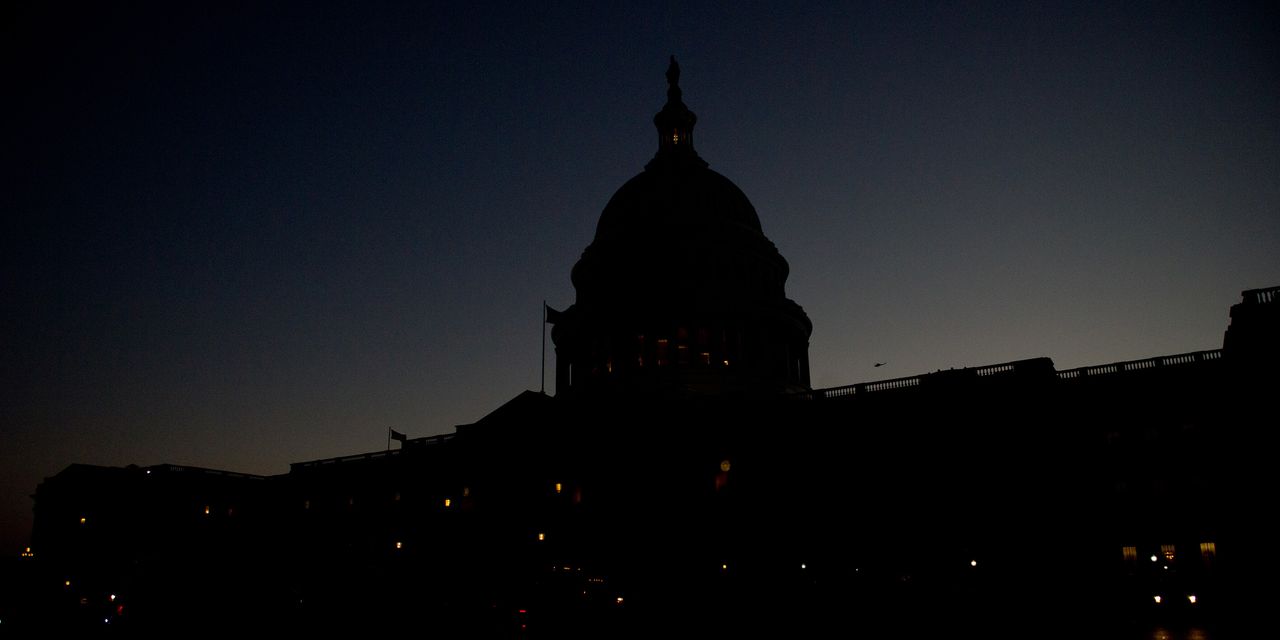

If you think the U.S. has become a dangerously politicized banana republic, just wait until September.

The federal government’s fiscal year ends on Sept. 30, and operations could shut down in October if Democrats and Republicans fail to agree on funding legislation.

Congress needs to pass 12 appropriations bills or a short-term funding bill to keep the government functioning—and there are only a few legislative days after politicians return to Washington following Labor Day.

Given House Speaker Kevin McCarthy’s (R., Calif.) difficulties with his most conservative members, the odds are greater than 50/50 for a shutdown, according to Brian Gardner, Stifel’s chief Washington policy strategist. And let’s not forget that Fitch recently lowered America’s debt rating because of political concerns.

Should the government not have enough money to operate, it’s hard to know whether history is a good guide about what happens next. Stock market performance was mixed during the six shutdowns since 1978 that lasted five days or more, Gardner writes.

Markets declined during the 1978 and 1979 shutdowns and rose during the others. During the shutdown that started in December 2018 and ended in January 2019, the most recent one, the

S&P 500 index

rallied more than 10%.

Yet investors are well served to proceed with caution.

Let the markets settle so that more can be learned about investor sentiment and positioning. The fallout around Donald Trump’s latest indictment probably will inject more virulent partisanship into the political proceedings.

Besides, it’s easy to be cautious and prudent when bond yields are increasingly attractive alternatives to stock returns. The 10-Year Treasury yield just hit its highest level since 2008. Just about every market conversation now includes someone saying that they cannot believe how much money they are making in interest on their cash.

The yields are compelling, especially as globalization seems to be sputtering. China just cut interest rates to try to protect the world’s second-largest economy from slipping deeper into chaos.

The war in Ukraine continues to economically press upon Russia, which just increased interest rates by an astounding 3.5 percentage points to stabilize the ruble’s sharp declines.

Meanwhile, U.S. earnings season is soon ending—and not on a high note. S&P 500 earnings growth has come in about 8.3% lower from a year ago, more than the 6.4% contraction that was expected at the start of second-quarter results. Weaker earnings bode ill for a stock market defined by momentum and event trading and the belief that someone will always pay more for whatever you just bought.

In recent weeks, we have suggested options strategies that would benefit from a rising market without requiring people to risk as much money as they would buying stocks, such as call-option spreads.

More recently, we suggested buying a November index put option to hedge against a 10% decline in the S&P 500.

The simple put purchase still makes sense, but so does an October put spread to better hedge government shutdown fears. With the S&P 500 around 4438, investors could buy the October $4,375 put and sell the October $4,300 put.

Should stocks rally and the shutdown fears prove misplaced, the hedge fails. But if Washington’s craziness becomes truly dangerous to the fiscal process, the $17 hedge will increase in value. If the S&P 500 is at 4300 or lower at expiration, the hedge is worth a maximum profit of $58 ($75 spread less hedge cost).

Steven M. Sears is the president and chief operating officer of Options Solutions, a specialized asset-management firm. Neither he nor the firm has a position in the options or underlying securities mentioned in this column.

Email: [email protected]

Read the full article here