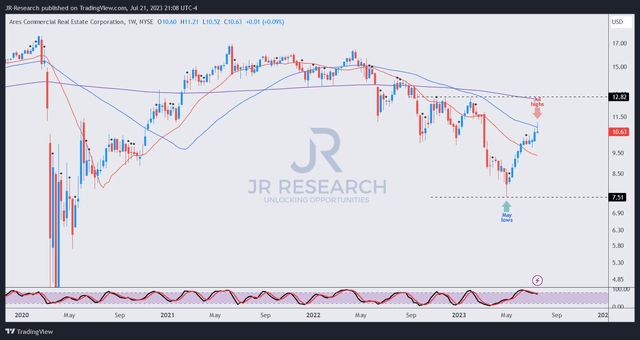

Ares Commercial Real Estate Corporation (NYSE:ACRE) dip buyers have enjoyed a remarkable recovery after its post-FQ1 earnings low in early May. Accordingly, ACRE formed its lows at the $7.50 level and recently surged through the $11.20 level, delivering a price-performance return of nearly 50% between those levels (not including its attractive dividends). In other words, dip buyers who braved pessimism have significantly outperformed the S&P 500 (SPX) (SPY) since then.

As such, it does call into question whether ACRE has bottomed out decisively for holders to consider adding more positions at the next pullback. Sellers who let go of their shares at ACRE’s May lows were justified in feeling aggrieved. After all, ACRE held a relatively significant percentage of its portfolio in the most embattled segment of the commercial property market: office (31%).

Therefore, why did ACRE still manage to bottom out, with buyers returning to support the malaise, despite its ongoing challenges with its four- and five-rated loans? The company indicated it actively manages these issues, “including loan modifications, sales, foreclosures, and other strategies to maximize outcomes and redeploy capital.”

Analysts on ACRE’s May earnings calls were concerned with its office exposure. However, management also attempted to assure and remind holders that “the degradation of office fundamentals has been well-publicized.” In other words, I assessed that the company wants investors to know that the challenges facing Ares Commercial Real Estate Corporation aren’t a new development. It has been ongoing, and the media’s negative portrayal has likely caught the attention of many investors across the sector.

Therefore, I’m pretty sure price action investors observed the significant pessimism forming a bear trap (false downside breakdown) before returning. The market is forward-looking, and price action investors leverage clues highlighting the market’s psychology at potential key turning points to make their move.

Notwithstanding, the concerns over the company’s high dividend yield are justified. At the lows in May, ACRE traded at a forward yield of more than 18%, well over its 10Y average of 9.5%. Therefore, I believe it’s pretty clear that the market has not ignored the challenges facing Ares Commercial Real Estate’s office exposure and priced in a very high possibility of it cutting dividends.

The company maintained sufficient liquidity ($225M of available capital) at the end of Q1 to make accretive investments. In addition, it also stressed that it “expects to maintain its current level of regular and supplemental quarterly cash dividends for the remainder of the year.”

As such, it indicates that the company has confidence in holding on to its income investors who invest for its relatively high yields, despite its weakened earnings capability. Accordingly, Wall Street estimates suggest that the company’s distributable EPS could fall to $1.20 in FY23, compared to its expected annualized dividend per share of $1.40 (17% above EPS).

However, analysts’ estimates also suggest that FY23 is expected to be the bottom, with its distributable EPS expected to recover to $1.34 by FY24. With ACRE still priced at a forward dividend yield of almost 13% despite its remarkable recovery since its May lows, ACRE’s valuation remains relatively appealing.

With macroeconomic conditions expected to remain favorable, suggesting a soft landing is increasingly likely, I don’t expect the challenges in the office segment to deteriorate further. However, structural headwinds remain and aren’t likely to go away in the near term. Therefore ACRE is expected to trade well above its 10Y dividend yield average, suggesting investors should reflect a significant discount to account for these headwinds.

ACRE price chart (weekly) (TradingView)

ACRE recently re-tested its 50-week moving average or MA (blue line), as selling pressure intensified after forming its July highs. Therefore, I believe dip buyers likely leveraged the resistance zone to cut exposure after its remarkable surge.

I assessed that ACRES is unlikely to fall back toward its May lows, indicating that investors who missed the opportunities back then can consider capitalizing on its next significant pullback.

For now, I’ll closely watch ACRE to assess where the selloff could take us before I turn more constructive.

Rating: Hold (On the watch for a rating change).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here