I think growth style investing is done. It’s overcrowded and extended, and we are due for a cycle that favors value and sectors outside of Tech. If you’re of the same mindset, you may want to consider the Avantis US Large Cap Value ETF (NYSEARCA:AVLV). Unlike a lot of value funds out there, this uses active management to potentially generate outperformance over generic market indices. The approach here is designed to invest in undervalued companies based on fundamentals and not momentum alone, using valuation metrics, profitability ratios and other signature financial performance measures.

The premise is that financial markets are not always efficient. Securities can be mispriced in the short term for many reasons: because there is a general sense of euphoria or panic among investors, or because the market has overreacted to certain events, or because not all information has been digested by the market, among other reasons. A disciplined and quantitative methodology can reveal such inefficiencies, and, by taking advantage of them, generate alpha, or returns that exceed the market.

The AVLV investment thesis rests on the premise that the price of a stock, along with its book equity and expected profits over time, dictates its predicted return. Accordingly, the fund aims to overweight those securities with the highest expected return, based on current prices, and to underweight or avoid those with lower expected returns. Actively.

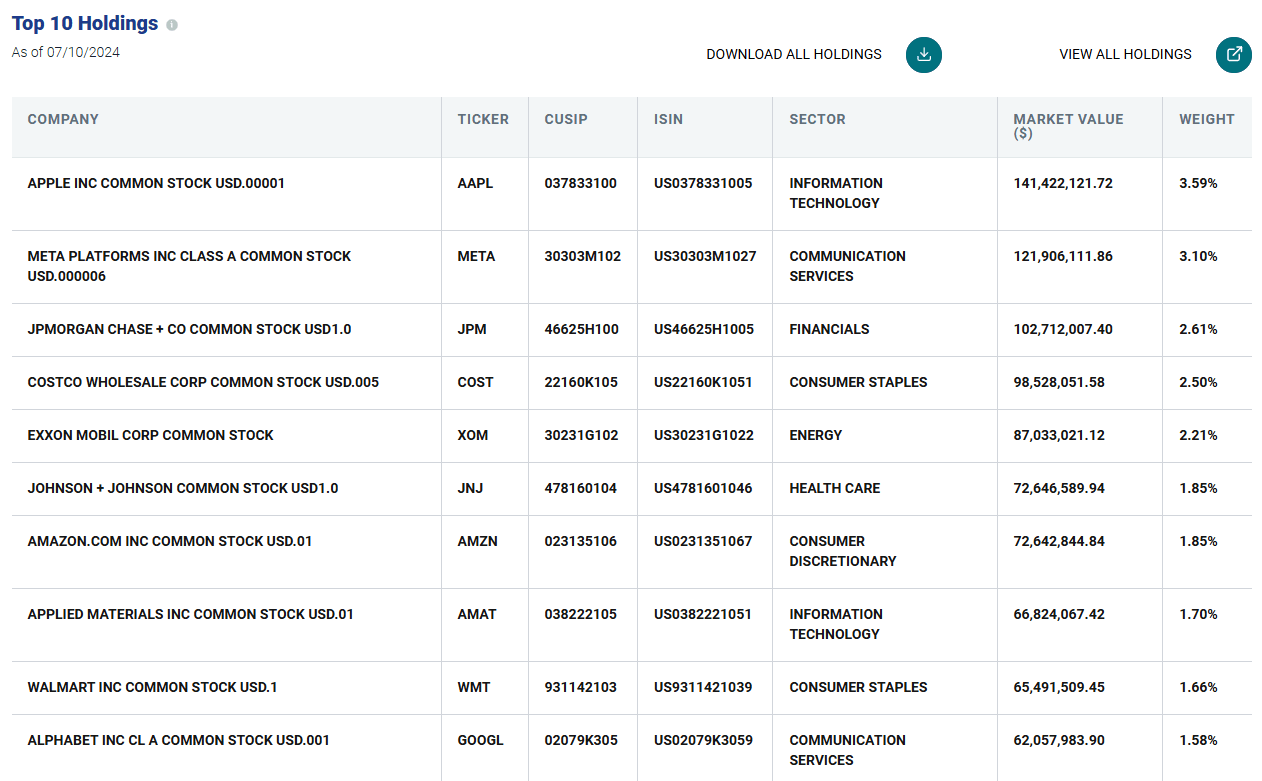

A Look At The Holdings

With 308 positions, this is a fairly well diversified fund. No position makes up more than 3.59% of the fund. While the top 10 names are all large companies you’re familiar with, the weighting mix is appealing relative to growth style averages which have far more concentration in those names, which, of course, means more risk.

