Arbor Realty Trust (NYSE:ABR) is a unique mortgage real estate investment trust (mREIT) that has managed to continue expanding its book value while much of the broader mREIT sector has faced continued declines in net asset value per share. The mREIT also offers a highly attractive dividend yield of just under 13%. However, at the time of my previous article on ABR, I observed that the mREIT was likely to continue witnessing an uptick in non-performing loans although management seems to have adequately planned for this eventuality and indeed expected it at the current stage of the credit cycle.

Since then, the stock has performed relatively well, with an 8.75% increase in the stock price and a total return nearing 16%. Nevertheless, much of the earlier concerns around an uptick in NPLs also occurred, and an ongoing monitoring of NPLs remain important for investors in ABR going forward. However, the extent of the uptick has been much lower than the doomsayers have predicted and there are some positive signs in respect of credit quality that emerged from the most recent earnings update.

Asset quality and NPLs

At the time of my previous article on ABR, NPLs had reached $157 million from a mere $3 million some three quarters before. Since then NPLs have continued to increase with ABR reporting that NPLs had increased to $275 million in the fourth quarter of 2023 and have since risen to $465 million in the first quarter of 2024. The effect thereof is that NPLs have effectively increased from just over 1% of the overall portfolio at the time of my previous article to around 4.38% of the overall portfolio in the first quarter of 2024.

The mREIT also saw a notable increase in delinquency rates, i.e. loans where payments are past due but less than 60-days past due (at which point ABR classifies them as non-performing). In its most recent earnings call management observed that:

The less than 60 days past due loans or our non-accrual loans came down to $489 million this quarter mostly due to $713 million of loans being successfully modified as I mentioned earlier inline with $175 million of loans moving to 60 plus days delinquent, which was partially offset by approximately $420 million of new loans this quarter that we did not accrue interest on.

So in summary, our total delinquencies are down 23% from $1.23 billion last quarter to $954 million this quarter, which is significant progress again deliver tremendous success we had in modifying resolving loans and continued strong collection efforts. And while we expect to continue to make considerable progress in resolving these delinquencies at the same time, we do anticipate that there will be new delinquencies in this challenging environment.”

The decline in total delinquencies might be an early indication of a turnaround in the portfolio. However, management makes it clear that the operating environment remains challenging and that delinquencies are still likely to continue increasing in the near term. Importantly, a substantial portion of the loans previously classified as delinquent were renegotiated, and will likely see some relief offered to borrowers, albeit the renegotiation contributed to a temporary uptick in interest income as borrowers were expected to pay up past due interest as part of the renegotiation.

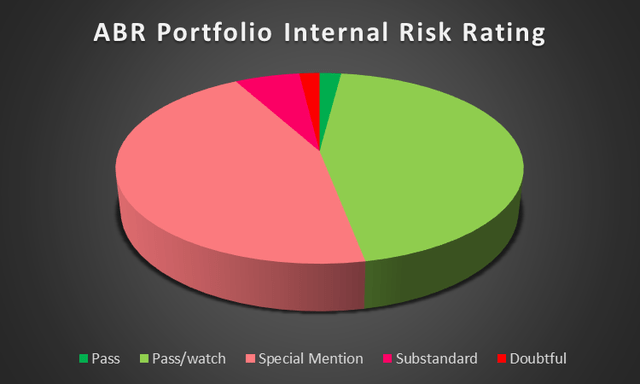

The internal risk rating of the portfolio could also offer investors some early insight into potential problems ahead in the portfolio. Arbor Realty Trust categorizes each loan with a credit risk rating ranging from pass, pass/watch, special mention, substandard, to doubtful. A pass rating indicates the lowest risk, while a doubtful rating suggests the highest risk. These ratings are guided by criteria including debt-service coverage ratios, loan-to-value ratios, borrower strength, asset quality, and cash reserves that are funded. Additional considerations like guarantees, market conditions, and the loan’s term and borrower equity also play a role in determining the assigned credit risk rating. ABR indicates that typically, loans with ratings of pass, pass/watch, and special mention are expected to meet their principal and interest obligations as per their agreements. Loans rated as substandard might need modifications, while those rated as doubtful are expected to underperform, potentially resulting in losses of interest and/or principal.

Author created based on company flings

From the chart above, it is clear that the majority of ABR’s portfolio is rated as either Pass/Watch or Special Mention. However, from the sheer volume of loans renegotiated in the first quarter of 2024, it appears that loans with an internal risk rating outside of substandard or doubtful may also occasionally be subject to modification. This is evident from the fact that some $1.9 billion worth of loans were modified, while the overall value of the portfolio rated as substandard or doubtful at the end of the fourth quarter amounted to around $805 million. The latter amount more closely reflects the portion of modified loans that were previously delinquent, albeit less than 60-days overdue.

