Dear readers,

Brandywine Realty Trust (NYSE:BDN) is a traditional office REIT with the majority of its portfolio located in and around Philadelphia. This is a stock that has seemingly reached true bargain territory with a nearly 20% dividend yield at one point. I’ve covered BDN a number of times here on Seeking Alpha and while I was bullish on the REIT at first, I grew more bearish over time. Most recently I wrote an article, where I cited three reasons for not investing in BDN.

These were:

- A largely traditional tenant base at risk of downsizing due to WFH

- A non-negligible number of distressed low quality properties in the portfolio

- And especially a real risk of a dividend cut

While I recognized that the REIT was trading at a very cheap valuation, providing substantial speculative upside, I wasn’t comfortable investing ahead of a potential major bearish catalyst (i.e. a dividend cut).

The dividend cut

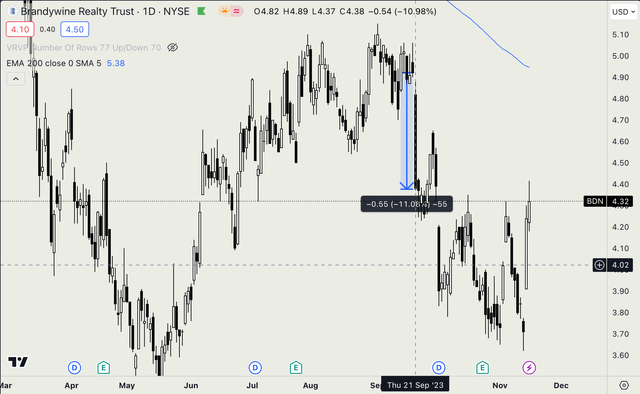

In September, despite reasonable FFO and CAD coverage, the board has decided to cut the dividend by about 20% to $0.15 per share. And as expected, the cut resulted in an immediate sell-off of more than 10%.

Tradingview

I believe the cut was the right move as it will save the REIT $28 Million per year in free cash flow. Following the cut, the CAD and FFO payout ratios for 2023 are expected at 75% and 52%, respectively. Both of these are very much in line with historical averages. While a second cut is always possible, at least part of one of my reasons for not investing has now been alleviated.

Today, following Q3 2023 earnings, I want to take the opportunity to update you on BDN’s recent performance and address its current positioning in the market.

Low quality portfolio

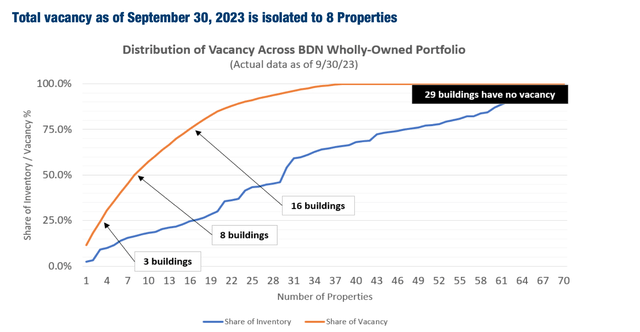

During the earnings call management has, for the first time, openly highlighted that several of their properties are really distressed. In particular, they mentioned that half of all vacancies are isolated to 8 buildings that average occupancy of just 65%.

They try to spin it as a positive, showing that the majority of their portfolio is doing well, but the fact of the matter is that these 8 properties account for a non-negligible 15% of BDN’s portfolio. Moreover, they’re not the only properties that are struggling to retain tenants, as evident from the chart below.

BDN Presentation

For anyone that has looked at BDN’s portfolio in any sort of detail, it’s hardly news that some of their properties are not desirable. This was one of my reasons for not investing. The problem is that tenants will not be attracted to low quality space, unless BDN spends a lot of money on refurbishment or provides rent discounts and other incentives to tenants. And both options will inevitably lead to lower cash flows for BDN in the future.

Sluggish leasing

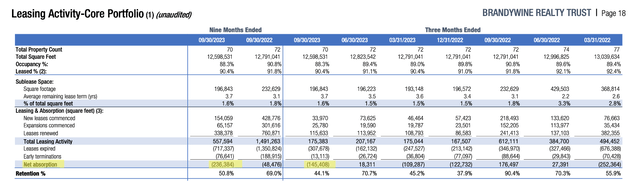

Recent leasing performance somewhat confirms this view. Overall retention has been low around 50% and in Q3 the REIT has posted another quarter of negative net absorption of -145 ths. sft. Consequently, occupancy has declined to 88.3%.

