Introduction

The priority of shareholders is held high within Artisan Partners Asset Management (NYSE:APAM). The company distributes a majority of all the cash flows generated to its shareholders. They can do this as they are efficiently increasing the AUM they have, which in Q1 FY2023 grew by $10 billion. The yield for APAM currently sits at 5.07% which doesn’t seem unreasonably high, and with the payout ratio at just under 80%, I think there is room for a continued increase in the dividend.

APAM does distribute a special dividend now and again when some years generate substantial returns. 2022 was such a year for example, with an additional $0.72 dividend distributed during the year. On top of an already near $3 per share dividend. APAM does boast a strong balance sheet and a TTM Return on Common Equity of 71.92%, far above the sector’s average of 11.1%. The premium which investors have to pay for APAM right now seems justified given these statistics and I will be rating APAM a buy.

Company Structure

Artisan Partners Asset Management operates as an investment manager but also provides services to pension and profit-sharing plans as well as aiding with foundations and mutual funds and collective trusts. The broad set of offerings the company has is helping them grow quickly and now has an AUM of over $138 billion.

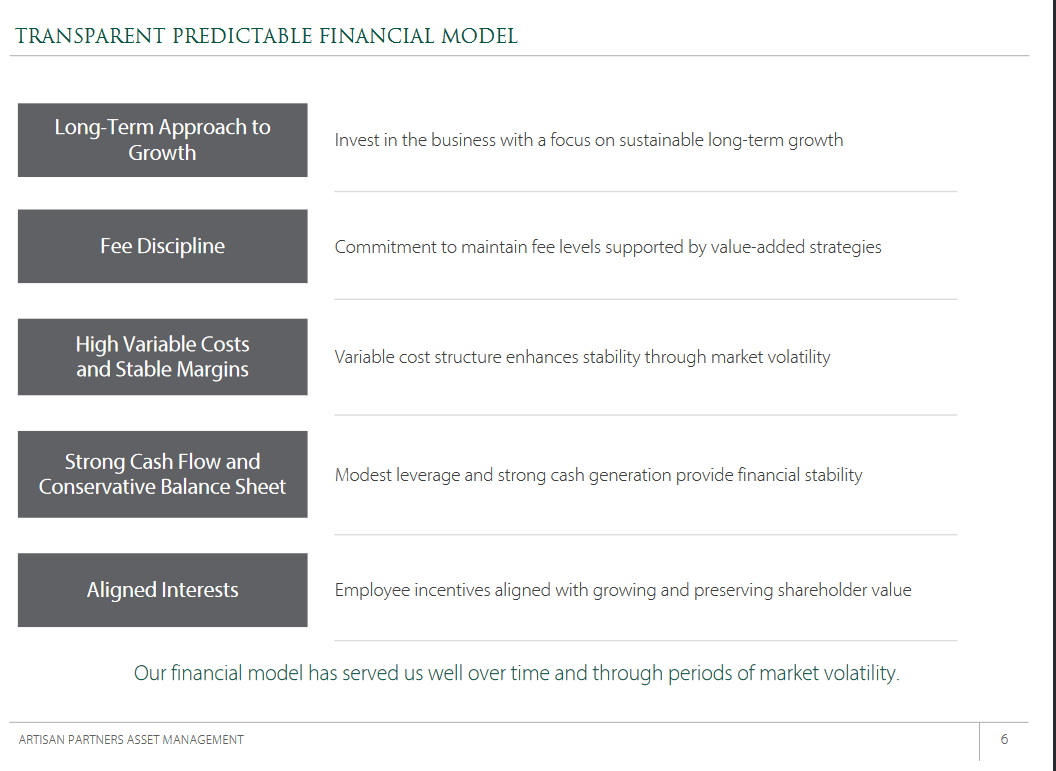

The philosophy of the business as per their own accord is to act as a “High-Value Added Investment Firm”. Something I think they have been very successful with so far as the ROE sits at near 72%.

Company Overview (Investor Presentation May 2023)

The company prides itself on maintaining strong FCF margins and a robust balance sheet that can weather through times of lower growth and activity in the border economy. With a payout ratio of nearly 80% the priority for APAM lies with its shareholders and ensuring ample returns for them over the long term. For the fixed income portfolio of the company they primarily invest the funds in non-investment grade corporate bonds but also secured and unsecured loans.

Valuation Profile

As for the valuation of APAM, I am primarily looking at how they might be able to grow their AUM and how that could reflect on growing Net Income.

