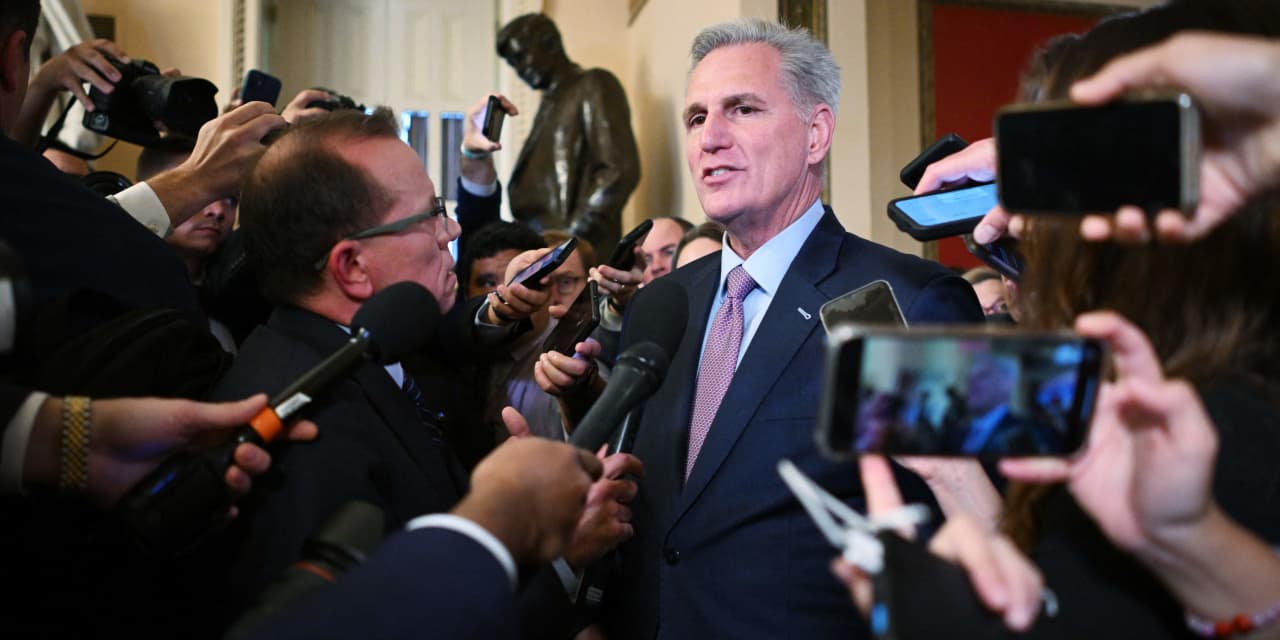

The House of Representatives ousted Speaker Kevin McCarthy in a historic vote. That will make life interesting for defense investors for the next few months.

McCarthy was removed Tuesday in a 216-210 vote after nine months in the role. It came after some Republican members, including Florida’s Matt Gaetz, were unhappy about his compromise to keep the government running for a few weeks, avoiding a shutdown.

Who the next speaker will be is anyone’s guess. McCarthy said he won’t run for the post again. His successor will likely have a tough time avoiding a shutdown when current authorizations run out in about 45 days.

The move will have an impact on the markets—not least when it comes to defense stocks.

“The bull case is that an effectual new speaker might be elected well before the current continuing resolution expires on November 17. Perhaps such a speaker may be able to work in a bipartisan manner, and carry out a legislative agenda that results in limited/no change in the financial outlook for Defense,” wrote Deutsche Bank analyst Scott Deuschle in a Wednesday note.

There is, of course, a bear case. An extended leadership crisis could put passage of the fiscal year 2024 Defense Appropriations bill at risk. That could eventually trigger a 1% cut in defense spending, the analyst noted.

“We believe the companies that are more geared to shorter-cycle work and future budget growth are arguably more exposed to these types of risk factors than the more long-cycle businesses that have robust backlogs built from prior appropriation cycles and more limited growth derived from the next budget,” added Deuschle.

For him, that makes nuclear component supplier

BWX Technologies

(ticker: BWXT),

Huntington Ingalls Industries

(HII), and

General Dynamics

(GD) relatively attractive compared with

L3Harris Technologies

(LHX),

Lockheed Martin

(LMT), and

Northrop Grumman

(NOC).

Investors probably shouldn’t overreact, though. Vertical Research Partners analyst Rob Stallard finds that stocks tend to be unfazed by shutdown drama. He wrote recently that defense stocks underperform the

S&P 500

by just one percentage point during shutdowns, and outperform by two percentage points after shutdowns end.

Shutdowns haven’t been that big a deal historically.

However, that doesn’t mean Wall Street loves the sector. Analysts’ average Buy-rating ratios on aerospace and defense stocks in the S&P 500 are nearly the same across the index—about 54% to 55%. Excluding

Boeing

(BA) and

Honeywell International

(HON), which are more commercial aerospace stocks than defense stocks, the Buy-rating ratio drops to 50%.

Lockheed Martin and Northrop Grumman are the least popular stocks with Buy-rating ratios in the 30% range.

Textron

(TXT) is the most popular stock with 63% of analysts covering the company rating shares Buy.

RTX

(RTX) has a Buy-rating ratio of 54%, but that is down from more than 60% just a few weeks ago. Analysts downgraded shares after problems have escalated with its geared turbofan engine that powers some A320-family jets.

L3Harris Technologies and

Huntington Ingalls Industries

fall in the defense-middle with Buy-rating ratios of 50% and 45%, respectively.

Excluding

Boeing

and Honeywell, share in the sector are trading for about 14.5 times estimated 2024 earnings, down from about 17 times, a historical average in recent years. Boeing earnings are still depressed following the Covid-19 pandemic and 737 MAX issues, and the stock trades for about 38 times estimated 2024 earnings.

The

iShares U.S. Aerospace & Defense ETF

(ITA) is up about 7% over the past 12 months, while the S&P 500 and

Dow Jones Industrial Average

are up about 12% and 9% over the same span, respectively.

Write to Al Root at [email protected]

Read the full article here