Fiscal Q1 2024 has been an eventful couple of months for Alibaba Group Holding Limited (NYSE:BABA). In addition to the new organizational structure announced earlier this year, which management had provided confirmation on during the F4Q23 earnings call alongside a roadmap for prospective IPOs and spinoffs for some of Alibaba’s fastest-growing units, the company also announced an overhaul of its senior leadership team at the group level shortly after. And more recently, the regulatory probe on Ant Group that marked the beginning of a yearslong regulatory crackdown on big tech has come to a close, with Beijing’s financial regulators levying a RMB7.12 billion ($984 million) fine on the company.

From a non-company-specific standpoint, Alibaba has also faced a whirlwind of macroeconomic impacts on its performance. They range from management’s optimism on user and order growth exiting April and potentially better-than-expected sales during the “6.18 shopping festival” period that leads up to mid-June, to a rapidly deteriorating consumer backdrop exiting the calendar second quarter based on the latest economic data. The mixed observations continue to underscore an uncertain demand environment for Alibaba’s macro-sensitive consumer-facing businesses.

We have been seeing some pretty good numbers, good results in March and April, especially in terms of growth in users and growth in orders. And I think there are several reasons for that. First, of course, is the [recovery] that’s been unfolding. And secondly, I think it’s the long-term effect of our efforts around cost optimization and efficiency enhancement that are starting to pay off.

Source: Alibaba F4Q23 Earnings Call Transcript.

Yet, investor optimism appears to be growing that Alibaba stock might finally be ripe for a rebound as Beijing shifts to a tone of support for the private sector in efforts to bolster China’s post-pandemic economic growth. Coupled with the completion of the Ant probe, which is symbolic of Beijing’s easing grip on the private sector, a significant regulatory risk overhang has essentially been lifted from the stock. PCAOB inspections have also been proceeding with positive progress in compliance with Washington’s requirements, further alleviating delisting risks that have been previously weighing on the performance of U.S.-listed Chinese stocks.

The Alibaba stock’s depressed valuation multiple, despite recent gains, on a relative basis to its U.S. counterparts also reflects the market’s pricing of the underlying business’ weakened fundamental prospects. The “permanent installation of a much higher regulatory barrier” for Chinese big tech in recent years has effectively restricted Alibaba’s growth trajectory, and the situation has only been exacerbated by near-term macroeconomic headwinds that have picked up in China as the reopening narrative loses steam. But the potential introduction of additional government support to stimulate the Chinese economy could provide respite for the stock and add fuel to the recent rally.

Our long view on Alibaba stock is that it will continue to trade at a steep discount to its U.S. peers due to the inevitable exposure to greater-than-usual regulatory and geopolitical risk. With BABA’s former breakneck growth and profitability prospects tempered by permanently tightened antitrust oversight and intensified competition, the latest set-up could benefit from further gains driven by the return of market interest, especially on the grounds of diversification from U.S. market exposure amid recessionary-driven volatility that is still brewing.

Organizational and Governance Structure Overhaul

In our previous coverage on the stock, we had discussed the potential implications of Alibaba’s organizational restructuring efforts, including heightened investors’ expectations for follow-through progress in renewing growth and value accretion, especially amid the mixed reopening outlook in China. In the latest development, Alibaba has followed up with an overhaul of its governance structure at the group level, replacing longtime CEO Daniel Zhang – which has recently taken up the role of leading the restructured cloud unit – with the company’s Co-Founder and current Chairman of Taobao and Tmall, Eddie Wu, Joseph Tsai, the Executive Vice Chairman of an early investor in Alibaba, will replace Zhang’s previous role as Chairman of the board.

Recall that management had set out three core strategies – namely, consumption, cloud computing, and globalization – earlier in the year for fiscal 2024, with three ensuing key focus areas to adequately respond to the relevant opportunities:

We will focus on the following areas in such a competitive market. Number one, acquisition and retention of high-quality users; number two, maintaining our platform’s deprecated consumer mindset; and number three, most importantly, creation of new demand through supply side innovations.

