The Allianz stock (OTCPK:ALIZF; OTCPK:ALIZY) is one of my anchor investments in my highly diversified retirement portfolio. In my last Allianz analysis in February, however, I was skeptical and put further share purchases on hold. In particular, I was not convinced by the risk/reward ratio. On the one hand, the stock was valued quite expensively, and on the other hand, I was put off by the compliance problems and possible liability issues surrounding the Alpha Funds. Now, however, almost half a year has passed, and I have taken another look at the shares. I am still a bit resentful about Alpha Funds, but from my point of view, the picture has improved somewhat, and I am changing my rating from Neutral to Buy.

Is the Alpha (Funds) Problem still a problem?

In my article from February, I detailed the compliance problems at Allianz. In particular, the focus was on the subsidiary Allianz Global Investors (‘AGI’). AGI employees allegedly misled investors and held investments of up to $11 billion from pension funds and other institutional investors. During the Corona crisis, AGI had to liquidate some funds at heavy losses. Against this background, Allianz has already been fined billions and is not allowed to offer investment funds in the US for ten years through its subsidiary Allianz Global Investors.

The status so far is as follows:

In May 2022, AGI conducted several settlements with the DOJ and the Sec. AGI pleaded guilty to the DOJ to one count of securities fraud. To the SEC, AGI stated that AGI violated relevant US securities laws. Interestingly, in the settlement with the DOJ, it is said that the criminal misconduct was allegedly limited to a few individuals in AGI US. It is also stated that the DOJ investigation did not reveal any evidence of knowledge of or involvement in the misconduct at Allianz SE or any other Allianz Group company. This isolates the problems at AGI and, in my view, greatly reduces the risk of spill-over effects and the possibility of allegations of fraud spreading to other Allianz companies.

Also, the financial liability issues seemed to have been resolved, at least with regard to public enforcement. AGI paid $174.3 million to the DOJ as a windfall and $675 million to the SEC as a penalty. At least part of the $675 million can be used to compensate investors. Similarly, the settlements stated that other financial obligations imposed on AIG by the DOJ and SEC are offset by the $5 billion already paid to harmed investors.

Against this background, I have criticized the fact that the internal compliance irregularities at Allianz were not uncovered for years. In particular, it was not foreseeable to what extent a wave of lawsuits from investors or other authorities would threaten.

However, a week ago, a US judge approved the settlements. Considering the new judgment, it appears that these settlements really ended the investigation by the US authorities into the Alpha Funds. This removes a lot of uncertainty from the table. Likewise, there is no news about further lawsuits by harmed investors. I think it is unlikely that other steps in public enforcement will be taken. The $5 billion already paid to injured investors and the additional $675 million, which can be used in part as compensation, should have massively reduced the risk of follow-on lawsuits in the context of private enforcement.

Overall, I am cautiously optimistic that the related matter has ended for Allianz investors.

Otherwise, business as usual

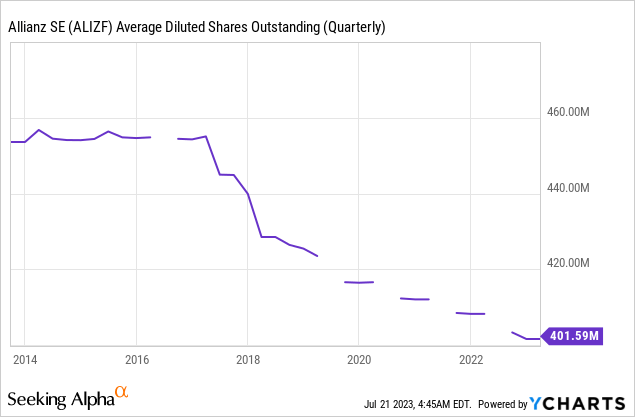

Otherwise, business at Allianz is as exemplary as ever. In the last quarter, operating income rose 24 percent to €3.7 billion thanks to a strong US business, offsetting the somewhat weaker development in the Asset Management division. In Asset Management, operating income declined 8.1 percent to €1.9 billion. However, AUM increased by €33 million compared to the end of 2022. Overall, Allianz saw positive net inflows of €14.9 billion. The new business margin climbed by 600 bps to 5.5 percent. In addition, Allianz announced a renewed share buyback program of €1.5 billion.

I am also optimistic for the future with regard to the current inflation and yield curve situation.

We see only moderate inflation and a stable yield curve in many areas. Such an environment is relatively positive for the business prospects of an insurer. This is especially true for life insurance and other long-term insurance products. Thanks to the stable yield curve, interest rates for different maturities remain relatively unchanged, allowing insurers to invest capital at attractive rates. Similarly, a stable yield curve and moderate inflation protect against sudden significant interest rate changes. Overall, premiums rise faster than costs in such an environment, which is suitable for Allianz and investors. For example, Allianz increased prices by 6.7 percent in Q3 2022, 7.5 percent in Q4 and 5.6 percent in Q1 2023. In my view, the fact that the momentum has weakened somewhat is justifiable, as inflation and the yield curve have also lost momentum.

In addition, Allianz expects an operating profit of around €14.2 billion for the full year. This represents a growth of 3 percent compared to FY 2022. Analysts expect adjusted earnings per share to rise from €16.35 in FY 2022 to €23.16 (Q1: €5.43), an increase of roughly 40 percent.

Valuation is high, but Allianz is not overpriced

In terms of valuation, the Allianz stock, with an adjusted P/E ratio of 13, is above the historical average multiple of 10.9 measured over the last ten financial years. However, EPS is expected to rise further in the coming years, so I think the shares are undervalued based on the 2024 multiples. Analysts expect EPS of €23.16 for 2023, EPS of €25 for 2024 and EPS above €27.23 for 2025. Based on this valuation scenario, the potential return for the end of the 2023 financial year is 23 percent.

In addition, I expect Allianz to increase next year’s dividend again. In the last five years, the average increase was 8.7 percent. In the previous ten years, it was even above 10 percent. Given the forecast EPS growth, I consider an increase of between 8 and 12 percent realistic. This puts the dividend yield measured against the current share price at 5.8 percent.

This results in a pretty good risk/reward ratio, even from a fundamental point of view.

Conclusion

The picture has improved noticeably for Allianz. In particular, the risks surrounding AIG’s Alpha Funds are no longer so massive, and I believe investors can be cautiously optimistic that no further financial burdens are imminent. This substantially improves the risk/reward ratio.

In addition, business continues to be very solid. With inflation stabilizing and the yield curve normalizing, I expect the business to remain solid in the coming quarters and the dividend to rise between 8 and 12 percent. With a potential 2024 dividend yield of about 5.8 percent and the still existing share price potential, Allianz stock is a buy for me.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here