Summary

Readers may find my previous coverage via this link. My previous rating was a buy as I believed Braze (NASDAQ:BRZE) would continue to see >30% growth after reviewing how BRZE 3Q24 performance. I am reiterating my buy rating as I believe the slowdown in growth (in FY25) is because of the change in sales strategy. Once BRZE stabilizes, we should see growth accelerate back to 30%.

Financials / Valuation

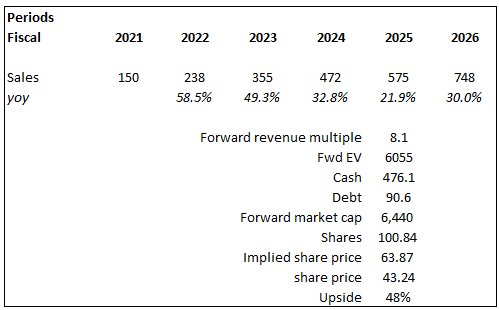

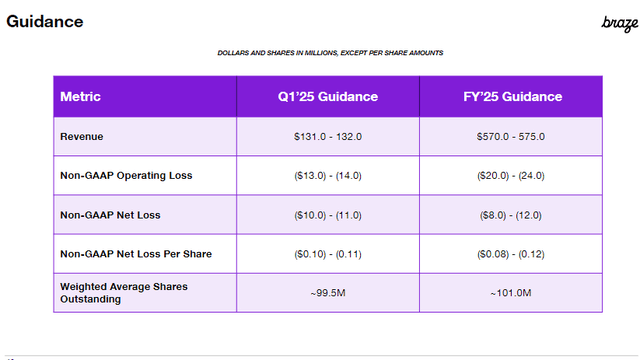

In 4Q24, both revenue and subscription revenue grew 33% y/y, inline with my expectation that BRZE can continue to grow >30%. Even if adjusted for the contribution from NorthStar, BRZE still grew 29.5% organically, which I take as a positive as it was a 50bps acceleration from 3Q24. While BRZE proforma gross margins underperformed consensus by 100bps, coming in at 68%, proforma EBIT margin was in line with consensus and guidance, coming in at -6%. Other leading growth metrics also point to very healthy growth ahead, wherein calculated billings grew 26%, cRPO grew 31%, while RPO grew 40%.

Based on author’s own math

Based on my view on the business, I remain confident that BRZE can see growth recover back to 30% in FY26. I believe the slow growth in FY25 is because of the change in go-to-market strategy that, typically, will impact sales as sales rep change their strategy (in sales pitch, etc) and it also takes time for them to become more productive. Therefore, my assumption is that BRZE will see the midpoint of management’s guided growth in FY25 ($575 million) follow by 30% growth in FY26. However, I did revise downwards my forward revenue multiple assumption, from 8.7x to 8.1x (8.1x is BRZE’s mean) as peers have traded down as well – likely because of the fear that rates are not going to get cut in 2H24. Peers like HubSpot (HUBS), Salesforce (CRM), Freshworks, Sprinklr (CXM), and Amplitude have all seen their multiples trended down since the start of this year, on average from ~7x to 6.4x forward revenue.

BRZE

Comments

While organic revenue growth is below my expectation for >30% growth, I believe it BRZE is able to accelerate its growth past 30% in the coming quarters, and the driver would be BRZE success in capturing Enterprise demand. On this front, management noted ongoing share gain in the enterprise led by customers replatforming legacy solutions. I believe this momentum is being catalyzed by Braze’s previous unbundling of its email solution. This move to unbundle basically allows BRZE to land with specific functionality and then expand with a phased rip and replace. The investment with the global system integrator ecosystem also certainly helped with driving this momentum – which significantly expands BRZE distribution reach, enlarging its pipeline of deals. The logic here is that these large distributors already have relationships with large enterprises, and by leveraging on their expertise, BRZE “instantly” achieve this relationship, albeit indirectly. If BRZE were to do it themselves, it would take a much longer time and a lot more resources. Once BRZE gains sufficient experience, they could eventually ramp up their own sales team to target these enterprise accounts. And I think management has already showed that they are doing this as they have increased sales capacity to target the enterprise accounts based on the momentum saw in CY23.

