Marathon Oil Corp (MRO) is down 2.5% at $24.90 at last glance, headed for its fourth-straight daily loss. The shares are down 9.3% in just the last week, though the pullback could provide an entry opportunity for bulls.

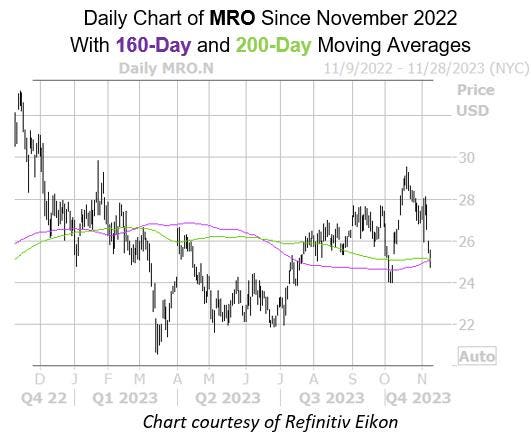

The recent dip has MRO within one standard deviation of its 160- and 200-day moving averages, which have both been bullish for the stock in the past. Both trendlines have seen three similar signals over the past three years, after which the stock was higher one month later each time, with the 160-day trendline averaging a 3.3% gain, while the 200-day averaged a 6.1% gain.

It’s also worth noting that Marathon Oil stock’s 14-day relative strength index (RSI) of 19.2 sits firmly in “oversold” territory. This is also an indicator of an upcoming short-term bounce.

Options are attractively priced at the moment, too. MRO’s Schaeffer’s Volatility Index (SVI) of 31% ranks in the low 20th percentile of its annual range, meaning options traders are pricing in low volatility expectations.

Read the full article here