Red Street Car Toronto Canada

Note: All amounts discussed are in Canadian Dollars. Securities discussed trade primarily on Canadian exchanges. Canadian options are not accessible by US investors.

On our last coverage of Canadian Apartments REIT (TSX:CAR.UN:CA), we maintained a hold on the company and looked to buy it a bit lower. While CAPREIT (as it is affectionately known), was a good play, we were not seeing the value on a relative or absolute basis.

Even amongst the whole REIT asset class, Canadian industrial REITs have better fundamentals (zero rent caps and no expenses side pressures), and so CAPREIT will struggle to be a top name. We are maintaining this at hold/neutral and would give it a buy under $40.00, all things remaining equal.

Source: Huge Rent Uplifts Offset NAV Pressures

That was about six months back, and the REIT has done a full dance and gone just a shade lower than where it was previously.

Seeking Alpha

We tell you why we have started buying and how we are doing it.

The REIT

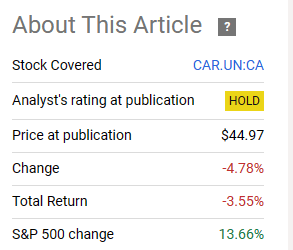

CAPREIT as its name implies, is primarily a Canadian multifamily residential play, though it does have some European exposure as well.

CAPREIT April 2024 Presentation

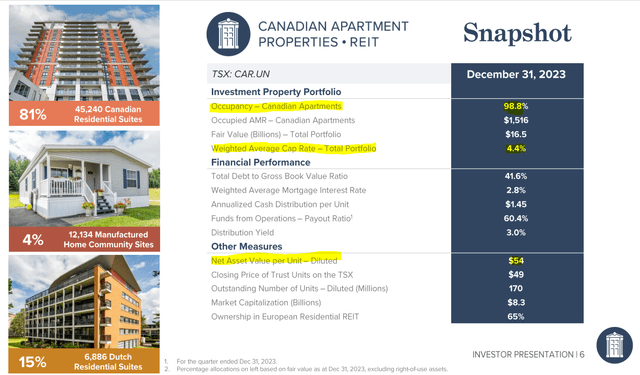

The REIT has quality assets and has maintained a very high occupancy rate and strong net operating income (NOI) growth. In the most recent quarter, we did see some deterioration in operating margins as rent controls butted heads against high inflationary pressure.

CAPREIT April 2024 Presentation

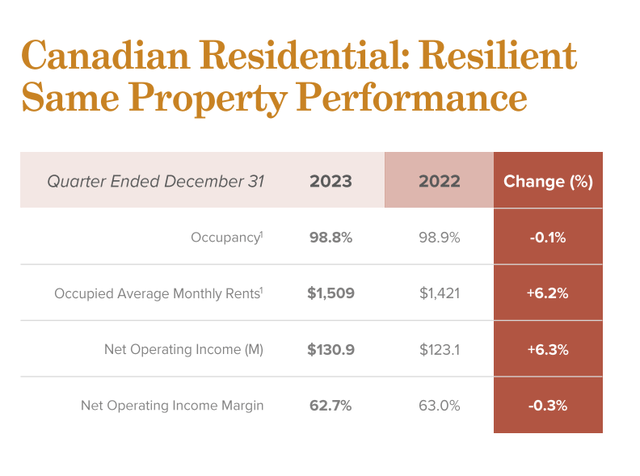

In this rapid rate increase environment, CAPREIT has focused primarily on capital recycling. Previously, they were making big acquisitions, but in 2022-2024, they have focused on upgrading portfolio quality.

CAPREIT April 2024 Presentation

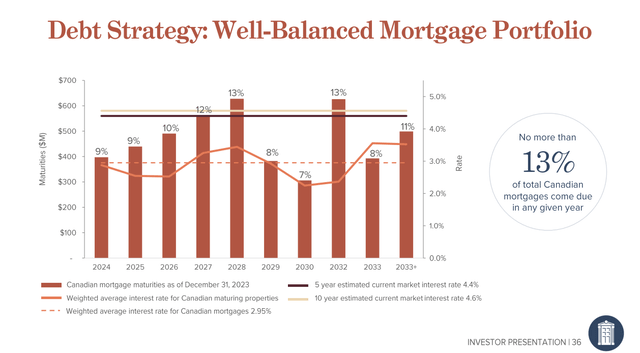

As with any REIT in this environment, the key thing to look at is the debt maturity profile. CAPREIT is one of the best here with a well spread out debt wall and this should allow NOI increases to easily offset rising interest costs.

