Our Theme of Apple Component Supplier Stocks, which includes a diverse set of companies that supply components for Apple’s

AAPL

NDAQ

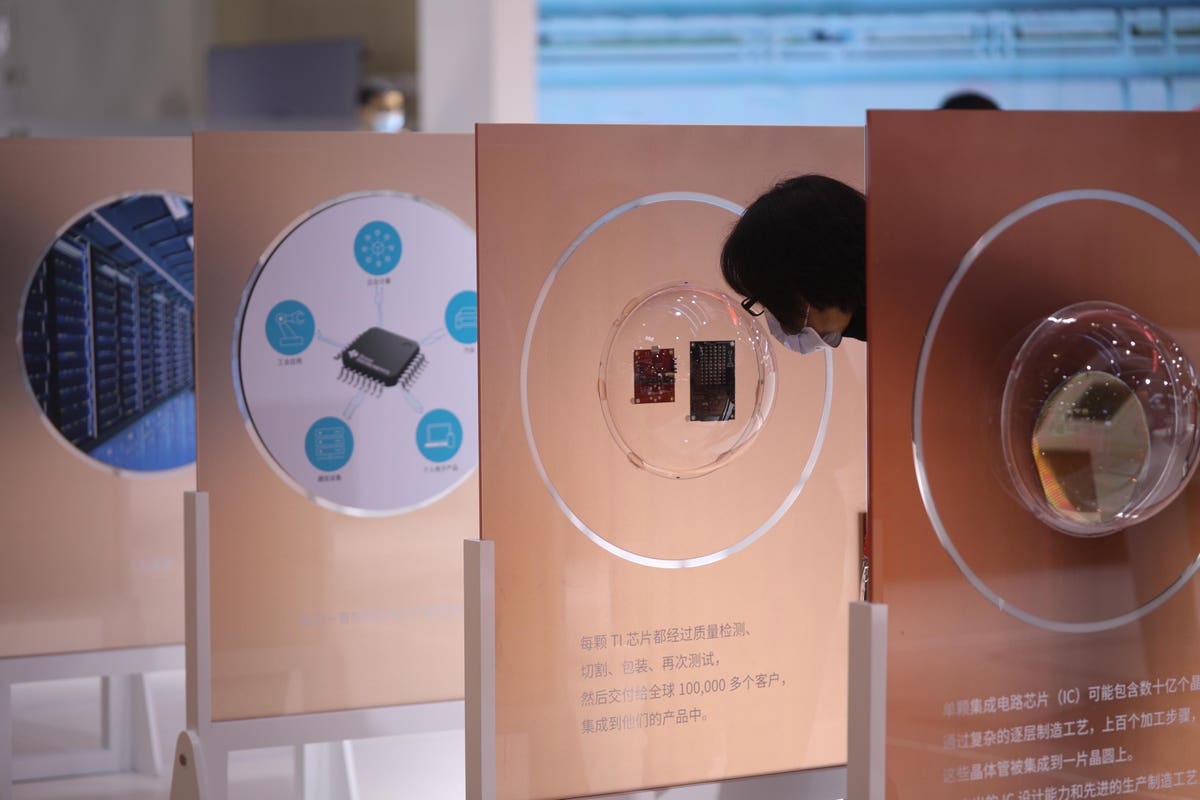

There are a couple of other factors that could benefit Apple suppliers in the near term. Apple’s next generation of iPhones, due this fall, is likely to sport more premium specifications and could sport higher prices, particularly for the Pro models. This could benefit suppliers to an extent. Moreover, the broader industry transition to 5G wireless networks is also likely to help Apple’s suppliers, who are largely focused on wireless chipsets and related semiconductors. For example, Android device vendors have been looking to equip more of their mid-range and lower-end models with 5G capabilities.

Within our theme, Jabil stock has been the strongest performer, rising by about 55% year-to-date. On the other side, Texas Instruments

TXN

What if you’re looking for a more balanced portfolio instead? Here’s a high-quality portfolio that’s beaten the market consistently since 2016.

Invest with Trefis Market Beating Portfolios

See all Trefis Price Estimates

Read the full article here