Investment Thesis

Carter’s (NYSE:CRI) has limited upside, trading at 13x and 12x consensus F2023 and F2024 estimates, respectively. As a mid-tier apparel brand for children, we think Carter’s has above average risk in a macroeconomy that’s uncertain at best and bordering on recession at worst. We think investors should approach consumer discretionary stocks with caution, focusing on those with catalysts irrespective of the economy, trading at very attractive valuations, and/or cater to affluent consumers whose spending is inelastic. In our view, the middle-income average consumer for Carter’s is likely hurt by inflation and soon will be by the resumption of student loan payments. We suggest that the most vulnerable retailers and consumer brands are mid-tier, since they are likely to be squeezed by core consumers trading down to less expensive alternatives while simultaneously not benefiting from an upmarket trade down effect as affluent customers stay loyal to their familiar brands. Therefore, we simply believe there are better investment opportunities, especially in apparel/retail, than Carter’s at 13x the consensus estimate for F2023 and suggest the stock has an unfavorable risk/reward profile.

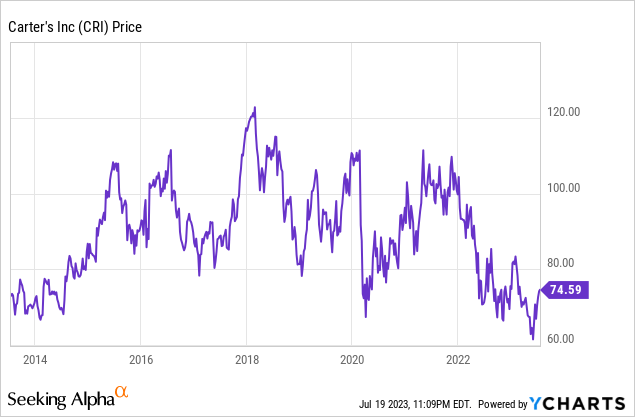

Stock Chart

During the past 10 years, CRI shares have been flat, and year-to-date the stock is down 2%.

Introduction

Carter’s is the dominant player in the children’s apparel space, with the top market share and distribution capabilities (multi-brand, multi-channel). Carter’s has a long-tenured management team with extensive retail experience.

Company Overview

Carter’s is the largest branded marketer of young children’s apparel in North America with the Carter’s and Oshkosh B’gosh brands, two of the most recognized brands in the marketplace. These brands are sold in leading department stores, national chains, and specialty retailers domestically and internationally, as well as direct-to-consumer online and at nearly 1,000 company-operated stores. As part of its wholesale strategy, CRI provides “made by Carter’s” exclusive branded merchandise to Walmart (Child of Mine), Target (Just One You), and Amazon (Simple Joys).

Management

Michael Casey, chairman and chief executive officer, is a 30-year veteran of CRI, having joined in 1993 as vice president of finance and later serving as chief financial officer. Brian Lynch, president and chief operating officer, has 18 years of tenure, having joining in 2005 as vice president of merchandising. Richard Westenberger is chief financial officer, joining 14 years ago for this role.

Challenging Headwinds, Questionable Strategy

Part of our neutral investment thesis is based on challenging business conditions for 1H:F23 with few near-term catalysts.

Lackluster Q1-23 Results, Rosy Full-Year Guidance

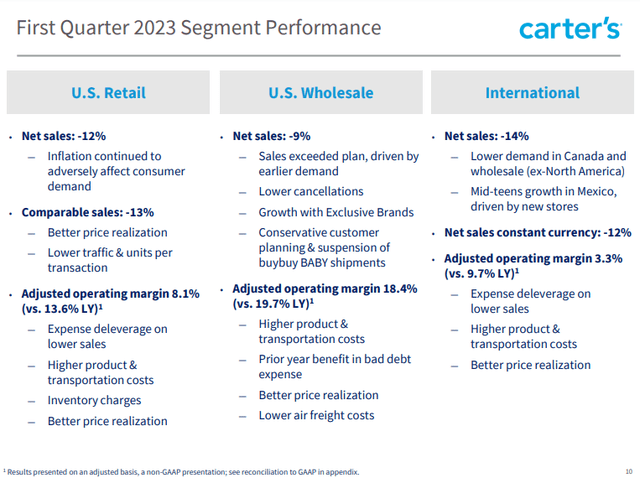

Q1-23 sales and earnings were down year over year. Net sales decreased 11% to $696 million, while adjusted EPS of $0.98 represented a 40% drop. For the U.S. business, same-store sales were down 13% and wholesale sales were down 9%. In addition, adjusted operating margin declined 480 basis points to 8.3%. On the conference call, management attempted to balance its commentary about “lower customer demand” with reassuring words about a “good start to year.”

