BRP or Bombardier Recreational Products (TSX:DOO:CA) (NASDAQ:DOOO) is a consumer stock that sells ATV vehicles, boats and motorcycles for recreational purposes. This category has exploded since the start of 2021 as people have been looking for something fun to do in a distanced environment. While growth remains strong, DOO has remained at a value multiple as the market appears to anticipate a collapse in demand at just a 10 P/E ratio. Over time though, demand has remained resilient and the stock looks cheap if demand can hold up in a soft landing scenario. The company has performed well over time with innovative new products and strong management. This makes it a solid buy for those with a higher risk tolerance assuming a more positive outlook for the economy going forward.

Strong first quarter bodes well for F2024

DOO had a great first quarter of Fiscal 2024 and looks good heading into Q2 period which comprises the heart of summer. The company reaffirmed strong 11.5% revenue growth guidance for the full year, a number that doesn’t seem to jive with such a low valuation. Weather was a headwind in April and May but has since improved with sales trends following. Revenue in Q1 was up 34% to $2.43 Billion in the quarter driven mostly by volume rather than price increases. Margins actually increased y/y in Q1 with them improving from 25.1% to 25.7% – a sign demand is still strong. Often when cyclicals roll over margins will fall as discounting increases and it’s harder to move expensive product. However, a reduction in supply chain issues against 2022 is helping drive margins up as efficiencies are improving again. Inflationary pressures on wages are still there, but less of an issue than a year ago allowing for some modest margin improvements. Materials and parts inflation is moderating and will allow better cash flow generation in F2024. Lending applications continue to show a strong consumer, with credit scores significantly above 2019 levels allowing people to continue to finance vehicles easily.

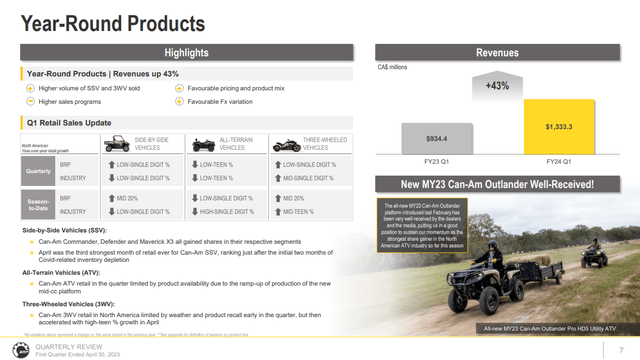

The company is continuing to invest in innovation with $750 million in capital expenditures for the fiscal year, as they try to accelerate new product additions in future years. The company has done well taking market share with 7% growth in share since the start of F2021. Inventory levels are well managed, with inventories now normalized just 4% above those pre-pandemic levels supporting growth and showing supply constraints abating. This means improved availability for customers among hard to find models and no sales pushed out due to lack of inventory. The biggest strength in Q1 was in year-round products like ATV’s and Three wheeled vehicles. Revenues in this segment are up 43% y/y as Can-Am product lines in particular showed strength. The side by side vehicles commander, defender and maverick x3 pushed DOO to its strongest quarter ever for this segment. The Sea-Doo switch, a fun sport oriented pontoon boat has seen strong uptake and growth, with accessories also performing quite well. It has the controls like a normal Sea-Doo personal watercraft making it a unique option and 2nd in share in the pontoon space. Dealers are calling out strength in BRP offerings especially the most premium and innovative options, allowing BRP to gain share against Polaris (PII) in recent months. This trend should be able to continue longer term as DOO continues to invest in new models like the Can-Am Outlander to fill gaps in their lineup and add premium products.

Q1 F2024 Presentation (DOO IR)

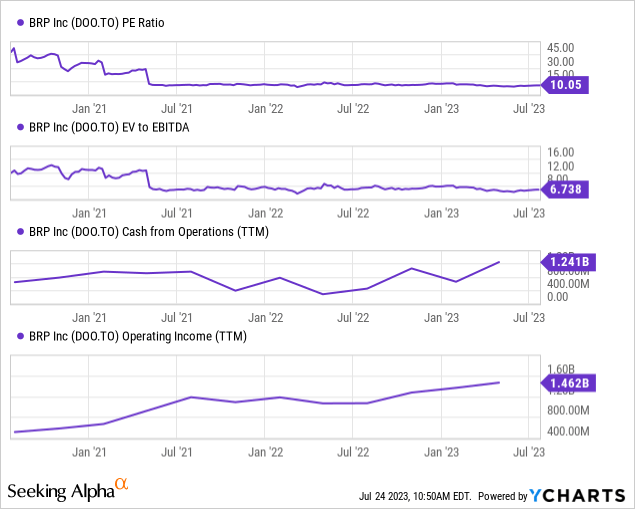

Valuation is very cheap as the company is considered extremely cyclical and trades like these earnings are temporary. Below you can see the company trades at just 10x trailing earnings and 6.7x enterprise value to EBITDA. Both of those levels are just above what it traded at during the worst of the start of Covid-19, when shares were just $20 CAD while today they are trading at $113. The stock has outperformed the wider Toronto Stock index over time with a 86% return over the past 5 years versus just 25% for the wider index. Much of this is because the company continues to support the stock with share repurchases, buying $54.7 million in the quarter and reducing the float over the past year by 2.8%. The company also pays a dividend of 72 cents per year, a small yield but a nice bonus in addition to the much larger share buyback return of capital to longs. This is due to the solid cash flow from operations DOO generates and the solid revenue scale they have achieved. The shares certainly hold some risk, as consumer spending on large purchases is likely to come down when excess savings on goods is drawn down likely by end of 2023. Street estimates for F2025 are for 9% growth in earnings and 6.5% growth of revenues, which doesn’t seem to be the expectation of the share price. The market continues to price this, and other large consumer good companies as if a large drop in revenue is in store for 2024, with multiples near trough levels across the board. Look for the stock to outperform the next 2 years if it can manage to grow earnings to that $13.50+ level which would be near just 8x earnings.

Buy on favorable risk/reward

Looking at the stock and its performance over time it’s hard not to be impressed. The company is well run, with a very manageable debt load with consistent growth through innovation. Canada is a great place to find companies trading at a discount to US peers with strong growth profiles right now. The continuous addition of new products with features customers are looking for is allowing them to outgrow the wider recreational product market. They are generating solid cash flow from operations with over $1.2 Billion in the past 12 months allowing buybacks and dividends. The stock trades at a low valuation due to its cyclical nature but it has proven it can grow in difficult environments. DOO under $120 CAD per share is a buy and will continue to outperform the market over the long term in my view.

Read the full article here