Sometimes “bad news” is “good news”. That seemed to be the case on Friday when the jobs report came in weaker than expected. That, combined with the Fed’s continuing rate “pause” on Wednesday ignited the financial markets – both equities and bonds. Among the popular averages, the DJIA gained 5.1% on the week, the S&P 500, 5.8%, the Nasdaq, 7.0%, and the small cap Russell 2000, 7.6%. In addition, interest rates fell (42 basis points on the 10-Year Treasury from near 5.00% to 4.58%, a large and rare occurrence). So, what were those downbeat numbers and why did they spark the rallies?

The Non-Farm Payroll (NFP) numbers, which is a survey of large and medium sized businesses, showed up as +150K, missing the consensus estimates of +180K That +150K included +127K from the Birth/Death model which are simply added (not counted) because the survey does not call on small businesses. Thus, the counted number was a meager +23K.

In addition, revisions for the prior two months amounted to -101K (those are huge revisions!). Remember, last month’s NFP number was a whopping +336K. As a result, the counted number was +23k (150K – 127K), and, if we include the revisions (-101K), that results in a real net of counted positions of -78K from the original September NFP release.

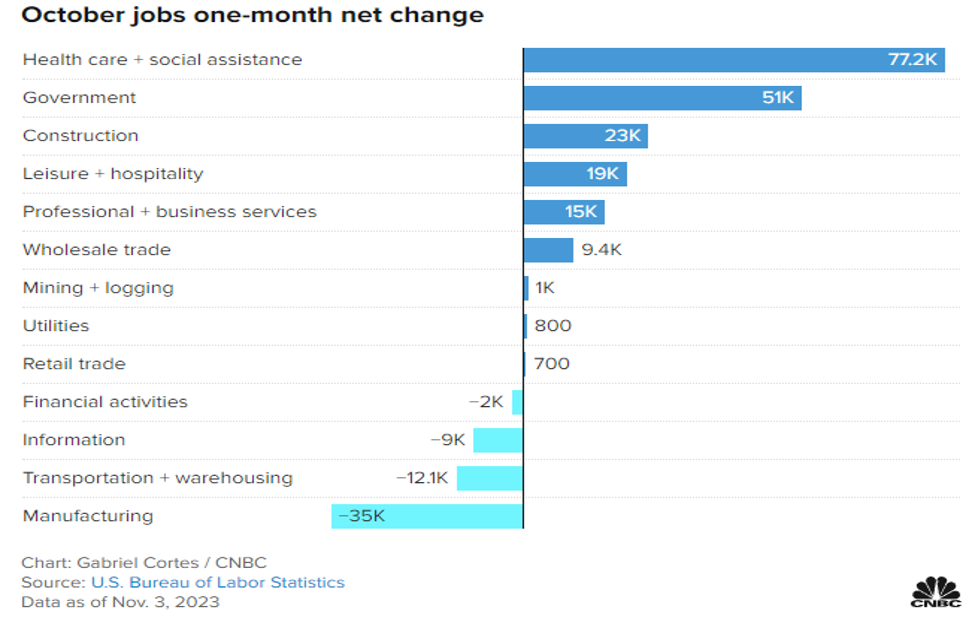

In addition, the sister survey (Household Survey, a phone survey of households) showed -348K, the worst report for this survey since the pandemic. If you’re thinking the auto strike, think again, as that only involved 30K workers. Weakness showed up elsewhere, too. As pointed out by Rosenberg Research, multiple job holders grew by +205K in October, after rising +123K in September, and 8.4 million people holding multiple jobs is a record, and a sign of growing financial stress. The chart at the top shows job growth by sector, and, as we opined in last week’s blog, the Manufacturing Sector looks to be in Recession with a loss of -35K jobs last month. Transportation and Warehousing, central to an economy that thrives on consumption, was the second weakest sector, losing more than -12K jobs. Retail would normally be hiring briskly for the upcoming holiday buying season. That sector showed up with essentially no hiring at all (a mere +700 jobs). To show what is going on in Retail, on its Q3 earnings call, (per Rosenberg Research) Target’s

TGT

We have also started to see a rise in the unemployment rate(s). The U3 rate rose to 3.9% from 3.8% (the consensus was 3.8% and the low rate was 3.4% earlier this year), and the U6 rate now stands at 7.2%. It’s low was 6.5% last December.

The Fed

The rally in the financial markets wouldn’t have been possible without the cooperation of the Fed. On Wednesday, after the Powell press conference, market players determined that the Fed was done hiking rates. To be sure, Powell left the door open for additional rate hikes, but that would only occur if the inflation numbers deteriorated badly (see below). That would be quite the turn of events given that nearly all of the inflation indicators are screaming disinflation. The critical CPI is sure to show disinflation as the shelter component, which has a 35% weight in the index, is calculated from lagged data which we know have been on a steep decline and have recently crossed into deflation (prices falling) territory (see left-hand chart below). In addition, the vacancy rate is climbing (right-hand chart), as a record number of new units come on the market. This is sure to keep rents in negative territory for the next few quarters, and consequently, have a depressing effect on the CPI.

