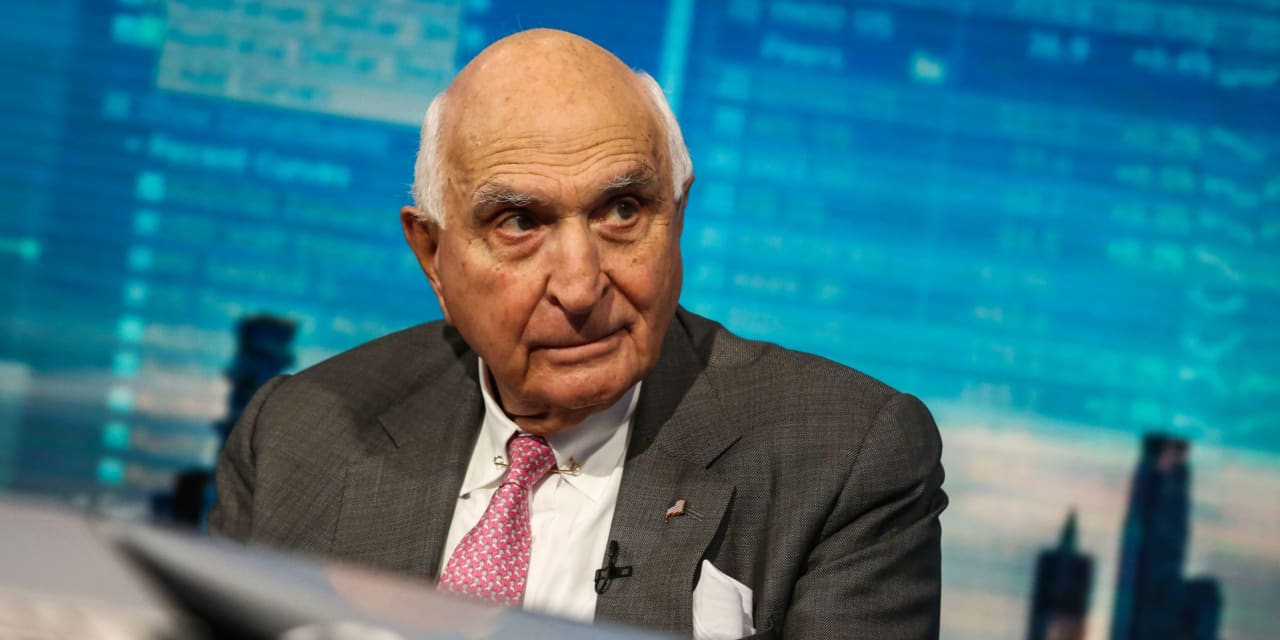

Billionaire investor and

Home Depot

co-founder

Ken Langone

just invested millions of dollars for more shares of

Unifi,

a company that makes synthetic and recycled performance fibers. Langone is a longtime Unifi director, and remains its largest shareholder.

On Dec. 22, Langone paid $2.9 million for 500,000 shares of Unifi, priced at $5.75 each through a private transaction. According to a form he filed with the Securities and Exchange Commission, Langone now owns 2.3 million shares in a personal account, and another 130,000 shares through Invemed Associates, an investment-banking company that he serves as president and CEO.

Langone couldn’t be reached for comment. He has been a Unifi director since 1969, and his latest purchase raises his stake to 13.7% from 10.9%.

Langone’s stock buy coincided with sales by a former large Unifi investor,

Jeff Ubben’s

sustainability-focused firm Inclusive Capital Partners, which is shutting down. On Dec. 22, 2023, one of Inclusive’s affiliate funds sold a total of 1.25 million Unifi shares in private transactions for $5.75 each, and Langone could have been on the other end for some of those shares, as it was the same day Langone bought, and the same price.

Inclusive Capital didn’t respond to a request for comment on its sales.

Unifi’s Repreve, a polyester fabric from recycled plastic bottles, is used by brands including Speedo, Patagonia, Land’s End, Guess, and FitBit. But Unifi stock hasn’t done well in recent years. Shares cratered 63% in 2022, dropped 23% in 2023, and are already 3% in the red so far in 2024.

Inside Scoop is a regular Barron’s feature covering stock transactions by corporate executives and board members—so-called insiders—as well as large shareholders, politicians, and other prominent figures. Due to their insider status, these investors are required to disclose stock trades with the Securities and Exchange Commission or other regulatory groups.

Write to Ed Lin at [email protected] and follow @BarronsEdLin.

Read the full article here