Alibaba (NYSE:BABA) is rapidly diversifying its revenue base which will help the company reduce China-centric headwinds and build a longer growth runway. In the recent quarter, the International Commerce segment reported YoY revenue growth of 41% compared to a 14% overall growth rate. This shows that the International Commerce segment has reported a YoY revenue growth rate 27 percentage points higher than the overall growth rate. A similar trend could be seen in the March-ending quarter when the International Commerce segment reported 29% YoY revenue growth compared to 2% overall growth rate. In the previous article, “Alibaba: Easier comps can deliver earnings surprise”, it was mentioned that Alibaba could easily beat the consensus which was clearly seen in the earnings.

The higher growth rate in international commerce has increased its revenue share to 9.5% of the consolidated revenue. If the current trend continues, the international commerce segment will contribute over 25% of the cumulative revenue base by the end of 2025. This will help reduce the geographic risk for Alibaba stock and provide the company with new growth options. Alibaba has already reached market leadership in a few major geographic locations. It is also trying to gain a higher market share in the lucrative European market by investing in logistics and improving the platform.

One of its main international competitors, Sea Limited (SE), is facing significant challenges and its market cap has dropped by close to 90% making it difficult to raise new funds. This should help the company improve margins and deliver faster growth in key international regions. Alibaba stock is trading at a very low multiple which can give long-term investors a good entry point as the company pivots its focus to international regions.

Positive diversification trend

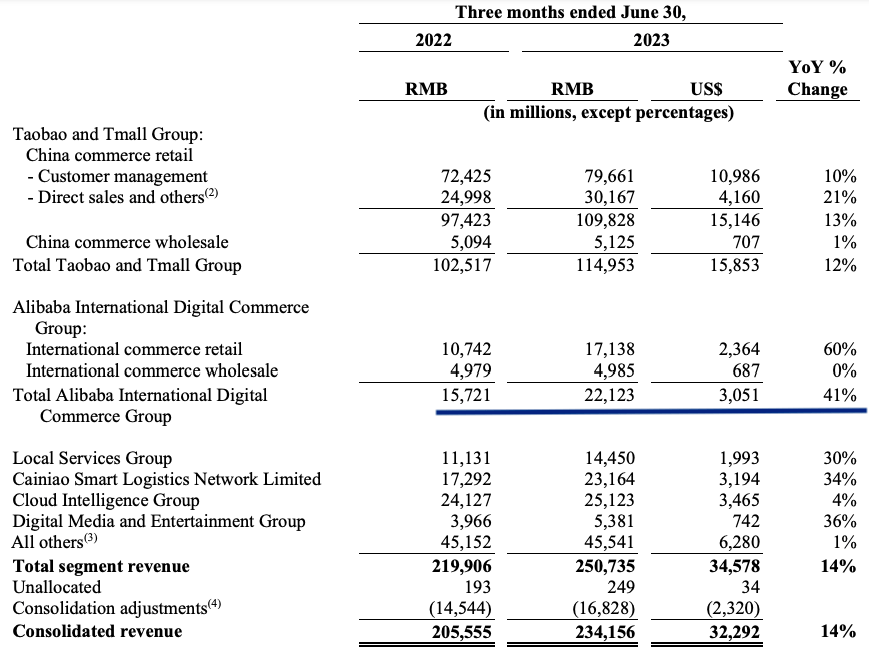

A short glance at the recent revenue growth metrics for different segments of Alibaba shows that the International Digital Commerce business has a completely different growth trajectory compared to other segments. The reopening of the economy has helped the Digital Media business. However, the YoY growth of Digital Media at 36% is still lower than International Commerce segment. The biggest segment is Taobao and Tmall Group which reported only 12% YoY revenue growth. This shows that there are strong fundamental growth opportunities in the International commerce segment which is driving the growth in this business.

Company Filings

Figure 1: The growth trajectory of International commerce is higher than all other segments

A higher revenue base and faster growth in international commerce is lifting the overall revenue growth of the company. In the recent quarter, the international commerce segment contributed 23% of the total incremental revenue for the company on a YoY basis. If the current trend continues, we could see international commerce contribute over half of the total incremental revenue for Alibaba by the end of 2025. This would put more focus on international operations and reduce the headwinds faced by the company within China.

A similar trend was seen in the previous quarter when the international commerce segment reported 29% YoY revenue growth compared to 2% YoY overall revenue growth. Hence, the international business had revenue growth 27 percentage points higher than overall growth.