BDN Supplement

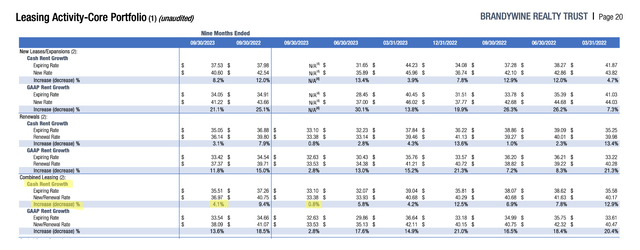

I always like to look at rent spreads on new leases and renegotiations to get an idea of how much tenants value their space. The idea is simple, if a tenant really wants to stay, he should be willing to pay more in rent, especially in an inflationary environment, and agree to a long lease term. In the case of BDN, however, we’re seeing neither.

Cash rent spreads year-to-date have been relatively low at 4.1% YoY and the average term on leases executed in Q3 was only 6 years, compared to around 8 years historically, proving that tenants don’t really value their space.

BDN Supplement

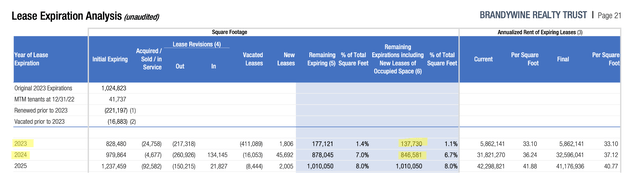

Another 177 ths. sft of space will become available before the end of the year, of which only about 40 ths. sft have been re-leased so far. As a result of relatively low leasing, especially in Austin, management has decreased their full year 2023 occupancy target by one percentage point to 89-90%.

BDN Supplement

High leverage

BDN’s leverage is higher than most. Net debt to EBITDA stands at 7.4x, largely as a result of aggressive development and redevelopment spending in an effort to increase their life science exposure.

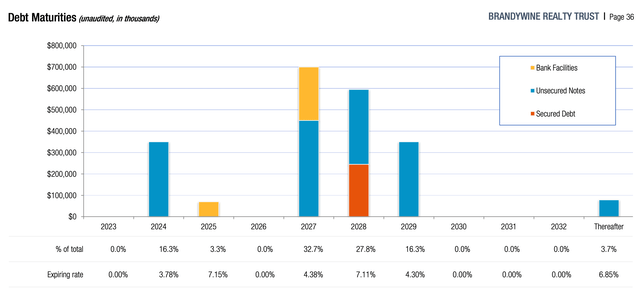

The majority of debt (93%) is fixed rate, but the weighted average interest rate is relatively high at 5.2%. Moreover, there’s a large $350 Million bond maturity coming due next year. The REIT has the entire $600 Million available on its revolving line of credit so it will be able to deal with the debt maturity even in the unlikely event that refinancing efforts fail. But either way, the REIT’s net interest expense will increase by about 10% next year, putting further pressure on cash flows.

BDN Supplement

Valuation

To sum up, following the dividend cut, the main near-term negative catalyst is out of the way. I want to be clear, I’m not a big fan of BDN’s portfolio and don’t own any shares, but it’s hard to be bearish at such low levels.

The portfolio has some problems, but those appear more than priced-in at this point. This opens the door for more speculative investors who don’t mind volatility and believe that traditional office space is here to stay.

Even after the dividend cut, the stock still yields 13%. And while a second cut is always possible, BDN’s yield is very likely to stay high, say 8%+.

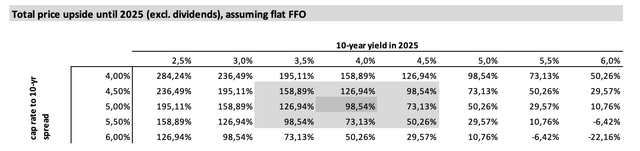

Moreover, the stock trades at an implied cap rate of 11.3%, which implies a 6.6% spread over 10-year treasury yields. This kind of spread provides a large margin of safety and any sort of re-rating in case sentiment changes will provide material upside.

Even if interest rate expectations don’t change and the 10-year yield stays at 4.5%, assuming the spread drops from 6.6% to 5% implies upside of 73% from today’s levels, on top of any dividends received. That’s RoR approaching 100% over two to three years. And a 5% spread is frankly still high by historical standards, given that the company isn’t really fighting for survival here.

Author’s calculations

Investing in BDN is riskier than most stocks I cover on Seeking Alpha and I don’t think it’s suitable for conservative investors. The price won’t move higher until yields drop and there’s a risk that WFH could lead to significant structural vacancy as more leases expire.

That being said, the stock has been beaten down and with a major negative catalyst out of the way, more aggressive investors may find the value proposition interesting. Consequently, I upgrade my rating to a BUY here at $4.30 per share, following the first dividend cut.

Read the full article here