You can’t teach genius. But you can learn a lot from observing geniuses at work. Here are a few nuggets of investment wisdom from seven master investors.

John Neff

The manager of the Windsor Fund for three decades, John Neff was a quintessential value investor. “To us, ugly stocks were often beautiful,” he wrote in his book On Investing. “If Windsor’s portfolio looked good we weren’t doing our job.”

He was happy to be greatly overweight, or severely underweight, any of the major market sectors. For example, while oil stocks were about 12% of the Standard & Poor’s 500, his holdings went as high as about 25% and as low as 1%.

“In disrepute, we grabbed them,” he wrote. “In favor, we sold them.”

John Templeton

Sir John Templeton founded the Templeton Growth Fund in 1954, and it boasted outstanding performance for more than three decades. A pioneer in international investing, he said that investing worldwide gave him more opportunities to find bargains.

As an example, he invested heavily in Japan in the mid-1960s, before it was recognized as a world economic power. “Invest at the point of maximum pain,” he liked to say.

He warned against selling a stock – or even worse, a whole portfolio – when it was down. “If you sell your investments just because of a temporary decline, you end up making the loss permanent,” he wrote.

Templeton also emphasized the importance of humility. “An investors who has all the answers doesn’t even understand all the questions,” he declared.

Warren Buffett

“Be fearful when others are greedy, and be greedy when others are fearful.” That’s probably the most famous quote from Warren Buffett. The chairman of Berkshire Hathaway

BRK.B

“Price is what you pay,” Buffett said. “Value is what you get.”

People who poured money into the speculative favorite of 2021 might want to heed another Buffett pearl: “The worst sort of business is one that grows rapidly, requires significant capital to engender that growth, and then earns little or no money.”

Phil Carret

Phil Carret was one of the pio0neers of the mutual-fund industry. I like his warning against overuse of borrowed funds.

“While a bank may be perfectly willing to lend [an investor] 75% to 80% of the value of sound marketable stocks, he would be very foolish to use such borrowing power up to the hilt.”

In his book The Art of Speculation Carret suggested reviewing holdings about every six months. More often than that, he said, will likely make an investor “fall into the evil and usually fatal habit” of excessive trading.

David Dreman

A successful mutual fund manager in the 1980s and 1990s, David Dreman helped to popularize value investing. He is very interested in heuristics – mental shortcuts that people use to reach conclusions when faced with insufficient or confusing information.

One is the “availability” heuristic. Things that stick in one’s mind assume exaggerated importance. “This is why we think deaths by shark attack are more common than deaths from pieces of airplanes falling on people.”

He was also interested in how people draw conclusions from small samples that may just be chance. “For example, investors regularly flock to mutual funds that are better performing for a year or a few years,” he wrote.

Yet, “financial researchers have shown that the “hot” funds in one time period are often the poorest performers in another.”

Peter Lynch

Renowned for his success running the Fidelity Magellan Fund, Peter Lynch shared some of his ideas in the book One Up On Wall Street.

Lynch says that more money has been lost by anticipating recessions than in the recessions themselves. “Of course I’d love to be warned before we do go into a recession, so I could adjust my portfolio. But the odds of my figuring it out are nil,” he wrote.

Lynch claims that individual investors can do better than institutions, because they can invest in things they know. “If you invest like an institution, you’re doomed to perform like one, which in many cases isn’t very well,” he wrote.

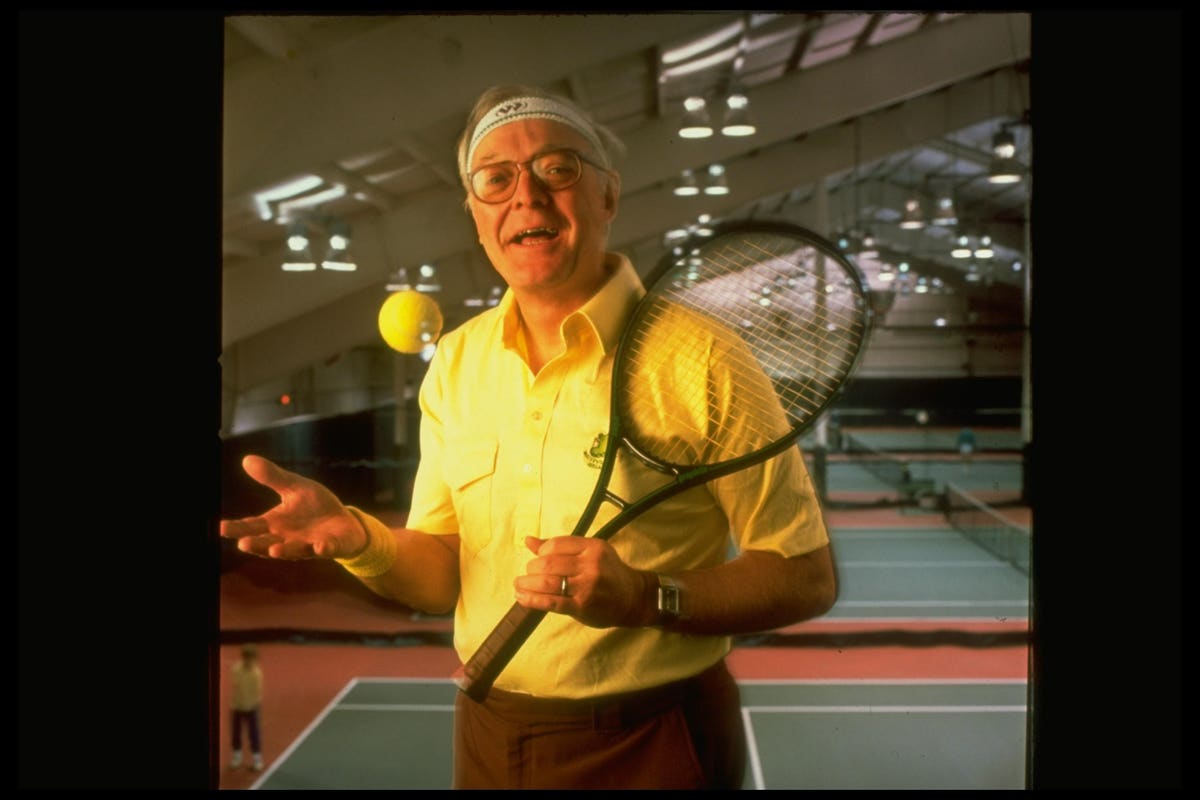

Martin Zweig

Marty Zweig was a hedge-fund manager, newsletter pundit and author of Winning on Wall Street. He aims to outperform the market with five out of every eight stock picks, he said, “not a bad batting average.”

Zweig used a multi-factor approach to picking stocks. He wanted earnings strength, a stock price that was reasonable in light of the earnings growth rate, and insider buying, or at least the lack of heavy selling by insiders.”

Read the full article here