Therefore, the internal risk rating may not always be a perfect barometer of the percentage of loans that are likely to be modified. Nevertheless, when tracking the internal risk rating component of the results it remains clear that these risk ratings were early indicators of potential increases in NPLs with the percentage of the portfolio in the lower two categories having increased well in advance of the seemingly sudden increase in NPLs towards the beginning of last year. In my view, the risk of asset quality degradation will persist as long as interest rates remain elevated. Investors should therefore continue to monitor increases in delinquency rates and NPLs closely.

The dividend and its safety

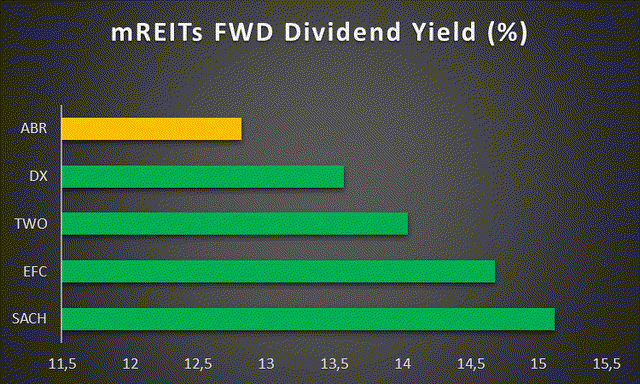

ABR currently offers an attractive forward dividend yield of nearly 13%. While higher dividend yields can be obtained from other mREITs as depicted in the peer comp chart below, ABR has been unique among mREITs in its ability to continue growing book value amidst the current high interest rate environment. Even with the NPL related challenges, ABR still saw its book value per share increase by around 1% in the first quarter of 2024.

Author created based on data from SA

Arbor Realty Trust’s dividend also continues to be fully covered by distributable earnings, with a payout ratio of around 90%. It has managed to retain this reasonable level of dividend coverage even as NPLs and loan loss provisioning has increased substantially in recent quarters. In my view, further defaults will likely be a drag on earnings in the near term but seem unlikely to threaten the dividend in the near term. This view might change if NPLs or delinquencies reach the levels suggested by certain analysts, such as Viceroy Research. Something which I view as unlikely.

Valuation

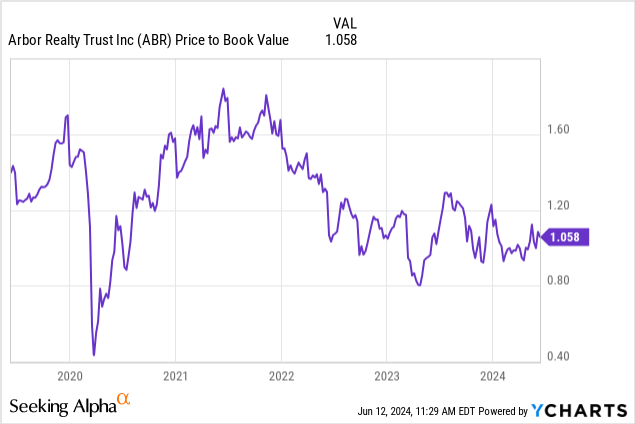

ABR has recovered somewhat since my last article and now trades at a slight premium to book value of around 5%. This premium remains relatively low for ABR on a historical basis, which has reached premiums of more than 60% in the past as depicted in the chart below.

Nevertheless, a discount to historic levels may be justified given the increased concern over NPLs and delinquencies at ABR. Given these factors, I am of the view that ABR is trading around fair value. However, a further rerating of the stock at levels closer to its historical premium could be possible if the current challenges around asset quality are resolved sooner than expected. At present, management expects these challenges to persist into the second quarter and potentially into the second half of the year, should interest rates remain elevated.

Conclusion

Arbor Realty Trust’s ability to expand its book value in a challenging economic environment, coupled with a robust dividend yield nearing 13%, underscores the investment case for this mREIT. However, the ongoing concerns regarding NPLs and asset quality, while not as dire as some predicted, continue to warrant a degree of caution. ABR’s proactive management of these risks, as evidenced by successful loan modifications and the management of delinquencies, suggests a structured approach to navigating credit cycle fluctuations. Yet, the persistent high interest rate environment and its impact on asset quality pose continued risks that could influence the mREIT’s financial stability and growth trajectory. Therefore, I maintain a hold rating on ABR for the time being.

Read the full article here