avantisinvestors.com

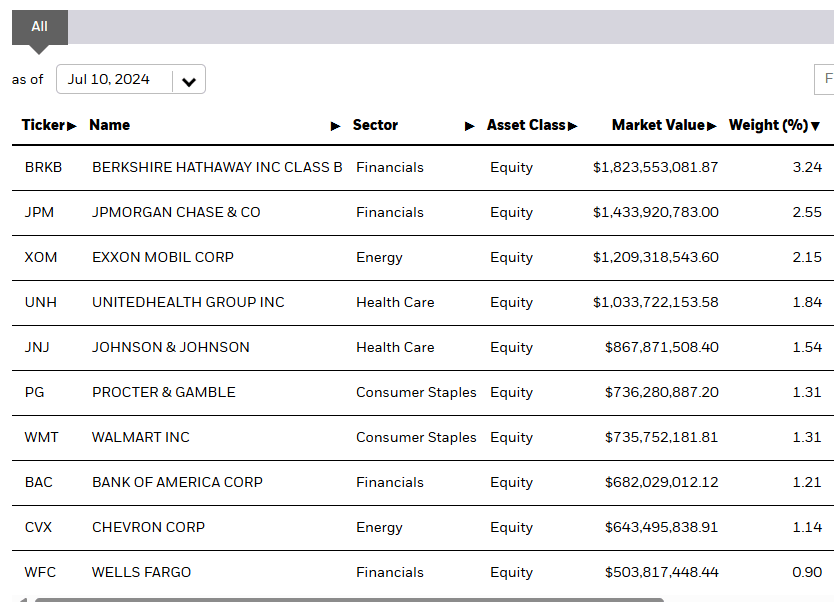

If we contrast these holdings to the iShares Russell 1000 Value ETF (IWD), we find a different mix across the board. The active management is clear when looking at a passive proxy.

