The updated buy thesis

Back in August, we wrote about Albertsons (NYSE:ACI) as a merger arbitrage play with respect to the pending buyout from Kroger (NYSE:KR). Since then, the arbitrage gap has narrowed to about 15% due to ACI appreciation, but the play might be better anyway due to the increased chance of closure.

On September 8th, Kroger and ACI put out a joint press release detailing a planned sale of 413 stores to C&S Wholesale for $1.9 billion. This article will analyze how the new events change the merger calculus and detail why we think it is a strong opportunity.

The arbitrage play

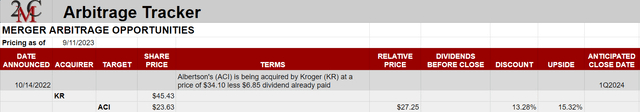

As of the close of trading on 9/11/23, ACI is trading at $23.63. Per the terms of the merger, KR is slated to pay $27.25 per share of ACI ($34.10 minus the $6.85 dividend that was already paid).

Portfolio Income Solutions Arbitrage Tracker Spreadsheet

That presents 15% upside upon merger completion to those who buy ACI at today’s price. Given that the expected close is in Q1’24 it is a fairly short wait for that sort of gain.

Previously a portion of the $27.25 consideration was going to be a SpinCo which made the buyout price a bit fuzzy, but it is now $27.25 in all cash. With the planned dispositions to C&S Wholesale, there is no longer a need for a SpinCo, and KR has publicly stated it is no longer pursuing a SpinCo.

This makes it a clean 15% all-cash upside to the arbitrage play.

So what is the downside?

When we discussed this idea back in August, we saw minimal downside because ACI was trading about in-line with where it was prior to the merger announcement. Today, ACI is trading higher, so there is about 10% downside to where I suspect ACI would trade if the merger fails.

As investors demand some sort of return for waiting the roughly 4-6 months for an expected close, current pricing suggests a completion chance of about 50%.

I think the chance of completion is substantially higher than that.

Barriers to merger have been largely eliminated

As consumer facing companies selling necessity products like basic food items, there are many interested parties.

- Customers do not want monopolistic pricing of groceries

- Labor unions want fair treatment of workers with minimal or no layoffs and preservation of pay/benefits

- Antitrust wants to ensure there is sufficient competition in the space

- ACI shareholders want a fair payout

- KR shareholders want to ensure the deal is accretive to KR earnings and quality

Since announcing the merger, Kroger has gotten some pushback from each of these groups. The asset sale to C&S Wholesale greatly improves the outlook for 4 of these parties while only slightly lowering the outlook for KR shareholders.

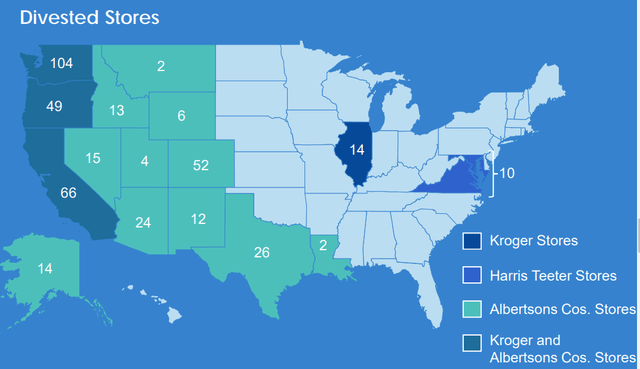

Assets chosen for divestiture are those which would have had the greatest overlap in the combined company footprint.

KR

Originally, the concern was that KR/ACI would become the only game in town. The previous plan of the SpinCo was a solution to the problem, but not a great solution.

Historically, assets contributed to a SpinCo have sometimes failed to be a proper competitor because they are too small to compete with a large established company. Then, a few years down the road, the SpinCo goes out of business and it is back to KR being the only game in town.

Selling the antitrust required assets to C&S Wholesale is a much more elegant solution as C&S is already a strong company. You may recognize them as Piggly Wiggly or Grand Union. With already existing operations, C&S will be able to smoothly take on the stores and operate them at full capacity presenting a proper competitor to the soon-to-be combined KR/ACI.

Beyond the initial 413 locations, there is an accordion feature to the divestiture, in which KR can add up to an additional 237 stores at similar economics.

Prior to the closing, Kroger may, in connection with securing FTC and other governmental clearance, require C&S to purchase up to an additional 237 stores in certain geographies. If additional stores are added to the transaction, C&S will pay to Kroger additional cash consideration based upon an agreed upon formula. (Company Release)

This, in my opinion, fully satisfies any concerns from consumers or antitrust.

Labor and unions were also taken into consideration in this divestiture. Per the agreement,

C&S commits that no stores will close as a result of the merger and that all frontline associates will remain employed, all existing collective bargaining agreements will continue, and associates will continue to receive industry-leading health care and pension benefits alongside bargained-for wages.

Everyone keeps their jobs and union terms are honored.

Albertsons also benefits from these asset sales as the merger consideration being in all-cash is a cleaner and better deal than some combination of cash and SpinCo.

ACI shareholders were in favor of the deal before and now it is just a clear win for them.

The only party that lost a bit of ground in this divestiture to C&S is Kroger shareholders. Specifically, the assets are being sold at an EBITDA multiple that was lower than expected.

On the related conference call an analyst questioned KR on the price of sales.

Michael David Montani

Just wanted to follow up, if I could, quickly on the potential multiple implied by the transaction for the divested stores, have had some pushback. It seems to be around 2 to 2.5x, which was a little less than we thought. So I didn’t know if you could discuss that potentially in the context of the ability to increase the stores divested if needed to close the deal vis-a-vis what the potential profitability might be of those locations.

For context, recall that the SpinCo was going to be at EBITDA multiples just north of 3X. I think the SpinCo multiples were fair and that C&S is getting a better than market deal.

Kroger CFO Gary Millerchap responded by saying:

[W]e haven’t actually assumed in our modeling that the transaction would move forward with a different number than we actually announced today. And in actual fact, the number would be very much in line with what we were contemplating.

In other words, this is what was underwritten and all the previously stated synergies and accretion from the ACI buyout remain on track for underwriting.

Essentially, with the terms of the SpinCo, the merger would have been wildly accretive to KR shareholders, well beyond what was underwritten in the original merger announcement, and now with the C&S divestiture it is still strongly accretive, just maybe to a less extreme extent.

ACI is a cheap stock and, at the buyout price, KR is still getting a great deal. They anticipate over a billion in synergies on top of the gains inherent to the valuation spread.

So the way I see it, all 5 interested parties should now be fully satisfied, and I don’t see any clear impediments to the merger completing. It is a big merger and there are a lot of moving parts, so perhaps closing gets delayed into Q2’24 instead of the scheduled Q1’24, but it would take a significant and unexpected event to derail it.

Consolation prize if I’m wrong

If I am wrong and something does derail the merger, Albertsons shareholders do get a bit of a consolation prize.

If KR fails to acquire ACI, there is a $600 million termination fee. That equates to just over a dollar per ACI share.

Even with this breakup fee, I suspect ACI shares would drop a moderate amount if the merger fails. That is the risk portion of the trade.

Overall, I think the 15% upside is the much more likely outcome, and for my goals, I think the risk is well worth taking.

Read the full article here

Offers free spin

Offers free spin