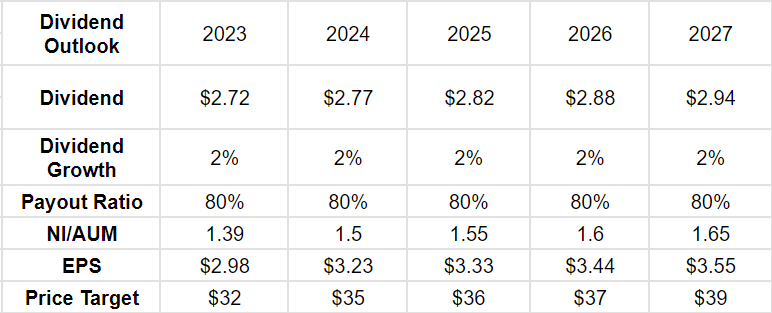

Dividend Outlook (My Own Estimates)

Looking at the chart above one might wonder why ever to buy APAM right now when the price target for 2023 is below what it’s currently trading a. This number does take into account the dividend for the company. Besides that, the growth rate of the dividend is quite low and for the model, I haven’t based any significant growth on the average AUM. I still have around $140 billion. The EPS growth will come from increasing margins as the company is rebounding from the slump the margins have had in the last few quarters.

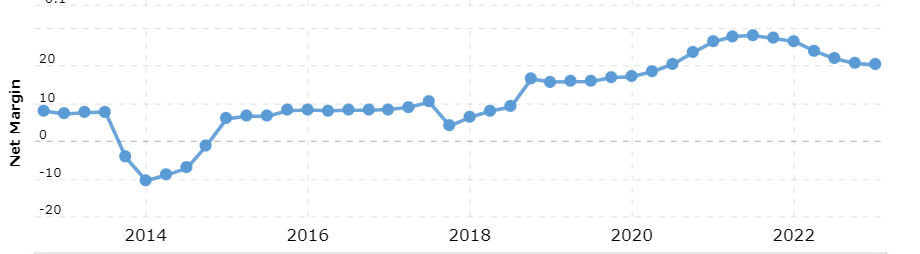

Net Margin History (Macrotrends)

I don’t find it unlikely that we won’t return to similar margins as in 2022 where net margins were above 28%. That would yield an EPS of $4.23 as the revenues estimates for 2023 are $982 million and I am basing the EPS on that APAM will have 65 million shares outstanding. With an 11x multiple which is the 5-year average for APAM, we land at a price target of $46 per share, above the current levels. I think this highlights the opportunity you have with APAM looking beyond just that of current quarterly results. As the company themselves mentions often, the priority lies in the long-term and achieving strong average yields and margins rather than the fluctuating short-term results.

Earnings Call Transcript

In the last earnings call the management had some good reflections on the operating expenses, CFO C.J. Daley had the following to say, “Just operating expenses for the quarter increased 6% sequentially due to an increase in certain compensation-related costs, including those that are impacted by seasonality. Though, seasonal expenses are always highest in the first quarter of each year. In the March 2023 quarter, expenses impacted by seasonality were $6.7 million higher than last quarter. Adjusted compensation expense also increased in line with higher revenues”.

I think the fact that seasonality is a thing with a firm like APAM shows why the quarterly results don’t play such a huge part in evaluating the business and investment prospects. As stated, the first quarter of the year is the highest in terms of operating expenses often due to compensation costs. For Q2 I will be watching out for just this, a lower efficiency ratio indicating strong margin fundamental. Currently, the TTM efficiency ratio for APAM is 14.4%, a very low amount that highlights the strong margins that it has acquired over its many years of operations.

Risk Associated

In terms of risks associated with an investment in APAM, I think the most prominent one is the fear of a recession. It is something that has come and gone in terms of coverage in the media. Right now it doesn’t seem to indicate we are heading towards a recession. Some indications of that could be that air travel is at its busiest ever, that sort of spending by people doesn’t seem to indicate we are heading towards an economic slowdown. Further rate hikes would prove a risk to the investment portfolio of APAM seeing as they are investing into corporate bonds. But some might say that further rate hikes right now aren’t necessary or at least we will see the speed at which the increases have happened slow down. I think we will see a few more hikes this year of 0.25 bps each, but it’s a guessing game of course. If we do see a decrease in the interest I do expect to see stronger returns from the fixed-income portfolio of APAM, which would be a very bullish signal.

Investor Takeaway

If you are an investor seeking a company with above-average margins and trading at what I would consider a good price then Artisan Partners might be what you want to look deeper into. The team of APAM has reached an ROE of 72%, which is far above peers and the sector’s average. This sort of stability to stand has netted them an average AUM of $140 billion in Q1 FY2023. I think that APAM will eventually return to the net margins it had in 2022. If it comes true then the full-year EPS for 2023 could reach $4.23 and with an earnings multiple of 11 investors are presented with a 17% upside potential. Now, I find it unlikely we will hit that in 2023, but in the medium term, I see it as a real possibility if it can begin generating strong earnings from its corporate bonds portfolio. In the meantime though I am comfortable rating APAM a buy here.

Read the full article here