Taiwan Semiconductor Manufacturing’s latest monthly sales suggest the chip maker is doing better than expected.

The growth of artificial intelligence technology has boosted demand but

TSMC

‘s figures could also be good news for the consumer-electronics sector.

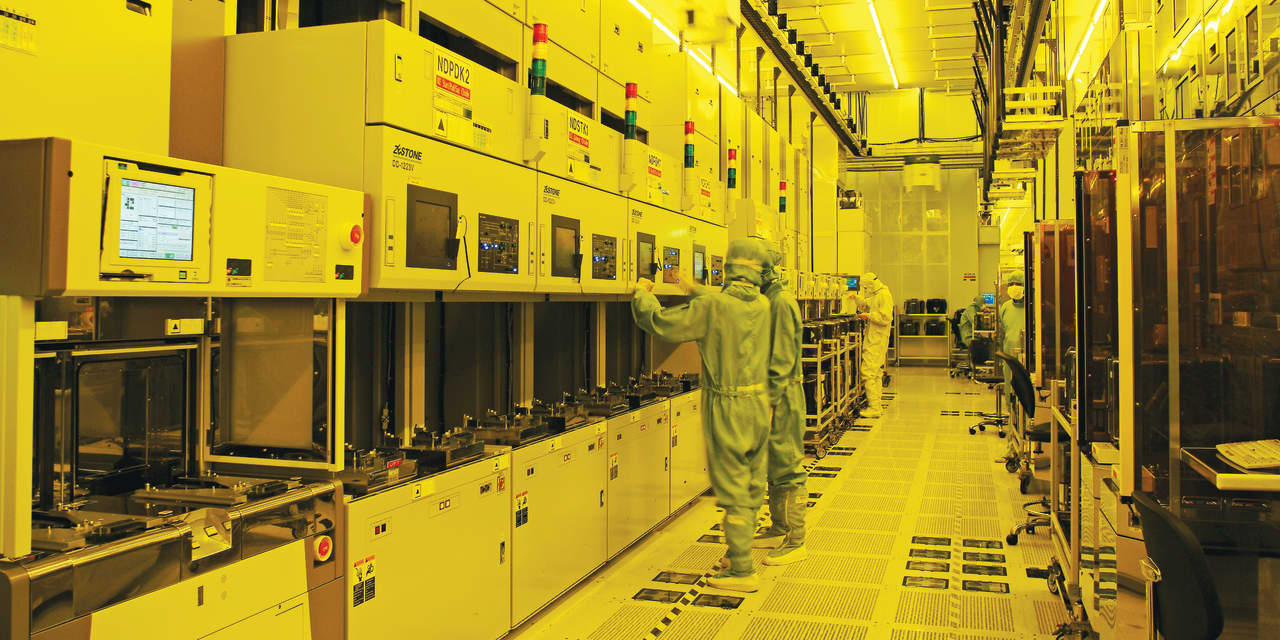

The world’s largest third-party semiconductor chip manufacturer announced its sales numbers for September on Friday. TSMC’s (ticker: TSM) revenue for the month fell 13% from the prior year and dropped 4.4% from August.

While the company is still suffering from a slowdown in the chip market overall, the figures for the September quarter were better than expected.

TSMC’s monthly reports indicate its quarterly sales came to 546.7 billion Taiwanese dollars, or around $17.0 billion. Analysts had forecast sales of 534.8 billion Taiwanese dollars, according to a FactSet consensus. TSMC makes the main processors inside Apple (AAPL) iPhones, Qualcomm (QCOM) mobile chipsets, and processors made by Advanced Micro Devices (AMD).

American depositary receipts of TSMC were up 1.0% in premarket trading on Friday.

“The big question mark here is to what degree has the seemingly unending demand for AI training chips offset weakness in smartphones and consumer electronics,” wrote independent analyst Richard Windsor, who publishes Radio Free Mobile.

TSMC makes chips designed by

Nvidia

(NVDA), which have become the favorite processors for powering AI applications. However, bottlenecks in supply have become an issue. Reuters reported Friday that ChatGPT-developer OpenAI was exploring designing its own chips to overcome the scarcity of AI processors.

“Even with stratospheric demand, I think it unlikely that much of the [TSMC sales] surprise has been caused by higher-than-expected sales of AI chips as there are no more available for sale,” Windsor wrote.

Instead, he pointed to a potential stabilization in inventories of semiconductors used in consumer electronics. That would be good news for companies such as

Qualcomm,

which supplies chips to

Apple

but has suffered due to a slower-than-expected recovery in Chinese consumer spending and a weak global smartphone market.

Qualcomm shares were up 0.6% in premarket trading.

Write to Adam Clark at [email protected]

Read the full article here