Assertio Holdings (ASRT) was materially affected by its flagship drug going generic, but the pharma firm still stands to make a major comeback.

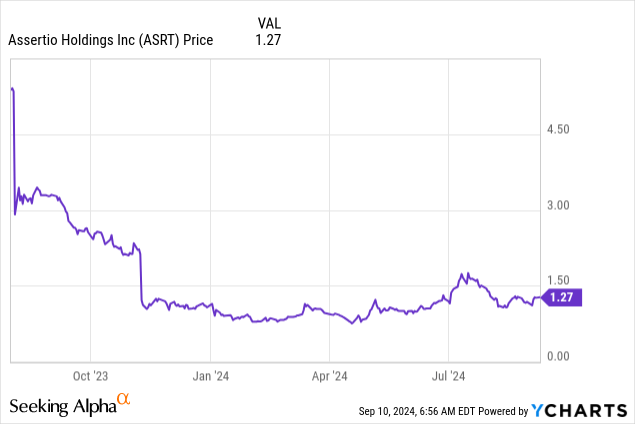

Assertio Holdings, Inc. (NASDAQ:ASRT) shares took a heavy beating in 2023 when the pharma firm’s flagship drug went generic. Thus far in 2024, ASRT stock has stabilized, but price action remains choppy. At first glance, this suggests waning confidence in the “comeback story” surrounding the company.

Taking a closer look, there’s more that underscores why the market keeps on pricing in a significant risk premium into shares. Assertio’s efforts to make up for the loss of its prior flagship drug, with a new flagship drug, remains at best a work in progress.

However, while there are valid reasons why ASRT continues to be priced as a long shot, there has been one recent development that could prove key when it comes to the company executing its turnaround.

That’s not all. Besides perhaps helping to improve this company’s turnaround chances, this factor may also end up adding additional long-term runway for shares.

ASRT Stock: Background and Recent Performance

As Hydra Research, Martin Fjeldhoj, and other Seeking Alpha commentators have detailed in prior coverage of Assertio Holdings, here is this company’s backstory, which explains full well how its shares whipsawed back deep into “penny stock territory” from mid-2023 to early 2024.

Based on its size and share price, you may think that Assertio is a clinical-stage biotech, but in actuality, the company’s primary business is the acquisition and monetization of already-developed pharmaceutical products. There are pros and cons to this approach, and last year, the downside of this business strategy was on full display.

Here’s the story in a nutshell. Indocin, a rheumatoid arthritis treatment that was Assertio’s flagship drug product, went generic. Even before hitting the market, the mere news of an Indocin generic obtaining regulatory approval was enough to kick off the extended sell-off for ASRT stock.

Falling from $5.35 to $2.91, or by around 45.6%, immediately after the generic news hit, shares continued to tumble in the months that followed, resulting in ASRT tumbling to prices as low as 73 cents per share. Since then, the stock has started to recover. During July, the stock appeared as though the rebound was starting to really gain momentum. This was due to the stock surging following the release of a bullish analyst rating from investment bank H.C. Wainwright.

Since then, however, shares have given back these gains. Again, based on Assertio’s latest fiscal results, this is not entirely surprising.

Assertio’s Latest Results: What They Mean for the Bull Case

Much as this company’s backstory has been well-covered here on Seeking Alpha, so too has the post-Indocin bull case for ASRT stock. As noted in Hydra Research’s write-up, Assertio made a well-timed acquisition just months before its tremendous fall. That would be the purchase of Spectrum Pharmaceuticals in a $248 million all-stock and contingent value rights deal.

Thanks to this transaction, Assertio picked up an approved drug with the potential to counter a move to “post exclusivity” status for Indocin. The drug: Rolvedon, a treatment used to reduce the incidence of infections in patients undergoing chemotherapy.

Those bullish on Assertio believe that Rolvedon could achieve Indocin-level success for Assertio. However, based on the company’s latest quarterly results, it’s unclear whether this is even starting to play out.

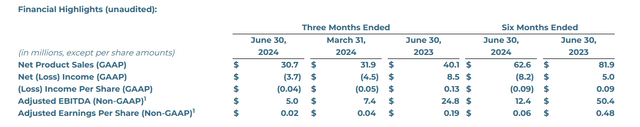

Yes, Rolvedon product sales once again increased on a sequential or quarter-over-quarter basis. However, the rate of sequential growth during Q2 2024 was far less than during Q1 2024. For the quarter, Rolvedon’s net sales increased from $14.5 million to $15.1 million, or by 4.14%. Compare that to Q1, when net sales of Rolvedon increased by 31.8% on a sequential basis, from $11 million to $14.5 million.

Besides the slowdown in Rolvedon sales growth, QoQ Indocin net sales decreased at a slightly higher rate during the June quarter than during the March quarter. This resulted in a far greater decline in overall net product sales during Q2 compared to Q1, as seen in the table below.

Assertio Holdings’ Q2 2024 results can be best described as mixed, as Rolvedon sales growth has yet to fully counter declining Indocin sales (Assertio Holdings Q2 2024 Financial Results Press Release)

Technically, gross margins improved during the quarter, from 65% to 71%, yet as stated in the earnings release, this was due to Rolvedon purchase accounting inventory step-up amortization. Excluding this factor, gross margins fell from 78% to 73%, although much of this can be attributed to write-downs of late-cycle stage product inventory (i.e., Indocin inventory).

Net losses on a GAAP basis narrowed, but much of this can be attributed to a $720,000 restructuring charge recognized during Q1 2024. Adjusted EBITDA declined during the quarter, from $7.4 million during Q1 to $5 million during Q2.

