In March, 2024, I wrote my first article Alliance Resource Partners, L.P.(NASDAQ:ARLP) in which I outlined a rather bullish thesis on this coal stock. The thesis itself was rather simple and based on the factors that are similar to those of ARLP’s peer case – CONSOL Energy Inc. (NYSE:CEIX) for which I recently also provided an updated view on my initial (bullish) thesis.

The key buildings blocks for ARLP’s investment case were the following:

- Depressed multiples enabling an abnormal dividend yield and introducing an embedded margin of safety in case the actual earnings come up short of what is baked into the cake by the analysts.

- Strong cash generation showing no signs of weakening.

- Increased focus on oil and gas royalty segments, which contribute meaningful flows of adjusted EBITDA and are inherently more defensive (and higher multiple) businesses than ARLP’s core coal activities.

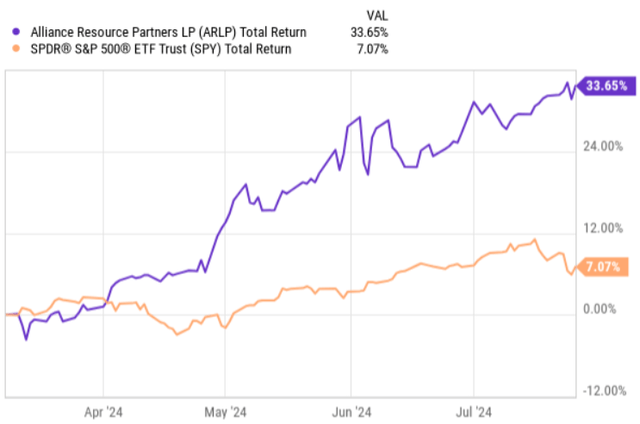

In the chart below, we can see how ARLP has delivered really strong returns outperforming the broader equity market by a huge margin.

YCharts

This dynamic could, at least optically, raise the question on whether ARLP’s return potential is already exhausted. However, let me now elaborate on the data points from the recent quarterly earnings and some other items that are worth considering in the context of the bull thesis here, which, in my opinion, still remains intact.

Thesis review

Since the publication of my article ARLP has issued two quarterly earnings reports – for Q1 and Q2, 2024. Both of these could be deemed strong and indicative of durability in the underlying business.

For example, in Q1, 2024 ARLP registered higher coal sales volumes and record oil and gas royalty volumes, which were sufficient to more than offset a lower average coal sales price per ton compared to the 2023 period. The higher sales volumes were achieved primarily due to the presence of long-term fixed price coal sales contracts that were stipulated during 2023 and early 2024 (thus driving the overall volumes up irrespective of the market dynamics such as mild winter weather and low natural gas price).

Speaking of Q1, 2024 it is definitely worth mentioning the fact that ARLP continued to register growing royalty volumes for oil and gas minerals that increased to a record 898,000 barrel of oil equivalent (i.e., an 18.3% increase on a year-over-year). The adjusted EBITDA for this “high multiple” segment landed at $123 million for LTM, Q1, 2024 period.

Yet, the Q2, 2024 earnings dynamics were a bit more unfavorable, since ARLP was forced to record a volume decline, where a marginal coal price increase was not sufficient to offset the downward pressure on the realized (shipped) coal front. Namely, the total revenues in Q2, 2024 decreased by 7.6% to ~ $593 million compared to ~$642 million in Q2, 2023, where the coal sale volume experienced a drop by 11.8%. The positive thing in this context was that the volume reduction was primarily caused by the transportation delays, which is really a short-term issue that will eventually be solved. According to management, the volumes were impacted by flooding on the Ohio River and disrupted rail and port logistics by the Baltimore bridge collapse.

Another aspect that we have to factor in is the growth on the oil and gas royalty segment end, which marked an uptick of 7.6% to $31.3 million in Q2’24 compared to $29.1 million in Q2’23.

As a result of slightly declining sales and pressured margins due to the lower volumes, the net income for Q2’24 landed at $100 million, or $0.77 per unit compared to $170 million or $1.30 per unit for Q2’23. Similarly, the EBITDA dropped from around $250 million to $177.7 million over the comparable period.

That being said, in my opinion, the aforementioned dynamics do not really change the investment case here. First, the P/CF multiple on a TTM basis still remains at a depressed level of ~4x. Second, as outlined above, a major reason behind the deteriorated performance was the struggles with the logistics and flooding that are per definition short-term issues. Third, the coal sector in general has become a more enticing place in which to deploy capital as the long-term demand prospects have clearly strengthened.

The commentary on the Q1’24 earnings call by Joe Craft – Chairman, President, and Chief Executive Officer – captured the essence very nicely:

While I could talk for hours about those examples, let me highlight three in particular. First, according to the Grid — the Clean Grid Initiative’s grid strategies report, the era of black power demand is over. According to 2023 FERC filings $630 billion of near-term investment in large load has driven the five-year outlook for nationwide peak demand to 852 gigawatts from just 835 gigawatts in the year ago report. That’s a doubling of the five year growth projection from 2.6% to 4.7% in just a 12 month window. This is attributable to investments in new manufacturing, industrial loads, and data center facilities, all the types of customers that not just expect, but rather require highly reliable, affordable electricity supply 24/7. This unexpected new demand is set to ramp up even as the nation’s power portfolio continues to be hamstrung by politically motivated regulatory-driven forced premature closures of coal fired and other fossil fuel generating sources.

On top of these secular forces, a recent explosion in one of the largest coal mines in Australia will introduce short-term tailwinds for ARLP to deliver stronger returns over H2 period as the prices have clearly gone up now.

Finally, in terms of the balance sheet, ARLP has managed to maintain a solid financial position despite keeping the dividend distribution levels high at $0.70 per unit and CapEx spend at circa $124 million (during Q2, 2024) period. This is because on an FCF basis, there has been positive cash surplus retention after covering the dividend distributions, which automatically allows it to reduce the financial risk in the system.

Nevertheless, if we look at the net leverage ratios, we will notice a slight and sequential uptick from 0.30x to 0.36x as measured by the TTM adjusted EBITDA. This increase is mostly driven by the decreased adjusted EBITDA generation and not the assumption of notable amounts of additional debt. Instead, management expects to retire ~$285 million of outstanding senior notes throughout the balance of 2024 mostly through its free cash flow generation.

The bottom line

All in all, Alliance Resource Partners remains a solid deep value play, which is priced as if the business is set to go belly up a couple of years from now. The FWD dividend yield of ~10.8% and P/CF multiple below 5x warrant a great entry point to enjoy decent total returns on a go forward basis.

In my opinion, if one enters any stock at such valuations and so attractive yield, the only thing that matters is the company’s ability to generate stable cash flows over the long-run. Yet, given the secular dynamics supporting the coal production in combination with a fortress balance sheet and stable cash flows from ARLP’s side, the stock is a clear buy.

Read the full article here