Nvidia Corp.’s stock was on track to close at levels that would value the chip giant at $1 trillion in the wake of new product announcements showcasing the company’s grip on the artificial-intelligence market.

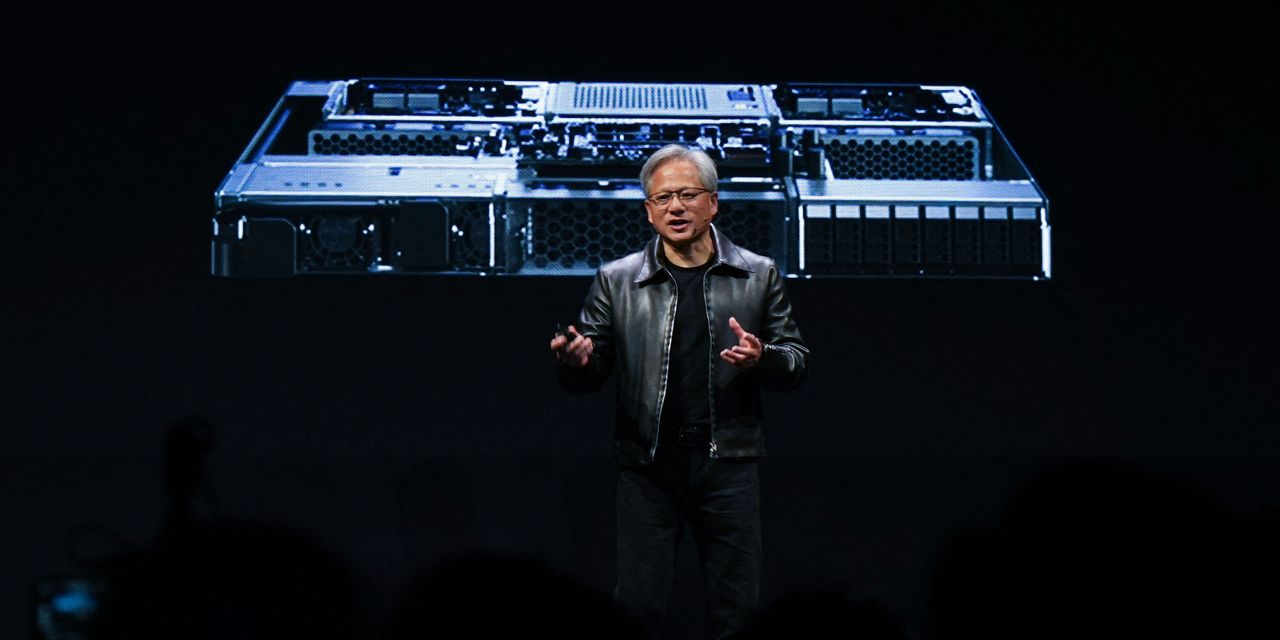

The company’s Monday product announcements, including its new Grace Hopper supercomputer and its first ethernet networking offering showed that Nvidia

NVDA,

is “not standing still” but rather “running as fast as they can and extending their already dominant lead,” according to Evercore ISI analyst C.J. Muse.

Read: Wall Street tech darling Nvidia unveils more AI products — including a new supercomputer

While Nvidia teased the ethernet debut on its last earnings call, Wells Fargo analyst Aaron Rakers noted that the announcement illustrated Nvidia’s “deepening enterprise strategy” with a product the company says will help in the deployment of generative AI, or the type of AI popularized by ChatGPT.

Nvidia shares were up 4.9% in morning trading Tuesday to a recent $408.70. The stock would have to close at $404.858 or above in the regular session for Nvidia to achieve a market capitalization upwards of $1 trillion, according to Dow Jones Market Data.

More from MarketWatch: Nvidia CEO tells graduates to take advantage of AI or get left behind

The stock’s rally builds on a year-to-date surge that hit high gear last week as Nvidia stunned Wall Street with its expectations for how AI-fueled demand for its data-center products would translate into financial performance. The company vastly exceeded consensus expectations with its revenue forecast for the current quarter, helping to send shares up 24.4% in a single day last week.

Don’t miss: ‘Unprecedented’ and ‘unfathomable.’ Nvidia makes jaws drop on Wall Street as stock explodes higher.

Nvidia shares are now ahead 181% so far this year.

Rosenblatt Securities analyst Kevin Cassidy wrote in a weekend note that Nvidia’s forecast, which implies 50% sequential growth for the July quarter, is one of the “historical and defining moments of a significant cycle which we view as secular and call the Mother of All Cycles.” (Marvell Technology Inc.’s

MRVL,

outlook was another key moment in that narrative, according to Cassidy.)

Read: Marvell stock rockets more than 30%, its best day ever — is it the next hot AI play?

Read the full article here