Written by Nick Ackerman

Outside of tech, there seems to be a lack of participation in the latest push higher for the ‘broader market’ as measured by the S&P 500 Index. The breadth of the climb for the year was rather narrow, but it is becoming even more so.

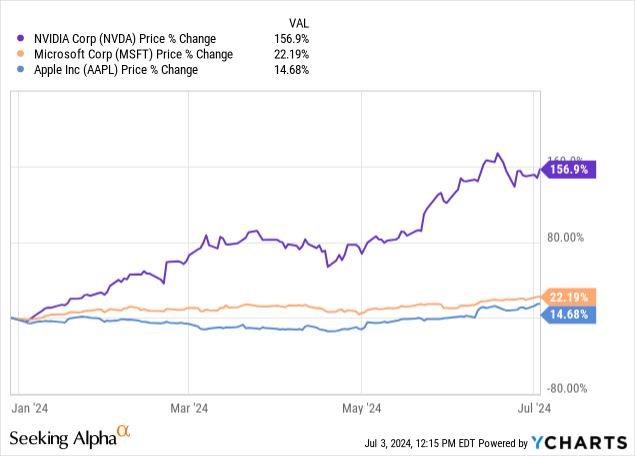

NVIDIA (NVDA) had surged to become the largest company in terms of market cap, surpassing Microsoft (MSFT) and Apple (AAPL) for a brief period of time. Those companies are still performing quite well but are just being dwarfed by the move by NVDA this year. NVDA has contributed to over a third of the market rally this year.

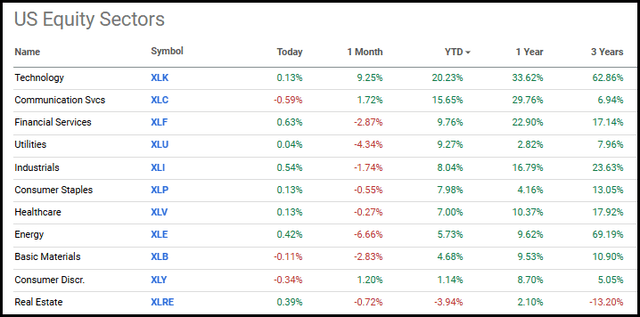

With that, there are a lot of pockets where things aren’t looking so hot. In particular, the real estate sector continues to be the big loser. The largest pressure on this space was the higher rate environment. With inflation that has remained sticky thanks to a resilient economy and solid labor market, the rate cut predictions continue to get pushed back further and further.

The latest Fed projection shows that they expect perhaps only one cut in 2024 now. That was down from the six that the market had been predicting at the beginning of the year and the Fed’s own expectations of looking at around three cuts this year. However, cuts are still expected to come over the next year or two, which could ease the negative pressures on real estate and REITs.

That’s one of the areas that remains one of the more attractive areas to put capital to work while it is beaten down. It is the only sector negative on a YTD basis, along with the consumer discretionary sector also not looking too hot.

U.S. Sector Performance as of June 19, 2024 (Seeking Alpha)

Today, I wanted to highlight two REIT names that are looking particularly attractive in terms of valuation. These are also long-term dividend growers, which include Realty Income (O) and NNN REIT (NNN). Both are triple net lease REITs-which is exactly where NNN gets its name and ticker-that focus on retail tenants.

I believe these REIT names offer long-term investors an attractive entry price currently that can pay dividends for years to come. Of course, aside from the leverage cost pressure side, the pressure on these names is the fact that investors can pick up risk-free yields for about 5% currently. When rates are cut in a year or two, these yields become more appealing once again.

Realty Income 5.94% Yield

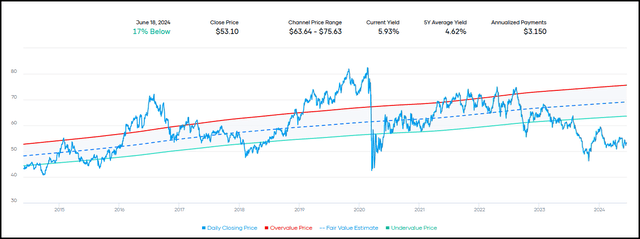

With the latest yield currently pushing about 6% due to the share price sliding over the last few years, it has pushed this to trade well below its fair value range based on yield. Again, though, one of the main pressures here is the risk-free rates that investors can get now that are competing with income investor dollars.