Lower competitive pressure

Alibaba faces much lower competitive pressure in several international regions. One of its subsidiaries is Trendyol which has achieved market leadership in Turkey and is building a major logistics hub as an entry point for goods to Europe. E-commerce business requires massive investment potential to build logistics and drive prices lower for customers. This is usually not possible for smaller companies. We could see most of the e-commerce business in international regions get divided by bigger companies like Alibaba, Amazon (AMZN), Walmart (WMT), and a few others. This trend has been seen in bigger international regions like India where a majority of e-commerce market share is carved between Amazon and Walmart’s Flipkart subsidiary.

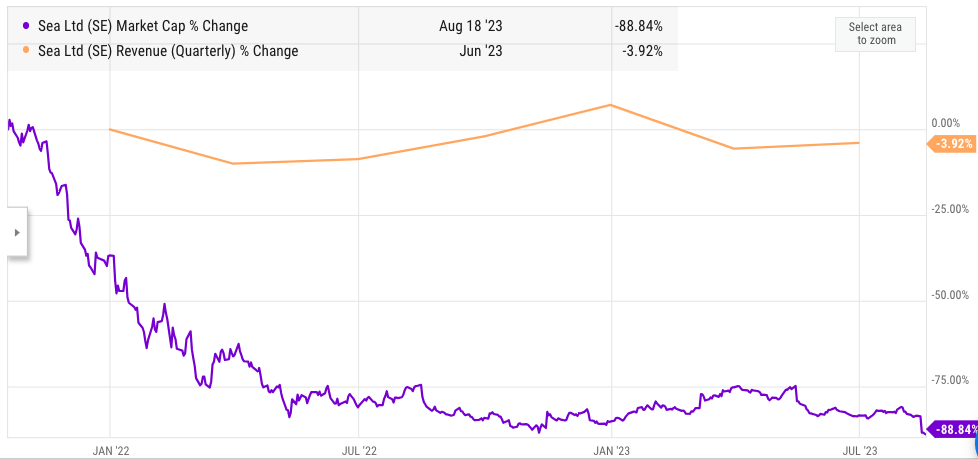

One of the biggest competitors for Alibaba is Sea Limited which competes against Alibaba’s Lazada in Southeast Asia. Sea Limited has seen its market cap decline by a staggering 90% in the last two years due to massive losses.

Ycharts

Figure 2: Market cap and quarterly revenue growth of Sea Limited in last 2 years

One of the problems facing Sea Limited is that it is too small to effectively compete with Lazada. The company used to burn cash to grow its market share. However, this strategy will not work now as the market cap of Sea Limited has declined significantly and the company will not gain leverage by diluting the shares further.

Alibaba has recently invested $845 million in Lazada. This is a long-term advantage with Lazada and other international units that can depend on Alibaba for resources and technical skills to improve logistics and their platform.

Long-Term Tailwind

The regulatory environment in different regions can be very different. For example, Alibaba has stopped investments in India due to growing geopolitical tensions between India and China. On the other hand, the regulations are very attractive in Southeast Asia where Alibaba has reported rapid growth. Even within different European Union countries, there are very different regulations. Hence, international growth diversifies the regulatory risk for the company.

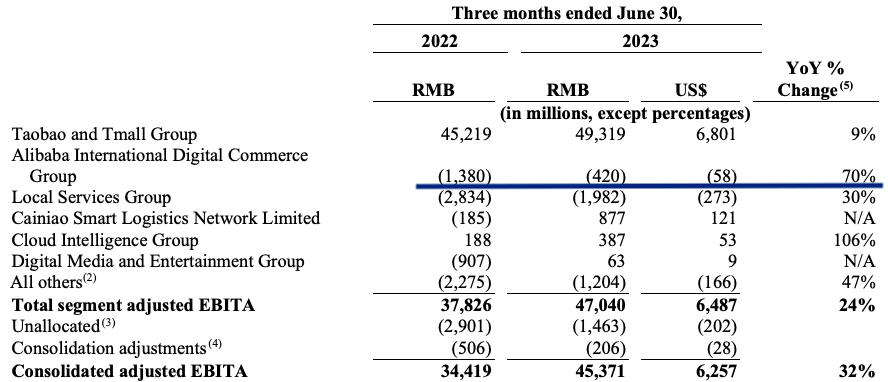

The International commerce segment is also close to the break-even point. In the recent quarter, the International commerce business reported losses of $58 million compared to more than three times this level in the year-ago quarter.

