Zoom Video Communications Inc.’s stock climbed in extended trading Monday, after the videoconferencing company topped expectations across the board with its financial results and forecasts.

Zoom

ZM,

rang up fiscal second-quarter net income of $182 million, or 59 cents a share, on revenue of $1.14 billion, up from $1.1 billion a year ago. After adjusting for stock compensation and other effects, Zoom reported earnings of $1.34 a share, up from $1.05 a share last year and topping analysts’ expectations.

Analysts surveyed by FactSet had on average expected adjusted net income of $1.06 a share on revenue of $1.11 billion.

Zoom forecast third-quarter adjusted earnings of $1.07 to $1.09 a share on revenue of $1.12 billion to $1.21 billion, while analysts on average were projecting $1.03 a share on sales of $1.06 billion, according to FactSet.

For the full year, the company predicted adjusted earnings of $4.63 to $4.67 a share on revenue of $4.49 billion to $4.5 billion, while analysts on average were expecting $4.32 a share on sales of $4.5 billion.

“In addition to delivering innovation to our customers, in Q2 we delivered GAAP EPS of $0.59 and non-GAAP EPS of $1.34, both up meaningfully year over year. With this strong operating discipline, we grew operating cash flow by 31% year over year to $336 million,” Zoom Chief Executive Eric Yuan said in a statement announcing the results.

Shares of Zoom initially advanced more than 8% in after-hours trading Monday following the release of its results, but they later cooled, ending the extended session up 3.7%. Zoom’s stock has dipped 0.7% this year, while the broader S&P 500 index

SPX

has advanced 15%.

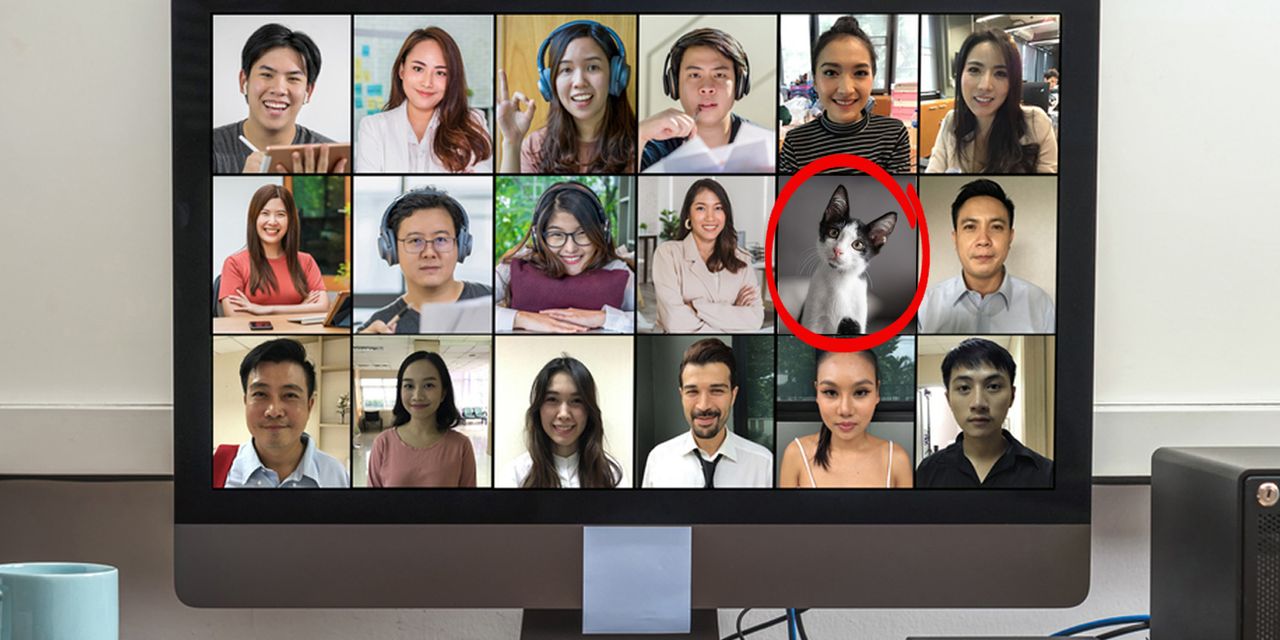

Earlier this month, Zoom joined scores of other tech firms and requested that most of its 7,400-person workforce return to the office. Employees within 50 miles of an office are now required to work in person on a part-time basis, a plan Zoom intends to roll out in August and September.

Despite escalating competition from the likes of Microsoft Corp.

MSFT,

Cisco Systems Inc.

CSCO,

and Alphabet Inc.’s

GOOGL,

GOOG,

Google, Zoom has been able to hold its own with a steady stream of products and services for consumers.

Read the full article here