Source: Alibaba F4Q23 Earnings Call Transcript.

The latest “management shake-up” is likely to ensure an independent tone at the top of the group and across the restructured businesses to ensure focus on unlocking new and incremental value to shareholders. For instance, the cloud unit has long been speculated as a prime candidate for a spinoff since even before management’s announcement of Alibaba’s organizational restructure, given its relative independence from the company’s broader consumer-facing business.

Alibaba even considered spinning off the cloud business last year with a potential valuation of more than $100 billion, say the people, asking not to be named because the discussions are private. The company eventually shelved the plan because of business and political obstacles, they say.

Source: Bloomberg News

By replacing those at the helm of Alibaba at the group level, the company ensures no overlap of management as Zhang focuses on directing the cloud unit towards a growth roadmap in urgent need of a rewrite. Recall from some of our previous discussions on the stock, Alibaba’s cloud unit has been facing heightened regulatory scrutiny due to cybersecurity concerns. This has caused a “broad swath” of state-backed agencies and businesses to favor “state-backed cloud platforms instead,” challenging Alibaba’s ambitions in expanding its market share gains. On the regulatory front, heightened geopolitical tensions between China and the West also risk limiting the cloud unit’s access to advanced technology critical to its developments in emerging high-performance computing, cloud, and AI technology trends.

Taken together, the cloud unit’s performance has been tepid at best in recent years. The headwinds have been clearly reflected in the unit’s stark y/y growth deceleration and consecutive periods of sequential declines, representing more than just cyclical challenges to the industry as warned by hyperscalers in the U.S.

With Zhang now at the helm of the cloud unit, it makes sense to bring a breath of fresh air and independence back into the leadership structure at the group level. The set-up could potentially reinforce strategic operational focus at the business unit level to ensure better capitalization of secular tailwinds ahead – especially with the advent of generative AI applications. Recall from Alibaba’s F4Q23 earnings call earlier this year that management highlighted two key forward growth drivers for the cloud unit: 1) expanded computing requirements from AI applications; and 2) the provision of “models as a service” to facilitate the development and deployment of AI applications.

Today, the age of AI brings two new historic opportunities to Ali Cloud. Firstly, the emergence and the broad application of artificial intelligence, large models and various vertical models have raised the new requirements for computing power…The second opportunity lies in building model as a service or mass on top of our foundation in us and parts.

Source: Alibaba F4Q23 Earnings Call Transcript.

The cloud unit’s focus areas are in line with our expectations discussed in the previous coverage, which outlined the potential for participation in cloud total addressable market (“TAM”) expansion given the incremental demand for HPC capacity to facilitate both the development and training of large language models, as well as the deployment of related applications. The integration of Alibaba’s recently introduced “Tongyi Qianwen” large language model and “Tongyi Wanxiang” AI image-generating tool, as well as their integration across internal platforms (e.g., DingTalk) and availability to customers via a marketplace-like cloud service is also expected to further the unit’s monetization of AI opportunities. This is corroborated by strong take-rates of related services disclosed by management during the F4Q23 earnings call, which implies pent-up demand which Alibaba’s cloud unit is well-positioned to address – the company has acquired more than 200,000 customers for trial access to Tongyi Qianwen. And the latest reshuffling of the company’s governance structure will likely ensure better focus on execution at the business unit level to further optimize growth and realization of efficiencies going forward.

Loosening Regulatory Deadlock

Beijing has also been loosening its regulatory grip on the private sector in recent months in an attempt to restore confidence among investors, consumers, and businesses. In addition to the government’s vow to support the private sector and shore up foreign investors’ confidence to ensure economic growth, the latest and greatest development in the regulatory scene has to be the completion of a yearslong probe on Ant.