At his post-meeting press conference, Chairman Powell expressed some surprise at how well the economy seems to be doing. But it shouldn’t have come as a surprise, especially to an organization with scads of economists. The chart below (which we’ve shown in prior blogs) shows the results of monetary policy on the economy if the lag between enactment of a policy and its impact is 12 months. The solid line is the actual Fed Funds rate as decreed by the Federal Open Market Committee (FOMC). The dashed line is the solid line lagged 12 months. The horizontal line is the Fed’s determination of where a neutral Fed Funds Rate would be (2.5%). Any Fed Funds rate below 2.5% is an accommodative monetary policy, above is restrictive. If the lag between enactment and impact on the economy is 12 months, then monetary policy just recently became restrictive in July (and the October jobs numbers appear to bear this out).

It was only the week before last when the 10-year Treasury was bumping up against a 5% yield. As noted, markets were volatile again this past week, but it is the kind of volatility that investors like, as both the equity and bond markets chased prices higher. As noted, the 10-Yr Treasury closed this past Friday at 4.58%, a 42-basis point rally in just a week. Credit the rally to both the weak jobs report and Chairman Powell who said that the overall downward move in wage growth was a welcome sign.

The wage increases have really come down significantly over the course of the last 18 months to a level where they’re substantially closer to that level that would be consistent with 2% inflation over time. – Chairman Powell at post-meeting press conference

As a result, markets have now concluded that the Fed has finished its rate hiking program and the rallies in the financial markets resulted. The latest Bloomberg survey of economists puts the probability of a rate hike at the December Fed meeting at a mere 4.6%. While the Fed has left the door open for more rate hikes, they said that would be “data dependent.” As we have shown in past blogs, the data shows a slowing economy and followers of Milton Friedman (the “Monetarist” school) couldn’t be more confident that inflation is on the wane.

The Money Supply

The monetary aggregates in the developed world have shown rapid deceleration, and most are showing negative year-over-year growth. This includes the U.S. (green line), the U.K. (orange), and the Eurozone (blue). Friedman’s Monetarists would look at the chart and claim that the inflation itself was central bank induced by the spike in the monetary aggregates in 2020 and 2021. Now that three of the four developed world money stocks are falling, we should continue to see disinflation if not outright deflation. (Japan’s money supply (brown) had a similar pattern, just not as pronounced and is not yet showing contraction, but the pattern is similar to the other three.)

Compensation

Another reason we believe that the Fed’s rate hiking cycle is over has to do with compensation. On the chart above, note the downturn in compensation for both manufacturing and in the leisure/hospitality sector. It does appear that the danger of a “wage-price spiral” is remote, even despite the UAW’s gains in the auto industry. In Q3, total labor compensation grew at an annual rate of 3.9% vs. 6.9% in Q2, quite the deceleration. And, given the rate of inflation, the 3.9% nominal rate works out to be about 0% after inflation. Additionally, we are now seeing the wage increases of job changers approaching that of job stayers. This is a dramatic change from earlier in the year and it goes to a weakening labor market.

Layoffs

In the most recent Challenger, Gray and Christmas survey, layoffs were up +8% from a year ago in October while hiring announcements were down a whopping -85%. In addition, as alluded to earlier, Retail’s seasonal hiring is the lowest since 2008 (Recession year). That says a lot about what Retailers expect from the upcoming selling season.

Inflation

Whether or not the FOMC listens to its own, those very economists say inflation is dying. The NY Fed’s inflation gauge is at a 30-month low and on a steep decline (see first chart below). The SF Fed’s inflation forecasts show inflation approaching 0% by late 2024 (see second chart). (Reasons to be bullish on bonds!)

What Could Possibly Go Wrong!

Yet, there’s lots to worry about! The chart below shows the corporate debt maturity distribution. Note the rapidly rising maturities through 2028. Most of the maturing debt was financed in the low interest rate years of 2009-2020. Now, as those bonds mature, rates are significantly higher, some by a factor of 3 or more. High rates will eat into corporate America’s profit margins. Our view is that this looks scarier than it will turn out to be, as we don’t see interest rates at current levels for more than two or three more quarters. No doubt, however, that refinancing the corporate debt will be at rates that are higher than what those maturing bonds are now paying, an upcoming issue for corporate profits.

And then there is the banking sector. As readers of this blog are well aware, we think credit is the lifeblood of the economy. The chart shows that commercial bank credit is now in contraction mode. In past blogs we have indicated that consumer credit is being denied at record levels and that consumers have loaded up their credit cards; yet another bad sign for the upcoming holiday shopping season.

Final Thoughts

Like the financial markets, we, too, think the Fed is done hiking and hope that they are wise enough to begin their easing before the Recession gets too deep. The highly feared “wage-price spiral” did not materialize, and it looks like, by the Fed’s own reckoning, that inflation will approach 0% as 2024 unfolds.

What does worry us is the lag in monetary policy. According to the chart above, if the lag in monetary policy is 12 months, then we are just getting into “restrictive” territory. And given what we are already seeing (e.g., the weak labor report and a Recession in the Manufacturing sector), the rate increases already taken but not yet felt look to be fearsome.

Already home sales are way down and it appears that they will remain so until rates fall significantly. And, as noted, Retailers don’t appear to be expecting a great selling season. Because the Fed just reiterated the “longer” portion of its “higher for longer” mantra, we are sticking by our Recession call.

(Joshua Barone and Eugene Hoover contributed to this blog.)

Read the full article here