O Fair Value Dividend Yield Range (Portfolio Insight)

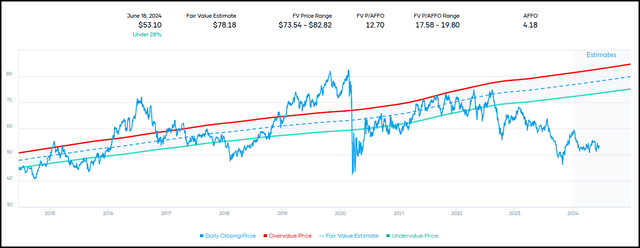

The 12.6x P/FFO also suggests that shares of O are trading quite cheap these days as well.

O Fair Value P/AFFO Range (Portfolio Insight)

We aren’t anticipated to go back to a zero rate environment, so it may not be logical to believe that Realty Income might go back to the 4-4.5% yield range. Still, that yield is growing over time as they lift the dividend, and that comes from FFO and AFFO growth over time as well.

They have a history of raising the dividend every quarter, generally with a larger increase and three smaller increases throughout the year. With an FFO payout ratio of ~75%, there doesn’t appear to be any worry about the dividend coverage here.

O Dividend History (Seeking Alpha)

We aren’t necessarily seeing some large increases, as this business has now grown to be quite large and mature. They now have over 15,450 properties, and it takes large acquisitions just to move the needle these days. That said, all those little dividend increases do add up over time. This REIT has been growing its dividend for years consecutively now, with the latest increase boasting the 126th dividend increase since its IPO on the NYSE in 1994.

Given the size, there is some security in that as well. It is generally going to be considered to be quite the stable REIT overall, given that it would require many businesses failing to start to threaten their balance sheet. Therefore, something like, say, Walgreens (WBA) closing up some of their locations shouldn’t have too negative of an impact on Realty Income.

NNN REIT 5.36% Yield

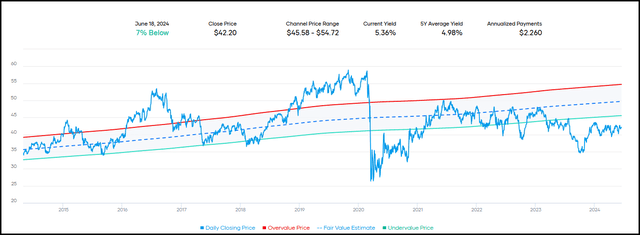

NNN is similar to Realty Income in that on the basis of the historical yield; the name is trading at quite a discount relative to its historical average. At the same time, the yield is a bit lower relative to where the dividend yield stands with O.

NNN Fair Value Range Dividend Yield (Portfolio Insight)

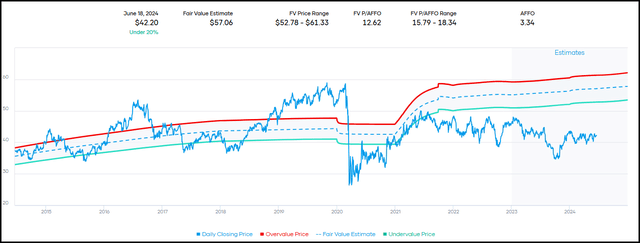

On the P/FFO front, we see that the 12.75x P/FFO is similar to where shares of O are trading these days.

NNN Fair Value Range P/AFFO (Portfolio Insight)

NNN trades at a similar valuation but interestingly, analysts actually expect O to see a touch higher FFO growth going forward. However, both are expected to show only modest growth for the next few years. Generally speaking, it is often the smaller operation that generally has an even larger potential runway for growth.