In short, the latest fiscal results can be best described as mixed. While not exactly calling into question the bull case, these numbers don’t exactly convey that Rolvedon sales growth will soon more than makeup for declining Indocin sales.

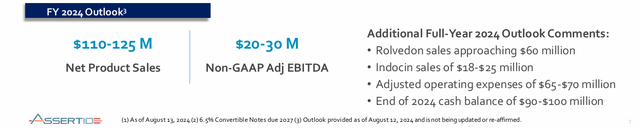

As stated in the earnings press release, as well as in Assertio’s latest investor presentation, the company reiterated its 2024 product sales and adjusted EBITDA guidance.

Alongside the latest fiscal results, Assertio’s management last month reiterated guidance for the full year 2024 (Assertio Holdings Investor Presentation, Aug. 15, 2024)

Assertio’s top line is expected to come in at between $110 million and $125 million, with the company’s adjusted EBITDA forecast coming in at between $20 million and $30 million.

Yet while this reiteration of guidance sounds promising, keep in mind that, even if Assertio hits this full-year forecast, it will still represent a decline compared to the full year 2023. During 2023, Assertio’s net sales totaled $149.5 million, with adjusted EBITDA coming in at $67.7 million.

Possible Long-Term Upside With ASRT

With the patent on Rolvedon expiring in 2036, Assertio Holdings has time on its side to fully maximize the potential commercial value of this drug. Based on the latest results/updates to guidance, annualized sales are now up to $60 million.

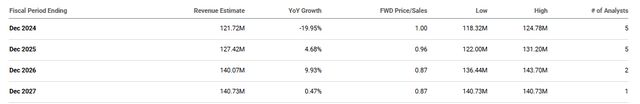

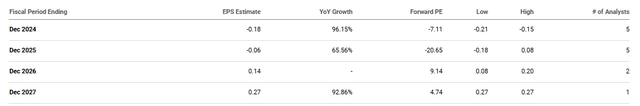

Analyst forecasts continue to call for Rolvedon sales to steadily climb higher in the years ahead, outweighing the impact of declining Indocin sales, resulting in modest revenue growth and a big swing back to GAAP profitability between now and 2027:

Analyst Forecasts for Assertio Holdings’ revenue growth between 2024 and 2027 (Seeking Alpha) Analyst forecasts for Assertio Holdings’ earnings growth between 2024 and 2027 (Seeking Alpha)

So, how, and to what extent, could improved results lead to share price appreciation for ASRT stock? Admittedly, given the company’s unique “buy and monetize” business model, it may prove difficult for shares to hit a valuation on par with other pharma stocks (around 20 times earnings).

After all, during Assertio’s last period of steady profitability, shares traded at a P/E ratio in the mid-single digits. Even if the market, less concerned about generic risk with Rolvedon, rates ASRT at a valuation of, say, 10 times earnings, a doubling in price compared to present levels may not sound like a substantial upside, given the multi-year timeline, not to mention the execution risks still at hand.

Nevertheless, there is a newly emerged factor in play that could prove to be the path to a far greater breakout. How so? Since May, a new CEO has been at the helm: Brendan O’Grady. A seasoned healthcare executive whose resume includes 21 years at Teva Pharmaceutical Industries Limited (TEVA), With his expertise and skills, O’Grady may be able to achieve two things that could really move the needle for ASRT.

First, he may be material in driving Rolvedon’s sales growth to a greater extent than currently anticipated. Second, O’Grady could transform the company, pivoting it away from its “buy and monetize” business model to a business model more akin to other generic and specialty drug manufacturers.

This, in turn, could result in the market giving the stock an even stronger re-rating in the event a return to consistent profitability happens. For example, if EPS climbs to 27 cents per share in 2027 and the market decides to give ASRT a mid-teens multiple, an ultimate move to between $4 and $5 per share could be within reach.

Still Risky Despite the Silver Lining

The recent change in the C-suite at Assertio is perhaps a silver lining, but make no mistake. The situation here remains very risky. Based on the latest results, growing Rolvedon sales may be proving to be easier said than done.

Even if the company goes for a more aggressive growth push under O’Grady’s leadership, before this leads to improved results, it may mean increased commercialization costs in the near term.

Assertio currently has $88.3 million in cash and short-term investments. Even in its current state, the company is generating positive cash flow. For the first half of 2024, operating cash flow came in at $14.9 million. Still, while perhaps not at risk of running out of cash before success with Rolvedon is possibly achieved, if ASRT burns through much of this cash in its sales growth push, with little to show for it, expect this to have a material impact on price performance.

Beyond risks related to the Rolvedon catalyst, there’s also the risk that Assertio, which again likely needs to diversify through acquisitions in order to garner greater appreciation from the market, makes an acquisition that proves disastrous.

Bottom Line on ASRT Stock

Recent performance notwithstanding, the bull case with Assertio has not necessarily been shattered. The promise of an experienced healthcare industry leader now at the helm helps to counter the company’s recent mixed results.

Shares may remain volatile in the near term. A lot is riding on the next quarterly earnings release (scheduled for Nov. 6). If, during this quarter, Rolvedon sales growth fails to re-accelerate, many of those bullish on the turnaround could lose faith, resulting in this stock quickly sinking back toward its lows.

However, despite these risks, there’s still merit in making a small, speculative wager on an ASRT stock comeback. An eventual move back to $3, $4, or perhaps even $5 per share remains within the realm of possibility.

Read the full article here