You know, one of the things we’ve been talking about the last few quarters is just how pleased we are with our success across the global systems integrators and the large major marketing agency holding companies.

I mean I think it’s a lot of the things that we’ve spoken about so far on the call. We’re definitely excited about the agency ecosystem and the global systems integrator ecosystem being able to continue to source and influence new pipeline. Source: 4Q24 earnings

The second driver would be BRZE increase focus in upsell rather than adding new logos. Hence, I was not too worried about the slowdown in net adds (33 in 4Q24 vs. 53 in 3Q24 and 55 in 4Q23), where FY24 adds were down 31%. Also, one thing to mention here is that customers churn that BRZE faced in 4Q24 are in the low end of the customer base, so they are unlikely to fit well into BRZE’s current strategy of upselling anyway (i.e. they are lower quality customers). I am positive about this change in strategy because it fits into the strategy of targeting large enterprises. The difference between large and small accounts is that large account have plenty of room (i.e. many departments, seats, functions) that BRZE can slowly penetrate (up/cross-sell). Whereas for small accounts, there is lesser up/cross-sell opportunity as they are small in nature. Notably, this strategy seems to be working well so far, where new order forms continue to be solid. The issue is this strategy needs more sales reps given the nature of upsells was indexed towards landing new brands or geographies at existing customers which require the same sales intensity of a new logo.

Another problem is that this is likely to impact sales in the near-term, as any change in go-to-market strategy needs time before it delivers results. Looking over the medium term, I expect sales accelerate post FY25 as sales reps become more productive and BRZE gains more traction in penetrating enterprise accounts.

The last area that I expect to support >30% growth is BRZE’s product innovation, specifically in AI. Braze was an early adopter of GenAI and has incorporated various AI and ML driven features in its products. I believe these features in AI help differentiate BRZE against legacy peers that are not built in a way that allows them to support nonlinear customer journeys, limiting the level of personalization that GenAI can ultimately help deliver. Some of the product features rolled out recently that I think worth mentioning are:

- Personalized Recommendations: This helps clients to increase their messages’ relevancy by providing better recommendations for products, services, and catalog items for individual consumers

- Personalized Paths: This is an interesting one because it allows clients to test out multiple iterations of customer journeys, so that they can find the optimal way to target customers,

- Estimated Real Open Rate: This should get incrementally important as it helps address challenges resulting from the changes Apple has made to mail privacy policy.

They interact with brands on their terms, they are on non-linear customer journeys, they have an ever-expanding collection of mediums and channels that they want to be communicated with and that they want to use when they’re accessing your products and services. Source: 4Q24 earnings

Risk

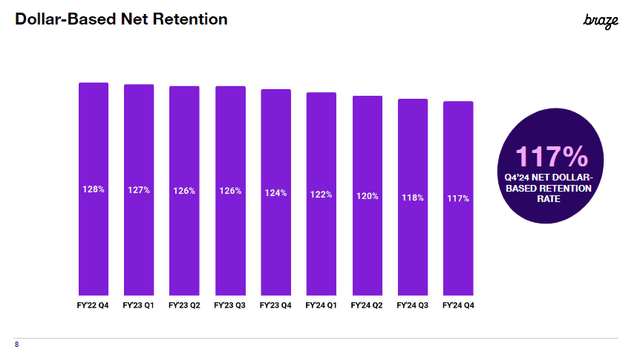

BRZE’s dollar-based net retention has been declining for the past few quarters, and this could be a major issue if it continues to decline, suggesting either BRZE’s efforts in up/cross-sell are not working or that customers keep churning. So far, I believe it is the latter (low end customers churning), and as BRZE executes its new up/cross-sell strategy, we should see an improvement here.

BRZE

Conclusion

I am recommending a buy rating for BRZE despite the expected slowdown in growth in FY24. In my opinion, the slowdown is due to the change in sales strategy – now aimed towards capturing enterprise clients and up-selling – which typically impacts sales in the near term. I am positive that BRZE can continue to see momentum in penetrating the large accounts as its current strategy leverages global system integrators which significantly expands BRZE’s reach.

Read the full article here