Another similarity between these two is that both show net debt to EBITDA of 5.5x, so each is similarly leveraged up. For some companies, that would be considered being rather highly leveraged, but for REITs, it is often between 4-6x. For retail REITs, the average comes to 5.24x

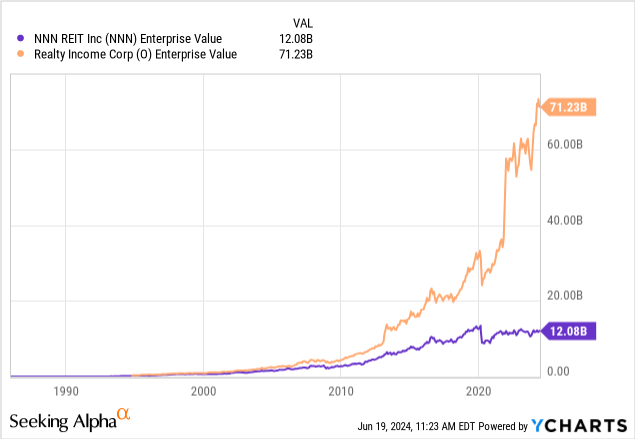

That said, for a big difference between these two, NNN isn’t nearly as large as O; the enterprise value of O is nearly 6x that of NNN. In total, they last listed having 3546 properties.

YCharts

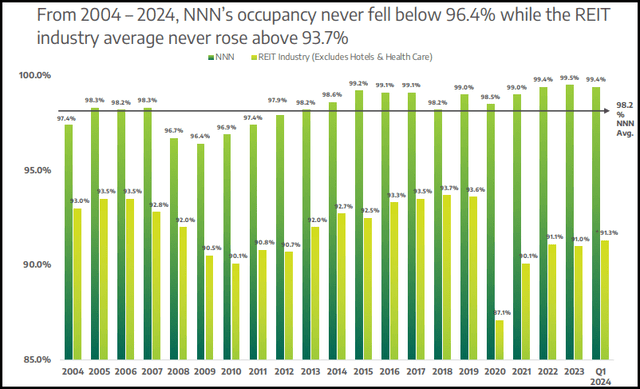

NNN may not be as large, but they still have a proven track record of being rather consistent. They’ve averaged over 98% occupancy rates since 2004. They boast that that is above the average of the REIT industry. Of course, that even includes the period of the Global Financial Crisis and the Covid pandemic.

NNN Occupancy Vs. Peers (NNN REIT)

So, while retail properties are one area that investors have begun to start to get nervous over due to an anticipated weaker consumer during an economic downturn, that hasn’t historically been an issue for NNN. That is, at least in terms of the actual operations of the REIT-unfortunately, strong fundamentals don’t always mean strong share prices. During those tumultuous periods of time, despite the resiliency, share prices still sunk. Though, it was those periods that offered truly bargain prices. Further, the dividend also remained resilient during these periods, which for income investors can be even more important.

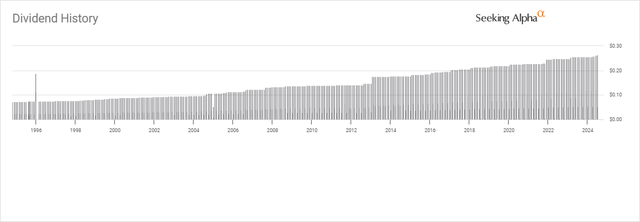

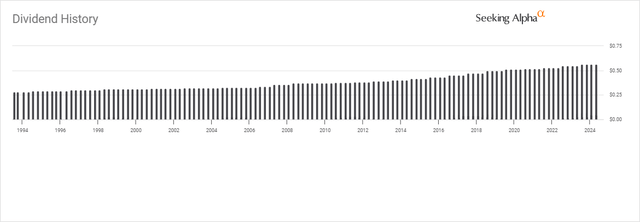

The smaller size also hasn’t kept NNN from being a name that comes with a solid dividend history of growth. They are listed as having 33 years of consecutive dividend growth, and they have a healthy payout ratio.

NNN Dividend History (Seeking Alpha)

The forward FFO payout ratio comes to a modest ~68%, which suggests that they have an even larger payout cushion relative to O-not that either is looking too stretched at all these days. With the anticipated growth going forward, albeit slow growth, the dividend raises look set to continue to keep going.

Read the full article here