2016. Solitron’s annual meeting was held in January 2023 and I discussed the press release issued by the company related to the U.S stockpile program, which noted.

In December 2022 the President signed the $1.7 trillion omnibus spending bill. Included in the bill (was) appropriations to replenish supplies used in Ukraine and to increase stockpiles. A number of programs are included in the spending, including two that represent Solitron‘s two largest revenue sources. The increased stockpiles program is a multi-year program that we currently expect to add approximately $20 million in total revenues starting in late (calendar) 2024 and running through 2028, or approximately $4 million annually. Actual contract awards are expected to occur by the fall of 2024.

Fiscal 2022 revenues were $12.3 million versus the prior year’s $10.5 million, which shows the significance of an expected $4 million annual increase. The press release also noted Solitron’s cost savings program is achieving or exceeding its targets. In addition, at the end of the fiscal second quarter and first part of the fiscal third quarter Solitron purchased 1.1% and 1.5%, respectively, of the outstanding shares of two small community banks that were recipients of the Emergency Capital Investment Program (ECIP).

PD-Rx Pharmaceuticals (PDRX) share price was unchanged at $6 per share in the quarter. As noted above, we continued to add to the position. It trades on the expert market. Since the company only reports once a year there is nothing new to add. We think it is ridiculously cheap. As of June 30, 2022 book value was $6.90 per share. Total cash and receivables less all liabilities was $4.90 per share. Cash alone was $3.33 per share. Trailing earnings were $1.84 per share. We are more than nine months into their fiscal 2023. If earnings are running the same as in fiscal 2022, which we think is likely, then we can add $1.40 per share to each of those metrics. At $6, we are likely paying 30% below book value, less than cash and receivables minus all liabilities, nearly the same as cash on hand, and just over three times earnings. Anytime an investor is paying below cash and receivables less all liabilities you are getting the business for “free” which is absurd if the business is profitable today and expected to be so into the future.

We would note that a company burning cash (i.e., experiencing operating losses) can easily be worth less than its cash and receivables since it is likely it will continue to incur those losses. That is why we are not comfortable with early-stage investments in money-losing businesses.

Pacific Coast Oil Trust (ROYTL) units increased from $0.46 to $0.49 per unit. Due to the stage we are in, in terms of calling a special meeting and filing proxy statements, we are not going to discuss any details. We would refer you back to our prior letters regarding how to view the potential return.

Our investment in Tix Corporation (OTC:TIXC) (private) performed poorly in the quarter. As a reminder, the company sells show tickets at four booths along the strip in Las Vegas. Sales in the first quarter were well below expectations and the prior year period. This was very surprising to us. We thought when shows re-opened in late 2021 and sales were a fraction of pre-COVID levels that the trend would be upward, or at worst flat. Due to the decreased sales, we decreased our valuation of Tix by more than 50% during the quarter. We are working toward adding online sales in the latter half of the year. Online sales should have a different profitability profile than the booths due to the absence of rent and most of the labor and replacing it with IT costs, some of which are already necessary at the physical locations. It is still too early to know whether the investment will turn around. Due to new funds coming in and the decreased valuation, it is now only 2% of the fund’s assets.

Room for New Members and/or Additional Funds

We continue to have more attractive ideas than capital. Thus, there is plenty of room for existing partners to increase their investment and for others to join. Please consider referring friends of yours who may be potential new investors. The basic requirements are 1) that each invests a minimum of $100,000 and 2) that new members are accredited (high net worth) individuals. Subsequent investments must be for a minimum of $10,000.

If this letter was passed on to you and you would like to be added to our monthly distribution list, please email me at the email address below. You can find more letters at eriksencapitalmgmt.com/investor-letters. Should you have any questions regarding the fund, please don’t hesitate to call or email.

Sincerely,

Tim Eriksen, Manager

DISCLAIMERS

Fund Performance

The financial performance figures for 2022 and 2023 presented in this report are un-audited estimates based on the best information available at the time of the letter and are subject to subsequent revision by the Fund’s auditors. Past performance may not be indicative of future results and no representation is made that an investor will or is likely to achieve results similar to those shown. All investments involve risk including the loss of principal.

Net Return reflects the experience of an investor who came into the Fund on inception and did not add to or withdraw from the Fund through the end of the most recently reported period. The reported net return figures will therefore include the impact of high water marks in the cumulative return. Individual investor returns will vary depending upon the timing of their investment, the effects of additions and withdrawals from their capital account, and each individual’s high water mark figure, if any.

Index Returns

The S&P500 Index returns are reported using the S&P500 Depository Receipt Trust (SPDR) which trades under the ticker symbol SPY. Reinvested dividends are included in these figures. A spreadsheet showing the SPY performance versus the fund since inception is available upon request.

Nasdaq performance excludes dividends, which historically have been immaterial to the total return of that index. In recent years more technology stocks have begun paying dividends thus the inclusion of dividends would increase the reported figures.

Russell 2000 performance is from data reported on Russell’s website, and includes reinvested dividends.

DJIA returns are reported using the SPDR Dow Jones Industrial Average which trades under the ticker symbol DIA. Reinvested dividends are included in these figures. A spreadsheet showing the DIA performance versus the fund since inception is available upon request.

While reported returns for SPY and DIA will likely be a few tenths of a percentage lower than the representative index annually, we believe they are a better reflection of what a non-institutional investor would earn following a passive investment approach.

Index returns are provided as a convenience to the reader only. The Fund’s returns are likely to differ substantially from that of any index, and there can be no assurance that the Fund will achieve results that are superior to such indices.

Share Prices

Share price figures for listed stocks are from Yahoo! Finance and unless specified otherwise are the closing price as of the previous month end. Share price figures for unlisted stocks are closing bid prices as reported on otcmarkets.com, except for unlisted stocks classified as expert market, which do not have public availability of quotes, and are marked to last sale.

Forward Looking Statements

This letter and the accompanying discussion include forward-looking statements. All statements that are not historical facts are forward-looking statements, including any statements that relate to future market conditions, results, operations, strategies or other future conditions or developments and any statements regarding objectives, opportunities, positioning or prospects. Forward-looking statements are necessarily based upon speculation, expectations, estimates and assumptions that are inherently unreliable and subject to significant business, economic and competitive uncertainties and contingencies. Forward-looking statements are not a promise or guaranty about future events.

Footnotes

1 While, no single index is directly comparable to Cedar Creek Partners, we believe that it is important to compare our performance to a passively managed approach. At the core of our investment philosophy is the belief that we can generate superior risk-adjusted returns by holding a more concentrated portfolio of under-valued securities, than an index holding a far greater number of securities. Index returns are calculated from information reported on Yahoo! Finance, Dow Jones, and Russell (see DISCLAIMER for more information).

2 Ratio excludes cash held by the fund. We add back non-economic amortization in our earnings estimate. We project $0.22 in earnings per unit for Pacific Coast Oil Trust.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here

Offers free spin

Offers free spin