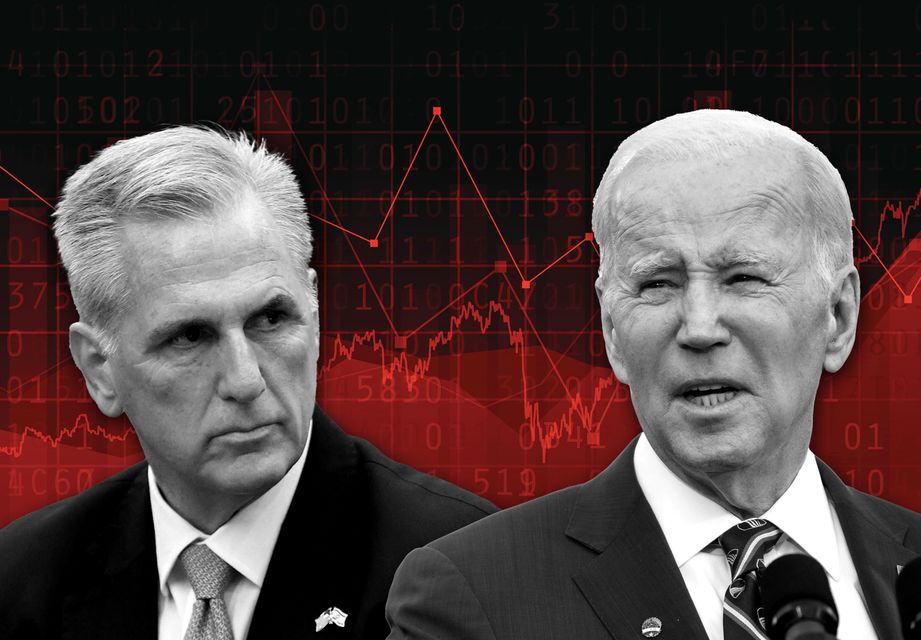

It might take a market mishap to end a debt-ceiling standoff that threatens to trigger a previously unthinkable default on U.S. government debt.

“An interesting question now is whether financial market vigilantes, in bonds, stocks or even currencies could flex their muscles the closer the government gets to running out of cash,” said Steven Barrow, head of G-10 strategy at Standard Bank, in a note late last week.

U.S….

Read the full article here