Q1-23 Segment Performance (Carter’s Investor Presentation)

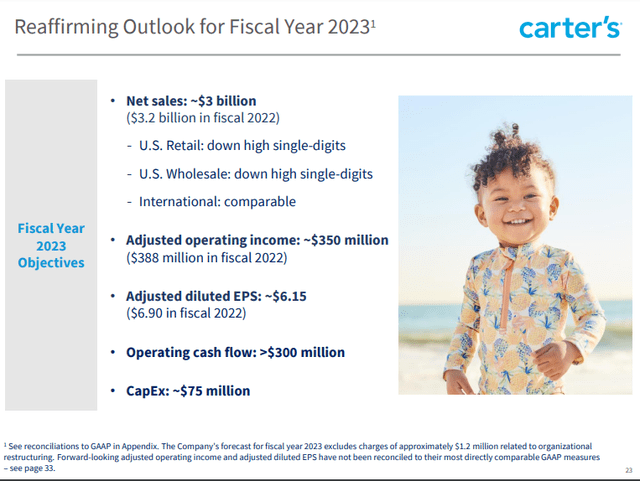

In our view, the performance speaks for itself and management appears overly confident. CRI reiterated its full-year guidance, partly due to its assumption that demand improves as inflation moderates. While we don’t dispute the other key assumptions, such as gross margin improvement due to both lower merchandise costs and freight expenses (representing among the few true catalysts for the CRI story), and stable SG&A expenses given expense reductions, we think consumer demand is the most important factor.

Moreover, we suggest that the full-year outlook is particularly rosy, when considering Q2-23 guidance assumes sequentially worse sales performance yet the 2H:23 outlook assumes improvements. In other words, full-year guidance is simply too back-half loaded.

F2023 Guidance (Carter’s Investor Presentation)

Core Consumer Economic Headwinds

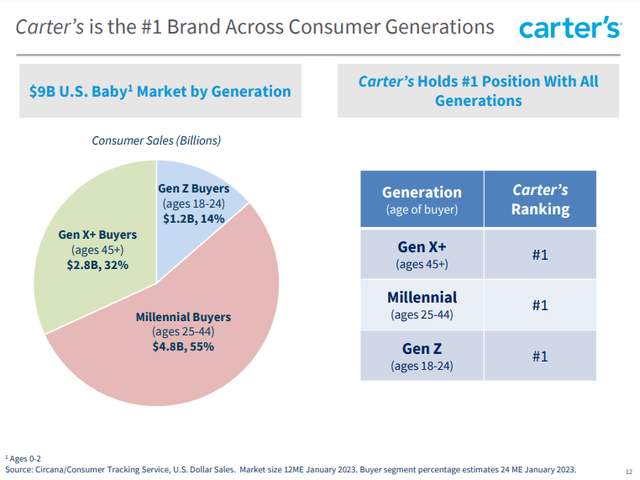

We suggest that the core consumer for Carter’s is a millennial, defined as aged 25 to 44. This group generates 55% of consumer sales in the U.S. baby apparel market. Yet, this demographic faces significant economic headwinds. In addition to overcoming the pressure of persistent yet moderating inflation, this group will soon need to manage the resumption of student loan payments, further reducing discretionary income. This demographic, particularly those with middle-income, is also likely to be renters. As a recent Bank of America Institute study indicates, discretionary spending by renters has begun to decrease, reflecting rising rent inflation. Given these cumulative factors, we think the assumption that easing inflation in the 2H:23 will automatically lead to stronger discretionary spending by consumers is too optimistic.