Ant was slapped with a RMB7.12 billion fine last week, with regulators “wrapping up more than two years of probes” into the company, and confirming that “most of the key problems in financial platform enterprises…have been rectified.” Recall that the Ant probe was one of the earliest, and highest profile investigations ordered by Beijing that preceded the grueling slew of crackdowns that upended operations across industries spanning ed-tech, e-commerce, digital media, and others. The latest completion of the Ant probe is symbolic of easing regulatory restraints on the private sector – especially big tech – that have permanently altered their growth and profitability prospects. In addition to the RMB 7 billion fine, Alibaba has lost as much as 80% of its market cap since its peak in October 2020, wiping out close to $600 billion of its value.

The latest development increase confidence that the ensuing uncertainties pertaining to Beijing’s regulatory agenda, which have been a key multiple compression risk for Chinese stocks in recent years, are expected to ease further going forward as long as the central government continues to follow through on its vows to support growth in the sector. This essentially lifts a huge weight off of Chinese big tech valuation multiples, which is in line with the market’s optimistic response to the news with the Alibaba stock rising more than 8% since regulators announced an end to Ant’s probe.

On the U.S. front, delisting risks have also taken a back seat this year following progress on the initial round of PCAOB inspections on registered Chinese firms. Despite significant findings and deficiencies, they were within regulators’ expectations for first-time inspections. The inspected firms – namely, KPMG Huazhen and Pricewaterhouse Coopers Hong Kong (Alibaba’s group auditor) – are given one year to remediate the deficiencies before the PCAOB discloses them to the public. In the meantime, the PCAOB is proceeding with their second round of inspections on registered firms in mainland China, including PwC, Ernst & Young, and Deloitte & Touche headquartered in the region, underscoring expectations for continued positive progress in further assuaging delisting risks.

But the stock’s recent gains still look nominal when compared to Alibaba’s highflying days. Admittedly, tempered growth prospects from the newly installed regulatory environment in the name of anti-trust and data privacy, among other factors, as well as near-term macroeconomic weakness have also softened fundamental strength needed to support the stock’s valuation outlook. While recent developments contribute to a favorable setup for the stock, we expect a “lingering confidence issue” in the stock over the longer term as fundamental concerns remain unaddressed, limiting prospects for a structural rebound.

Broader Macroeconomic and Geopolitical Challenges

Meanwhile, worsening macroeconomic conditions appear to be the core immediate-term challenge over Alibaba’s fundamental prospects. Flat CPI reported in June, alongside accelerating PMI declines underscores not only consumer weakness but also the rising “threat of deflation” that will be detrimental to China’s post-pandemic recovery aspirations. Coupled with deterioration in international demand, stifled by a “U.S. drive for de-risking” supply chains from exposure to intensifying geopolitical tensions, the growth prospects of both Alibaba’s core consumer-facing and enterprise-facing businesses remain on shaky grounds.

As mentioned in the earlier section, Alibaba’s fiscal first quarter results could potentially benefit from strong demand observed exiting the fiscal fourth quarter and during April. Better-than-expected sales during rival JD.com’s (JD) flagship “6.18 shopping festival” which ran from May through mid-June also underscores similar optimism for Alibaba’s core commerce platform during the period. However, the rapid deterioration of consumer spending based on June economic data suggests a lack of fundamental strength in the Chinese economy to support a structural revival of growth for businesses – especially in consumer-facing industries – implying a potential return to weakness in the second half of calendar 2023, despite easier PY comps.

And on the international front, despite Alibaba’s recent focus on capitalizing on acceleration in international e-commerce demand – primarily from Europe through AliExpress, Turkey through Trendyol, and Southeast Asia through Lazada – deteriorating financial conditions in said regions, impacted by persistent inflation and central bankers’ embrace for further monetary policy tightening, suggest emerging headwinds for the growth strategy. Taken together, looming macroeconomic uncertainties will likely risk dimming Alibaba’s near-term growth outlook. This suggests that current expectations for demand resilience during the June quarter, alongside easing regulatory headwinds, will likely serve as more of a “sentiment boost” to investors in the near term, rather than a structural turnaround of fundamentals to support a sustained long-term trajectory of profitable growth.