CAPREIT April 2024 Presentation

Key Reasons To Invest

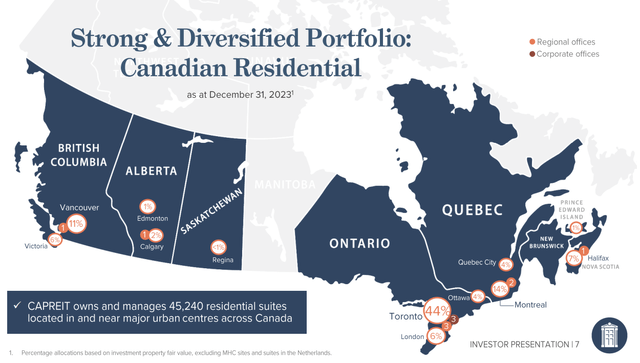

The biggest problem that the bears see with CAPREIT and one we will gladly agree with, is rent control. As can be seen in the picture below, very little of its asset base is outside of rent controlled Ontario or British Columbia.

CAPREIT April 2024 Presentation

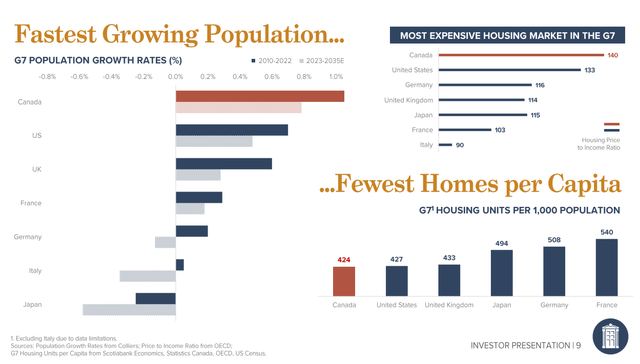

Unfortunately rent controls alongside the fastest population growth has made the immigration policy a giant pain for all of Canada.

CAPREIT April 2024 Presentation

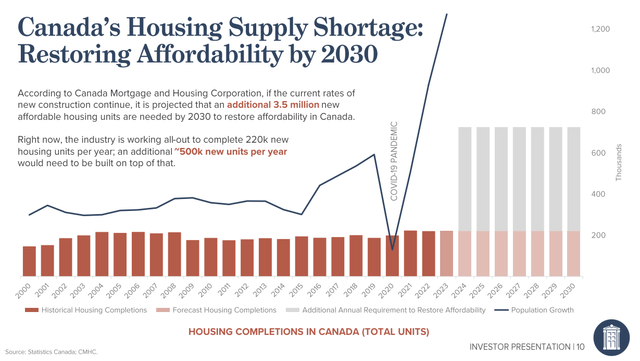

According to official figures from the same government that gave you this problem, we have a huge housing supply shortage.

CAPREIT April 2024 Presentation

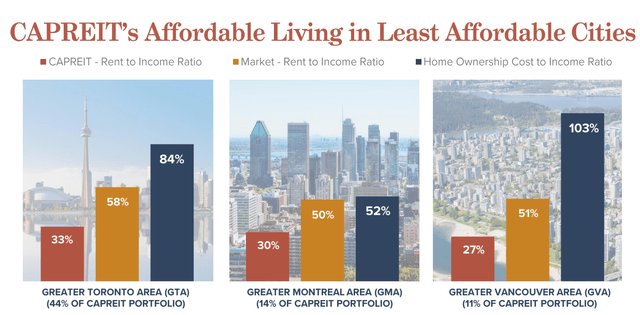

In all of this, we would normally expect rents to rise rapidly and equalize the gap with home ownership. That cannot happen when there are rent controls. So CAPREIT’s apartments remain the most affordable places to live in the least affordable cities.

CAPREIT April 2024 Presentation

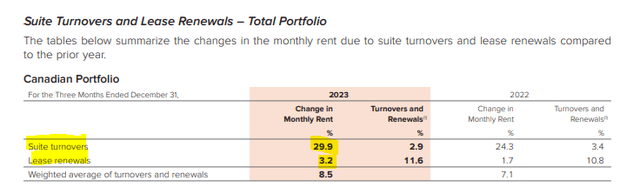

But in all of this, there is a silver lining. CAPREIT can raise rents to market levels whenever a tenant moves out. These move-outs have been falling precipitously, as everyone knows that leaving a rent controlled place is a huge problem. But they are happening. When they do happen, you can see the big bump that CAPREIT gets relative to lease renewals (Annual Report link).