Consumer Generations (Carter’s Investor Presentation)

Reliance On Baby Clothing

On the Q1 conference call, Casey mentioned that baby apparel accounted for 60% of Carter’s apparel sales and was the best performing product offering. In our view, this signifies another key risk. We think within children’s apparel, baby clothing is the category that is most likely to either be traded down for cheaper private-label merchandise or simply substituted with used clothing from friends or family. Babies outgrow their clothing very quickly, so there is less incentive to buy new (or expensive) offerings.

Wholesale Channel Uncertainty

The U.S. wholesale channel remains challenged, as major big box customers (i.e. Walmart (WMT), Target (TGT), Amazon (AMZN), etc) are undergoing destocking programs after too much inventory was purchased in the prior year. Management indicated that on its Q1 conference call that replenishment trends have begun to improve. However, that’s clearly a relative statement, as management later conceded that sales were down in the off-price channel as well as to department stores and club stores. In addition, due to the Bed Bath & Beyond bankruptcy and resulting closure of the Buy Baby chain, CRI lost a major wholesale customer. We suggest that even after the destocking issue is resolved this year, retailers will remain cautious about inventory levels and therefore the wholesale channel may require more time to normalize than management assumes in its full year guidance.

Direct-To-Consumer Expansion Raises Concerns

In its most recent investor presentation, Carter’s discusses plans to open 50 more retail stores in North America this year, as part of its direct-to-consumer growth strategy. We believe there are potential problems with this initiative.

We don’t dispute management’s contention that stores are its top source of new customer acquisition and nearly 70% of children’s apparel in the U.S. market is purchased in store. However, we suggest that these figures are likely to erode over time, particularly given trends for younger consumers towards online shopping.

In addition, from a macro perspective, we are concerned by the strategy implemented by many consumer brands that deploy multi-channel distribution strategies: direct-to-consumer (retail stores, e-commerce websites) and wholesale. In our view, this is risky, since the brand essentially competes with its wholesale customers for consumer demand. Over the long-term, this confuses consumers and may weaken the brand value.

Valuation

Based on our analysis, we are skeptical of Carter’s full-year F2023 guidance which includes adjusted EPS of approximately $6.15, and Wall Street shares that view. Consensus is $5.90, approximately 4% less than guidance. CRI trades at 13x and 12x, consensus EPS estimates for F2023 and F2024, respectively. In our view, CRI is fairly valued, even if its 5-year average P/E is 15x. Therefore, we suggest there is limited upside to shares with an unfavorable risk/reward profile. We prefer retailers that trade with single-digit P/E multiples (read below for a trading idea).

Catalysts/Risks

We think the primarily catalysts for CRI are an increase to its quarterly dividend, which is currently $0.75, better-than-expected gross margin expansion from realization of lower input and freight costs, and positive same-store sales.

In addition to the risks already discussed, additions concerns for shareholders include management turnover (given the long tenure of the leadership team), competition (particularly on price), and execution risk (new store growth and cost-cutting initiatives).

Trade Idea: Swap PLCE for CRI

Earlier this month, we wrote an article about The Children’s Place (PLCE): The Children’s Place: The Right Place For A Retail Turnaround.

Simply put, The Children’s Place is a competitor of Carter’s, particularly in the direct-to-consumer / retail space. Moreover, PLCE is poised to benefit even more than CRI will in 2H:F23 from lower cotton prices and freight expenses. In addition, PLCE has undertaken major cost-cutting initiatives, its CEO recently purchased $1 million of stock, and free cash flow generation is likely to exceed adjusted net income this year based on our model. Yet, even with all of these attributes, PLCE trades at a fraction of the P/E multiple that CRI commands; based on F2023, PLCE trades at 5x our $6.00 EPS estimate, while CRI trades at 13x consensus estimate.

Therefore, we suggest that CRI investors swap out of CRI and into PLCE.

Conclusion

Carter’s is the dominant children’s apparel company and benefits from a seasoned, well-tenured leadership team. CRI shares reward investors by paying a $0.75 quarterly dividend (4% dividend yield) and buying back stock. The company’s flagship brands are iconic in the marketplace. Nonetheless, a “great company” can be a “bad stock” and we simply believe at the current valuation this applies to CRI. Given challenging macroeconomic, competitive, and operational headwinds, we believe the 13x P/E multiple on F2023 consensus estimates fully values the stock. We would be more constructive on the stock, if shares were to trade below $60, representing a 10x multiple.

Read the full article here