In addition to worsening macroeconomic challenges, Alibaba also faces headwinds from geopolitical uncertainties. As discussed in a previous coverage, Alibaba’s cloud unit had plans to introduce a new in-house developed server processor based on 5nm nodes, which would mark a “milestone in China’s pursuit of semiconductor self-sufficiency”. The chips would be key to its data centers, especially considering the surge of demand for compute capacity ensuing from generative AI developments. But U.S.-levied restrictions on the export of advanced semiconductor technologies to China are likely to stifle Alibaba’s cloud aspirations. Specifically, the export curbs imposed last year, which are expected to be further tightened later this month, restricts industry-leading contract manufacturers like Samsung Electronics (OTCPK:SSNLF) and Taiwan Semiconductor (TSM) – the only ones with 5nm processing technology – from exporting anything more advanced than 16nm technology to China.

This could potentially thwart Alibaba’s capabilities in optimizing its monetization of generative AI opportunities. Although the latest “chip war” between the U.S. and China could potentially imply further domestic policy support for building-out self-sufficiency of Chinese supply chains for AI-linked technologies, they will take time to materialize, and potentially dull Alibaba’s ambitions to capitalize on a “first move advantage for Ali Cloud” in capitalizing on emerging AI opportunities. However, potential implementation of rules in the U.S. to curb China’s access to American hyperscalers could potentially drive incremental demand from the local Chinese enterprise end-market to Alibaba and offset some of the headwinds related to limited chip technology access.

The revolving situation underscores a complex geopolitical climate facing Alibaba – particularly regarding developments in cloud, HPC, AI, and other advanced technologies – which could lead to further volatility in the stock. The fluid situation could also drive uncertainties to how Alibaba’s recent restructuring plan would play out – particularly for its cloud unit, as near-term market conditions may not be favorable for its valuation, and the ensuing share dividend may not be as attractive to Alibaba’s shareholders as expected.

Fundamental and Valuation Analysis

Author

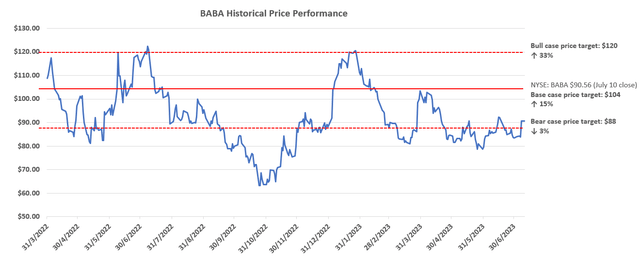

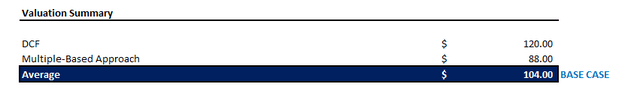

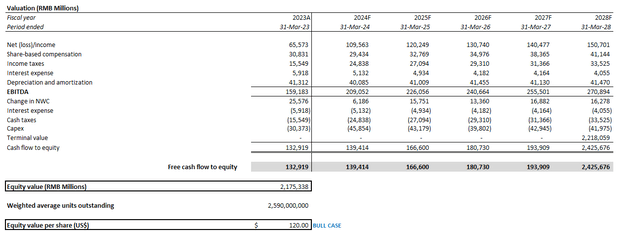

We are upgrading our base case price target for Alibaba to $104 by equally weighing outcomes from the discounted cash flow (“DCF”) and multiple-based valuation approach. The combination of the two valuation approaches offers a better reflection of the upside potentially attributable to both market sentiment for the stock as well as the underlying business’ pent-up value if based solely on fundamental considerations.