ishares.com

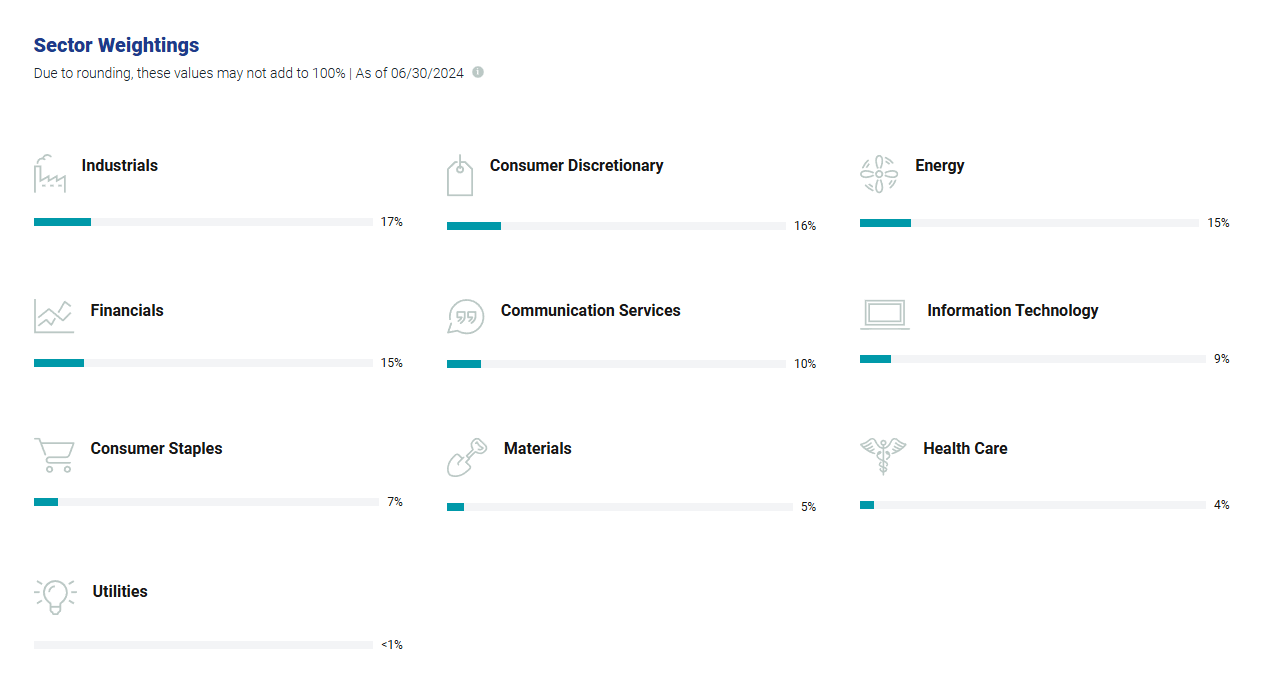

As to sector allocation, no major surprises here. AVLV, like other value averages, has a large exposure to Industrials, but less so to Financials than other funds I’ve seen out there.

avantisinvestors.com

Notice that Tech makes up just 9% of the fund, furthering the point that this will behave quite differently than growth indices and even core market proxies like the S&P 500. Relative to the Russell 1000 Value, the sector weightings are clearly different. AVLV’s top 3 allocations are Industrials, Consumer Discretionary, and Energy, whereas for the Russell 1000 Value it’s Financials, Health Care, and Industrials. I like that — it shows the active management at work in the value space.

Peer Comparison

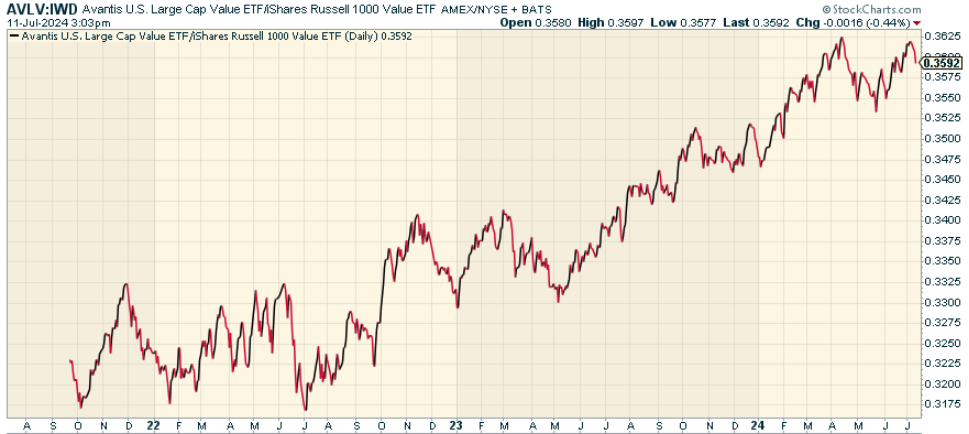

Since I already referenced IWD, it’s worth comparing AVLV to IWD as the Russell 1000 Value Index is AVLV’s benchmark, and IWD tracks it. When we look at the price ratio of IWD to AVLV, we find that AVLV has substantially outperformed its benchmark. The active management approach to value investing clearly has worked.

stockcharts.com

Pros and Cons

The benefit of AVLV’s active management and focus on companies that are profitable and selling discounted to peers is that it has the potential for superior long-term returns versus indexing. The performance is clearly there, and I’m a fan of approaches where there is high conviction among managers (often seen through sector allocations, not just stock weightings).

But it’s also true that active management can backfire. The analysis might be faulty, and in the case of AVLV is not rules-based, meaning there is an element of judgment that goes into the decision-making process. It’s also worth noting that the fund has only been around since September 2021. Sure, the performance has been strong, but it’s not clear given the shorter track record if that can be relied upon over much longer time frames and cycles.

Conclusion

I’m a fan of the Avantis U S Large Cap Value ETF. As an active strategy, it checks the boxes by truly attempting to look different from its passive benchmark. The performance is strong, and I actually personally like the sector mix in the portfolio at this stage in the cycle. I think if you’re looking for an active value strategy and believe value style investing is going to make a big comeback, this is one worth considering.

Read the full article here