Company Filings

Figure 3: Rapid decline in losses for International commerce

There are a lot of international regions where Alibaba can grow. At the current growth trajectory, this segment will contribute over 25% of the total revenue base for the company by the end of 2025. This should reduce the China-based risk for the stock significantly. The future spinoffs bring some uncertainty in how and when the management will divide different segments. However, it is highly likely that the International commerce segment will be a key driver for future stock growth.

Impact on Alibaba stock

Any negative news from China causes an instant headwind for Alibaba stock. We have seen this in recent days when negative macroeconomic data in China led to a 10% decline in stock despite good earnings numbers. The geopolitical tensions between U.S. and China are also increasing and we could see greater trade restrictions on chips and other goods as the presidential race heats up.

In this background, the importance of International commerce increases significantly. Alibaba’s management is likely to focus all its attention on improving the growth trajectory within different international regions for the next few quarters. Wall Street could reward patient long-term investors with good returns as Alibaba stock becomes more of an international e-commerce platform instead of a China-centric company.

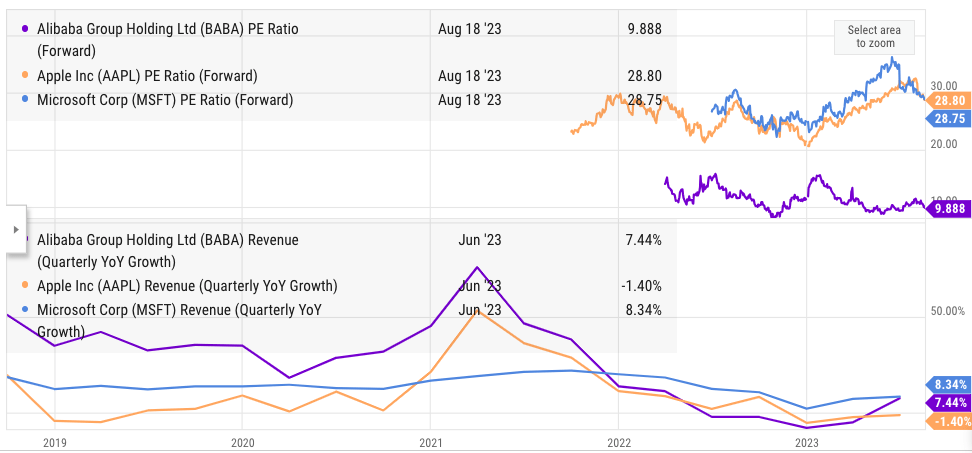

Ycharts

Figure 4: Quarterly YoY revenue growth and forward P/E comparison between Alibaba and other tech companies

Alibaba’s forward P/E ratio is less than 10 which is a massive discount to other big tech companies like Apple (AAPL) and Microsoft (MSFT). The YoY revenue growth of Alibaba is starting to improve and we could see better numbers in this metric as the macroeconomic situation improves in China. The increase in revenue share from international regions will also boost the overall growth trajectory for Alibaba. Currently, Alibaba’s international operations contribute only 10% of the revenue while companies like Apple receive over 60% of revenue from outside the domestic U.S. market. Apple receives close to 20% of the revenue from China.

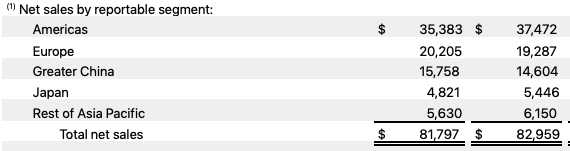

Apple’s Filings

Figure 5: Apple’s revenue share from different regions in the recent quarter

As this decade progresses, we should continue to see higher geographic diversification of Alibaba’s revenue base. It is certainly possible that Alibaba’s revenue base will look a bit like Apple where the domestic market contributes less than 50% of the total revenue. This will take another decade but long-term investors could see lower risk from Alibaba stock in the next few years.

Investor Takeaway

Alibaba’s International commerce segment is growing at a faster pace compared to other segments. This has increased the revenue share of International commerce to 10%. At the current growth trend, International Commerce segment could contribute 25% of the revenue share by the end of 2025. This should reduce the geopolitical risk associated with the stock and we could see better valuation multiple.

Recent earnings report shows that Alibaba’s YoY revenue growth is starting to improve and it is already much better than Apple. The forward revenue growth estimates are also quite strong for Alibaba. Long-term investors could consider Alibaba as a good buy-and-hold option and wait out the current macroeconomic and geopolitical headwinds.

Read the full article here