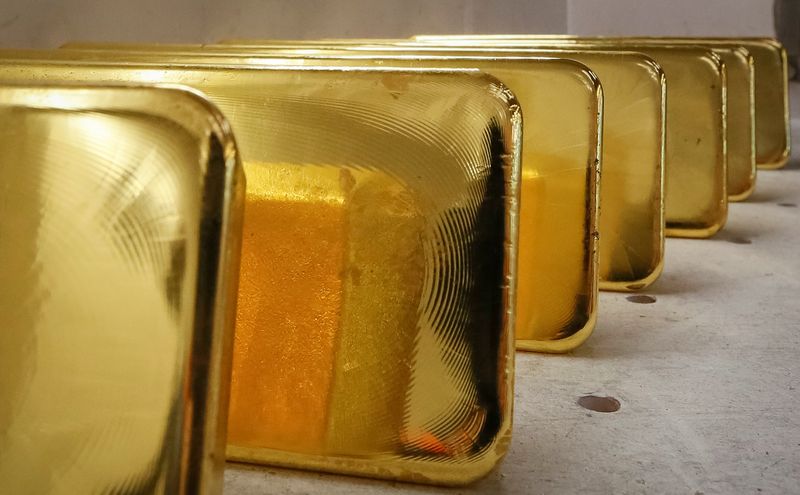

Investing.com– Gold prices moved little in Asian trade on Friday, hovering near a seven-month low hit earlier this week as markets awaited key U.S. inflation data, while copper prices rose amid bets that a week-long Chinese holiday will help perk up economic growth.

The yellow metal saw some respite as the dollar came off a 10-month peak, while a recent rally in Treasury yields also appeared to have paused.

But gold prices were still nursing steep losses for September, with a bulk of them coming in the past week after the Federal Reserve said interest rates will remain higher for longer.

Bullion prices also lost the key $1,900 an ounce level, which is likely to herald further losses and keep the prospects of a recovery dim.

steadied at $1,865.30 an ounce, while expiring in December rose 0.2% to $1,882.05 an ounce by 00:47 ET (04:47 GMT).

Spot prices were down 3.3%, while gold futures were set to lose 4.3% in September. They were also headed for their worst month since February.

PCE inflation in focus, dollar and yields cool

The fell 0.2% in Asian trade, as did , after notching strong milestones this week.

Markets were now waiting to see whether the rally had more legs, with – the Fed’s preferred inflation gauge- due later in the day.

Analysts expect the reading to have accelerated in August from the prior month, tracking an increase in amid upward pressure from higher fuel prices and steady retail spending.

A stronger inflation reading gives the Fed more headroom to keep rates higher. The central bank said last week that it could potentially hike rates once more in 2023, and will cut them by a smaller margin through 2024.

High rates bode poorly for gold, given that they ratchet up the opportunity cost of investing in bullion.

Copper prices surge on China hopes

Among industrial metals, copper prices rose sharply on Friday, recovering a measure of their losses through September amid lesser pressure from the dollar.

rose 0.7% to $3.7363 a pound, and were down 2.3% for September, their second straight month in red.

While concerns over slowing Chinese demand had been a key source of pressure on copper through the month, the red metal took some support from bets that consumer spending and business activity will pick up in China through the week-long mid-Autumn holiday, which begins today.

China is the world’s biggest importer of copper, and has been a key weight on the red metal’s price over the past year.

Read the full article here