Author

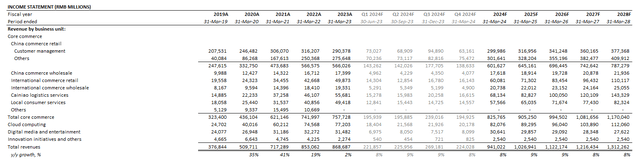

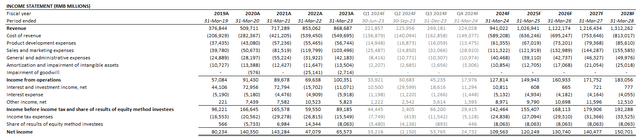

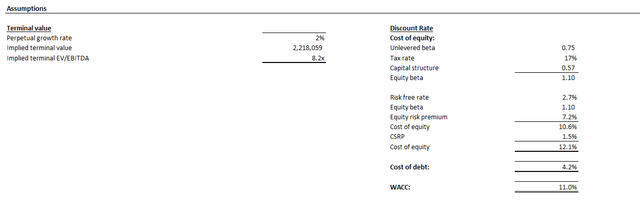

On the DCF analysis, we have applied an 11% WACC in line with Alibaba’s capital structure and risk profile, alongside a 2% estimated perpetual growth rate consistent with anticipation for a bumpy economic recovery in China and recessionary headwinds across its global end markets, on projected cash flows taken in conjunction with our previous fundamental forecast adjusted for fiscal four quarter results and fiscal 2024 expectations.

Author Author Author Author

Alibaba_-_Forecasted_Financial_Information.pdf

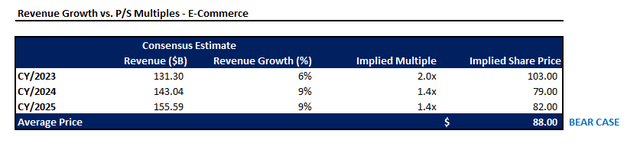

For the multiple-based analysis, we have made an upward adjustment to Alibaba’s valuation at current levels based on sales growth prospects relative to its e-commerce and internet peers in both China and the U.S. to better gauge market sentiment on the stock.

Author

We expect the DCF analysis to be an appropriate reflection of the upside scenario price, reflecting a primarily fundamental-driven valuation outlook without the incremental weight of market sentiment driven by the volatility of angst and optimism. The upside scenario assumes further alleviation of regulatory and geopolitical uncertainties facing the stock and could potentially materialize depending on the impact of anticipated stimulus and private sector support from the central government going forward. Our upside valuation is $120 and would represent an upside potential of 33% from current levels at about $91 apiece (July 10 close).

Meanwhile, the multiple-based approach yields an appropriate downside scenario price, as it reflects the continued overhang of market angst related to Alibaba’s uncertain operating environment, given evolving regulatory and geopolitical considerations as a lingering multiple compression risk. Our downside valuation is $88.

The Bottom Line

While Alibaba appears to be turning a corner, its exposure to prominent risks remains. Near-term macroeconomic headwinds and ensuing risks of earnings deterioration could remain a dominant multiple compression risk that has yet to play out, nonetheless, given the “limited scope” of economic support from Beijing so far. Potential value accretion from Alibaba’s internal restructuring efforts will also take time to materialize, especially as the planned IPOs and spinoffs are still at least a year away and could be subjected to regulatory and market hurdles – which Alibaba is no stranger to.

This could potentially weigh on the durability of near-term upside potential on improved investors’ confidence, as long-view risks ensuing from regulatory, geopolitical, and macroeconomic uncertainties remain intact and unresolved. While the near-term setup based on market’s expectation for government stimulus measures and improved confidence in the stabilizing regulatory backdrop could add fuel to the stock’s latest uptrend, we remain in search for structural improvements to Alibaba’s longer-term growth trajectory – whether that is made through progress on its restructuring roadmap or dependent on further policy support for the private sector – before turning positive on a durable recovery to its valuation outlook.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here