CAPREIT Annual Report

So this is the embedded value in the portfolio, and it will be crystallized slowly over several years. This creates kind of a floor in our opinion when the REIT is viewed from the lens of replacement costs or longer term cash flows (say 10 years out). It becomes one of those harder to lose cases as you go lower in price.

Valuation & Verdict

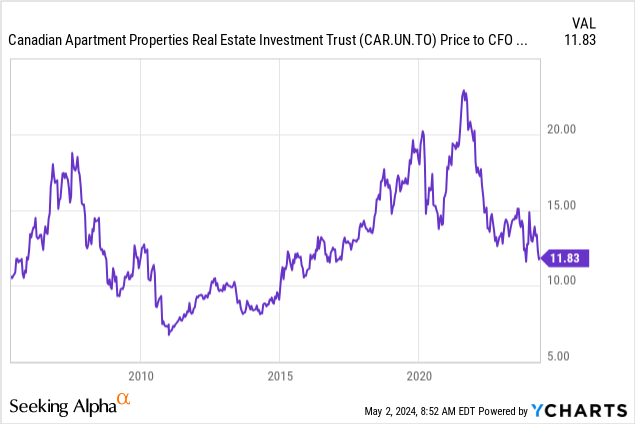

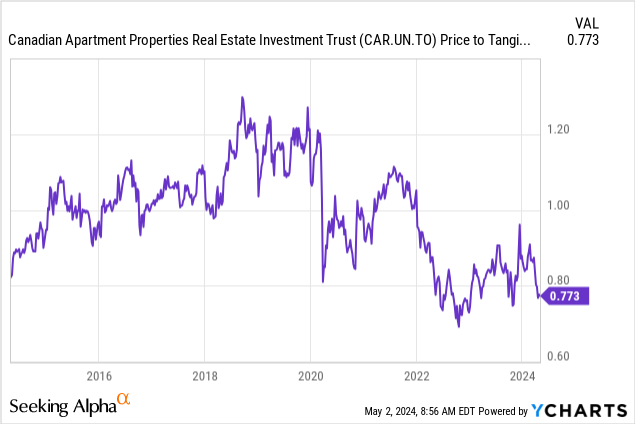

Of course, the big question is whether this is cheap enough. At the current valuation, we have corrected all the 2021 madness for sure, but the REIT does not look like it is at rock-bottom levels.

On the traditional price to funds from operations (FFO) basis, the REIT is near the lower end of its range that we have seen, but it certainly could move 2-3 turns lower.

TIKR

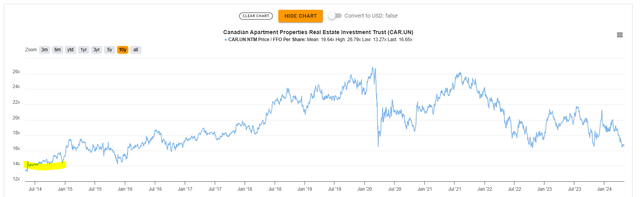

On a price to NAV basis, the REIT has seldom been cheaper. Note that on this metric we only go till 2014 as that as when Canada embraced IFRS. Under IFRS tangible book value per share for REITs is about in line with NAV.

We will add here that CAPREIT is one of the most conservative at estimating NAV and we see NAV as higher than what the company is projecting. Combining the two facts above on valuation, with the embedded rent growth, gives us enough confidence to pull the trigger. Sure, this could be a value trap for the next four years. The distribution yield is fairly measly at 3.4%. Could you get 3.4% a year for four years while the price depreciates by about that much? Certainly possible and may even be a probable outcome if interest rates stay high as they currently are. In fact, we think rates will stay higher than what most expect. What we do know is that we are not buying at the highs, and we think fundamentals are aligned sufficiently to actually make the longer term case for 7% annual returns from here, with relatively lower risk. Of course, when you are expecting 7% annual returns, it makes no sense not to marry each position with a covered call that gets you far more. We are finding very good opportunities on CAPREIT to create 12%-17% annual yields with covered calls, and we have started doing that for our portfolio. We rate the shares a Buy, with the caveat that we would only buy if we can attach a covered call on the purchase.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult a professional who knows their objectives and constraints.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here